Now Might be the Perfect Time to Switch to This Technology-First Insurance Company Lemonade is at the forefront of revolutionizing the renters and homeowners' insurance industries.

By StackCommerce Edited by Jason Fell

Disclosure: Our goal is to feature products and services that we think you'll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

As an entrepreneur running a small business, you have endless considerations outside of everything you do on a daily basis to help your company succeed. What about choosing renters or homeowners insurance for your office, for one thing? We often shy away from anything that has to do with insurance. From the application to filing a claim, it's usually a long-winding affair that leads to feelings of utter frustration.

But insurance is highly necessary, and could inevitably save us from financial ruin due to an unforeseen incident. Are you using the most cost-effective and reliable insurance? Now is a great time to revisit your commitment.

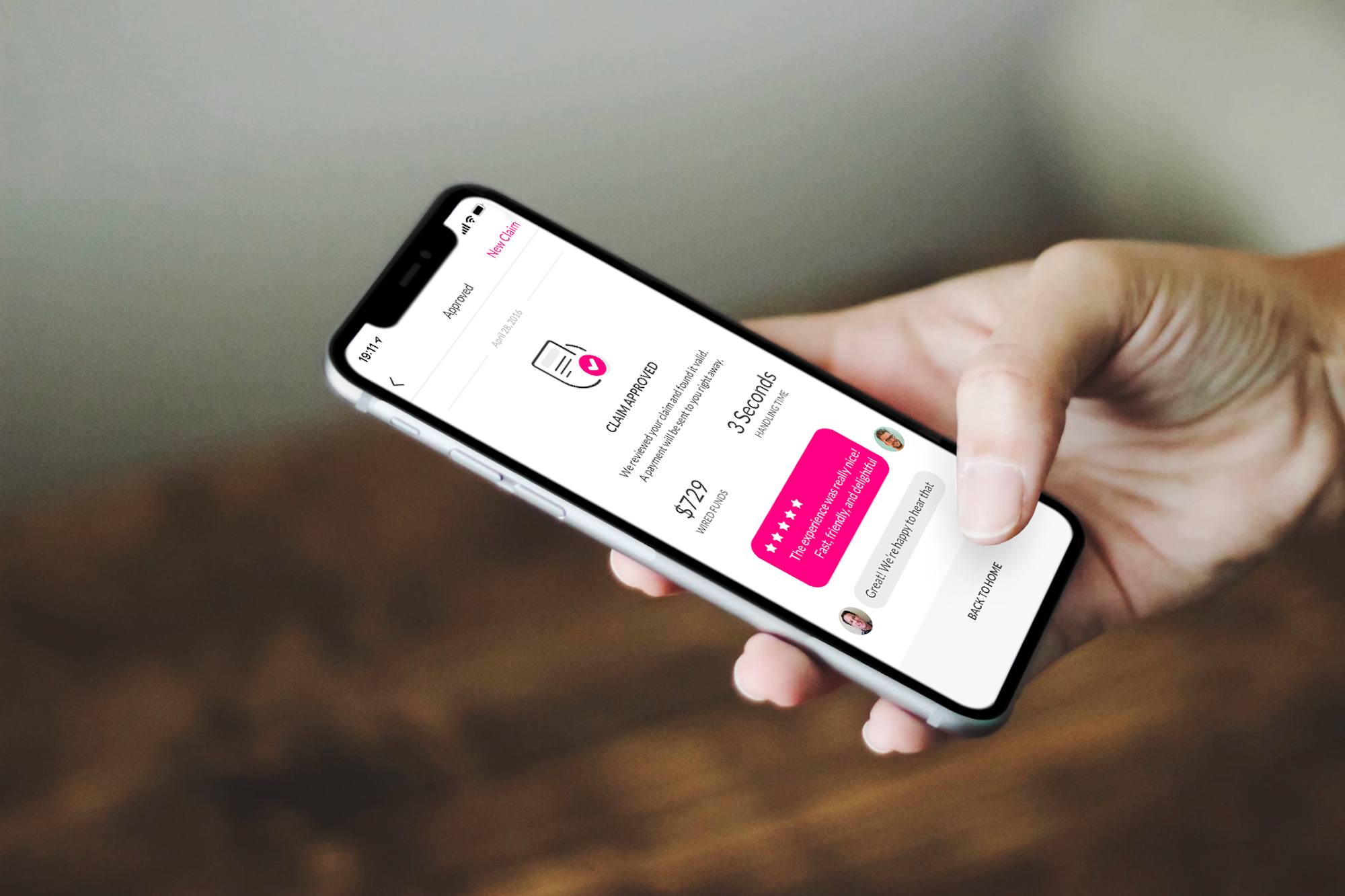

While the health industry has a long way to go in revolutionizing insurance, the renters and homeowners' insurance industry is steps ahead, with Lemonade at the forefront. It's a technology-powered platform that removes all the red tape typically associated with insurance. Everything can pretty much be done in an instant — from getting insured to filing a claim all the way to getting your reimbursement.

Since the entire process is completed in the app itself, you can get insured in as little as 90 seconds and could receive a payout for a claim in just three minutes. Of course, some situations may take longer, but the fact remains: you'll never have to pick up a phone. Instead, a delightful chatbot named Maya will be of assistance to you every step of the way and answer any queries you might have.

Lemonade is also committed to turning insurance "from a necessary evil to a social good" as they put it. Unlike other insurance platforms, any extra money that is not used to pay out claims goes straight to the charity of your choice (after their flat fee is deducted — they are a business, after all). Not only will you get the insurance that you deserve, you'll also get the chance to donate to causes you care about.

Policies start as low as $5 per month for renters and $25 per month for homeowners. During this time of economic uncertainty, it's certainly worth taking a moment to get a quote today.