LiveXLive Media Stock is a Risky But Compelling Streaming Network Play Digital media company LiveXLive Media (NASDAQ: LIVX) stock has been a bit of a rollercoaster experiencing extreme spikes and drops as a speculative play on streaming music and video content.

By Jea Yu

This story originally appeared on MarketBeat

Digital media company LiveXLive Media (NASDAQ: LIVX) stock has been a bit of a rollercoaster experiencing extreme spikes and drops as a speculative play on streaming music and video content. The independent network offers music-related live and streaming audio and video content along with niche events like its "Social Gloves: Battle of the Platforms: YouTubers vs. TikTokers" pay-per-view boxing event, catering to social media fans and millennials. It also operates Slacker Radio and various podcasts. LiveXLive claims to have transcended the 1 million paying subscriber mark and always carries the potential for an acquisition if their portfolio is compelling enough. The Company is also trying to gain from the non-fungible token (NFT) momentum by opening an NFT division that will mint performances, video and audio content, and digital playing cards. This could be an up-and-coming viable network utilizing social media in an underground manner. This small-cap company is a purely speculative play suitable for nimble traders and seasoned speculators that can keep stop-losses and tolerate high-volatility and periods of thin liquidity.

Q3 Fiscal 2021 Earnings Release

On Feb.11, 2021, LiveXLive released its fiscal third-quarter 2021 results for the quarter ending December 2020. The Company reported an earnings-per-share (EPS) losses of (-$0.12) missing analyst estimates for a loss of (-$0.10) by (-$0.02). Revenues came in at $19.1 million versus $17.7 million consensus. The Company raised full-year fiscal 2022 revenue estimates to come in between $90 million to $100 million versus $91.3 million consensus analyst estimates.

Raised Guidance Estimates

On April 5, 2020, LiveXLive raised it's full-year fiscal 2021 revenue guidance to a range of $64.5 million to $65.5 million versus analyst estimates for $64.09 million. Adjust fiscal 2021 operating income is expected between $1 million to $3 million. The Company expects full-year 2022 revenues to come in between $100 million to $110 million versus $99.13 million consensus analyst estimates. The Company ended Q4 and fiscal 2021 with over 1.075 million paid subscribers and has livestreamed over 140 live music events and 1,781 artists across the LiveXLive platform, generating over 150 million live stream views compared to 42 events, 256 artists and 69 million live streams in prior year. The Company saw 533% growth in its Q4 fiscal 2021 livestream views hitting 38 million versus 6 million views in the same year ago period. LiveXLive's 24-hour linear OTT streaming channel reaches over 300 million people. It's PodcastOne generated more than 2.25 billion downloads in 2020, with over 234 exclusive podcast shows and now produces more than 400 podcast episode weekly. Total social media reach across the exclusive PodcastOne talent roster exceeds 240 million.

Samsung Free and PodcastOne Deal

On April 9, 2021, LiveXLive inks a deal with Samsung (OTCMKTS: SSNLF) for all PodcastOne distributed content to be available on Samsung Free service via the Listen tab. PodcastOne President, Kit Gray stated, "Listening to all your favorite hosts and shows shouldn't be more than a one tap process and our agreement with Samsung brings fluid accessibility to podcast fands in a new way."

Growth Drivers

LiveXLive could be an up-and-coming network both in terms of digital streaming platform and its podcast network. In Hollywood, the saying "Fake it "til you make it" could apply here. In its Nov. 16, 2020 conference call, LiveXLive CEO Rob Ellin summed it up, "Today, LiveXLive has grown and evolved to be a leading talent-first platform focusing on connecting artists with their superfans, building long-term sustainable valuable franchises, audio music, podcasting, vodcasting, OTT and pay-per-view, live streaming and video on demand and our distribution, which continues to expand. LiveXLive's 24 hour OTT streaming channel now has a reach of over 300 million people on platforms like Amazon Fire and Roku, Apple TV, SLING, Xumo, STIRR, and both Samsung Smart TVs and Samsung TV Plus." It's worth noting that LiveXLive has had a partnership with Tesla (NASDAQ: TSLA) for 8 years where LiveXLive subscriptions are pre-installed in every Tesla vehicle sold in America. The LiveXLive app is pre-installed in 85 other automobiles as well as major carriers including T-Mobile (NASDAQ: TMUS) and Verizon (NYSE: VZ). Time will tell whether the Company is hype or the real deal.

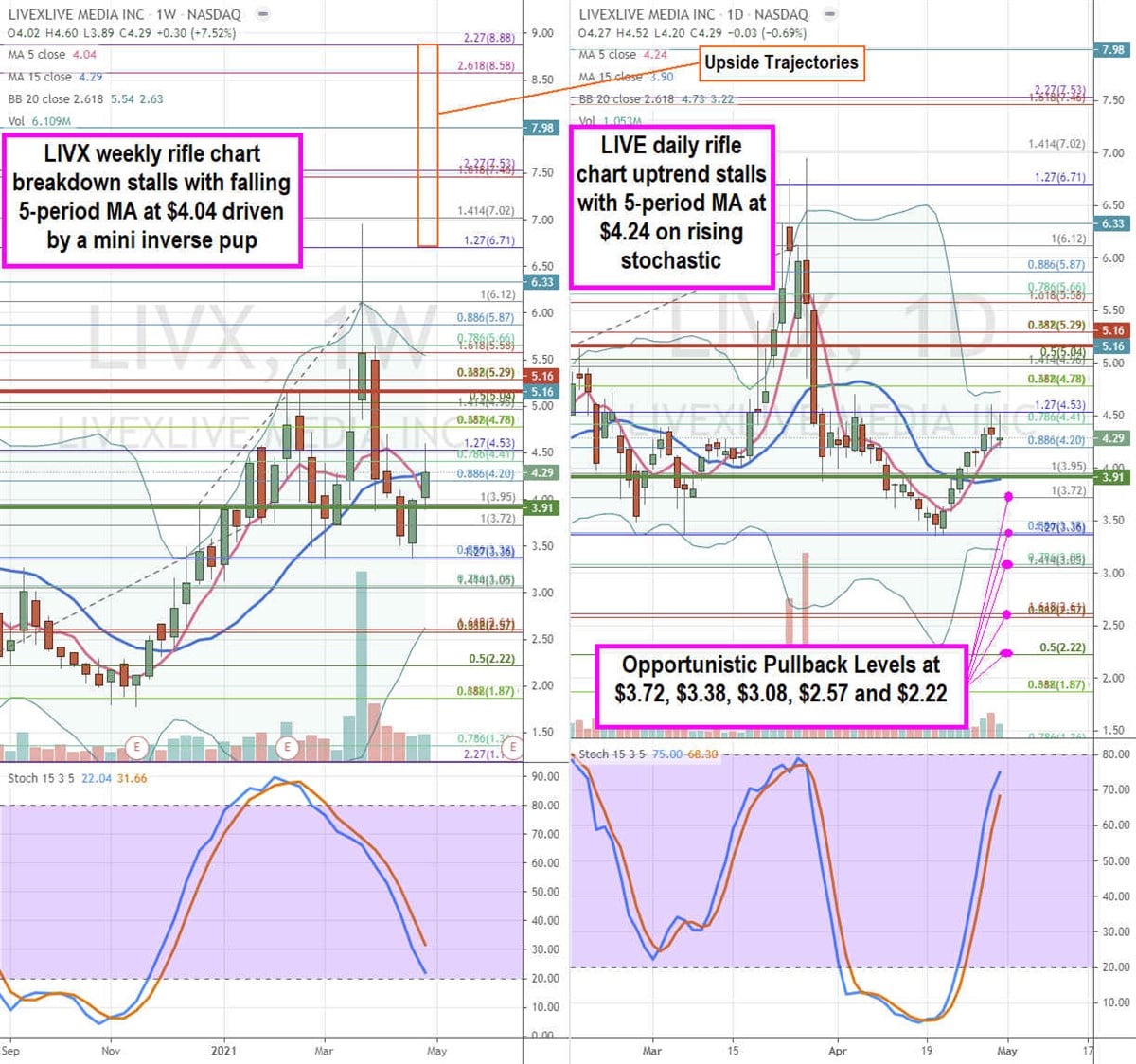

LIVX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the playing field for LIVX shares. The weekly rifle chart uptrend peaked out near the $7.02 Fibonacci (fib) level and abruptly collapsed to the $3.38 fib support, which has proven to be a sturdy support area. The weekly 5-period moving average (MA) is at $4.04 with 15-period MA at $4.29 as the weekly stochastic tries to mini inverse pup lower. However, the recent spike to the $4.53 fib has stalled out the weekly downtrend until the daily rifle chart resolves its uptrend, which may be peaking out. The daily market structure high (MSH) sell triggered on the breakdown below $5.16. However, the daily market structure low (MSL) buy trigger sits at $3.91. The daily 5-period MA support overlaps at $4.24 but is on the verge of a potential MSH trigger if the $4.20 fib breaks. Nimble traders and seasoned speculators can monitor for opportunistic pullback levels at the $3.72 fib, $3.38 fib, $3.08 fib, $2.57 fib, and the $2.22 fib. As a small-cap stock, liquidity could be a problem so it's important that only seasoned traders and speculators are suited for this high-risk stock.

Featured Article: The role of implied volatility with call option volume