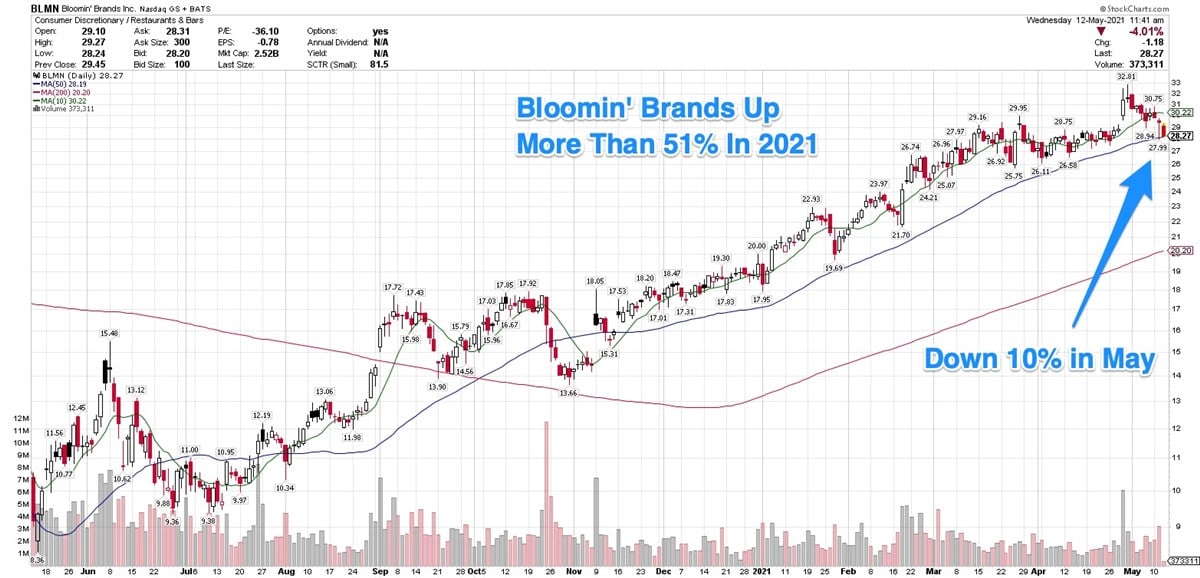

Bloomin' Brands Business Blossoms, But Shares Down In May Restaurant chain operator Bloomin' Brands (NASDAQ: BLMN) brands is consolidating below its April 30 high of $32.81, which it reached a day after reporting first-quarter results.

By Kate Stalter

Our biggest sale — Get unlimited access to Entrepreneur.com at an unbeatable price. Use code SAVE50 at checkout.*

Claim Offer*Offer only available to new subscribers

This story originally appeared on MarketBeat

Restaurant chain operator Bloomin' Brands (NASDAQ: BLMN) brands is consolidating below its April 30 high of $32.81, which it reached a day after reporting first-quarter results.

The company's brands include Outback Steakhouse, Fleming's, Bonefish Grill, Aussie Grill and Carrabba's Italian Grill.

Despite taking a drubbing during the pandemic, like all restaurants, Bloomin' Brands has been a growth-stock success story. The company notched a series of positive returns over various rolling time frames:

- 3 months: 25.80%

- Year-to-date: 51.65%

- One year: 158.11%

However, growth stocks as an asset class have been getting hammered since a late April rally attempt fizzled. The Nasdaq Composite is down 5.31% in May, slumping 5.85% as of mid-session Wednesday

As three-fourths of stocks typically follow the broader market's direction, either higher or lower, it's no surprise to see stocks like Bloomin' Brands skidding as big techs lead the market lower. For example, Apple (NASDAQ: AAPL) is down 5.95% for the month, and Microsoft (NASDAQ: MSFT) is down 4.34%.

Bloomin's earnings report offered much to cheer about. The company posted revenue of $987.5 million, down 2% from a year ago, when pandemic lockdowns struck toward the end of the quarter.

It marked the third quarter in a row of sequential revenue gains, illustrating gradual improvement as customers return to reopened restaurants.

The company reported a rapid increase in weekly per-store sales volume, which rose from $21,000 to $35,000 in the four weeks prior to April 28.

Earnings per share came in at $0.63 per share, up a whopping 350% from a year ago.

Analysts expect earnings of $2.20 a share this year, and $2.43 a share in 2022. Both numbers were revised higher recently.

In the earnings call, executive vice president and chief financial officer Chris Meyer said off-premise dining - also known as takeout - comprised 35% of earnings in the quarter, down only 2% from the fourth quarter, when dine-in options were more restricted. Meyer said the company is planning for takeout business to be a significant revenue stream going forward, even as indoor dining continues to reopen.

"This occasion is proving to be highly incremental and will remain a key part of our growth strategy moving forward," he said.

Meyer cited another milestone. "We ended the quarter with 100% of our domestic company-owned restaurants open with in-restaurant dining," he said.

Even as Covid restrictions ease and Americans are ready to dine in restaurants again, a fresh crop of challenges have emerged. One of the biggest is higher food prices as commodity prices rise and there's now a shortage of chickens. Another looming challenge is higher labor expenses.

Both of those could have an impact on Bloomin's bottom line, resulting in a potentially lower earnings number for the year.

Of course, rival restaurant chains are facing those same headwinds. But Bloomin' Brands may have an advantage over competitors, when it comes to staffing.

"We did not furlough any employees during the pandemic, and this decision has contributed to low turnover," said CEO David Deno, in the earnings call.

"Maintaining a motivated and well-trained and engaged employee base is critical to our long-term success. As sales volumes are now exceeding pre pandemic levels, these actions provide a competitive advantage to retaining talent as the industry faces some staffing challenges," Deno added.

Bloomin' shares are down 10% so far in May, underperforming the wider group of publicly traded restaurants, down just 2.6%. With a beta of 1.55, the stock is more volatile than the broader market, so it's not necessarily a surprise to see the underperformance.

While the stock is currently trading below its late April high, it's not yet etching a proper base. At this juncture, the stock is still in the "falling knife" category, meaning would-be investors should track the stock, waiting until it begins its next upward trajectory before jumping in.

In the current market environment, coupled with higher commodity prices that are a real threat to restaurant-industry profits, you also want to see a broad market rally to buoy this stock.

Featured Article: Determine Your Level of Risk Tolerance