Ethereum's Berlin and London hard fork: The biggest upgrades providing a tailwind for the upcoming ETH 2.0 2021 is a year of progress for Ethereum, as it goes through some of the major network upgrades to take a big leap forward from its Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanism. Every year, the Ethereum network goes through periodic upgrades to bring necessary improvements to its underlying architecture. However, two of the most […]

By Haroon Baig

This story originally appeared on ValueWalk

2021 is a year of progress for Ethereum, as it goes through some of the major network upgrades to take a big leap forward from its Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanism. Every year, the Ethereum network goes through periodic upgrades to bring necessary improvements to its underlying architecture. However, two of the most prominent upgrades making headlines this year are Berlin and London Hard Fork, because of a good reason.

Q1 2021 hedge fund letters, conferences and more

The Berlin and London Hard Fork aren't the regular non-contentious upgrades that we see every year. They bring together a series of changes in the network to continue the natural progression of Ethereum towards Ethereum 2.0, also known as the Serenity. This article will discuss the details about the Berlin and London Hark Fork upgrades and why they are a stepping stone towards the sustainable future of Ethereum.

The Ethereum Berlin Hard Fork

The naming convention behind the Berlin Hard fork is inspired by the first Ethereum DevCon that happened in Berlin, the capital of Germany. The Ethereum Foundation officially announced this upgrade on March 8, 2021. The Berlin Hard Fork followed the Istanbul and Muir Glacier upgrades and went live on the Ethereum mainnet at block 12,244,000 on April 15, 2021.

The Berlin Hard Fork implements a series of four Ethereum Improvement Proposals (EIPs) that introduce new transaction types and tinker with the gas costs associated with complex transactions. The changes made in the Berlin Hard Fork are a stepping stone to the upcoming London Hard Fork that is planned to roll out in July this year.

The EIPs incorporated in the Berlin Hard Fork are:

EIP-2565: Lowers the cost of a specific set of transaction types that use modular exponentiation, i.e., ModExp (0x00..05).

EIP-2929: Increases the cost of those transaction types that use state access 'opcodes' upon first initialization. These transaction types were a major reason behind the denial of service attacks on Ethereum in the past, and EIP-2929 fixes this issue.

EIP-2718: Introduces a new transaction type called 'envelope transactions' that brings backward compatibility to all the new transaction types.

EIP-2930: Adds a new transaction type that allows users to create future templates for complex transactions (based on EIP-2718 envelope transactions) to lower gas costs and improve processing.

The Berlin Hard Fork upgrade is non-backward compatible, meaning that node operators and miners need to upgrade their Etherum client to the latest version that supports the upgrade. Before going live on the Ethereum mainnet, the Berlin Hard Fork was rolled out on Ropsten (the Ethereum testnet) on March 10, precisely two days after the announcement, followed by its implementation on Goerli and Rinkeby.

Next stop, the London Hard Fork

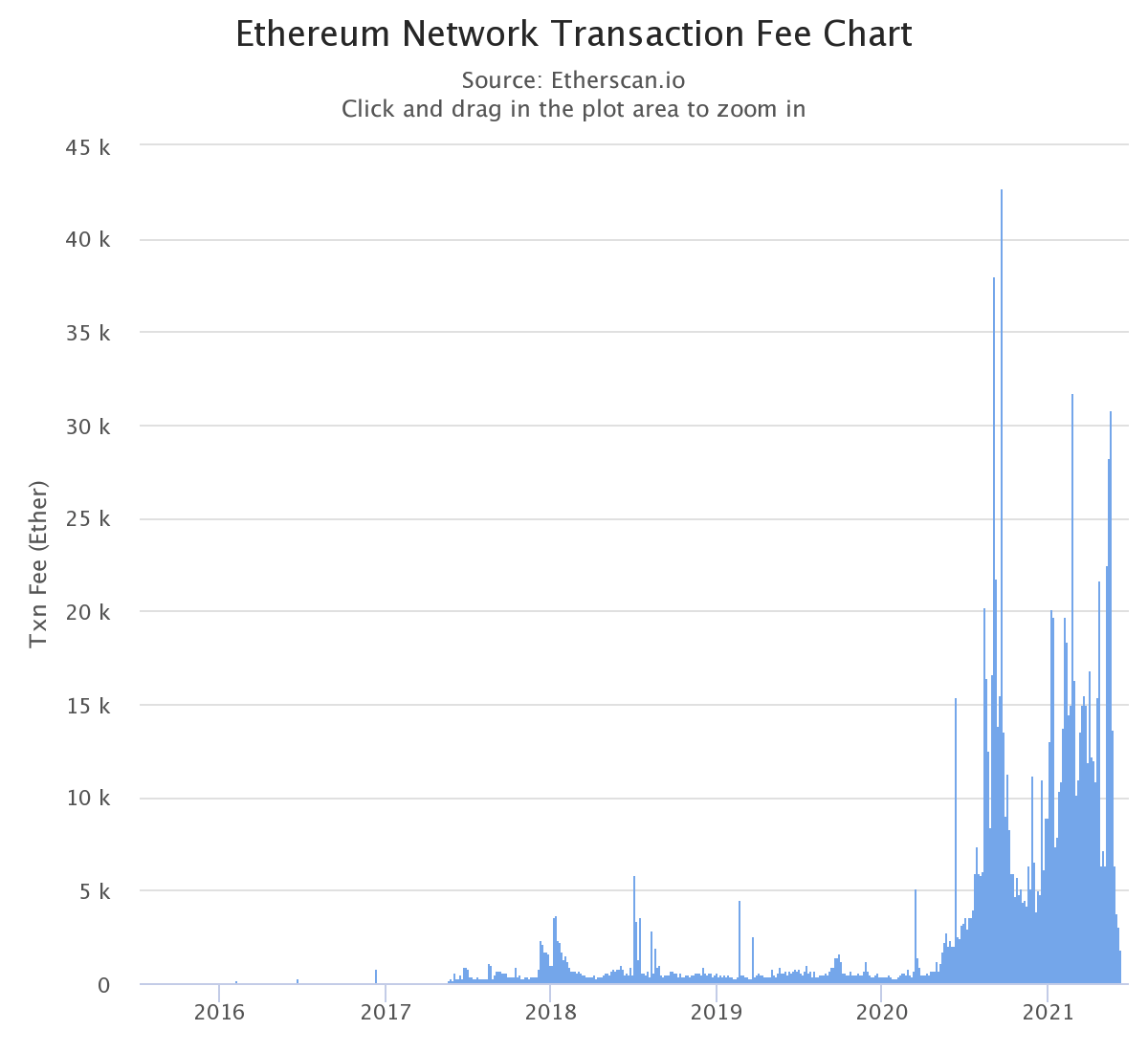

The London Hard Fork is the most anticipated upgrade among the Ethereum community that aims to solve the decades-old problem of high transaction fees on the Ethereum network. Network congestion and high transaction fees on Ethereum have been a topic of debate for a long time. Over the years, the Ethereum network has become very congested and the transaction fees are skyrocketing, raising some serious concerns around scalability and performance.

Source: Etherscan.io

To solve the underlying scalability issues, we do have promising Layer-2 scaling solutions like Celer Network that brings ultra-fast and low-cost transactions on Ethereum. Celer is a Generalized State Channel Network with advanced Rollup technology that reduces the transaction costs by 100X with its project called Layer2.Finance, which is quite a big leap considering the massive transaction volume on Ethereum, thanks to DeFi.

Layer-2 solutions don't just solve the scalability problem, but they go beyond the limitations of the underlying platform to provide different services that are not possible otherwise on Layer-1. A perfect example of this is Celer cBridge, which provides cross-chain asset transfer between Ethereum's main chain and any Layer-1 or Layer-2 platform in a blazing fast and secure manner.

The London Hard Fork can't come close to the scalability and flexibility offered by the Layer-2 scaling solutions, but it helps set the right foundation to improve the transaction fee mechanism by taking out the wrong fee estimation problem that is prevalent in the 'first price auction' model that Ethereum currently uses.

The London Hard Fork implements the EIP-1559 that was first proposed by Vitalik Buterin back in 2018. This improvement proposal brings the following key changes:

Exclusion of 'single fee': Ethereum has one 'single fee' estimated through the 'first price auction' model. EIP-1559 proposes that instead of a single fee, there will be two fees; base fee (which will be fixed per block depending upon the block size) and inclusion fee (an optional fee that will go directly to the miners).

Deflationary pressure on Ethereum: The base fee will be burnt permanently, putting deflationary pressure on Ethereum over the long run.

Elastic block size: The block size on Ethereum will now be dynamic, depending on the state of the network congestion. The maximum gas limit per block will now be 25 million, which is 2x the current gas limit per block of 12.5 million.

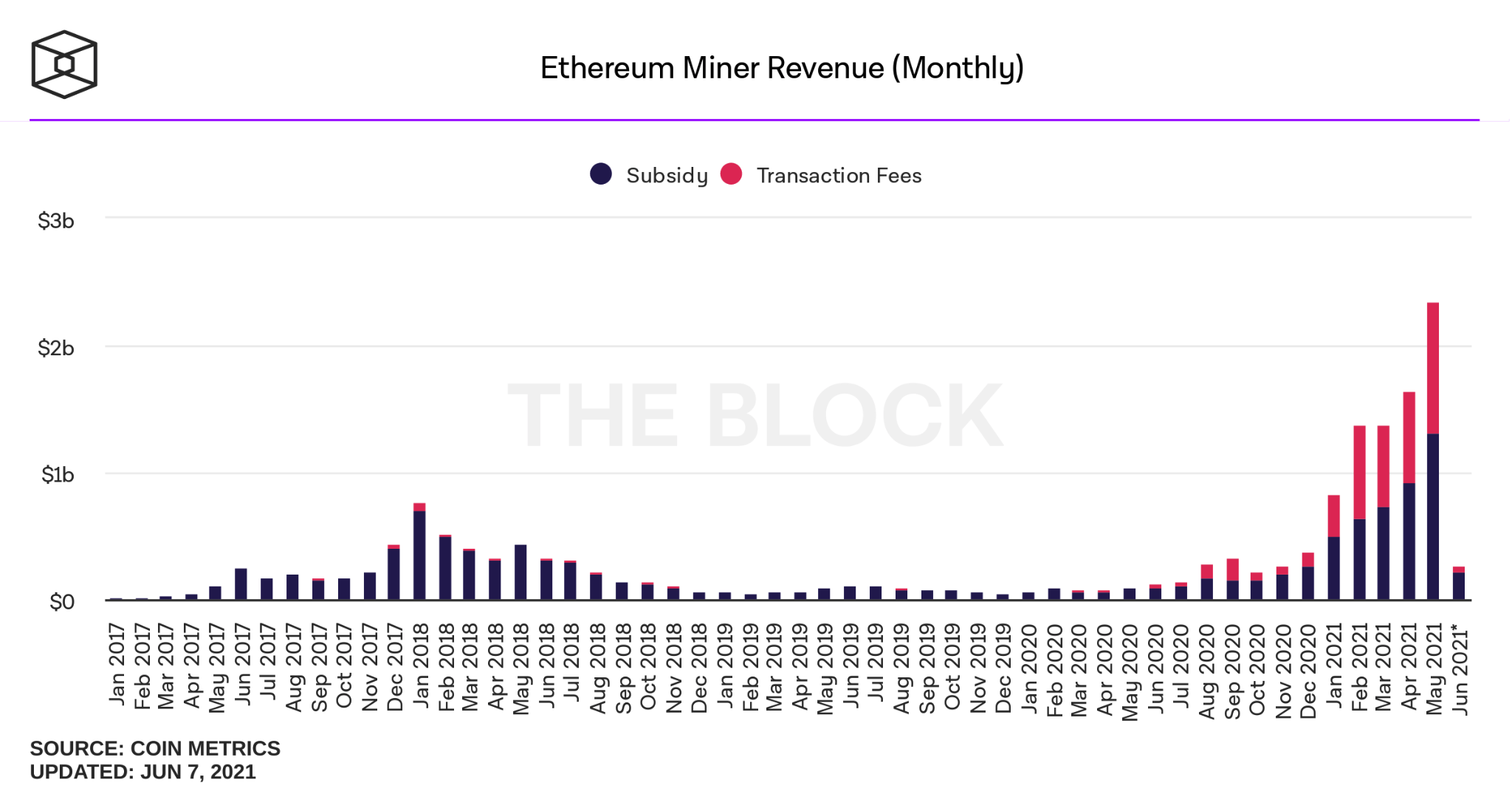

The London Hard Fork is good news for Ethereum users but certainly bad news for the miners. Just last month alone, Ethereum miners made $2.35 billion in revenue, out of which $1.35 billion came from transaction fees. Over the past couple of months, we have seen this trend that almost half of the total miner revenue came from transaction fees. With EIP-1559 implemented, miners could potentially lose ~50% of their total revenue.

Source: The Block

The London Hard Fork is planned to be rolled out in July, but the tentative date is still not finalized because of the concerns raised by the big mining pools. Sparkpool, one of the biggest Ethereum mining pools with a combined hash rate of over 50%, is on the opposing side, while F2Pool that controls 11% of the network hash rate is on the supporting side for the implementation of EIP-1559.

Wrapping Up

The Berlin and London Hard Fork are among the most anticipated upgrades that are the stepping stone towards the shift from Eth1 to Eth2. The Berlin Hard Fork introduces several transaction types and brings optimization around a specific set of transactions, while the London Hard Fork brings a deflationary pressure on Ethereum by omitting the first price auction model, introducing a base fee, and burning the transaction fees altogether.

About the Author

Haroon Baig is an Ex-Microsoft hire, a coding geek turned freelance researcher and writer. He works with companies of every size in the blockchain space to establish, expand, and improve their online footprint through his writings. He got involved in the crypto space back in 2012 and was fascinated by the underlying technology. Since then, He has been educating people about this space through his content.