Why Should You Add CNO Financial (CNO) to Your Portfolio?

CNO Financial (CNO) holds prospects to benefit investors owing to its declining costs, technological investments, a solid portfolio and strategic measures.

This story originally appeared on Zacks

CNO Financial Group, Inc. CNO will continue to gain traction from its cost-cutting measures, solid investments in cutting-edge technology and strategic initiatives. This multiline insurer also boasts an impressive capital and investment portfolio.

CNO has witnessed its 2021 and 2022 earnings estimates move 2% and 0.9% north over the past 60 days.

CNO Financial’s earnings even managed to beat estimates in three of its trailing four quarters (while missing the mark in one), the average beat being 13.2%.

Now let’s see what makes this currently Zacks Rank #2 (Buy) company an investor favorite.

CNO Financial is a top-tier holding company for a group of insurance companies operating throughout the United States, which develops, administers and markets supplemental health insurance, annuity, individual life insurance and other insurance products.

In the third quarter of 2021, its sales surpassed the pre-pandemic levels in several areas. CNO Financial’s Worksite division is well-poised for growth on higher sales. It is steadily gaining from its healthy revenue stream, deferred care across its health lines and strong alternative investment performances.

CNO is also taking cost-curbing initiatives. In 2019 and 2020, benefits and expenses decreased 18.3% and 7.1%, respectively, year over year. Despite expenses increasing in the first nine months of 2021, we expect the same to reduce on the back of its measures. This, in turn, is likely to aid margins.

It invested significantly in technology to improve agent productivity as well as sales and advertising. This, in turn, is expected to enrich its online customer experience and enhance lead productivity, which is its priority. CNO also introduced its digital health insurance marketplace myHealthPolicy.com, which is likely to strengthen its presence in the online health insurance market. With added technology, CNO Financial has access to employer partners as well.

Earlier this year, CNO Financial closed the DirectPath buyout to boost its portfolio in the Worksite division. The acquisition was made with the expectations of boosting CNO’s best-in-class benefits management services and enhancing its enrollment capabilities.

This currently Zacks Rank #2 (Buy) player has been raising its quarterly dividend since 2013. It also deploys capital to share repurchase programs. CNO Financial returned $131.3 million to its shareholders through a combination of share buybacks and dividends in the third quarter. In May this year, management increased its dividend by 8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Further Upside Left?

CNO Financial is also poised for long-term growth on the back of a solid alternative investment performance, product and service launches, and strong contributions from its Consumer Division.

The stock carries a VGM Scoreof B. Here V stands for Value, G for Growth and M for Momentum with the score being a weighted combination of all three factors.

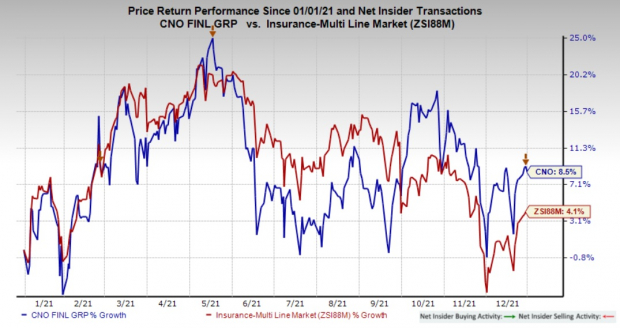

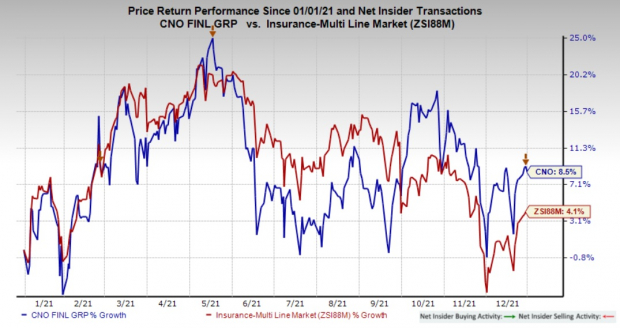

Shares of CNO have gained 8.5% in a year’s time, outperforming its industry‘s growth of 4.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the insurance space are Aflac Incorporated AFL, Old Republic International Corporation ORI and Brighthouse Financial, Inc. BHF. While ORI sports a Zacks Rank #1 (Strong Buy), AFL and BHF hold a Zacks Rank #2 (Buy) at present.

Aflac is a general business holding company that oversees the operations of its subsidiaries by providing management services and making capital available. AFL came up with a trailing four-quarter surprise of 18.3%, on average.

Old Republic International Corporation is an insurance holding firm. Its subsidiaries actively market, underwrite and provide risk management services for a wide variety of coverages, mainly in the general and title insurance fields. ORI’s earnings managed to surpass estimates in all its trailing four quarters, the average being 54.6%.

Brighthouse Financial is a holding organization formed to own the legal entities that historically operated a substantial portion of the former Retail segment of MetLife, Inc. BHF delivered a trailing four-quarter surprise of 67.6%, on average.

Shares of AFL, ORI and BHF have gained 31.7%, 24.8% and 43.8% each in the past year.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the Zacks Top 10 Stocks gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First To New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO): Free Stock Analysis Report

Aflac Incorporated (AFL): Free Stock Analysis Report

Old Republic International Corporation (ORI): Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

CNO Financial Group, Inc. CNO will continue to gain traction from its cost-cutting measures, solid investments in cutting-edge technology and strategic initiatives. This multiline insurer also boasts an impressive capital and investment portfolio.

CNO has witnessed its 2021 and 2022 earnings estimates move 2% and 0.9% north over the past 60 days.

CNO Financial’s earnings even managed to beat estimates in three of its trailing four quarters (while missing the mark in one), the average beat being 13.2%.

Now let’s see what makes this currently Zacks Rank #2 (Buy) company an investor favorite.

CNO Financial is a top-tier holding company for a group of insurance companies operating throughout the United States, which develops, administers and markets supplemental health insurance, annuity, individual life insurance and other insurance products.

In the third quarter of 2021, its sales surpassed the pre-pandemic levels in several areas. CNO Financial’s Worksite division is well-poised for growth on higher sales. It is steadily gaining from its healthy revenue stream, deferred care across its health lines and strong alternative investment performances.

CNO is also taking cost-curbing initiatives. In 2019 and 2020, benefits and expenses decreased 18.3% and 7.1%, respectively, year over year. Despite expenses increasing in the first nine months of 2021, we expect the same to reduce on the back of its measures. This, in turn, is likely to aid margins.

It invested significantly in technology to improve agent productivity as well as sales and advertising. This, in turn, is expected to enrich its online customer experience and enhance lead productivity, which is its priority. CNO also introduced its digital health insurance marketplace myHealthPolicy.com, which is likely to strengthen its presence in the online health insurance market. With added technology, CNO Financial has access to employer partners as well.

Earlier this year, CNO Financial closed the DirectPath buyout to boost its portfolio in the Worksite division. The acquisition was made with the expectations of boosting CNO’s best-in-class benefits management services and enhancing its enrollment capabilities.

This currently Zacks Rank #2 (Buy) player has been raising its quarterly dividend since 2013. It also deploys capital to share repurchase programs. CNO Financial returned $131.3 million to its shareholders through a combination of share buybacks and dividends in the third quarter. In May this year, management increased its dividend by 8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Further Upside Left?

CNO Financial is also poised for long-term growth on the back of a solid alternative investment performance, product and service launches, and strong contributions from its Consumer Division.

The stock carries a VGM Scoreof B. Here V stands for Value, G for Growth and M for Momentum with the score being a weighted combination of all three factors.

Shares of CNO have gained 8.5% in a year’s time, outperforming its industry‘s growth of 4.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research