The Ten Rules to Put an Annuity Into Your Retirement Plan

Even if you love what you do for a living, at some point you need to face the music and retire. That’s not a bad thing either. After all, you’ve…

This story originally appeared on Due

Even if you love what you do for a living, at some point you need to face the music and retire. That’s not a bad thing either. After all, you’ve earned the right to thrive throughout your golden years.

However, to get there first, you need to have a retirement plan.

Of course, retirement planning is no easy task. You need to take into consideration various factors like life expectancy, cost of living, and the housing market, to name a few. In turn, this doesn’t make gauging how much you’ll need to live comfortably in retirement easy.

Moreover, retirees will be presented with many different retirement strategies, products, services, and investment options. And, while vehicles like 401 (k)s and Social Security grab all of the headlines your retirement plan should definitely include annuities.

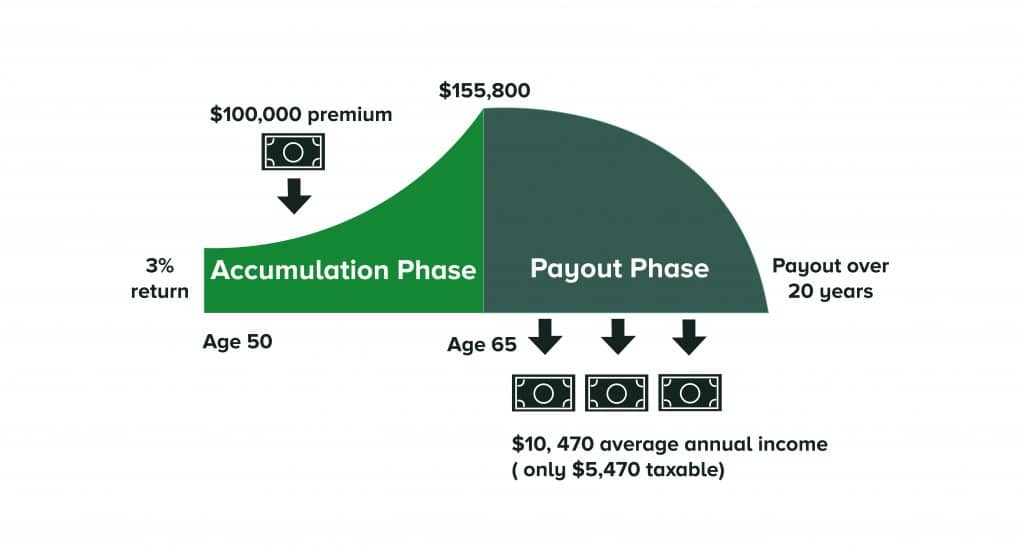

Why should you put an annuity into your retirement plan? As well as providing a stream of income in retirement, annuities offer tax benefits, grow tax-deferred, and don’t have any contribution limits.

If that sounds good to you, then are the ten rules you should follow if your retirement plan includes an annuity.

1. Purchase an annuity with assets you already have.

Did you know that you purchase an annuity with the money you have in your savings or investment accounts? Moreover, you’ll be able to continue to grow your money tax-free if you purchase an annuity with 401(k) or IRA funds. Additional premiums can usually be made on most variable annuities, making them a tax-deferred investment opportunity with no IRS contribution limit.

Does that mean you should completely deplete your other retirement sources? Not exactly.

“If you’ve already reached your 401(k) contributions limit for the year—or soon will—that’s a problem,” explains Kimberly Rotter for Investopedia. “You can’t afford to fall behind in the funding-retirement game.” Furthermore, “losing the contribution’s reduction in your gross income isn’t going to help your tax bill next year.”

Not sure what an annuity is? Here is our “what is an annuity” basics article.

If you’ve maxed out your 401(k), then here’s what you can do next.

“Maxing out a retirement account contribution means that you’ve contributed or deposited the maximum amount that’s allowed to an individual retirement account (IRA) or a defined contribution plan, such as a 401(k),” explains Rotter. “If you’re under the age of 50, the maximum amount that you can contribute to a 401(k) is $19,500 for both 2020 and 2021.” For 2022, this will increase to $20,500.

But, there is a way to add more money to your account if you’re over 50. This is “a catch-up contribution, which amounts to $6,500 for 2020 and 2021,” as well in 2022. Therefore, “if you’re 50 or older, your maximum, annual limit for total 401(k) contributions is $26,000.”

After this, you should invest in an IRA. Traditional IRAs and Roth IRAs are both tax-deferred accounts. Contribution limits, however, apply. According to the IRS, “For 2022, 2021, 2020, and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs can’t be more than:

- $6,000 ($7,000 if you’re age 50 or older), or

- If less, your taxable compensation for the year”

Contribution limits, however, do not apply to rollover contributions and qualified reservist payments.

In short, as long as you’ve accounted for employer plans with matching, Roth IRAs, employer plans, and traditional IRA, then you should focus on annuities.

2. Consider your other retirement income sources.

“When considering annuities and whether a particular type of annuity fits your needs, do so in the context of all your retirement income, savings, investments, and assets, and determine which purpose each income stream will serve,” the Charles Schwab team. “You’ll probably already have one form of income—monthly payments from either Social Security or a government pension—and that might be enough to satisfy your need for lifetime guaranteed income.”

“But if you’re concerned about outliving your savings and want a higher level of guaranteed income that doesn’t depend on markets, one strategy might be to allocate a portion of your retirement savings to a fixed income annuity and invest the rest in a portfolio of investments,” they suggest. “A combination of annuity payouts and portfolio can be particularly helpful if what you receive from Social Security or a pension doesn’t meet your financial needs.”

A deferred annuity is also an option. This type of annuity will issue payments sometime in the future. Additionally, it is a relatively small investment that can be spread out over time. The plan is ideal if you’re worried about the state of Social Security or your other retirement vehicles.

3. Ask yourself, “Do I need money today or tomorrow?”

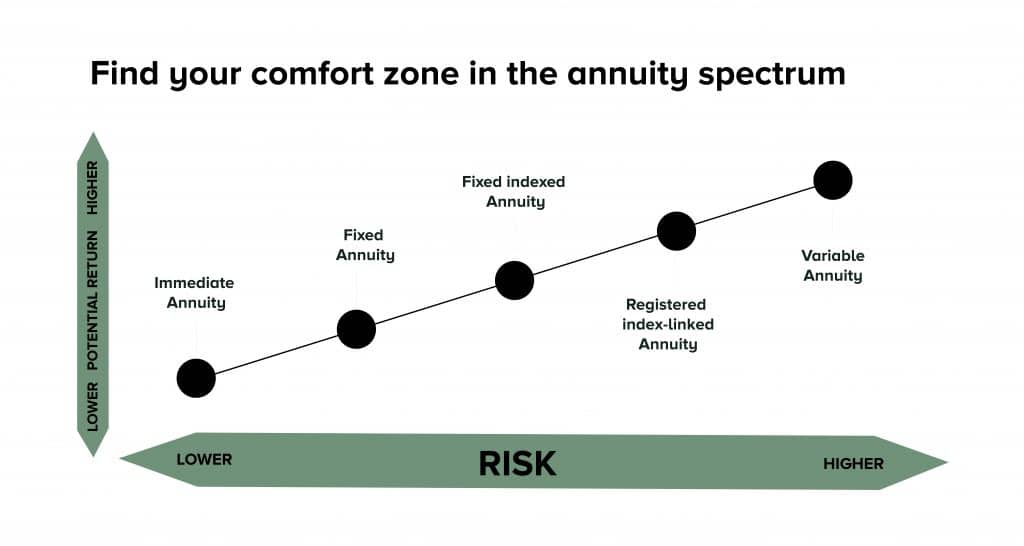

When planning your retirement, there are two basic types of annuities you should consider; immediate and deferred annuities. What sets them apart? When you can begin receiving payments.

If you purchase an immediate annuity, you pay a lump sum to the insurer and begin receiving regular payments, well, immediately. If they plan to maintain a regular income stream once they retire, some older adults may opt to invest a portion of their nest egg in this type of annuity.

Comparatively, a deferred annuity is a longer-term asset. You make premium payments to an annuity company and in exchange will receive regular payments at a later date. Your money has the opportunity to accrue interest (fixed annuities) or profit from market gains (variable annuities) before that date.

Deferred annuities may seem appealing, especially to younger people. But there is a major disadvantage: they bind your investment up for years, if not decades after you purchase it. Additionally, deferred annuities have high commissions and fees.

Consider investing in 401(k)s or IRAs instead. You might also want to consider an HSA if you qualify. However, as mentioned above, once these have been maxed out and you have the money, investing in a deferred annuity is a smart move if you want a guaranteed retirement income down the road.

Conversely, if you are planning on retiring soon or have already retired, the accumulation period is much shorter. Therefore, an immediate annuity is a good choice. Besides providing a supplemental retirement income, you don’t have to worry about market fluctuations as much.

4. Use “buckets” to support time segmentation.

The buckets concept was first developed by Harold Evensky in 1985 to reduce sequence-of-returns risk, states Pacific Life. There were originally two buckets, one for cash and a second for investments. The cash bucket was used for immediate expenditures, while the other was reserved for growth.

Long-term investments used to be mainly stocks, but the strategy has now evolved into three buckets;

- 1–5 years; cash flow. You will need low-risk investments to cover your expenses in the first five years of retirement.

- 6–15 years; bonds. In a middle retirement age, bonds offer potential growth.

- 16+ years’ stocks. Equity investments carry the highest risk but are also the most rewarding.

And, yes. Annuities can help with this approach. Looking for more info. Here is our Retirement 101 Guide to help you understand retiring with annuities.

Bucket one; money for current expenses.

To meet spending needs in the first five years of retirement, the retiree needs income and cash flow. You can meet those essential expenses with an income annuity, such as a single-premium immediate annuity (SPIA). This type of annuity can also bridge the gap between retirement and claiming Social Security benefits.

Bucket two; money for the middle.

For the second bucket, growth is required in a shorter time frame. Due to the low-interest rates and bond yields, an investor can earn a higher return by participating in the market. Because of the shorter time horizon, this option is riskier than some might be comfortable with. These concerns can be reduced if a variable annuity provides a guaranteed minimum accumulation benefit.

Bucket three; growth for the future.

The third bucket is typically used for long-term investing, but it carries the highest risk. This can be as easy as an investment-only variable annuity (IOVA) that’s purchased from both qualified and non-qualified accounts. Costs are reduced by eliminating additional living benefits. And, investments can be made as aggressively as the investor desires using as many (or as few) sub-accounts as they want.

Assets can grow faster in non-qualified accounts that allow rebalancing without recognizing gains, for example through tax deferral.

5. Don’t be fooled by so-called guarantees.

“One of the most common sales tactics used by variable annuity peddlers is the promise of a guaranteed rate of return,” note the good folks over at Annuity Gator. “This practice has prompted the regulatory authority FINRA to issue an Investor Alert for variable annuities, and The North American Securities Administration listed “variable annuity sales practices’ as one of its top investor threats.”

Usually, variable annuities offer a guaranteed rate of return through the addition of a rider called an income rider, or the Guaranteed Lifetime Withdrawal Benefit rider (GLWB), they explain. In addition to the underlying fund expenses, administrative fees, and the M&E expense or risk charge, you may be charged 1 to 2 percent for these special features.

“Furthermore, a variable annuity’s rate of return is NOT stable,” they add. The stock market determines what you earn on your investment and there is no guarantee you will make a profit. Even if you pay extra for the guarantees, your actual account may still lose money.

Unless you’re younger and have the extra funds to absorb these potential losses, it’s often recommended that you avoid variable annuities. Instead, you should purchase a fixed or indexed annuity for your retirement.

The benefits of fixed annuities are that they’re tax-deferred and don’t charge any fees. It’s important to keep an eye on the annuity’s interest rate, however. The advantage of indexed annuities is that you can participate in market upswings, rather than downswings. Furthermore, these annuities are tax-deferred and fee-free, which can maximize your investment returns.

Do you know about the pros and cons of annuities. Make sure to read our “Pros and Cons of Annuities” article to help you understand what you’re getting into before you start. We like annuities, but you need to understand all sides before you start.

6. Guard your savings against today’s — and tomorrow’s — taxes.

In planning for a reliable retirement income stream, an annuity can protect your savings from today’s-and tomorrow’s taxes, notes the Lincoln Financial Group. How so? Well, through the following three tactics;

- Deferral of taxes. In the event of a withdrawal, taxes are only applied to your assets within an annuity, since they are a tax-deferred vehicle. Tax deferral can allow your portfolio to grow more over time.

- Income that is tax-efficient. Annuities have the advantage of being highly tax-efficient. For an additional fee, you can add a rider to your policy to allow withdrawals from the gains and a portion of your initial principal. In such cases, only the gains get taxed. Annuities can also be transferred tax-free between subaccounts.

- Diversification of taxes. An annuity can be enhanced with a living benefit option (for an additional cost) to make withdrawals from gains and principal more tax-efficient. In such a case, only the gains are taxed.

“Tax planning is a crucial part of retirement planning—something that all too often goes unaccounted for,” state the Lincoln Financial Group. “The impact of taxes in the future is unknown; in the face of this uncertainty, a tax diversification strategy that includes an annuity can give you the confidence that you will always have income available to you.”

7. Delay taking your Social Security benefits.

Chances are that if you’re planning for your retirement, then you haven’t started taking Social Security just yet. If you’re in this situation, consider buying a fixed annuity to take care of your bills. As a result, you’ll be able to postpone claiming your benefits.

Why’s that important? While you can start collecting Social Security benefits at age 62, your monthly amount increases every year until you turn 70, at which point you must begin collecting benefits. And, as David Roedeck points for Kiplinger, that difference can be substantial.

“In an example from Social Security, a $708-per-month benefit for someone who starts taking it at age 62 becomes $1,013 at age 67 and $1,253 at age 70,” he explains. “Those higher benefits last your entire life and even continue for a lower-earning surviving spouse, who potentially could swap a smaller benefit for your larger one after you’re gone.”

Of course, there are some drawbacks if you use your annuity in this manner. “If you die early in your retirement, there’s no bucket of Social Security funds that you can give to others” besides a spouse, says Sara Wiener, assistant vice president of annuities at Principal Financial Group. By compromising on benefits, you’ve depleted assets that might have passed to heirs.

Overall, a retiree in good health who wants a more reliable income can benefit the most from this strategy.

8. Leverage your annuity for long-term care.

Besides running out of money, health care costs during the later stages of life is one of the top retirement concerns people have. Approximately 66% of Americans are afraid that they will not be able to afford medical care this year, according to a December 2020 AccessOne survey of 1,000 U.S. adults.

But, it gets worse. This fear doesn’t apply to just large medical expenses. 49% of respondents reported that they’re concerned about how they would pay for unexpected medical bills under $1,000.

In order to prepare for such a situation, many insurers offer long-term care insurance. Unfortunately, the cost of these policies can be pricey and they can be difficult to qualify for. Furthermore, the money you pay into them if you do not need long-term care stays with the insurer instead of being divided.

How can you get around this? A long-term care annuity. Not only does this have popular deferred annuity features, it also comes with long-term care protection.

By purchasing a long-term care rider, you can increase your insurance benefits by a specified amount. In some hybrid long-term care and annuity plans, you can have immediate coverage that leverages every dollar you put in by providing two or three dollars worth of coverage. With other annuities, though, the benefits are available beginning at age 85.

Best of all? Any funds not used for long-term care may be transferred to your family in case you do not need it.

9. Consider a qualified longevity annuity contract.

Do you have a tax-deferred employer-sponsored retirement plan? Examples would be most 401(k) and 403(b) plans, IRAs, and small-business accounts (Keoghs)? If so, then annual withdrawals must be made once you reach age 72. And, if you don’t you can face harsh penalties.

The good news? If you plan for this in advance, you can avoid these penalties. One example of this would be purchasing a qualified longevity annuity contract.

“In 2014, the U.S. Treasury Department permitted IRA owners and qualified plan participants to purchase a qualified longevity annuity contract,” is what I wrote about RMD’s. “Shortened to QLAC, this lets you fund an annuity from assets that you already have stashed in a longevity annuity contract, such as an IRA or pension.”

If you do this, you will receive monthly payments for the rest of your life. Furthermore, you can defer your RMDs until the age of 85.

As a result, “this can reduce a person’s required minimum distributions,” adds Rampton. And, even better, “you can remain in a lower tax bracket and avoid a higher Medicare premium.”

Just note that your money won’t grow in a QLAC. On the flip side, it won’t go down either. You should also be aware that contributions to IRAs are limited to 25% of assets, with a maximum of $130,000.

10. Transfer wealth to your heirs.

We don’t always want to talk about legacy planning, but it is an important aspect of retirement planning. But, investing in an estate plan prepares us on how to bequeath our assets to heirs or loved ones after we die. And, as you’ve probably assumed, this includes annuities if you own them.

Annuity payments may cease upon the death of the annuitant, depending on the terms of the contract. The death-benefit provision, however, lets you designate a beneficiary who is entitled to the greater of all remaining assets or a minimum guaranteed amount.

In short, an annuity owned by a parent, spouse, or family member can leave the annuity for someone else to inherit.

Any remaining payments owed to an annuitant’s beneficiaries are distributed by insurance companies either as a lump sum or as a series of payments. To prevent the accumulated assets from being surrendered to a financial institution if the owner dies, it’s important to include a beneficiary in the annuity contract.

The post The Ten Rules to Put an Annuity Into Your Retirement Plan appeared first on Due.

Even if you love what you do for a living, at some point you need to face the music and retire. That’s not a bad thing either. After all, you’ve earned the right to thrive throughout your golden years.

However, to get there first, you need to have a retirement plan.

Of course, retirement planning is no easy task. You need to take into consideration various factors like life expectancy, cost of living, and the housing market, to name a few. In turn, this doesn’t make gauging how much you’ll need to live comfortably in retirement easy.