Conagra Stock Has More Room to Grow

Consumer packaged foods giant Conagra Brands, Inc. (NYSE: CAG) stock rebounded into its fiscal Q3 2022 earnings.

This story originally appeared on MarketBeat

Consumer packaged foods giant Conagra Brands, Inc. (NYSE: CAG) stock rebounded into its fiscal Q3 2022 earnings. However, the Company lowered its guidance mainly due to a surge in inflationary pressures. The Company faced higher-than-expected cost pressures which ate into margins. However, it has been implementing price inflation-driven price-actions that will be seen in fiscal Q1 2023 as consumer demand still remains very strong. Keep in mind the price hikes being passed onto consumers still take time to hit the bottom line. The higher inflation is affecting its strongest business lines including meat, snack and frozen. Cost pressures in logistics and freight also ate into margins. These are transitory effects that the Company should see get tempered as the U.S. Federal Reserve carries forward on its seven interest rate hikes in 2022 attempting to bring it closer to the 2% inflation target rate. Prudent investors looking to get in ahead of the margin improvement from price and interest rate hikes can watch for opportunistic pullback levels in Conagra before its fiscal Q1 2023 earnings release.

Q3 Fiscal 2022 Earnings Release

On April 7, 2022, Conagra released its fiscal third-quarter 2022 results for the quarter ending February 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.58 excluding non-recurring items meeting consensus analyst estimates for a $0.58. Revenues grew by 5.1% year-over-year (YOY) to $2.91 billion beating analyst estimates for $2.84 billion. Net sales grew 5.1%. Organic net sales rose 6% YoY. Operating margins fell 387 bps to 12.3%. Conagra CEO Sean Connolly commented, “We experienced higher-than-expected cost pressures as the third quarter progressed and expect those pressures to continue into the fourth quarter, particularly in certain frozen, refrigerated, and snacks businesses. In response, we have taken steps to implement additional inflation-driven pricing actions. We will begin to see the benefits of these actions in the first quarter of fiscal 2023. Consumer demand has remained strong in the face of our pricing actions to date, but there will continue to be a lag between the timing of the incremental inflation and the benefits of our mitigating actions.”

Downside Guidance

Conagra issued downside guidance for fiscal full-year 2022 EPS of approximately $2.35 versus $2.43, from prior guidance of $2.50. Fiscal full-year 2022 organic net sales growth is expected to be around 4%, up from prior guidance of 3%.

Conference Call Takeaways

CEO Sean Connolly noted the Company met its expectations in fiscal Q3 and remains committed to the Conagra Way playbook in creating superior products that create everlasting connections between consumers and its brands. The Company gained market share on key categories on a 1 to 2-year basis. He pointed out, “And it’s important to note that in response to inflation-driven pricing that has been executed in the market to date, elasticities have been favorable to historical patterns, even more so than what we expected. Unit demand remains strong as consumers continue to recognize the superior relative value that our portfolio provides.” He reflected on how inflation spikes higher than anticipated throughout the quarter, prompting price increases which deter strong consumer demand. While Q3 experienced margin compression, the actions taken were the right ones for the long term. The Company expects inflationary pressures to continue on through Q4 amounting to an additional $100 million, a 26% increase versus two years ago. Inputs like dairy and protein are harder to offset as its meat business relies on them. The frozen is even more complicated as it requires specialist temperature controlled transportation. CEO Connolly stated, “But as we started to see this latest wave of inflation coming, we took action on pricing just as we have throughout the year. These new pricing moves go into effect in Q1 of fiscal ’23 and are highly targeted toward frozen and protein snacks.”

CAG Opportunistic Pullback Levels

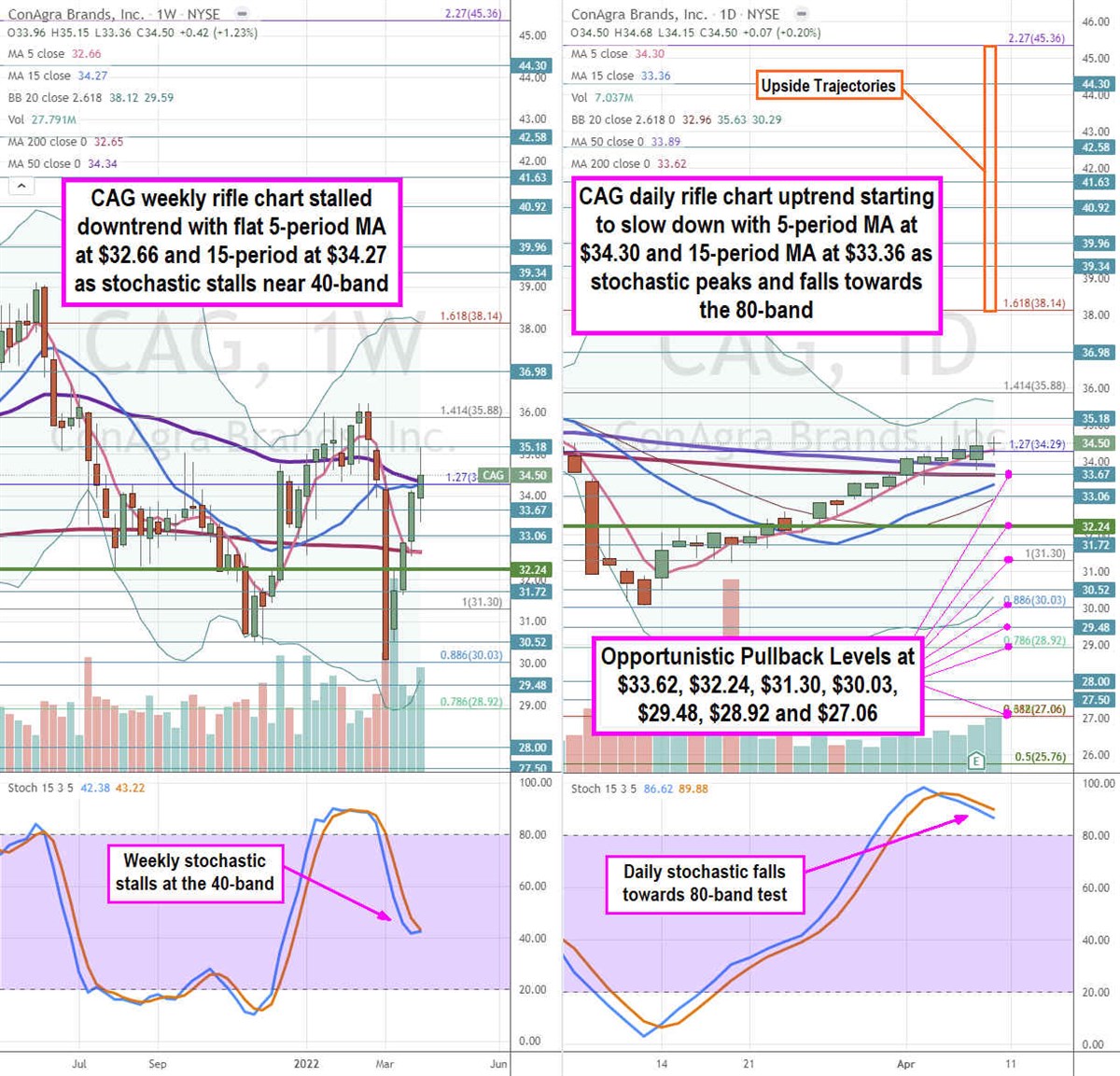

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for CAG stock. The weekly rifle chart peaked near the $35.88 Fibonacci (fib) level. The weekly rifle chart downtrend stalled on the earnings bounce as the weekly 5-period moving average (MA) is flat at $32.66 overlapping the weekly 200-period MA at $32.65 and the 15-period MA at $34.27 overlapping the 50-period MA at $34.34. The weekly stochastic is stalled at the 40-band to either cross up or trigger a mini inverse pup. The weekly market structure low (MSL) buy triggered on the breakout through $32.24. The weekly upper Bollinger Bands (BBs) overlap the $38.14 fib level. The daily rifle chart has been in a grinding uptrend that looks to have peaked on the earnings release as the 5-period MA stalls at $34.30 followed by the 50-period MA at $33.89 and 200-period MA at $33.62. The daily 15-period MA is rising at $33.36 as the stochastic is falling towards the 80-band test. Needless to say, there is a cluster of supports and resistance in the $34.35 to $32.65 price range. Prudent investors can look for opportunistic pullback levels at the $33.62 daily 200-period MA, $32.24 weekly MSL trigger, $31.30 fib, $30.03 fib, $29.48, $28.92 fib, and the $27.06 fib level. Upside trajectories range from the $38.14 fib level up towards the $45.36 fib level.

Consumer packaged foods giant Conagra Brands, Inc. (NYSE: CAG) stock rebounded into its fiscal Q3 2022 earnings. However, the Company lowered its guidance mainly due to a surge in inflationary pressures. The Company faced higher-than-expected cost pressures which ate into margins. However, it has been implementing price inflation-driven price-actions that will be seen in fiscal Q1 2023 as consumer demand still remains very strong. Keep in mind the price hikes being passed onto consumers still take time to hit the bottom line. The higher inflation is affecting its strongest business lines including meat, snack and frozen. Cost pressures in logistics and freight also ate into margins. These are transitory effects that the Company should see get tempered as the U.S. Federal Reserve carries forward on its seven interest rate hikes in 2022 attempting to bring it closer to the 2% inflation target rate. Prudent investors looking to get in ahead of the margin improvement from price and interest rate hikes can watch for opportunistic pullback levels in Conagra before its fiscal Q1 2023 earnings release.

Q3 Fiscal 2022 Earnings Release

On April 7, 2022, Conagra released its fiscal third-quarter 2022 results for the quarter ending February 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.58 excluding non-recurring items meeting consensus analyst estimates for a $0.58. Revenues grew by 5.1% year-over-year (YOY) to $2.91 billion beating analyst estimates for $2.84 billion. Net sales grew 5.1%. Organic net sales rose 6% YoY. Operating margins fell 387 bps to 12.3%. Conagra CEO Sean Connolly commented, “We experienced higher-than-expected cost pressures as the third quarter progressed and expect those pressures to continue into the fourth quarter, particularly in certain frozen, refrigerated, and snacks businesses. In response, we have taken steps to implement additional inflation-driven pricing actions. We will begin to see the benefits of these actions in the first quarter of fiscal 2023. Consumer demand has remained strong in the face of our pricing actions to date, but there will continue to be a lag between the timing of the incremental inflation and the benefits of our mitigating actions.”