Time to Buy any Dip in Prologis Stock Global logistics real estate investment trust (REIT) Prologis (NYSE: PLD) stock has been resilient in the face of the sell-off in benchmark indices.

By Jea Yu

Our biggest sale — Get unlimited access to Entrepreneur.com at an unbeatable price. Use code SAVE50 at checkout.*

Claim Offer*Offer only available to new subscribers

This story originally appeared on MarketBeat

Global logistics real estate investment trust (REIT) Prologis (NYSE: PLD) stock has been resilient in the face of the sell-off in benchmark indices. The world's largest REIT focuses on building and managing logistics warehouses throughout America, Europe, and Asia. Shares recently hit an all-time high of $174.54. The Company maintains itself as the world's leader in logistics real estate solutions and has maintained ESG practices over the last four decades. The Company ended Q1 fiscal 2022 with a 97.4% occupancy rate. The Company is benefitting wildly as rent changes work in their favor with rising rates driving same-store NOI growth to a record high 8.7%, which means $1.6 billion of annual NOI will result in over $2 per share added to the bottom line even with no more rent growth. With all-time low vacancies and supply chains returning to normal, the Company signed 60 million square feet of leases and issued 90 million square feet of proposals for clients to compete for "the little space that remains." The tight and uncertain global supply chain is prompting Companies to take on more inventory especially in epicenter industries like homebuilding for fear of further disruptions. Prudent investors seeking to monetize supply chain and logistics improvement can look for opportunistic pullbacks in shares of Prologis to consider buying-the-dips.

Q1 Fiscal 2022 Earnings Release

On April 19, 2022, Prologis released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported earnings per share (EPS) profits of $1.54 versus $1.07 consensus analyst estimates, a $0.47 beat. Revenues grew 5.4% to $1.08 billion missing estimates for $1.09 billion. Prologis and its co-investment ventures issued $2.6 billion in debt at a weighted interest rate of 1.5% including $1.6 billion in green bonds. The Company has maintained its leading liquidity of $6.8 billion in cash and credit revolvers. Debt as a percentage of total market capitalization was 13.5% and weighted investment interest rate on its share of debt was 1.7% with a weight average of 10 years. The combined investment capacity including its open-ended ventures is nearly $18 billion.

Raised Guidance

Prologis raised its fiscal 2022 FFO to come in between $5.10 to $5.16 versus $5.04 consensus analyst estimates and up from previous range of $5.00 to $5.10. Prologis CEO Hamid Moghadam commented, "The need for resilience in the supply chain continues to drive record demand despite today's economic and geopolitical risks. With our well-positioned portfolio, irreplaceable land bank, abundant investment capacity and differentiated customer solutions, we expect to continue to outperform while delivering exceptional customer service."

Conference Call Takeaways

Prologis CFO Tim Arndt starting off the conference call reviewing financial metrics and achievements in the quarter. He noted that core FFO was $1.09 per share ahead of forecast and rent change rollover was 37% led by the U.S. at 42%. Its Southern California, New York, New Jersey portfolios realized 86% and 67% rent change in the quarter. Prologis ended the quarter with 97.4% occupancy. The lease mark-to-market is at 47% which "…equates to $1.6 billion of annual NOI as leases roll to market or over $2 per shares of earnings that will drop to the bottom line even with no additional rent growth." The Company commenced with more than $1 billion in new development across 32 projects and 15 markets with expectations to generate value creation exceeding $400 million. The buildout land bank is 200 million square feet and $28 billion. Debt-to-market cap is 14%. Vacancy is at all-time lows.

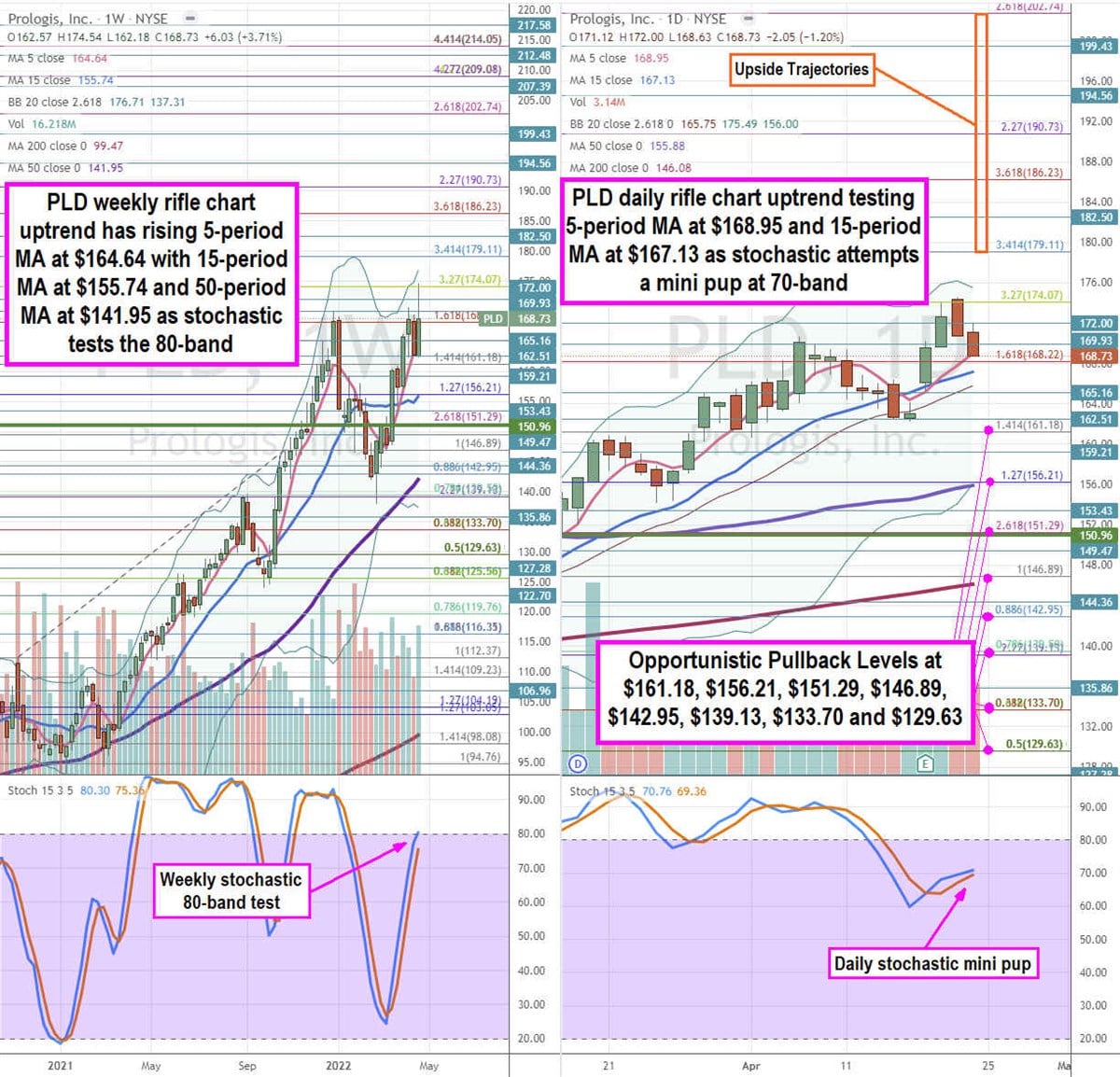

PLD Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for PLD stock. The weekly rifle chart uptrend peaked near the $174.07 Fibonacci (fib) level and pulled back to test the uptrend support at the rising 5-period moving average (MA) at $164.64. This is followed by the 15-period MA at $155.74. The weekly upper Bollinger Bands (BBs) are at $176.71. The weekly market structure low (MSL) buy triggered a breakout above $150.96. The weekly stochastic oscillation is testing the 80-band. The weekly 50-period MA is rising at $141.95. The daily rifle chart uptrend is testing its 5-period MA support at $168.95 followed by its 15-period MA at $167.13. The daily upper BBs sit at $175.49. The daily 50-period MA sist at $155.88 and 200-period MA support sits at $146.08. Prudent investors can watch for opportunistic pullbacks at the $161.18 fib, $156.21 fib, $151.29 fib, $146.89 fib, $142.95 fib, $139.13 fib, $133.70 fib, and the $129.63 fib level. Upside trajectories range from the $179.11 fib level up towards the $202.74 fib level.