Iridium Communications Stock is Ready to Return to Orbit

Global satellite communications provider Iridium (NASDAQ: IRDM) stock recently took a nosedive from the selling in benchmark indices.

This story originally appeared on MarketBeat

Global satellite communications provider Iridium (NASDAQ: IRDM) stock recently took a nosedive from the selling in benchmark indices. The provider of satellite-based broadband caters to industries ranging from aviation, transport, logistics, emergency, maritime, energy, and government. Commercial services represented the largest top-line contributor at 59% of total revenues. The Company reported record equipment sales in its fiscal Q1 2022 earnings report and beating analyst estimates by $0.02 per share. Its primary business is “firing on all cylinders” according to CEO Matt Desch. The Company grew its subscriber base by 17% driven largely in part by internet-of-things (IoT). Incidentally, the Company is gaining business from competitors suffering from supply chain constraints. However, Iridium is also facing supply chain constraints creating backlog but expects to meet the demand by later in the year. The Russia Ukraine conflict is also boosting demand for handsets. The Company’s strong financial position and growth trajectory enable ESG compliance without sacrificing opportunities or business priorities. Prudent investors seeking exposure in a space and satellite company that actually makes a profit can watch for opportunistic pullbacks in shares of Iridium.

Q1 Fiscal 2022 Earnings Release

On April 19, 2022, Iridium released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit $0.02, beating consensus analyst estimates for breakeven, by $0.02. Revenues rose 14.8% year-over-year (YoY) to $168.2 million versus $156.83 consensus analyst estimates. Revenues consisted of service revenue of $126.1 million and $42.1 million of equipment sales. Net leverage was 3.4 times OEBITDA at Dec. 31, 2021. Iridium ended the quarter with 1,781,000 total billable subscribers, up 17% YoY driven by growth in IoT. Iridium CEO Matt Desch commented, “Iridium continued to see strong demand in the first quarter. I’m continually amazed at the innovative ways in which our technology and distribution partners utilize our unique satellite network to drive growth and serve their respective markets.”

Reaffirmed Full-Year Fiscal 2022 Guidance

The Company reaffirmed guidance for full-year 2022 with total service revenue growth between 5% to 7% from the $492 million total service revenue in 2021. Full-year 2022 O (operational) EBITDA is expected between $400 million to $410 million, up from $378.2 million in 2021.

Conference Call Takeaways

CEO Desch started off stating that the space and satellite industry remains vibrant and optimistic, and Iridium is stands in the middle of that dynamic as a “clear leader”. Its primary business is robust as its commercial land mobile handset demand continues at a strong pace. This is driven by growing momentum from PTT, quality product and supply chain issues faced by competitors. Maritime is improving for most countries as indicated by its rising ARPUs thanks to faster speeds from Iridium Certus compared to its legacy Iridium OpenPort terminals. The highlight was the strong tailwinds from IoT demand stemming from the fast growing array of personal satellite messaging devices on the network. Iridium posted 50,000 commercial IoT activations in the quarter. He noted that it would have been higher if they had the supply to meet the demand, which is expected by the end of the year. U.S. government business is a cornerstone of its service revenue business. New video compression technology supported over its Iridium Certus network helps improve efficiency making its service more attractive for both government and commercial applications. CEO Desch noted that subscriber growth from U.S. government still lags due to the Space Force and DISA transition to administer the EMSS contract. While he doesn’t have an immediate need to launch satellites, he still sees an opportunity to rideshare launch most of its ground spare satellites. It would entail a $35 million one-time expense that shouldn’t impact overall CapEx holiday plans.

IRDM Opportunistic Pullback Levels

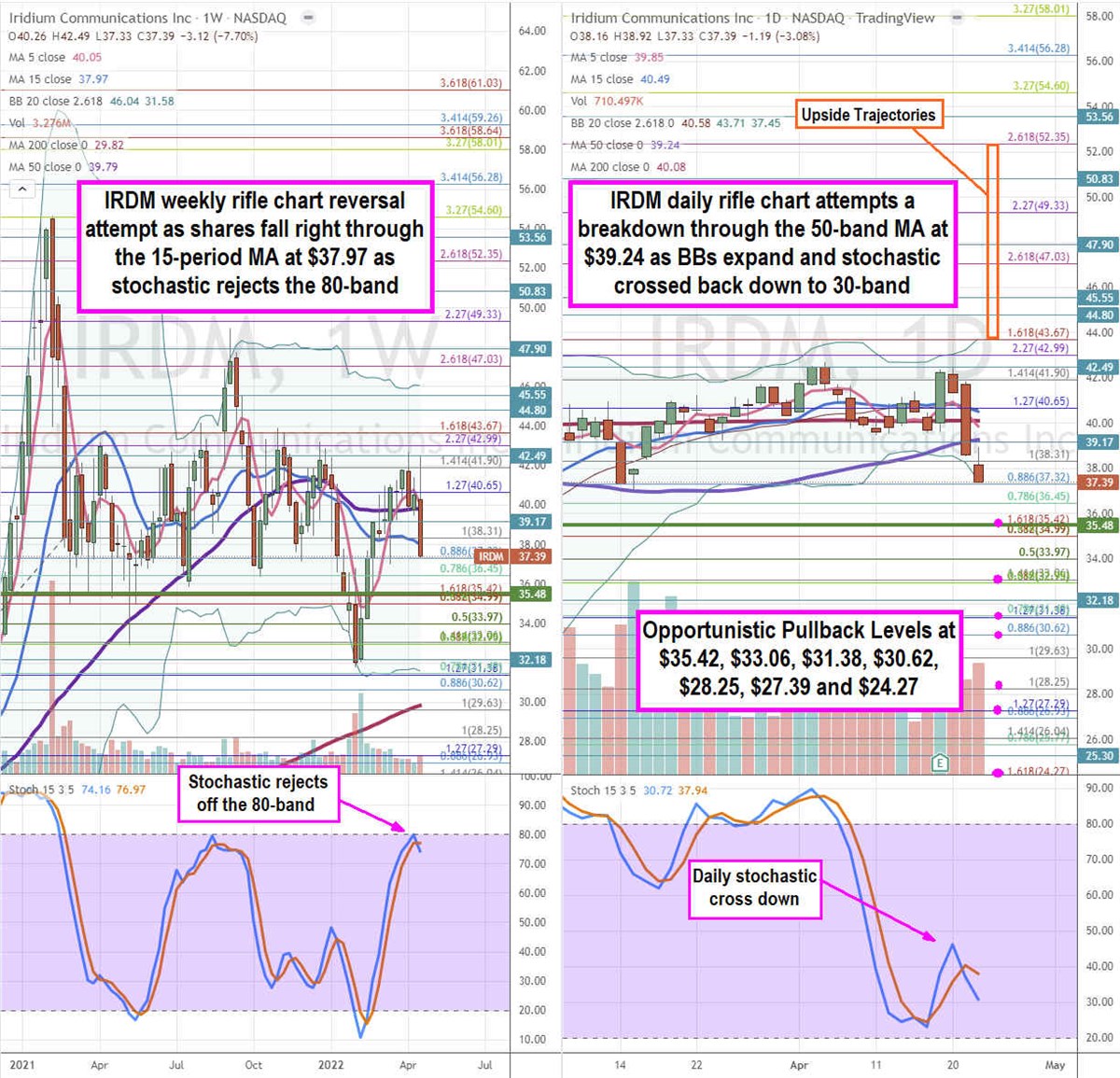

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field for IRDM stock. The weekly rifle chart uptrend made a sharp reversal as shares peaked and rejected just below the $42.99 Fibonacci (fib) level. Shares collapsed through the weekly 5-period moving average (MA) support at $40.05. the weekly 50-period MA at $39.79, and the weekly 15-period MA at $37.97 in one candle. The weekly stochastic also peaked and rejected back down off the 80-band. The weekly lower Bollinger Bands (BBs) sit at $31.58. The weekly market structure low (MSL) buy triggered on the earlier breakout through $35.48. The daily rifle chart has been in a consolidation that is attempting to breakdown as the upper and lower BBs start to expand at $43.71 and $37.45, respectively. The daily 5-period MA at $39.85 crossed below the daily 200-period MA at $40.08 as the 15-period MA starts to fall. Shares fell through the daily 50-period MA at $39.24 to overshoot the daily lower BBs at $37.45. The daily stochastic crossed back down through the 40-band. Prudent investors can watch for opportunistic pullback levels at the $35.42 fib, $33.06 fib, $31.38 fib, $30.62 fib, $28.25 fib, $27.39 fib, and the $24.27 fib level. Upside trajectories range from the $43.67 fib level up towards the $52.35 fib level.

Global satellite communications provider Iridium (NASDAQ: IRDM) stock recently took a nosedive from the selling in benchmark indices. The provider of satellite-based broadband caters to industries ranging from aviation, transport, logistics, emergency, maritime, energy, and government. Commercial services represented the largest top-line contributor at 59% of total revenues. The Company reported record equipment sales in its fiscal Q1 2022 earnings report and beating analyst estimates by $0.02 per share. Its primary business is “firing on all cylinders” according to CEO Matt Desch. The Company grew its subscriber base by 17% driven largely in part by internet-of-things (IoT). Incidentally, the Company is gaining business from competitors suffering from supply chain constraints. However, Iridium is also facing supply chain constraints creating backlog but expects to meet the demand by later in the year. The Russia Ukraine conflict is also boosting demand for handsets. The Company’s strong financial position and growth trajectory enable ESG compliance without sacrificing opportunities or business priorities. Prudent investors seeking exposure in a space and satellite company that actually makes a profit can watch for opportunistic pullbacks in shares of Iridium.

Q1 Fiscal 2022 Earnings Release

On April 19, 2022, Iridium released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit $0.02, beating consensus analyst estimates for breakeven, by $0.02. Revenues rose 14.8% year-over-year (YoY) to $168.2 million versus $156.83 consensus analyst estimates. Revenues consisted of service revenue of $126.1 million and $42.1 million of equipment sales. Net leverage was 3.4 times OEBITDA at Dec. 31, 2021. Iridium ended the quarter with 1,781,000 total billable subscribers, up 17% YoY driven by growth in IoT. Iridium CEO Matt Desch commented, “Iridium continued to see strong demand in the first quarter. I’m continually amazed at the innovative ways in which our technology and distribution partners utilize our unique satellite network to drive growth and serve their respective markets.”