Is Hanesbrands a Good High-Yield Dividend Stock to Invest In? The iconic apparel brand marketer Hanesbrands Inc. (HBI) posted solid sales and earnings growth in its last reported quarter, led by year-over-year improvement in segmental revenue. In addition, the company...

This story originally appeared on StockNews

The iconic apparel brand marketer Hanesbrands Inc. (HBI) posted solid sales and earnings growth in its last reported quarter, led by year-over-year improvement in segmental revenue. In addition, the company declared a regular cash dividend of 0.15. The stock delivers a 4.8% dividend yield currently. But is it worth adding the stock to one's portfolio given the supply chain issues that continue to impact HBI's growth? Let's discuss.

Hanesbrands Inc. (HBI) in Winston-Salem, N.C. is a consumer products company that develops, manufactures, sources, and distributes a variety of basic clothes for men, women, and children. The company operates through three segments: innerwear; activewear; and international. As of Jan. 2, 2022, it operated 216 retail and direct outlet stores in the United States and the Commonwealth of Puerto Rico and 626 retail and outlet outlets overseas.

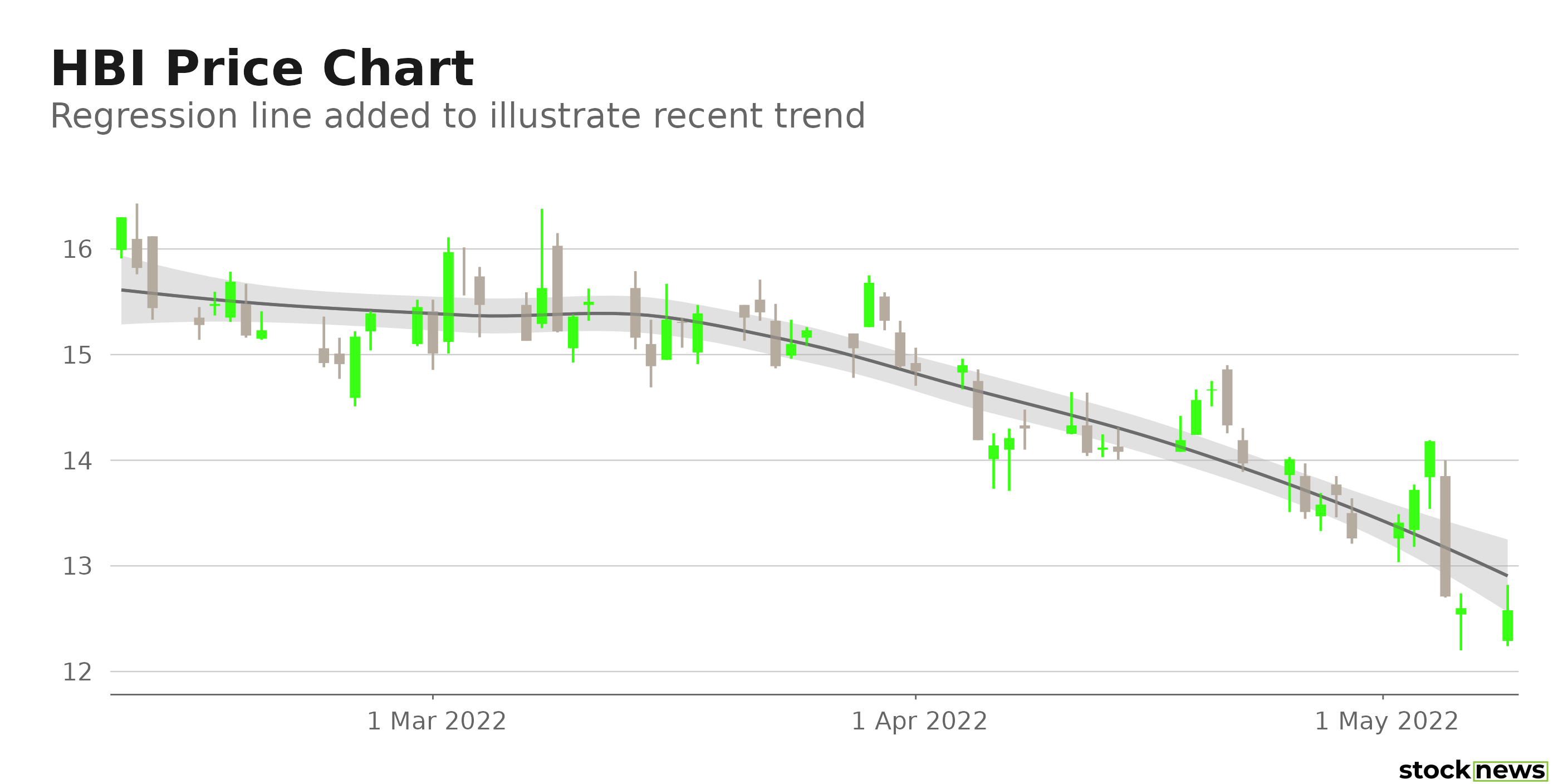

While HBI's four-year average dividend yield is 3.9%, its current dividend translates to a 4.8% yield. It declared a $0.15 per share quarterly dividend on April 26, 2022, to be paid on May 31, 2022. However, the stock has declined 24.8% in price year-to-date and 12% over the past month to close yesterday's trading session at 12.58.

HBI said its first-quarter performance was negatively affected by supply chain issues with its Champion brand. "Product supply challenges to the U.S. market did not improve as expected in the quarter, resulting in approximately $40 million in unfulfilled in-hand orders in the U.S.," the company said in its results report on Thursday. "Had the product arrived on time, Champion sales in the United States would have increased by high teen rates."

Here is what could shape HBI's performance in the near term:

Mixed Financials

HBI's net sales grew 4.5% year-over-year to $1.58 billion for the three months ended April 02, 2022. Its net income was $118.70 million, compared to a $263.26 million net loss in the prior-year quarter. However, its gross profit decreased 3.1% from its year-ago value to $584.18 million. The company's operating profit declined 10.3% year-over-year to $170.51 million. Its Earnings per share decreased 20% from the prior-year quarter to $0.24. In addition, its cash and cash equivalents declined 31.2% for the three months ended April 2 to $369.21 million.

Discounted Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 7.42x, which is 38.8% lower than the 12.11x industry average. Also, its 0.62x forward Price/Sales is 32.1% lower than the 0.92x industry average. Furthermore, HBI's 9.32x forward EV/EBIT is 18.1% lower than the 11.27x industry average.

POWR Ratings Reflect Uncertainty

HBI has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. HBI has a C grade for Quality and Stability. The company's mixed financials are consistent with the Quality grade. In addition, the stock's 1.50 beta is in sync with the Stability grade.

Among the 68 stocks in the A-rated Fashion & Luxury industry, HBI is ranked #54.

Beyond what I have stated above, one can view HBI ratings for Growth, Momentum, Value, and Sentiment here.

Bottom Line

HBI's robust revenue growth from growing innerwear and activewear sales across its brand portfolio, and ongoing investments in improving its e-commerce platform, should bode well for the stock. However, an unabating supply chain crisis could further mar its segmental growth in the near term. Analysts expect its EPS to decline 27.7% in the current quarter (ending June 30, 2022). In addition, the stock is currently trading below its 50-day and 200-day moving averages of $14.60 and $16.69, respectively, indicating bearish sentiment. So, we believe investors should wait before scooping its shares.

How Does Hanesbrands Inc. (HBI) Stack Up Against its Peers?

While HBI has an overall C rating, one might want to consider its industry peers, J.Jill Inc. (JILL), Hugo Boss AG (BOSSY), and Caleres Inc. (CAL), which have an overall A (Strong Buy) rating.

HBI shares rose $0.22 (+1.75%) in premarket trading Tuesday. Year-to-date, HBI has declined -22.37%, versus a -14.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Hanesbrands a Good High-Yield Dividend Stock to Invest In? appeared first on StockNews.com