Is Energizer Holdings a Winner in the Household Products Industry? Leading household and specialty batteries manufacturer Energizer Holdings (ENR) posted better-than-expected earnings for its fiscal second quarter and raised its top-line growth outlook for the fiscal year. However, the company...

This story originally appeared on StockNews

Leading household and specialty batteries manufacturer Energizer Holdings (ENR) posted better-than-expected earnings for its fiscal second quarter and raised its top-line growth outlook for the fiscal year. However, the company has stated that uncertainty in global economic and financial market conditions could hamper its performance. Also, considering the company's insufficient cash inflows, is ENR a buy now? Keep reading.

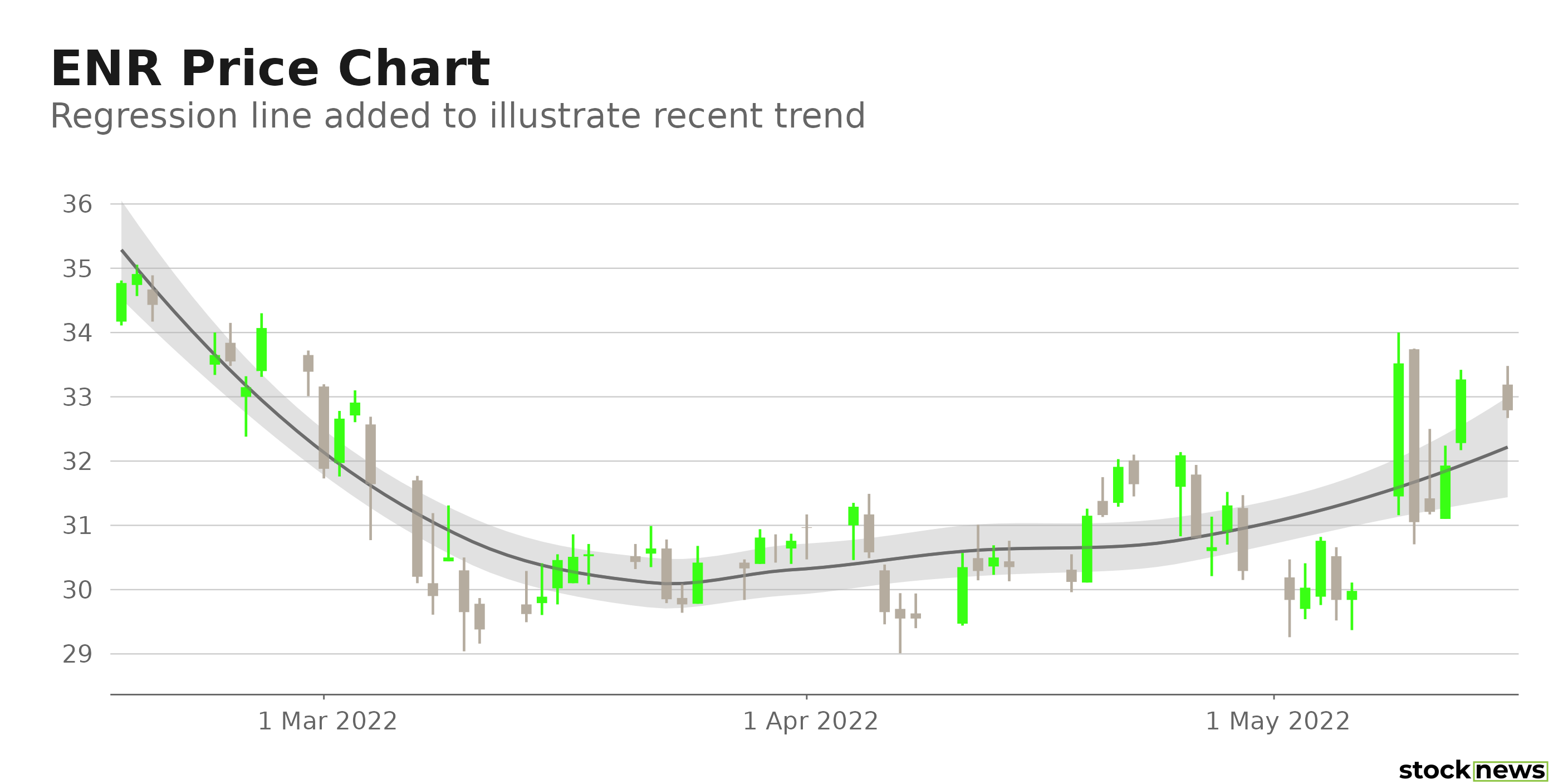

St. Louis, Mo.-based Energizer Holdings, Inc. (ENR) is a global manufacturer, marketer, and distributor of household and specialty batteries, portable lights, and automotive appearance, performance, refrigerants, and fragrance products. The company operates through two geographic segments: Americas and International. ENR's shares have slumped 31.7% in price over the past year and 16.6% over the past six months to close yesterday's trading session at $32.79. The stock has declined 18.2% year-to-date.

Earlier this month, ENR reported its second-quarter fiscal 2022 results, with its top and the bottom lines surpassing Street estimates. Its pricing execution across brands and strong organic growth in its auto care business helped drive better-than-expected performance on its top line. "Through pricing actions and improved supply chain performance, we continue to offset inflationary cost pressures and improve speed to market," said Mark LaVigne, Chief Executive Officer. However, the company's sales were flat, and its adjusted earnings were down year-over-year.

In addition, ENR raised its outlook for its top-line growth for the fiscal year while maintaining its outlook for adjusted earnings per share. It now expects full-year sales growth in the low single digits and still expects adjusted EPS of $3.00 to $3.30. But the company also noted that global economic and financial market conditions, the conflict between Russia and Ukraine, and the COVID-19 pandemic might negatively impact ENR. Furthermore, "competition in our product categories might hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers," the company stated.

Here is what could shape ENR's performance in the near term:

Mixed Profitability

ENR's 37.24% gross profit margin is 7.5% higher than the 34.63% industry average, while its 6.06% net income margin is 14% higher than the 5.32% industry average. However, its levered FCF margin of negative 1.05% compares with the 4.32% industry average.

Its ROA and ROTC of 3.55% and 6.45%, respectively, are 25.2% and 1.1% lower than the industry averages of 4.74% and 6.52%. But its 42.42% ROE is 212.7% higher than the 13.57% industry average.

Mixed Performance

For its fiscal second quarter, ended March 31, 2022, ENR's total net sales increased marginally from its year-ago value to $685.40 million, surpassing the consensus estimate by $30.02 million. Its gross profit stood at $238.40 million, down 11.9% year-over-year. Its adjusted net earnings decreased 36.8% from the prior-year quarter to $33.30 million, while adjusted EPS declined 39% year-over-year to $0.47, topping Street expectations by 24.2%. Also, for the six months ended March 31, 2022, ENR's cash flow from operating activities came in at negative $108.70 million, compared to $12.40 million in the same period the prior year. Its cash, cash equivalents, and restricted cash balance came in at $213.20 million, indicating an 18.3% year over year.

Debt Burden

The company has $3.72 billion in total debt, while its net debt came in at $3.51 billion. But its insufficient cash inflows raise concerns regarding its debt repayment capacity. Its trailing-12-month net operating cash flow was negative $58.60 million, and its trailing-12-month levered free cash flow stood at a negative $31.65 million. It has a negative 148.45 debt/free cash flow ratio. Also, its 0.82 quick ratio questions its ability to pay its liabilities.

Mixed Valuation

In terms of forward non-GAAP P/E, ENR is currently trading at 10.43x, which is 43.4% lower than the 18.42x industry average Also, its 0.77 forward Price/Sales ratio is 35.3% lower than the 1.19 industry average.

However, ENR's trailing-12-month Price/Cash Flow is 176% higher than the 14.66x industry average, and its forward Price/Book is 56.2% higher than the 2.74x industry average.

POWR Ratings Reflect Uncertain Prospects

ENR has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Value, which is consistent with its mixed valuation.

ENR also has a C grade for Quality, in sync with its mixed profitability.

Among the 63 stocks in the Home Improvement & Goods industry, ENR is ranked #40.

Beyond what I have stated above, you can also view ENR's grades for Sentiment, Growth, Momentum, and Stability here.

View the top-rated stocks in the Home Improvement & Goods industry here.

Bottom Line

ENR pays $1.20 in dividends annually, yielding 3.66% on its current share price, triggering income investors' interest. Its dividend payouts have increased at a 2.7% CAGR over the past five years. However, its insufficient cash inflows could make returning cash to shareholders difficult in the future. Moreover, the Street expects its EPS to decline 8.4% year-over-year in the fiscal year ending Sept. 30, 2022. Thus, it could be wise to wait for an improvement in its financials and cash flow generation before investing in the stock.

How Does Energizer Holdings, Inc. (ENR) Stack Up Against its Peers?

While ENR has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Acuity Brands, Inc. (AYI), which has an A (Strong Buy) rating, and Builders FirstSource, Inc. (BLDR) and Select Interior Concepts, Inc. (SIC) which has a B (Buy) rating.

Note that BLDR is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

ENR shares were unchanged in premarket trading Tuesday. Year-to-date, ENR has declined -17.52%, versus a -15.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree's keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master's degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Energizer Holdings a Winner in the Household Products Industry? appeared first on StockNews.com