Teladoc Health Stock is Pricing Right

Telehealth software company Teledoc Health (NYSE: TDOC) stock has collapsed from a post-pandemic high of $308 in Feb 2021 to a recent low of $27.38 in May 2022.

This story originally appeared on MarketBeat

Telehealth software company Teledoc Health (NYSE: TDOC) stock has collapsed from a post-pandemic high of $308 in Feb 2021 to a recent low of $27.38 in May 2022. To call this a tragedy for investors at the top would be an understatement. However, shares were trading in the $9s pre-pandemic in 2016. Telehealth stocks were a pandemic benefactor during the COVID lockdowns, but the hype has blown off as vaccinations spread during the reopening. The perfect storm tailwinds have ceased as the narrative shifts towards convenience, access, and personalized healthcare aptly labeled as whole-person virtual care which is represented by its Primary 360 service. Teladoc shares have fallen back down to more realistic levels in the $30s where it dwelled during 2017. While growth has ramped up during the pandemic, its returning to normal levels but is still in the double digits. The Company lowered its fiscal Q2 and full-year 2022 top and bottom-line guidance, which prompted a collapse after earnings. The shortfalls come from a reduction in chronic care revenues and the launch of its direct-to-consumer (DTC) mental health service BetterHelp, which is expected to have 30% to 40% annual top-line growth. Teladoc is the leading brand in the digital health segment and has over $830 million in cash. Prudent and patient investors seeking exposure in the leading telehealth player can watch for opportunistic pullbacks in shares of Teladoc.

Q1 Fiscal 2022 Earnings Release

On April 27, 2022, Teladoc released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an adjusted earnings-per-share (EPS) loss of (-$0.47) excluding non-recurring items versus consensus analyst estimates for a loss of ($0.52), beating estimates by $0.06. Revenues rose 24.6% year-over-year (YOY) to $565.35 million, falling short of analyst estimates for $568.63 million. The Company reported a (-4%) YoY decline in adjusted EBITDA to $54.5 million versus the $51 million to $55 million previous guidance. Teladoc CEO Jason Gorevic commented, “While we continue to see sustainable growth across our suite of products and services, we are revising our 2022 outlook to reflect dynamics we are currently experiencing in the direct-to-consumer (D2C) mental health and chronic condition markets. In the D2C mental health market, higher advertising costs in some channels are generating a lower-than-expected yield on our marketing spend. In the chronic condition market, we are seeing an elongated sales cycle as employers and health plans evaluate their long-term strategies to deliver the benefits and care that their populations need. Despite the revision to our 2022 outlook, we are confident in our strategy, along with our breadth and depth of capabilities, which empower people everywhere to live healthier lives.”

Downside Guidance

Teladoc lowered its fiscal Q2 2022 revenue guidance between $580 million to $600 million versus $615.15 million. Adjusted EBITDA is expected between (-$200 million) to (-$190 million). Adjust EBITDA is expected between $39 million to $49 million. The Company lowered its fiscal full-year 2022 revenue guidance to come in between $2.4 billion to $2.5 billion versus $2.58 consensus analyst estimates with adjusted EBITDA lowered to $240 million to $250 million from $330 million to $355 million.

Conference Call Takeaways

CEO Gorevic discussed the BetterHelp expectations to grown mental health revenues 30% to 40% annually. Chronic care sales pipeline developed slower than anticipated due to employer benefits managers being more focused on COVID and the return to work. The competition has gotten tighter with numerous healthcare deals. The lowered guidance assumes chronic care revenues grow in the low to mid-teens. He elaborated on the whole-person virtual care with its Primary360 product, “Primary360 is designed to act as the front door to care for our members. It opens pathways to Teladoc’s own ecosystem of digital and virtual solutions and coordinates care with third-party providers within a health plan or employer’s network when needed. We continue to be excited about the momentum we’re seeing in Primary360.”

TDOC Opportunistic Pullback Levels

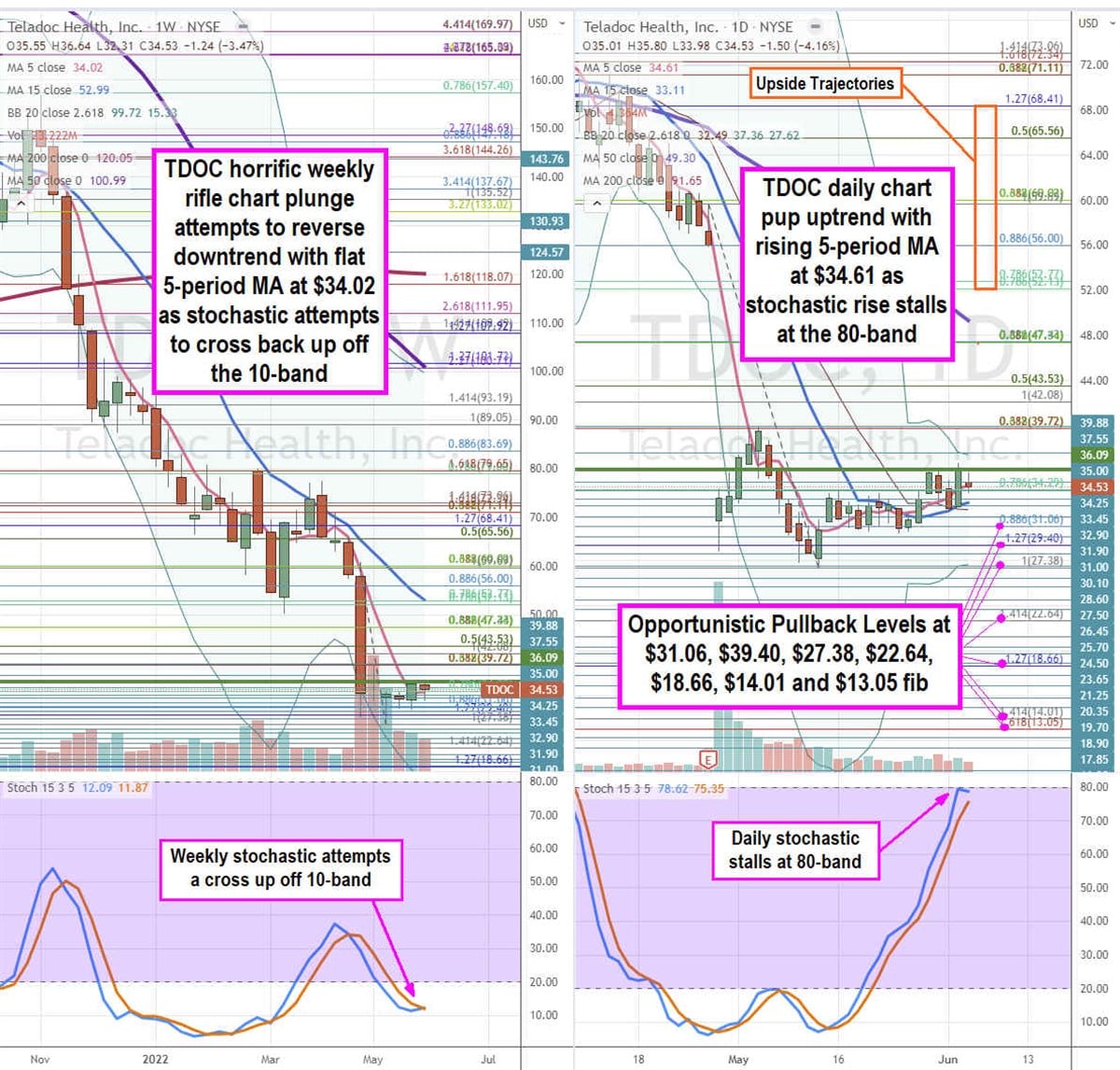

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for TDOC stock. Shares sat at the $56.00 Fibonacci (fib) level before its collapse on its fiscal Q1 2022 earnings release gap down. The weekly rifle chart inverse pup breakdown is starting to bottom out as the weekly 5-period moving average (MA) is flattening at $34.02 as the 15-period MA continues lower at $52.99. The weekly stochastic is also attempting to coil just above the 10-band. The weekly lower Bollinger Bands (BBs) sit at 15.32. The weekly market structure low (MSL) buy triggers on the $36.09 breakout. The daily rifle chart has been in an uptrend with a rising 5-period MA at $34.61 followed by the 15-period MA at $33.11. The daily upper BBs sit at $37.36 and lower BBs at $27.62. The daily stochastic has made a full oscillation up to stall at the 80-band. Prudent investors should not chase but rather wait for opportunistic pullback levels at the $31.06 fib, $29.40 fib, $27.38 fib, $22.64 fib, $18.66 fib, $14.01 fib, and the $13.05 fib level. Upside trajectories range from the $52.13 fib up towards the $68.41 fib level.

Telehealth software company Teledoc Health (NYSE: TDOC) stock has collapsed from a post-pandemic high of $308 in Feb 2021 to a recent low of $27.38 in May 2022. To call this a tragedy for investors at the top would be an understatement. However, shares were trading in the $9s pre-pandemic in 2016. Telehealth stocks were a pandemic benefactor during the COVID lockdowns, but the hype has blown off as vaccinations spread during the reopening. The perfect storm tailwinds have ceased as the narrative shifts towards convenience, access, and personalized healthcare aptly labeled as whole-person virtual care which is represented by its Primary 360 service. Teladoc shares have fallen back down to more realistic levels in the $30s where it dwelled during 2017. While growth has ramped up during the pandemic, its returning to normal levels but is still in the double digits. The Company lowered its fiscal Q2 and full-year 2022 top and bottom-line guidance, which prompted a collapse after earnings. The shortfalls come from a reduction in chronic care revenues and the launch of its direct-to-consumer (DTC) mental health service BetterHelp, which is expected to have 30% to 40% annual top-line growth. Teladoc is the leading brand in the digital health segment and has over $830 million in cash. Prudent and patient investors seeking exposure in the leading telehealth player can watch for opportunistic pullbacks in shares of Teladoc.

Q1 Fiscal 2022 Earnings Release

On April 27, 2022, Teladoc released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an adjusted earnings-per-share (EPS) loss of (-$0.47) excluding non-recurring items versus consensus analyst estimates for a loss of ($0.52), beating estimates by $0.06. Revenues rose 24.6% year-over-year (YOY) to $565.35 million, falling short of analyst estimates for $568.63 million. The Company reported a (-4%) YoY decline in adjusted EBITDA to $54.5 million versus the $51 million to $55 million previous guidance. Teladoc CEO Jason Gorevic commented, “While we continue to see sustainable growth across our suite of products and services, we are revising our 2022 outlook to reflect dynamics we are currently experiencing in the direct-to-consumer (D2C) mental health and chronic condition markets. In the D2C mental health market, higher advertising costs in some channels are generating a lower-than-expected yield on our marketing spend. In the chronic condition market, we are seeing an elongated sales cycle as employers and health plans evaluate their long-term strategies to deliver the benefits and care that their populations need. Despite the revision to our 2022 outlook, we are confident in our strategy, along with our breadth and depth of capabilities, which empower people everywhere to live healthier lives.”