Is Lonely Kohl's Ready to Be Picked Up? Retail department store chain Kohl's Corporation (NYSE: KSS) stock took a one-two punch after losing its takeover bids then cutting estimates.

By Jea Yu

This story originally appeared on MarketBeat

Retail department store chain Kohl's Corporation (NYSE: KSS) stock took a one-two punch after losing its takeover bids then cutting estimates. It's been a turbulent year for Kohl's investors as shares plunged by over 50% at its lows in 2022. During the first quarter of 2022, shares were riding high in the $60s as the Company was rumored to go private via leveraged buyout, then multiple suitors were interested in competing for a takeover. All that came to a screeching halt when prospects dried up on July 1, 2022. Its once buoyant shares sank as the acquisition halo effect vaporized. Kohl's casual lifestyle branding was a smashing success during the pandemic lockdowns as consumers stayed home, but it missed the mark as trends reverted back to dress up clothing for the office and live engagements. Supply chain disruptions caused the Company to overstock its inventory which now needs to be discounted to clear. Kohl's went on to join the ranks of other big retailers including Target (NYSE: TGT), Walmart (NYSE: WMT), and Ross Stores (NASDAQ: ROST) that experienced surprise sales slowdowns prompting guidance cuts on climbing inventory levels. Consumer spending took an abrupt hit from inflationary pressures and an impending recession in June. Management has decided to stay the course on its own and weather the slowdown with a focus on long-term growth and initiated an accelerated $500 million stock buyback program. Shares trade at just 8.8X forward earnings with a 5% dividend yield. Could Kohl's be a more lucrative acquisition target as its stock price sinks lower?

Runaway Bride is Left at the Alter

Kohl's was rumored to have had more than 25 suitors ranging from Sycamore Partners to the Franchise Group (NYSE: FRG) offering takeover bids from the $50s up to through $60 per share. They rejected a $64 per share offer in February from an activist group. What makes Kohl's desirable is that it actually owns more than 30% of the real estate that its stores are located in. The Franchise Group made an initial $60 per share offer in early June with financing coming from selling off Kohl's real estate assets, which Kohl's rejected. The deteriorating retail and economic landscape prompted the Franchise Group to lower their offer to $53 per share which Kohl's again rejected. On July 1, 2022, the merger talks with Franchise Group were officially terminated as Kohl's cut its Q2 2022 revenues guidance.

The Party's Over

On Aug. 18, 2022, Kohl's released its fiscal second-quarter 2022 results for the quarter ending July 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $1.11 excluding non-recurring items versus consensus analyst estimates for a profit of $1.12, missing estimates by (-$0.01). Revenues fell by (-8.1%) year-over-year (YOY) to $4.09 billion still beating analyst estimates for $3.91 billion. The Company entered into an accelerated $500 million stock buyback program.

Let the Hangover Begin

They cut their full-year 2022 EPS dramatically to $2.80 to $3.20 versus $4.19 consensus analyst estimates. Full-year revenues are expected to fall (-5%) to (-6%) to $17.36 billion to $17.55 billion versus $17.78 billion consensus analyst estimates. Kohl's CEO Michelle Gass commented, "Second quarter results were impacted by a weakening macro environment, high inflation and dampened consumer spending, which especially pressured our middle-income customers. We have adjusted our plans, implementing actions to reduce inventory and lower expenses to account for a softer demand outlook. Kohl's has navigated difficult periods in the past and I am confident in our ability to successfully manage through the current uncertainty. I want to thank our incredible associates around the country for their commitment to Kohl's and for providing excellent service to our customers every day. We continue to execute on our transformation strategy and are pleased to deliver outsized performance in the nearly 600 stores which have been refreshed and elevated, featuring Sephora as a key cornerstone,"

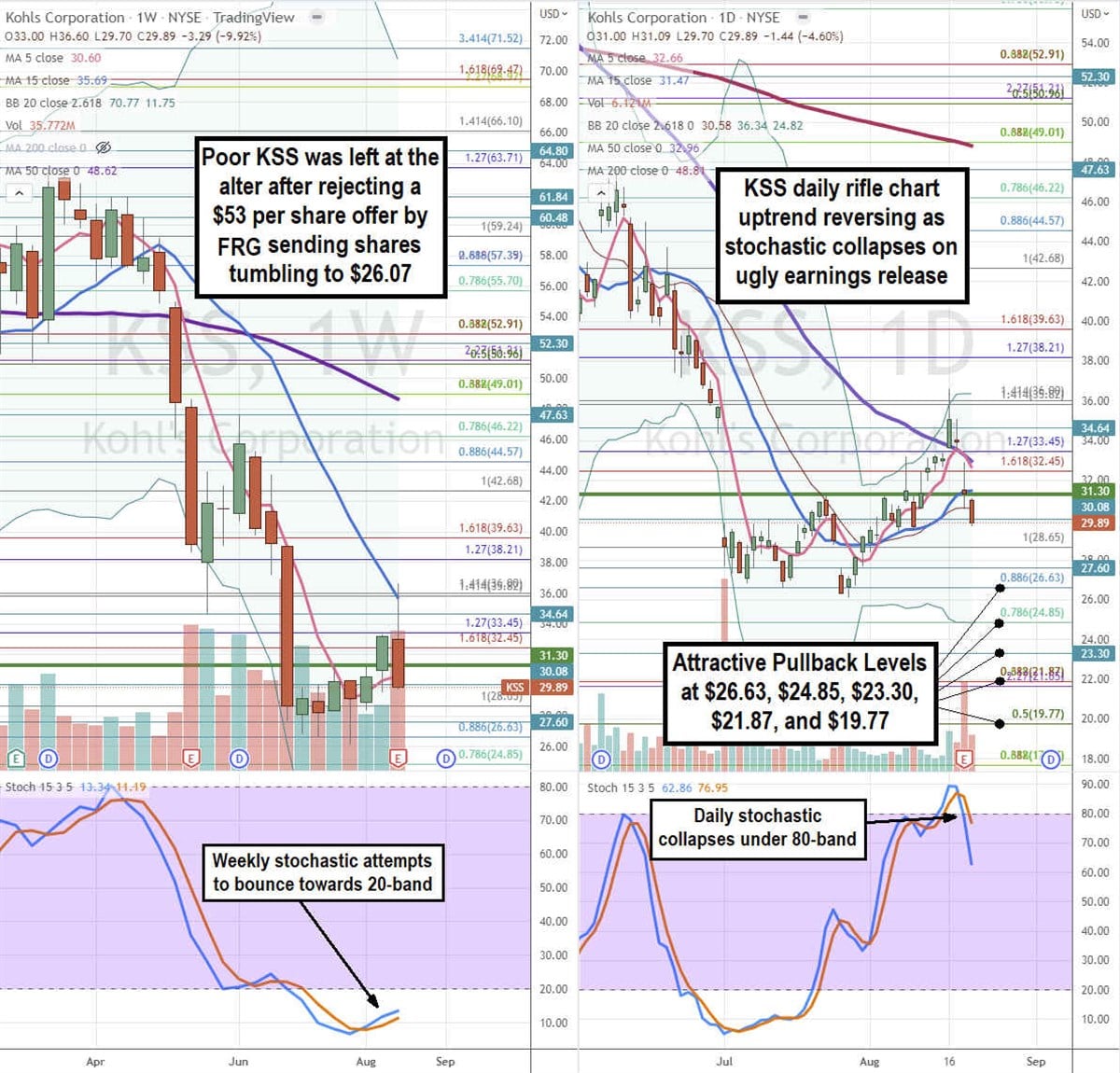

Here's What the Charts Say

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for KSS stock. The weekly rifle chart peaked out around the $64.18 Fibonacci (fib) level. Shares collapsed through the weekly lower Bollinger Bands (BBs) at $37.61 on the earnings release. The weekly downtrend has a falling 15-period moving average (MA) at $48.25 under the 200-period MA at $49.52 and 50-period MA at $53.39 followed by the 15-period MA at $55.31. The weekly stochastic oscillation is falling below the 30-band. The daily rifle chart has a downtrend with a flattening 5-period MA at $39.83 and 15-period MA falling at $46.23 with daily 200-period MA flat at $54.02. The daily stochastic is attempting to coil back up again off the 10-band. The daily market structure low (MSL) buy triggers above $42.62 breakout. The daily lower BBs sit at $30.10. Prudent investors can look for opportunistic pullback levels at the $38.76, $35.66, $32.85 fib, $31.19, $29.56 fib, $27.29 fib, and the $25.55 fib level. Upside trajectories range from the $47.25 fib level up towards the $60.19 fib level.