Make Learning To Trade Options Your Go To Way To Beat Inflation

Trading options, not GLD, is a great way to fight inflation.

This story originally appeared on StockNews

Trading options, not GLD, is a great way to fight inflation.

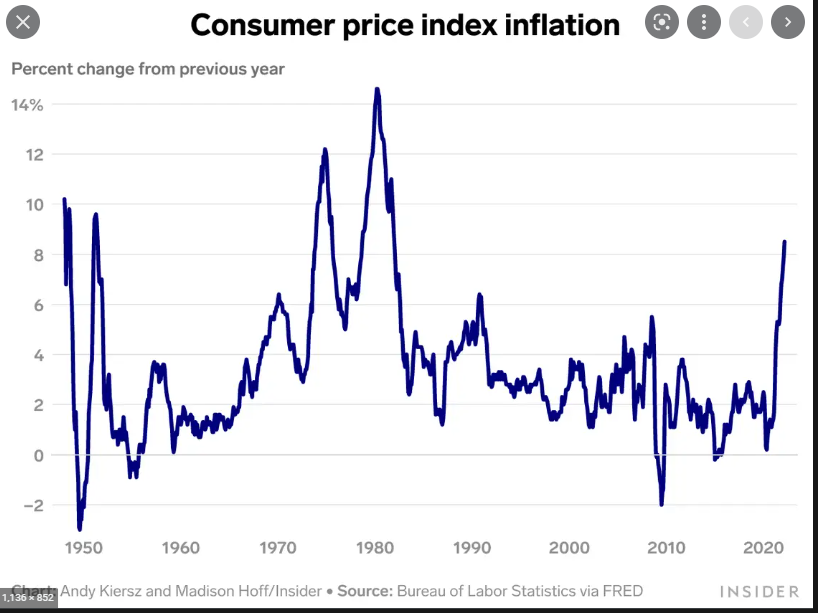

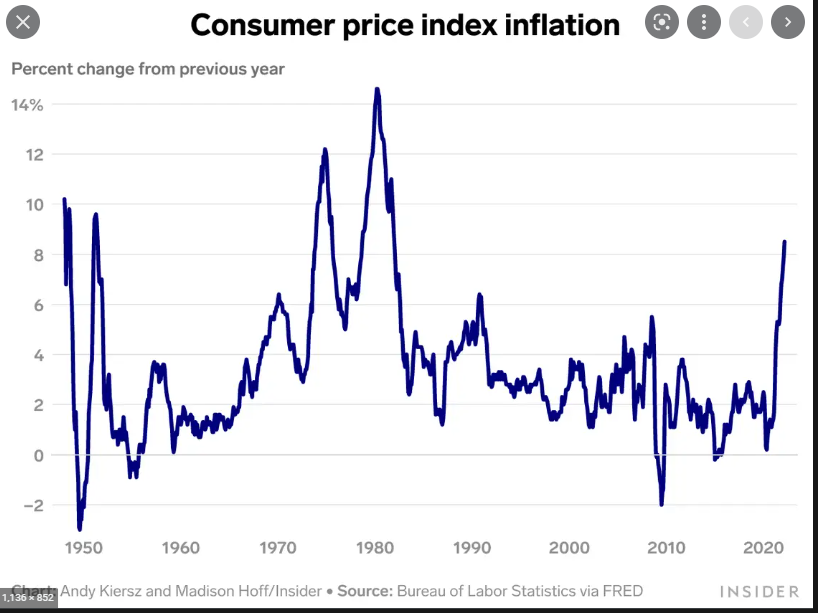

Inflation fears continue to climb in the U.S. The Federal Reserve has risen rates to combat the ever-increasing CPI (Consumer Price Index) which hit a recent historic high over 9% last June. This pushed Consumer Prices to the highest readings since late 1979.

Recent weakness in food and energy prices have served to soften the CPI, which last report stood at 8.5% in July. Better, but still not great news on inflation.

The difference between the two-year Treasury yield and ten-year Treasury yield continued to show inverson. Recession may be in the offing regardless of future Fed Policy.

Gold Prices Find Support

Gold prices (GLD) once again held major support at the $157 area.

Shares reached oversold conditions on a 9-day RSI basis before strengthening. MACD got oversold as well then turned higher.Bollinger Percent B went briefly negative but has since retaken positive territory. GLD is trading at a big discount to the 20-day moving average.

The prior four times this occurred marked significant short-term lows in GLD as highlighted in aqua on the chart. A move back above the 20-day moving average seems the most likely outcome.

It will be interesting to see if the recent rally in GLD has meaningful legs or if it will pullback to re-test support again.

Investing in gold as an inflation hedge appears to a spurious exercise at best. The fact that gold peaked in March 2022 right before the Fed began raising rates in earnest takes away much of the inflation fighting concerns to owning gold.

Instead of gold, consider using the power of POWR Options to heighten your overall returns.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

GLD shares closed at $159.82 on Friday, up $0.84 (+0.53%). Year-to-date, GLD has declined -6.52%, versus a -13.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post Make Learning To Trade Options Your Go To Way To Beat Inflation appeared first on StockNews.com

Trading options, not GLD, is a great way to fight inflation.

Inflation fears continue to climb in the U.S. The Federal Reserve has risen rates to combat the ever-increasing CPI (Consumer Price Index) which hit a recent historic high over 9% last June. This pushed Consumer Prices to the highest readings since late 1979.