Three Reasons Why It May Be Time To Buy Stocks Again Warren Buffett said,"Be Greedy When Others Are Fearful." With fear at highs, now is an opportune time to be a little greedy.

By Tim Biggam

This story originally appeared on StockNews

Warren Buffett said,"Be Greedy When Others Are Fearful." With fear at highs, now is an opportune time to be a little greedy.

A little over a month ago, I wrote about how the big drop in implied volatility (IV) in the NASADQ 100 (QQQ) stocks had set up a short-term sell signal. This proved to be the case as the QQQ has dropped nearly 20% in that time frame.

In a similar manner, however, big spikes in IV also signal short-term buying opportunities. Currently QQQ has reached the point that favors a probabilistic rally over the coming few months. Let's take a walk through some of the reasons why a move higher may be in the offing.

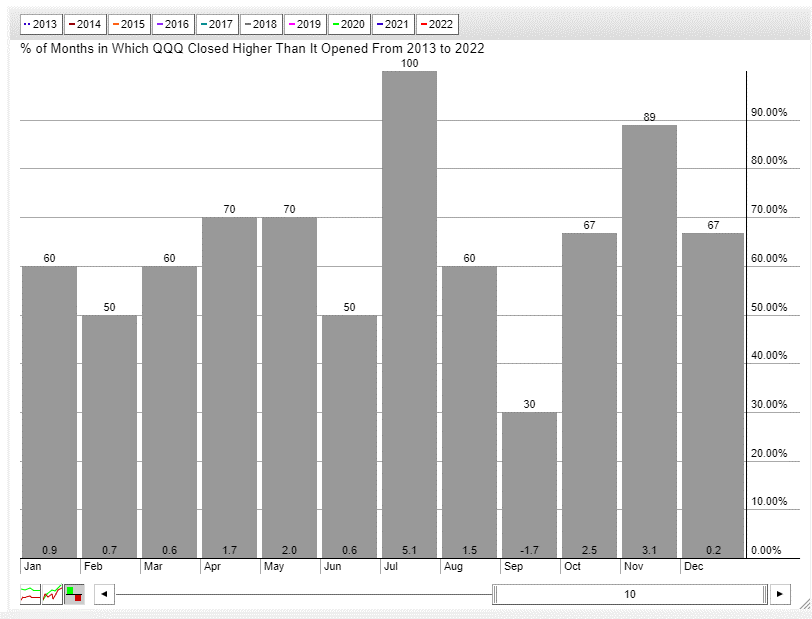

Seasonality

September has been by far the worst month for stocks in the past decade, especially higher growth NASDAQ names. Now that September has come to an end, the next few months show solid seasonal returns. October and November are the second and third best months of the year for stock performance over the prior 10 years.

Implied Volatility

Implied Volatility (IV) has once again spiked to recent extremes. A look at a measure of the VXN -or 30-day IV in QQQ options- shows levels are back near the 40 area after reaching lows near 25 back in August. You can see how spikes in VXN have been equated to short-term lows in QQQ over the past year.

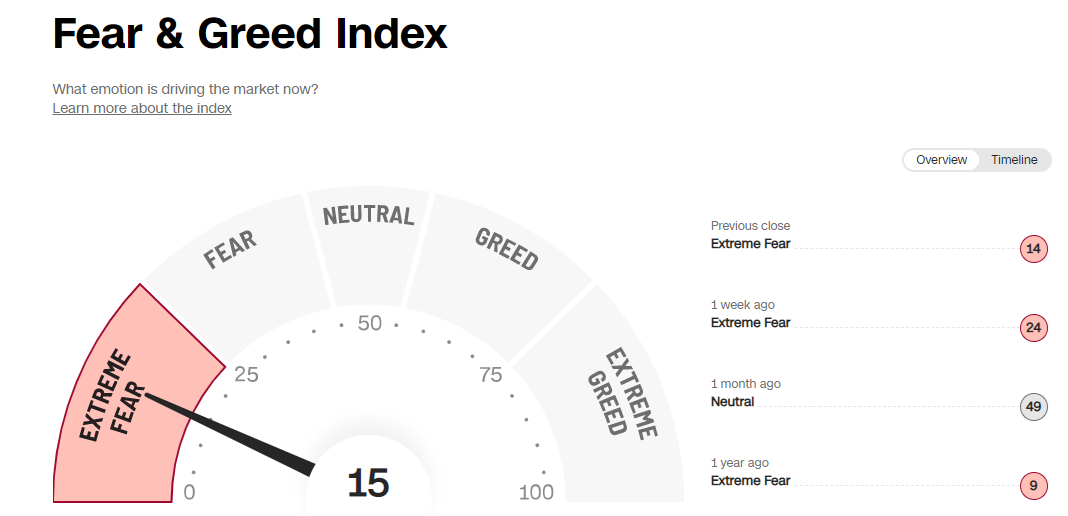

Fear

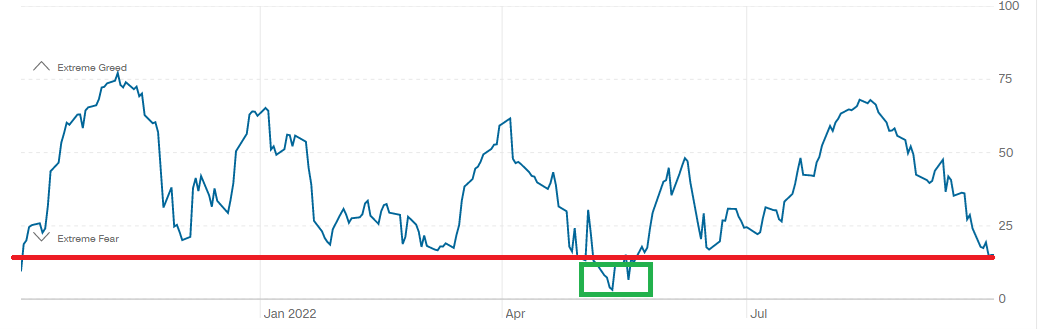

The CNN Fear and Greed Index is back near the lowest levels of the year at 15-which is extreme fear.

The only previous time this past year it was lower was back in May. This coincided with a significant low in stocks.

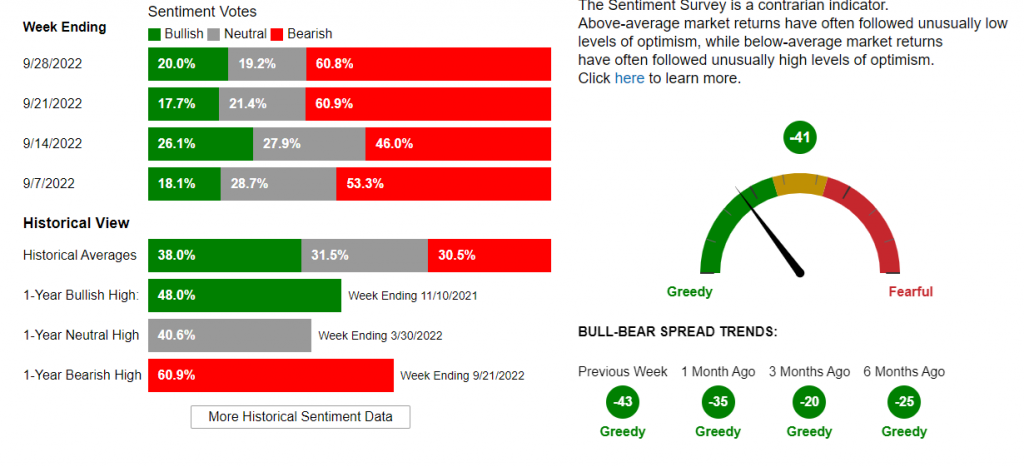

AAII Investor Sentiment Survey is also at extremely bearish levels. Current bearish sentiment is over 60% which is double the historical average of about 30%. This is considered a contrary signal that usually equates to big stock out-performance over the upcoming 6 months.

The combination of seasonality, implied volatility, and fear are all setting up to put the odds in favor of a year-end rally in stocks. Of course, probability doesn't mean certainty. As I always say, trading is about probabilities, not certainty. But traders who like to play the odds may want to take a guarded bullish position to position to profit from a probabilistic pop in stocks into year-end.

POWR Options

What To Do Next?

If you're looking for the best options trades for today's market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

QQQ shares closed at $267.26 on Friday, down $-4.61 (-1.70%). Year-to-date, QQQ has declined -32.49%, versus a -23.93% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post Three Reasons Why It May Be Time To Buy Stocks Again appeared first on StockNews.com