3 Big Reasons Why You Need To Consider Covered Call Trades The combination of cheaper stock prices and more expensive option prices sets up ideally for a covered call trade in stocks like Apple.

By Tim Biggam

This story originally appeared on StockNews

The combination of cheaper stock prices and more expensive option prices sets up ideally for a covered call trade in stocks like Apple.

Stocks have fallen back to the lowest levels in the past year. Investors are torn as to whether this is once again the lows or if stocks may indeed head lower before rebounding. The VIX is nearing recent highs reflecting this uncertainty.

But rather than wait and see whether this is a buying opportunity, astute investors may want to consider taking advantage of the current conditions of cheaper stock prices and higher VIX to put on a lower risk covered call trade. Remember that VIX is simply a way to say the price of options.

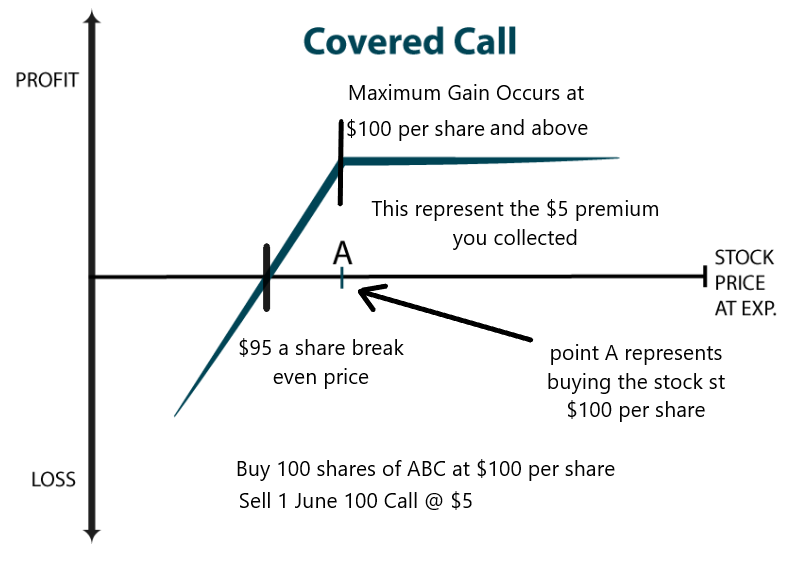

A covered call trade involves buying 100 shares of stock and simultaneously selling a call option against the stock to reduce the overall cost of the trade. This provides downside protection by the amount of the call premium received but does cap the upside at the strike price of the call option sold.

It is an ideal trade for those who are neutral to slightly bullish on stocks. Here are three big reasons why this strategy may be a good way to take advantage of more subdued stock returns in 2023.

Stocks Lower/ Calls Higher

Stocks are no doubt lower than they were a year ago. The S&P 500 has fallen over 20% in that time frame while the NASDAQ 100 and Russell 2000 have fallen even further. Implied volatility (IV), which measures the price of options, is significantly higher than it was 12 months back. The VIX is a well-known and general gauge of option prices on the S&P 500. It has virtually doubled from 16 to 32 over the past 365 days. This means options prices, both calls and puts, are much more expensive now than back then.

Doing a covered call trade of buying stock and selling calls benefits from both the lower stock prices and higher call prices.

Upside Likely Limited

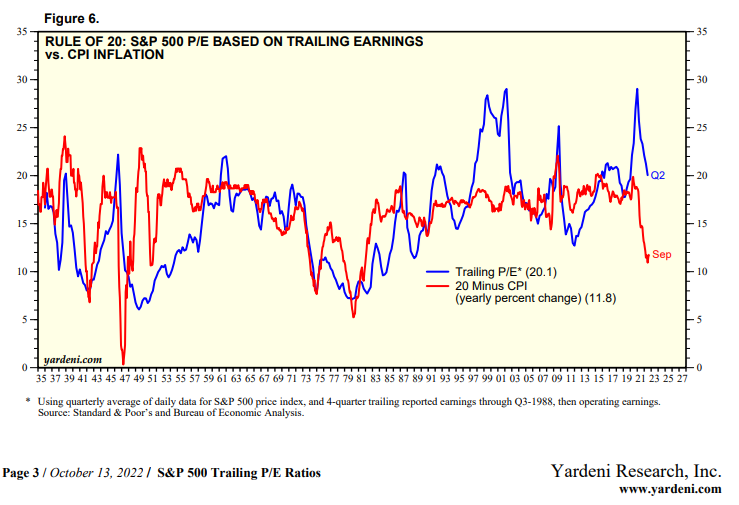

Given the recent red-hot rise in interest rates, valuation multiples will likely be capped for the foreseeable future. The 10-year Treasury yield just closed above 4% compared to well under 2% just last year. The Consumer Price Index, or CPI, is at 40-year highs of over 8%. The chart below shows how much inflation has risen recently using the Rule of 20 (20 minus CPI rate of currently 8.2%). This rise in inflation and interest rates has brought the trailing P/E down from almost 30 to nearly 20.

With the Fed likely to raise rates again and inflation unlikely to slow substantially, P/E multiples should continue to be somewhat subdued for the next several quarters. This will serve to provide a serious headwind for stock prices in the coming months, making call sales even more beneficial as a hedging mechanism.

Money For Nothing

Covered call trades have the combination of long stock and short calls to produce potential profits. If the stock rises, the long stock position will make good money while the short call position loses less. Most investors get that idea.

But if the stock position goes nowhere, the covered call position will still do quite well since the short call option will do good as time premium erodes while the go-nowhere stock remains near break-even.

The chart above shows how the covered call trade is profitable if the stock remains around the $100 per share initial purchase price because of the $5 initial premium collected as part of the covered call trade.

Let's take a walk through a real-time covered call trade in Apple (NASDAQ:AAPL) to see just how much the recent drop in stock prices and increase in covered call prices can provide a potent one-two punch to the covered call strategy. The same sort of rationale can be applied in a similar manner to different stocks or ETFs.

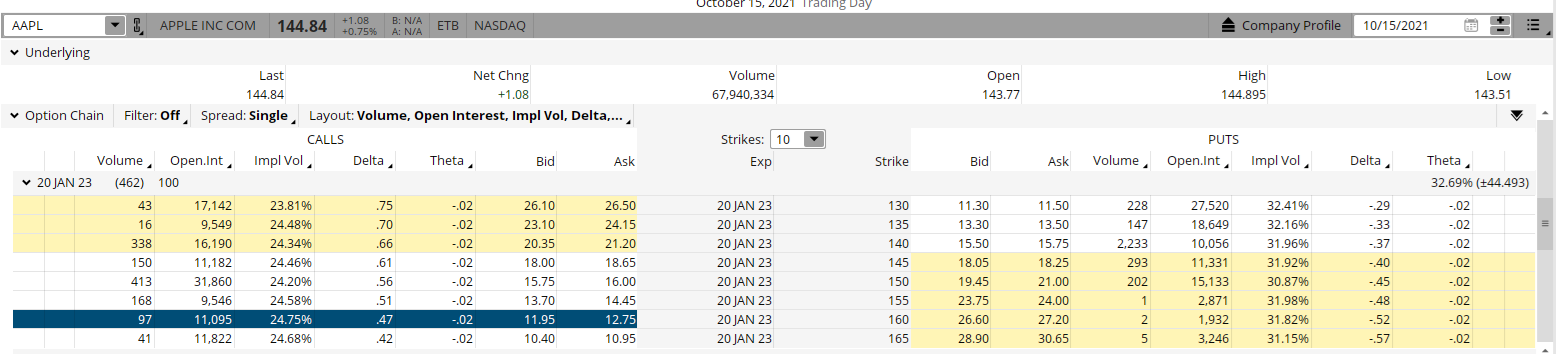

Looking back at Apple stock a year ago, we can see shares closed at $144.84. The January $160 calls (462 days to expiration) were at $12.35 as seen in the option montage below. Doing a covered call trade of buying AAPL stock and selling a Jan $160 call would cost $132.49 ($144.84 - $12.35).

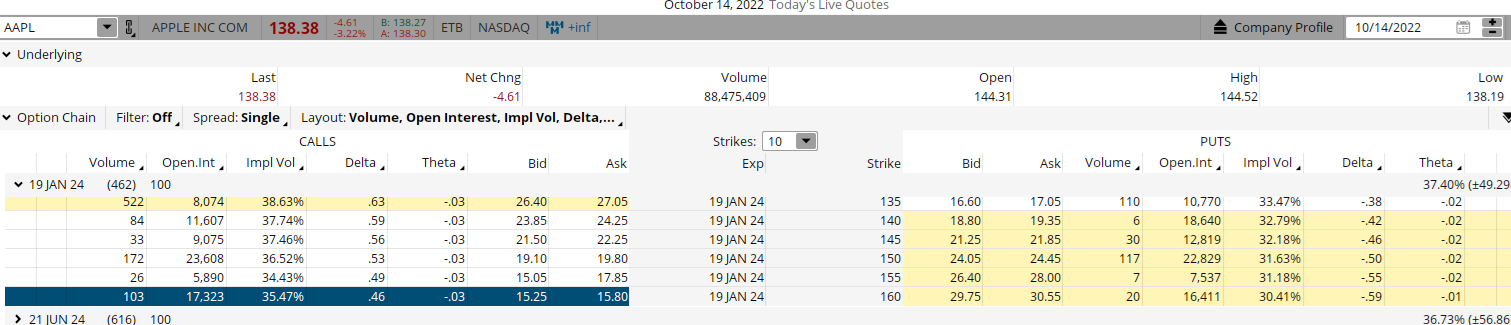

Looking at the close on Friday, AAPL stock closed at $138.38. The January $160 calls (462 days to expiration) were at $15.50 as seen in the montage below. Doing a covered call trade now would cost $122.88 ($138.38 - $15.50).

Comparing the two is shown in the table below

| then | now | change | |

| stock | 144.84 | 138.38 | -6.46 |

| call | 12.35 | 15.5 | 3.15 |

| 0 | |||

| buy write | 132.49 | 122.88 | -9.61 |

Even though the price of the stock dropped by nearly 6 1/2 points, the price of the $160 calls actually increased by over 3 points. Putting those two notions together, the cost of the covered call trade fell by $9.61 (buying cheaper stock and selling more expensive calls).

I put together the table below to highlight some of the pertinent points.

| iv | 24.75 | 35.47 |

| call delta | 47 | 46 |

| dte | 462 | 462 |

| dp | 8.53% | 11.20% |

| ur | 20.76% | 30.21% |

Implied volatility (IV) shot higher by nearly 11 vol points from 24.75 to 35.47. This is the reason why the call price rose by over 3 points even with AAPL down significantly. The delta of the calls remained pretty much unchanged due to the rise in IV as well. Buying the stock (100 delta) and selling the 46 delta calls reduces the overall delta to 54, or roughly half of just owning AAPL stock outright.

Days to expiration (DTE) was the same in both examples at 462. Downside protection (dp) of 11.20% -or how far the stock can fall until breakeven- was significantly better now by 2.67% compared to a year ago. Upside return (ur) of 30.21%-or how much we would make if AAPL is above $160 next January-also rose by almost 9.5% if AAPL stock closes above the short $160 strike.

Investors who are more risk adverse can sell a lower strike call to bring in more call premium and reduce the overall risk even further. More bullish traders may want to sell higher strike calls at a lower premium that allows more potential upside.

The combination of a lower stock price and a higher call price means implementing a covered call trade of buying the stock cheaper and selling the call option more expensive can lower your downside risk and also increase your upside return. Traders and investors alike who are looking to take a lower risk guardedly bullish position with still solid upside return should seriously consider a covered call strategy. This is especially true given that stocks are currently at the lows and call prices are near the highs.

POWR Options

What To Do Next?

If you're looking for the best options trades for today's market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

AAPL shares closed at $138.38 on Friday, down $-4.61 (-3.22%). Year-to-date, AAPL has declined -21.75%, versus a -23.83% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post 3 Big Reasons Why You Need To Consider Covered Call Trades appeared first on StockNews.com