Time to Hit Up Hasbro Stock for the Holiday Season Entertainment products and media company Hasbro, Inc. (NYSE: HAS) stock recently hit 52-week lows of $63.44 down (-35%) on the year.

By Jea Yu

This story originally appeared on MarketBeat

Entertainment products and media company Hasbro, Inc. (NASDAQ: HAS) stock recently hit 52-week lows of $63.44 down (-35%) on the year. The Company missed its Q3 2022 earnings estimates primarily due to overstocking its retailers in Q2 2022 to avoid potential post-pandemic supply chain problems. It's Magic: The Gathering card game sets and content releases were pushed forward to the fourth quarter as it celebrates its 30-year anniversary heading into the holiday season. Hasbro has been expanding its iconic IP portfolio, which includes G.I. Joe, Monopoly, My Little Pony, Nerf, Play-Doh, Power Rangers, and the Transformers, into other forms of entertainment including video games, digital content, live-action films, and shows for release in both major theaters like AMC Entertainment (NYSE: AMC) and streaming services like Netflix (NASDAQ: NFLX), and Paramount Global (NASDAQ: PARA). Hasbro continues to stick to its fiscal full-year guidance which is expected to have flat top-line growth. The strong U.S. dollar is a boon to Hasbro's product margins as it manufactures most of its toy products in China and India. With the holiday season approaching, Hasbro may surprise to the upside despite inflationary headwinds impacting consumer discretionary spending habits.

Entertainment Content

Although its 2021 live-action G.I. Joe motion picture Snake Eyes bombed, they will move forward with an Amazon (NASDAQ: AMZN) Prime live-action TV series centered around Lady Jaye of G.I. Joe. It's trying to build its own live action "universe" similar to the Marvel Cinematic Universe (MCU) (NYSE: DIS), and the D.C. Extended Universe (DCEU) (NYSE: WBD). It also licenses MCU IPs for it action figures and toys with a big rollout of the upcoming Black Panther: Wakanda Forever live-action film scheduled to release in November 2022. The Company is also preparing the next version of its timeless Dungeons & Dragons franchise in the coming year, which has generations of fans spanning baby boomers to gen-Z'ers.

Earnings Miss

On Oct. 18, 2022, Hasbro released its third-quarter fiscal 2022 results for the quarter ending Sept 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $1.42 excluding non-recurring items versus consensus analyst estimates for $1.60, an (-$0.18) miss. Revenues fell (-15%) year-over-year (YoY) to $1.68 billion, matching consensus analyst estimates. The expects full-year 2022 revenues to be flat to slightly down in constant currency versus (-3.7%) current estimate. Adjusted profit margins are expected to be 16.7% excluding non-GAAP items. The Company ended the quarter with $552 million in cash. The weak numbers were primarily due to the accelerated push of product to retailers in in Q2 in anticipation of supply chain shortages and its Magic: The Gathering set releases scheduled to release in the fourth quarter rather than the third quarter like last year.

CEO and CFO Comments

Hasbro CEO Chris Cocks commented, "As expected, the third quarter is our most difficult comparison and was further impacted by increasing price sensitivity for the average consumer. To achieve our full-year outlook, we are projecting Hasbro's fourth quarter revenue to be approximately flat versus last year on a constant currency basis with particular strength from our Wizards and Digital Gaming segment. Growth will be driven by what we expect to be one of the biggest fourth quarters for MAGIC: THE GATHERING as we kick off the brand's 30th anniversary and celebrate Hasbro's first ever $1 billion brand."

Attractive Pullback Levels to Watch For

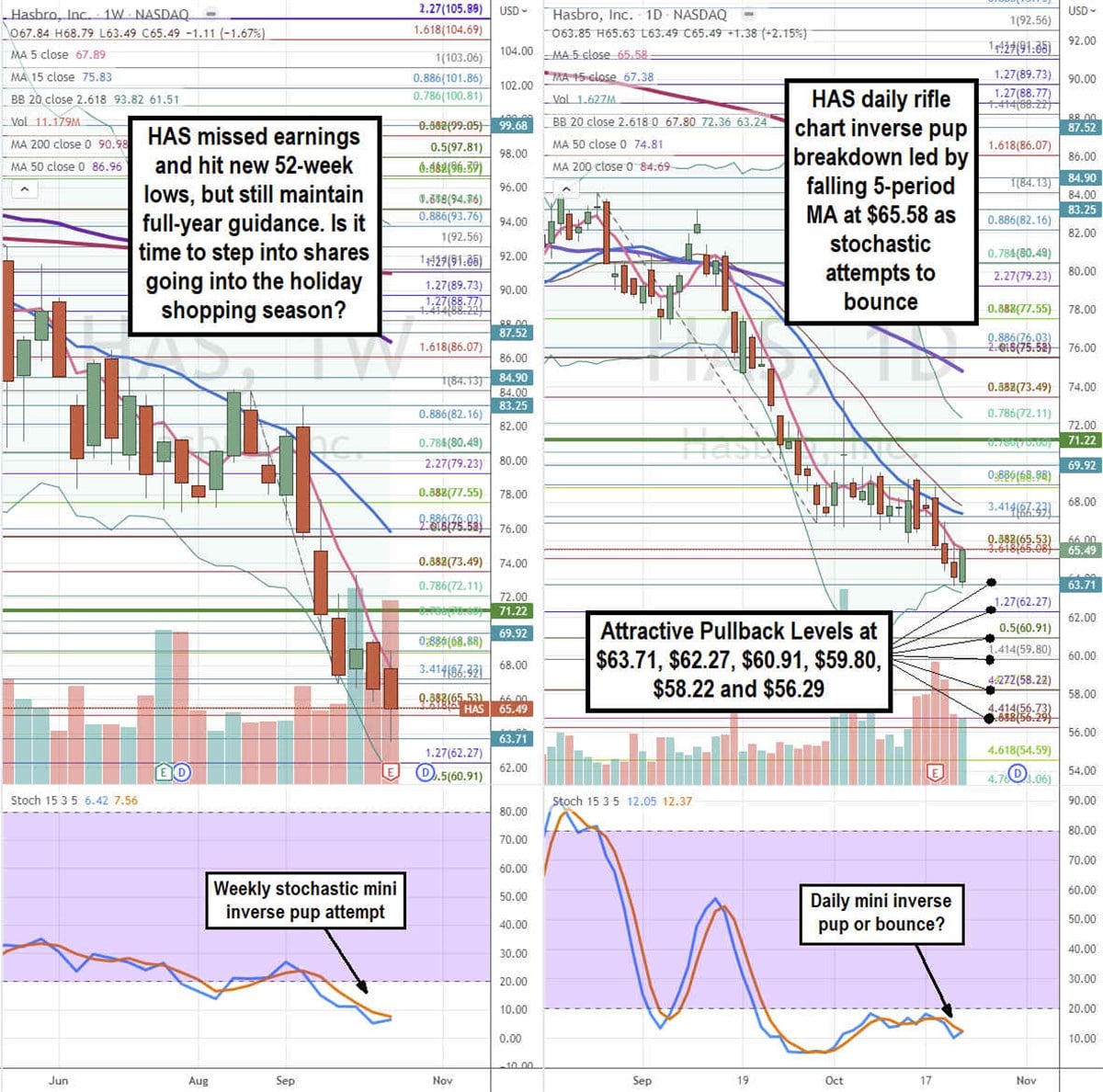

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for HAS stock. The weekly rifle chart formed a bearish inverse pup breakdown on the rejection of the $84.13 Fibonacci (fib) level. The breakdown is led by the falling weekly 5-period moving average (MA) resistance at $67.89 followed by the weekly 15-period MA at $75.83. The weekly stochastic slipped through the 20-band and setting up for another possible bearish mini inverse pup breakdown below the 10-band. The weekly lower Bollinger Bands (BBs) sit at $61.51. The weekly market structure low (MSL) buy triggers on a breakout through $71.22. The daily rifle chart also has a bearish inverse pup breakdown led by the falling daily 5-peiod MA at $65.58 followed by the 15-period MA resistance at $67.38. The daily stochastic has reject multiple attempts to bounce through the 20-band as it attempts to cross the 10-band again for a bounce. The daily lower BBs sit at $63.24. Attractive pullback levels sit at the $63.71 fib, $62.27 fib, $60.91 fib, $59.80 fib, $58.22 fib, and the $56.29 fib level.