7 Roth IRA Secrets You Have To Know Pop quiz. What's the greatest wealth-building tool? Dave Ramsey says it's income, while Daniel Mollat wrote a book entitled, "Stock Options: The Greatest Wealth Building Tool Ever Invented." For my...

This story originally appeared on Due

Pop quiz.

What's the greatest wealth-building tool?

Dave Ramsey says it's income, while Daniel Mollat wrote a book entitled, "Stock Options: The Greatest Wealth Building Tool Ever Invented."

For my money, it's the Roth IRA.

What's a Roth IRA (And Why You Need it In Your Life)

Roth IRAs were first introduced in 1997 and are named after former Delaware Senator William Roth. Roth IRAs are simply individual retirement accounts (IRAs) that permit tax-free distributions.

A Roth IRA is a qualified retirement plan, just like a traditional IRA. The most notable difference between these accounts is how they are taxed. Also, because Roth IRA investments are funded with after-tax dollars, they are not deductible. However, when the funds are withdrawn, they are deductible.

You also have a bunch of different ways to fund a Roth IRA. This could be through;

There are several ways to fund a Roth IRA;

- Regular contributions

- Spousal IRA contributions

- Transfers

- Rollover contributions

- Conversions

You must always contribute to a Roth IRA with cash, which includes checks and money orders. But you cannot contribute stocks or real estate. Once contributions are made to a Roth IRA, there are other investment options such as mutual funds, stocks, bonds, ETFs, CDs, and money market funds.

Traditional and Roth IRAs will both limit contribution amounts to $6,000 for 2021 and 2022 and $7,000 for people over 50.

That's all well and good. But, why am I such a big fan of Roth IRAs?

For starters, your money can grow and be withdrawn tax-free. That's because you used after-tax dollars to fund it.

Also, if you're in financial trouble, you can easily access these funds. I'm also big on the fact that there aren't required minimum distributions and that you can contribute at any age. And, Roth IRAs can protect you against future tax increases and you can leave your heirs a tax-free legacy.

The Roth IRA also has many hidden features you may not even realize, such as the fact that you can save up to $5 billion in this account type.

1. You Always Have Access

What if I told you that you can access Roth IRA funds at any time before you reach the age of 59 ½? If you're familiar with most other retirement accounts you might think that I'm pulling a fast one on you. But, it's true.

A Roth IRA allows you to take withdrawals at any time without being penalized. So, whatever you have contributed over the years can be withdrawn at any time. Any earnings you make must stay in your account for continued growth, however.

Since you invest after-tax money in a Roth IRA, it offers this feature. Generally, you are able to withdraw that money for any reason, whether you have medical bills to pay off or a remodeling project.

In addition, if you invest the Roth IRA contribution limit of $6,000 per year for five years, then you will not have to pay any fees or penalties after the five years.

2. Roth IRAs Aren't Just For Retirement

Just because "IRA" stands for "individual retirement account" doesn't necessarily mean the funds have to be solely used for retirement. There are actually many strategies are available to you to avoid paying the 10% tax penalty normally applied to Roth IRA contributions and earnings.

Why and how does this work?

Well, there is some language in the IRS tax code that will allow you to withdraw earnings from a Roth IRA in certain situations without incurring any fees. So, let's take a look at the most common exceptions.

Invest in your education.

It may be possible to avoid student loan debt if you are considering attending college. How? Using a Roth IRA to pay for college for you or a loved one is possible. If you already have a healthy investment portfolio in your workplace retirement plan and are able to save a little extra money for qualified education expenses, this would be an excellent option.

Early withdrawals from retirement accounts are typically subject to steep tax penalties. If you use your Roth IRA funds to pay for qualified education expenses, like tuition, books, fees, and supplies, you'll escape the 10% penalty.

To maximize the Roth IRA education account, I strongly suggest that you invest as much as possible into the account each month until you reach the maximum contribution amount. Additionally, if your child has earned income through their job, you can open up a Roth IRA for them.

Purchase a home.

The homeowner's exemption is one of the best-kept secrets of Roth IRAs. When you have insufficient funds to take the next step in buying a house, it's a great resource.

With a Roth IRA, you can use all or part of your earnings to build, rebuild, or buy a home without paying tax or penalties. Don't forget to follow the five-year rule and pass the qualified distribution test though. By doing this, you are able to avoid paying taxes that you would otherwise have to pay if you tried to claim this homeowner's exemption through a traditional IRA.

Unfortunately, there's a catch. Applicants must be first-time homebuyers. In reality? Being a first-time homebuyer means that you haven't owned a home within the past two years.

If you include the benefits of your contributions with this homeowner's exemption, it becomes even more attractive. Homeowners receive an additional $10,000 exemption on top of what they have contributed. For example, if you have contributed $35k to your Roth IRA over the last 10 years, you will be able to withdraw the whole $35k plus the $10,000 homebuyer exemption.

Death, disability, certain medical expenses, and others are just a few of the exceptions you may qualify for.

3. Show Your Spouse Some Love

The Roth IRA has a third secret that comes into play here, despite the fact that the majority of people require earned income for retirement.

Are seating down for this?

You can set up a Roth IRA for your spouse even if they don't have a traditional 9-to-5 gig.

Often, this is called a spousal Roth IRA.

The IRS simply requires that you earn enough so that both of you can contribute for this strategy to work. Moreover, you must not exceed the IRS income limit for Roth IRA contributions.

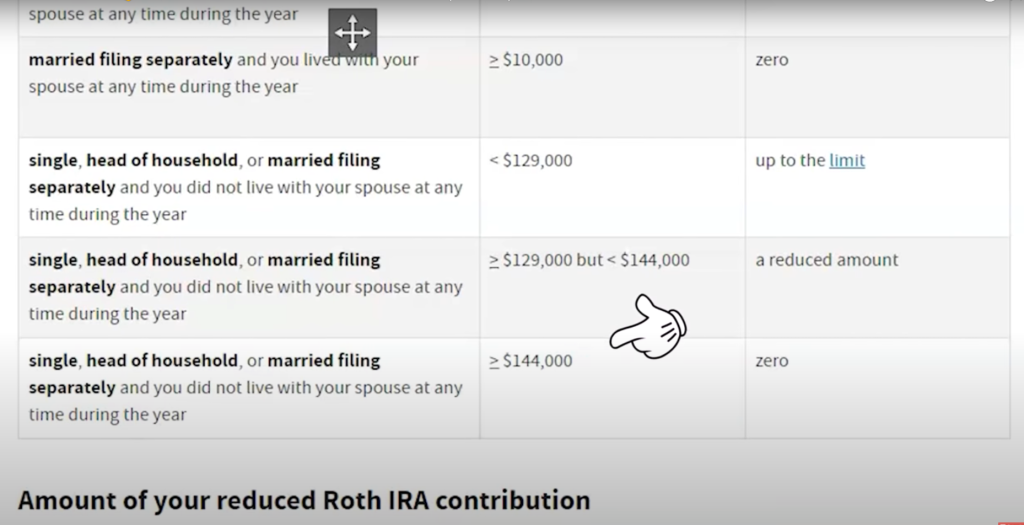

Couples filing jointly must have a minimum adjusted gross income of less than $204,000 in 2022, for example, to have the option of contributing the full amount. Also, contributions are phased out for couples with incomes between $204,000 and $214,000, and those earning more cannot contribute to Roth IRAs.

4. The Tax Saver's Credit

Although Roth IRAs are known for tax-free growth and after-tax contributions, you might be able to get a credit for the money you contribute to it. Even if you don't earn much, you can still qualify for the Tax Saver's Credit, which lets you save up to 50% upfront on your contributions.

In the case of married couples filing jointly and earning more than $41,000 each, for example, the maximum credit of 50% will not apply to them. But, there are still ways to save some upfront taxes if you earn more than that.

A married couple filing jointly who earns between $44,001 and $68,000 may qualify for a Tax Saver's Credit of 10%. For those who earn between $41,000 and $44,000, a 20% credit may be available.

If you're curious where your tax credit may fall, you can find out on the IRS website using this tool.

5. Backdoor Roth IRA

The IRS revised Roth IRA rules in 2011 permitting a backdoor Roth IRA to be used by high earners who are unable to save enough in a Roth IRA. To prevent any confusion, backdoor Roth IRAs are also known as Roth IRA conversations.

In a backdoor Roth IRA, you first invest your money in a traditional IRA or non-deductible IRA instead of directly into a Roth IRA. When the money is in there, you convert those funds into a Roth IRA.

Although it sounds straightforward, there is, obviously, a catch. Conversions are subject to taxes. As a result, Roth conversions make more financial sense in the years when your tax rate is lower.

So, here's how this process goes down;

- Open a traditonal and Roth IRA at the same time.

- Fund your traditional IRA with funds from your bank account. Contribute only the remainder of the amount you could contribute to your Roth if you made part of a contribution. You can contribute all $6,000 or $7,000 if you are over 50 if you were unable to make any contribution.

- Ask a custodian or account manager for conversion forms.

- The custodian will complete the transfer from the traditional IRA.

- For tax purposes, you will report your backdoor Roth conversion on Form 8606, Nondeductible IRAs.

- Pay any taxes owed

With all that in mind, you should be cautious about backdoor Roth IRAs. I would adamantly recommend that you speak with your CPA or a tax professional if you are considering taking advantage of this secret.

6. Roth IRA For Kids

This secret will be appreciated by people with kids or who plan to have them one day. I am among them; after all, I have four children ages 14, 11, 10, and 7. Despite being minors, all of them have their own Roth IRAs.

You need reportable income to be eligible for a Roth IRA (unless you're using a spousal IRA, as we discussed earlier). Tax laws permit parents to open a custodial Roth IRA on behalf of dependent children, but the IRS offers exceptions.

Roth IRA custodial accounts are your responsibility until your children become adults. Having said that, your kid needs to have a real job and not just babysit or mow lawns for cash. Due to my online business, I made it work for my family. After all, it's no secret that my kids are often part of brand and sponsorship deals. And, according to my CPA, adding our kids to the payroll was a logical move.

You can use this secret to help your child build long-term wealth, whether or not you are the one who employs them. This tip can pay off for your kids in a big way, with the power of time and compound interest on their side.

7. $5 Billion IRA

Alright. Here's what you've all been waiting for. How can you build up a $5 billion dollars Roth IRA?

You should first be aware that Roth IRAs can be used for other investments than just stocks. With regard to the $5 billion Roth IRA, we're dealing with an investor named Peter Thiel, who was other founder of PayPal not named Elon Musk. Thiel was also the first outside investor in Facebook. So, just imagine the amount of wealth he has built.

As Peter saw it, he had the opportunity to invest in PayPal before anyone knew what it was and when the price for a share was only 0.001 cents. PayPal stock is now worth over $5 billion and Thiel purchased them using $2,000 of his Roth IRA funds back then.

There are other investments that you can place inside a Roth IRA, like real estate, cryptocurrency, or private businesses. You might not have access to IPO stocks like Thiel, but you might be able to place them inside your Roth IRA. There's just one catch, though. You have to find a custodian who's willing to take these kinds of assets.

Fidelity, Vanguard, and Edward Jones will not allow you to hold these types of assets if you open a Roth IRA with them. To pull off this feat, you'll need to find third-party custodians that will manage your Roth IRA and other investments, as Thiel did.

The Bottom Line

Whether you know about these Roth IRA secrets or not, the Roth IRA is very powerful when it comes to retirement savings. The money has to be invested after-tax, so there are no tax breaks upfront. But having tax-free income in retirement can be great, especially if rates go up.

TD Ameritrade, Vanguard, and M1 Finance are just a few of the companies that offer Roth IRAs. If you do not have a Roth IRA, do not delay opening one. If you do not have a Roth IRA, you should compare all your options. You'll be glad you did.

The post 7 Roth IRA Secrets You Have To Know appeared first on Due.