Apple and Facebook Knock the Cover Off the Ball in Q1 Earnings As most companies have reported earnings for the first quarter, two stand out with massive growth, Apple (AAPL) and Facebook (FB). With Facebook facing changes at Apple, can both companies keep this growth up? Read more to find out.

By Andrew Hecht

This story originally appeared on StockNews

- Apple's growth was impressive

- Massive market cap- No problem

- Facebook delivered the goods

- FB faces changes at Apple

- Are these earnings sustainable in the post-pandemic economy?

We recently heard from Apple (AAPL), and Facebook (FB) as the two companies reported first-quarter earnings during the final week of April. The numbers were incredible, as both companies blew away analyst's consensus forecasts. Apple and Facebook have a long history of under-promising and over-delivering when it comes to quarterly earnings reports. Each has beaten the forecast levels over the past four quarters, which continues a far longer streak.

The shares of both companies initially moved higher after the latest earnings reports. While FB moved to a new all-time high, AAPL fell short, and the shares have backed off. APPL is a far larger company when it comes to its over $2.165 trillion market cap. FB's cap remains below the $1 trillion level, making it more sensitive to the earnings reports.

Meanwhile, the incredible earnings results raise the question of if the two companies can sustain the growth level over the coming quarters and years. The global pandemic lifted the market caps of both companies, but they could run into some blockage because of their sheer size.

Technology continues to change the world. Apple's products allow consumers to carry a powerful computer, phone, camera, and many other electronic products in their back pockets. FB has revolutionized the social media world. While innovations are likely to continue to propel earnings, the impact on the companies grows more challenging as their market caps rise.

Apple's growth was impressive

Apple continued its history of underperforming and overdelivering when it released its latest earnings report for Q1 2021.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows the market had expected EPS of 99 cents, and the number came in at $1.40. Revenues were $89.59 billion versus expectations of $77.3 billion. iPhone revenue was $47.9 billion versus the average forecast at $41.5 billion. iPad revenues of $7.8 billion exceeded the $5.6 billion, and Mac revenue of $9.1 billion blew away the estimates of $6.8 billion.

Meanwhile, the company with the world's largest market cap warned that chip shortages could hurt revenue in Q2 and beyond. However, time will tell if that is only a way to continue its history of outperformance by managing expectations.

Massive market cap- No problem

At the $130.21 level at the end of last week, APPL's market cap stood at near the $2.2 trillion level.

Source: Barchart

Source: Barchart

The chart shows that AAPL shares rose to a record high of $145.09 in January 2021. The stock turned lower after the recent earnings report.

While the $2.2 trillion market cap makes Apple a massive company, the impact on overall value through quarterly earnings is like turning an ocean liner. The company remains one of the most innovative in the technology sector. Rising US corporate taxes are likely to impact consumers more than the company as they will be passed along in pricing.

Apple has always found a way to roll out new and exciting products and upgrades that add to the company's value. There is no reason to think Apple will not continue innovating and creating products that consumers must have.

Meanwhile, inflationary pressures in markets across all asset classes are weighing on money's value. The bottom line is that a trillion is not what it once was.

Facebook delivered the goods

FB knocked the ball off the cover when it reported its first-quarter 2021 earnings.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, FB reported EPS of $3.30 compared to consensus expectations of $2.37. In Q1, FB grew revenue by an incredible 48%, with its advertising revenue climbing 46%. "Other" revenues were 146% higher. Meanwhile, the company's total costs were only 29% higher, increasing the bottom line. The higher costs went mostly to servers, data centers, and research and development, translating to future profits. Marketing and general and administration expenses were only 2% higher.

Revenues were $26.17 billion versus the expected $23.67 billion. Daily active users came in at 1.88 billion compared to the forecast of 1.89 billion, and monthly active users were at 2.85 billion compared to the expected 2.86 billion. While the active user data posted slight declines compared to expectations, the average revenue per user was $9.27 versus the forecast $8.40. By increasing its advertising charges, FB turbocharged its first quarter.

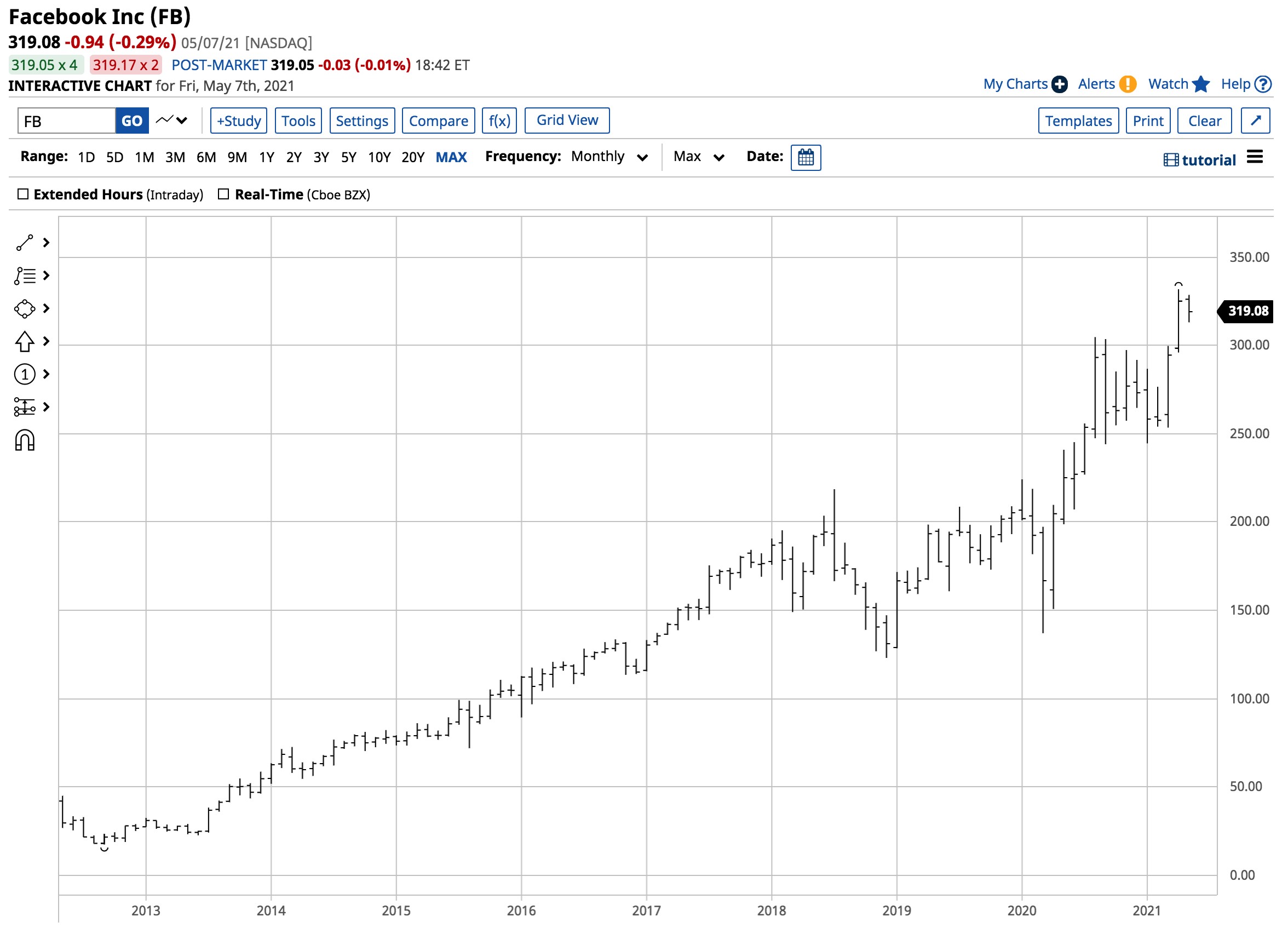

Source: Barchart

Source: Barchart

The chart shows that the new record high at $331.81 per share came after the Q1 earnings report. FB shares pulled back to the $319.08 level at the end of last week.

FB faces changes at Apple

FB and APPL are squaring off over Apple's iOS update, which is a feud over privacy issues. The update gives users the option to permission the tracking of their activity across other apps and the web. Apple calls the change App Tracking Transparency, and Facebook is not pleased with the change. FB claims it threatens the source of its $86 billion in annual revenue- targeted advertising. FB further argues that APPL is not protecting consumer privacy but its own business. Mark Zuckerberg, FB's CEO, and founder said, "the moves clearly track their competitive interests."

Mr. Zuckerberg argues that FB's business model uses ad revenue to allow users to access its site for free. Apple claims that, as CEO Tim Cook said, "If a business is built on misleading users, on data exploitation, on choices that are no choices at all, it does not deserve our praised, it deserves reform."

The tension between FB and APPL reflects one of the leading issues facing the technology sector in Washington DC and the European Union. The power of data and its use or abuse is under the hot lights and could face regulatory changes protecting privacy. Regulation is likely to be an issue for both companies over the coming months and years.

Are these earnings sustainable in the post-pandemic economy?

Earnings at APPL and FB were more than impressive for the first three months of 2021. While some market participants believe the global pandemic created an earnings boom, these two companies have been growing by leaps and bounds for years. They will continue to innovate, roll out new products, and the consumer market will eat them up like candy.

The sheer size of APPL and FB and their leadership roles in technology and social media make any competition more than a challenge. If legislators and regulators do not put a leash on their activities, we should expect them to continue to grow. Higher corporate taxes may only be a speedbump for their growth as their customers will undoubtedly pay more for the products and services that many have grown to accept as essential. Therefore, earnings may not be only sustainable, but growth is likely to continue.

AAPL shares were trading at $124.00 per share on Tuesday morning, down $2.85 (-2.25%). Year-to-date, AAPL has declined -6.25%, versus a 10.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy's background, along with links to his most recent articles.

The post Apple and Facebook Knock the Cover Off the Ball in Q1 Earnings appeared first on StockNews.com