Beware the Goldilocks Labor Data The May non-farm payrolls number appears to be a Goldilocks figure but we're not convinced. It's hot enough for the market to believe economic activity is accelerating yet not so hot as to force the FOMC's hand.

This story originally appeared on MarketBeat

Goldilocks NFP Numbers Lift The S&P 500

The May non-farm payrolls number appears to be a Goldilocks figure but we're not convinced. It's hot enough for the market to believe economic activity is accelerating yet not so hot as to force the FOMC's hand. In our view, the data is only okay, as it reveals a new risk for the market. Based on the latest figures from the JOLTs report, prepared by the BLS, shows upwards of 8.1 million job openings right now. If those jobs can't be filled there is no way the S&P 500 (NYSEARCA: SPY) will be able to meet its revenue and earnings estimates over the next few quarters. If there's one thing the market can't stand it's weak revenue and earnings figures so.

May Job Gains Miss Target, Market Rises

The May non-farm payrolls figures were strong but they missed the target by more than a hundred thousand jobs. In our view, the 559,000 new jobs are short by at least half a million simply based on the number of unemployed people and the number of job openings currently available. Admittedly, the NFP numbers are flawed and we do expect to see revisions in the coming months, but this month's revision left a lot to be desired. In total, including the revisions, there were less than 580,000 jobs added this month.

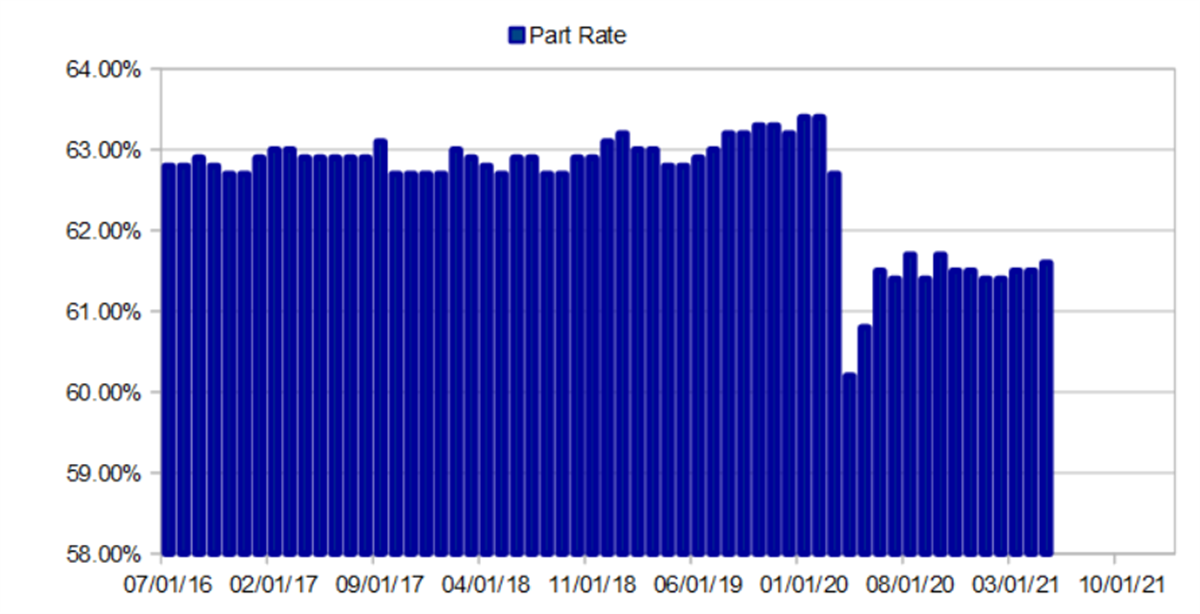

Moving down the report, the data remains a little bit mixed. Unemployment fell by 0.3% to 5.8 % and the lowest level since the pandemic started, but labor force participation remains weak. Labor force participation held steady at 61.6% and within the range it has held for the past few months. The LPR figures might begin moving higher over the next month or two due to the fact many states are ending unemployment benefit extensions but we'll see. If not, there is a real chance economic growth in the second and third quarters of the year will fall far short of the current consensus estimates.

On the wage front, those who are working are benefiting from the tight labor market conditions. Average hourly wages rose 15 cents or a half a percent over the past month to hit the highest level on record.

The Fed's GDP Outlook Weakens

The Federal Reserve is still expecting solid double-digit GDP gains in the second quarter but the outlook is softening. The combination of "tepid" labor data, super tight conditions in the housing market, and the specter of rising prices are weighing on growth potential. At last look, the Atlanta Fed was expecting GDP growth in the second quarter to top 10%. we expect to see that figure trend lower over the next month unless something changes in the labor market scene. The takeaway here is that new risks are emerging for the Fed and the economy that add up to a no-win situation. Inflation is already running hot, If the Fed needs to keep stimulating the economy to spur job creation inflation will only get worse.

The Technical Outlook: The S&P 500 Is At An Inflection Point

The S&P 500 has been winding up for its next move over the past few weeks. The price action going into the NFPA report was tepid and gave little indication of Direction. In the wake of the report price action firmed and futures turned positive but there are still technical risks for the market. For one, the S&P 500 index is trading just below resistance at the all-time high level. If that cannot be surpassed, there is a real chance the index could enter a reversal. If resistance is confirmed at the all-time high investors should expect the index to trade sideways at best and lower at worst with a possible near-term target at 4150 + 4100. If the 4100 level doesn't hold as firm support we may see the index correct a full 20% from its high.

If the S&P 500 index, however, can maintain upward momentum and set a new high it would signal another leg of the uptrend has begun. In that case, we might see another 3% to 10% added to the index by the end of the summer. The caveat is that the underlying risk will remain and a market correction is still due.

Featured Article: What is the S&P 500 Index?