Clean Energy Is the Way to Independence – and Huge Gains

InvestorPlace – Stock Market News, Stock Advice & Trading TipsThe Russo-Ukrainian crisis underscores the need for energy independence. And a global energy grid built on clean energy is the…

This story originally appeared on InvestorPlace

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Every crisis creates opportunities. And the current one is creating a huge opportunity in energy stocks.

But not in the way you think.

If you’re listening along with mainstream media, you’re probably thinking that now is a good time to buy oil and natural gas stocks because the economic sanctions on Russian fossil fuels will cause a price spike on those commodities.

Makes sense.

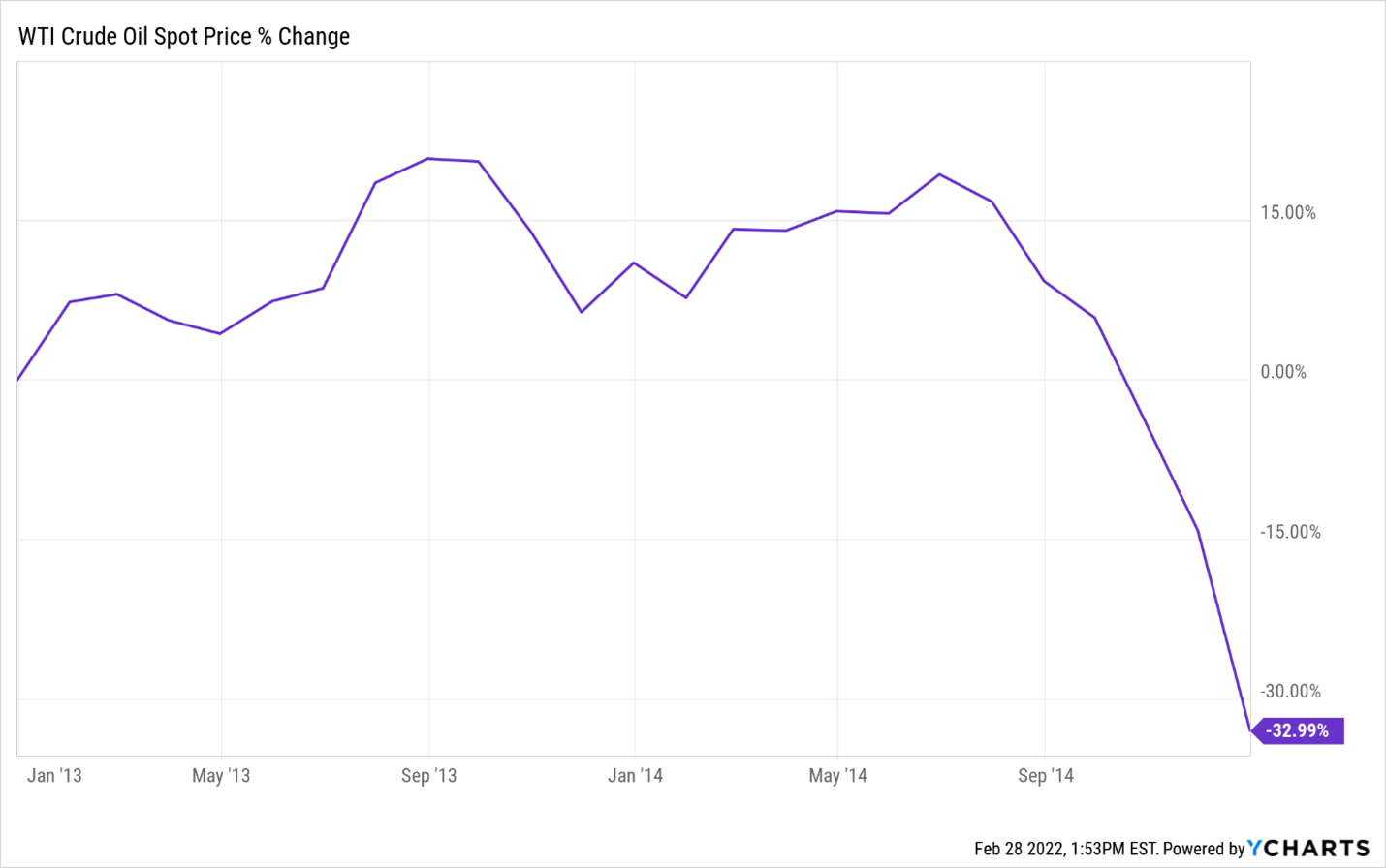

But look at what happened the last time the U.S. and its allies imposed heavy sanctions against Russia, following its Crimean invasion in early 2014. Oil prices spiked for a few weeks – and then they crashed!

The point? In the big picture, sanctions on Russia’s fossil fuels are somewhat meaningless. The rest of the world has enough reserves to plug the supply gap left by Russian production.

So while there exists a huge opportunity in energy stocks amid the Russian invasion of Ukraine, that opportunity is not in oil and natural gas.

Rather, it is in clean energy stocks.

Clean Energy Is the Path Forward

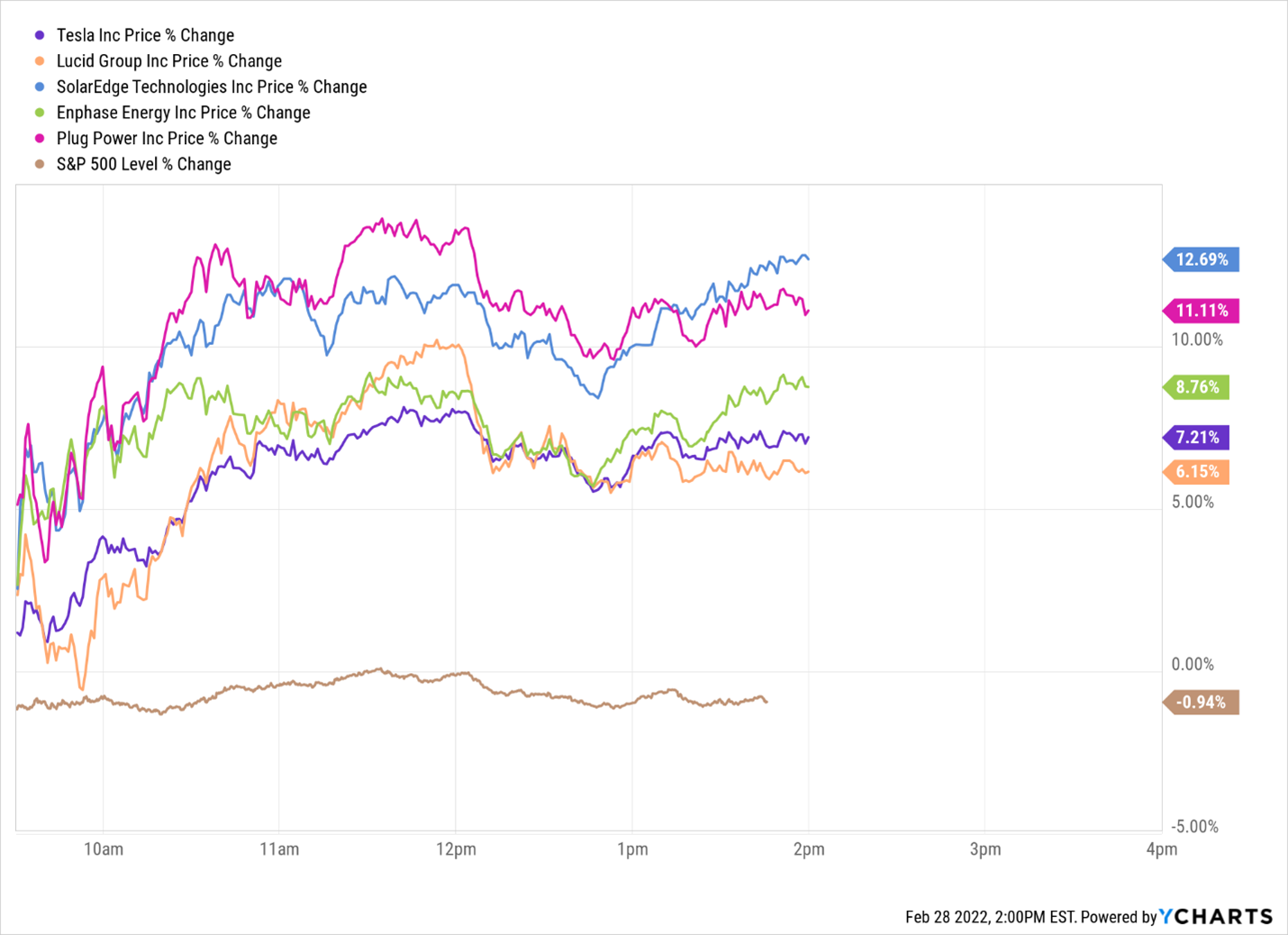

Did you notice the price action of stocks yesterday?

The broader stock market struggled, as you would expect with the escalating geopolitical tensions in Eastern Europe. But clean energy stocks soared!

Shares of electric vehicle makers like Tesla (NASDAQ:TSLA) and Lucid Group (NASDAQ:LCID) popped. So did shares of solar companies like SolarEdge (NASDAQ:SEDG) and Enphase (NASDAQ:ENPH), as well as shares of hydrogen fuel cell producer Plug Power (NASDAQ:PLUG).

These stocks were rattling off 9%, 10%, 11% and even 12% gains yesterday, while the market was down 1%.

Why the huge outperformance in clean energy stocks? The Russian invasion of Ukraine underscores the world’s need for energy independence. And clean energy offers the only viable pathway to TRUE energy independence.

It’s inarguable that energy independence is the ultimate goal for every country. No government wants their energy supply to be reliant upon another country – especially if said country is Russia, which provides about 40% of Europe’s natural gas supply.

At the end of the day, every country wants to produce its own energy. It’s cheaper. It’s more reliable and creates more jobs. And, perhaps most importantly, it’s safer.

Achieving Self-Sufficiency

The question, though, is how do countries achieve energy independence?

Well, by the very nature of fossil fuels, it is impossible for every country to achieve energy independence through oil and natural gas. Those two energy sources are non-renewable and only exist in certain places on Earth. In some places, like Russia, fossil fuels are abundant. And in others, they are not.

Therefore, a global energy infrastructure built on top of fossil fuels is one that will forever be mired in energy dependence. A select group of countries – like Saudi Arabia and Russia – will always supply most of the world’s oil and natural gas.

As evidenced by the current situation in Ukraine – or the 2000s situation in Iraq – that is a recipe for disaster. More specifically, it’s a recipe for warfare.

However, the sun does shine nearly everywhere on Earth, and the wind blows most places, too. Therefore, a global energy infrastructure built on top of solar, wind and hydrogen power is one that allows for true energy independence.

And so in our flagship investment research advisory Innovation Investor, we’re passing on oil stocks – and buying clean energy stocks instead.

Clean Energy Independence

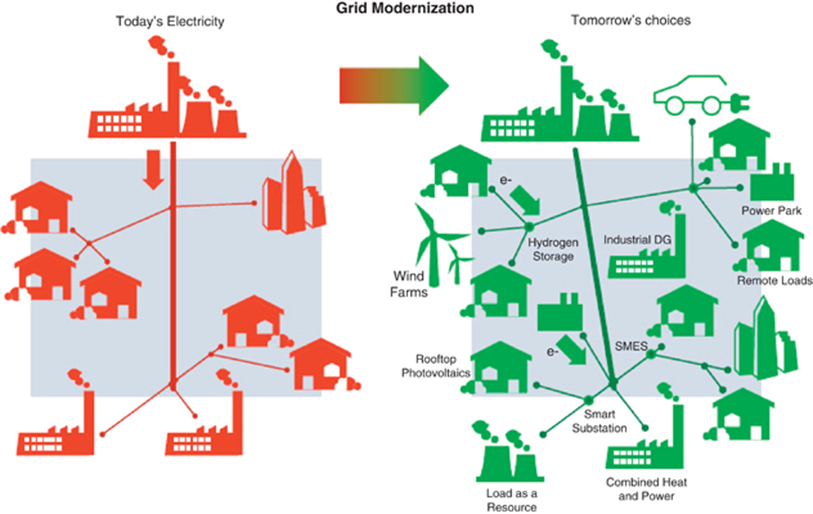

In our belief, due to the emergence of the Distributed Energy Revolution, the world will achieve energy independence by 2050.

Some of you may have heard about the Distributed Energy Revolution before. The general idea is that in this revolution, all people are energy independent. No more relying on Russia or Qatar. No more grid or power outages.

We’ll generate power on our own through solar panels on our homes and commercial buildings, massive solar farms in the desert and wind turbines in high-altitude locations.

We’ll store that power on our own through battery storage solutions installed at our homes, office buildings and power generation hubs.

And we’ll deploy that power on our own through AI-powered algorithms that optimize energy usage throughout the day.

That’s the future. Forget this nonsensical global energy system built on unreliability. The future is energy independence, achieved through grid modernization and clean energies.

And for the first time, the U.S. is ready to embrace that future.

Renewables Now

Solar energy costs have plummeted, so much so that it is not only the cheapest energy source in the world. But it’s the cheapest energy source in the history of humankind.

Solar panel efficiency has dramatically improved from ~15% back in the 1990s to upwards of 25% and even 30% in some panels today.

Energy storage technology has done the same, and residential battery solutions can now provide long-duration storage.

Lithium-ion battery costs have plunged to new lows, making storage systems quite affordable.

AI algorithms have radically accelerated, and companies are already using automated systems to optimize self-service energy usage.

And hydrogen costs have collapsed and are on track to beat fossil-fuel costs within just a few years.

The writing is on the wall, folks. All the stars have aligned. Costs have plummeted. Capability and reliability have improved. And legal support is fast-growing.

The world didn’t need the push toward energy independence that it’s getting from Eastern Europe right now. But hey… it’ll accelerate the Distributed Energy Revolution.

And the stocks tied to this revolution – solar, EV, wind, hydrogen, energy storage and more – aren’t just going to soar here in 2022.

They’re going to soar hundreds, if not thousands, of percent over the next few years.

These stocks represent some of the market’s best short-term trades and long-term investments.

Investing in the Clean Energy Revolution

The Russo-Ukrainian crisis underscores the world’s need for energy independence. And while some think that domestic oil and natural gas production is the way to achieve that, it is a way that only works for a select few – and one that, long-term, is unsustainable.

The only true and sustainable path toward energy independence involves embracing the Distributed Energy Revolution and transforming the global energy grid into one built on clean energy.

That’s the inevitable future. And we’re investing in it.

Specifically, there is one tiny $3 stock that we have our eyes set on right now. This company is working on next-gen technology that will help power the whole Distributed Energy Revolution.

The potential upside in this stock is immense. And I’ve only shared its name with a small group of 60 who attended a presentation of mine at the Hudson Theater in Southern California.

But I want to give you that same opportunity.

Learn more about the little stock at the epicenter of the clean energy revolution.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post Clean Energy Is the Way to Independence – and Huge Gains appeared first on InvestorPlace.

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Every crisis creates opportunities. And the current one is creating a huge opportunity in energy stocks.

But not in the way you think.