Elastic Stock is a Long Opportunity on Data Volume Growth Data search and analytics platform Elastic (NYSE: ESTC) stock has been an under-the-radar rollercoaster ride as the Company is relatively unknown amon...

By Jea Yu

This story originally appeared on MarketBeat

Data search and analytics platform Elastic (NYSE: ESTC) stock has been an under-the-radar rollercoaster ride as the Company is relatively unknown amongst retail investors. The provider of enterprise data search solutions is utilized by some of the most well-known Companies like Netflix (NASDAQ: NFLX), Twilio (NYSE: TWLO), Uber (NYSE: UBER), Adobe (NASDAQ: ADBE), T-Mobile (NASDAQ: TMUS), Microsoft (NASDAQ: MSFT) and so on. The Elastic stack enables enterprises to search through oceans of data securely and efficiently to find documents, applications, metrics, monitor infrastructure, and protect against security threats. Its software enables the flexibility to serve public and private clouds, as well as hybrid and on-premises environments. It enables robust data analytics and even snapshots which allows for fewer compute resources. The platform covers so many functions that finding one competitor is futile as it as competitors in many sub-segments which is the value proposition for keeping everything in a one-stop shop model that continues to innovate with new target product launches space out every quarter. Data volumes will continue to grow and accelerate as the reopening gets underway with the acceleration of COVID vaccinations. The new normal guarantee the growth of data volume and Elastic helps to organize and utilize that data in a robust manner. Prudent investors seeking exposure in this inevitable data tailwind can monitor shares of Elastic for opportunistic pullback levels.

Fiscal Q4 2021 Earnings Release

On June 2, 2021, Elastic released its fiscal fourth-quarter 2021 results for the quarter ended April 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.08) versus (-$0.16) consensus analyst estimates, an $0.08 beat. Revenues grew 44% year-over-year (YoY) to $177.6 million, beating analyst estimates for $158.87 million. Software-as-a-service (SaaS) revenues rose 77% YoY to $51.3 million. Total subscription customers were over 15,000 compared to 13,800 prior quarter and 11,300 in same quarter a year ago. Subscription revenue now represents 93% of total revenues. Elastic founder and CEO Shay Banon stated, "We had a strong fourth quarter capping off an exceptional year, due in large part to the continued adoption of Elastic Cloud and broad-based demand for our enterprise search, observability, and security solutions. Data volumes keep increasing as companies become more digital and move to the cloud, and our customers are seeing that the ability to search, observe, and protect this ever-increasing amount of data is critical to their success. We believe this continued demand puts us on path to becoming a $1 billion plus revenue company in fiscal year 2023."

Fiscal 2022 Guidance

Elastic raised Q1 fiscal 2022 EPS estimates to (-$0.13) to (-$0.10) versus (-$0.50) consensus analyst estimates on revenues between $171 to $173 million compared to $165.54 million analyst estimates. The Company lowered full-year 2022 EPS to come in between (-$0.60) to ($0.51) versus analyst estimates for ($0.50) with raised revenues expected between $782 million to $788 million versus $740.61 analyst expectations.

Conference Call Takeaways

CEO Banon set the tone, "In Q4 revenue grew 44% year-over-year, and we once again saw robust customer acquisitions and expansion metrics. We ended the quarter with more than 15,000 subscription customers, including over 730 with annual contract value of more than $100,000." He went on to detail the growth across all geographics driven by the adoption of their solutions and expansions to new use cases. He went on, "Companies throughout the world are becoming more digital and distributed, especially as the move to the cloud. And they are generating ever increasing amount of data." CEO Banon laid out the value proposition, "Elastic enables customers to quickly search across any data anywhere, anytime, from adding a search box to a website, to monitoring applications, infrastructure and cloud services and preventing, detecting and responding to threats across their organization." The bottom line is data volumes are growing exponentially and the need to sift through is an inevitable need. Summed up, "They need data to be easily accessible and always on and fully searchable at a moment's notice regardless of temperature. With searchable snapshots in a new frozen tier, customers can now search petabytes of data in just minutes anytime they want. They will not be forced to delete data to reduce costs with the power to easily balance the speed of results with the cost of storage." The Company has gotten upgrades to enterprise subscription just by offering free 60-days trial usage, up from 7-days to bolster conversions.

ESTC Opportunistic Pullback Levels

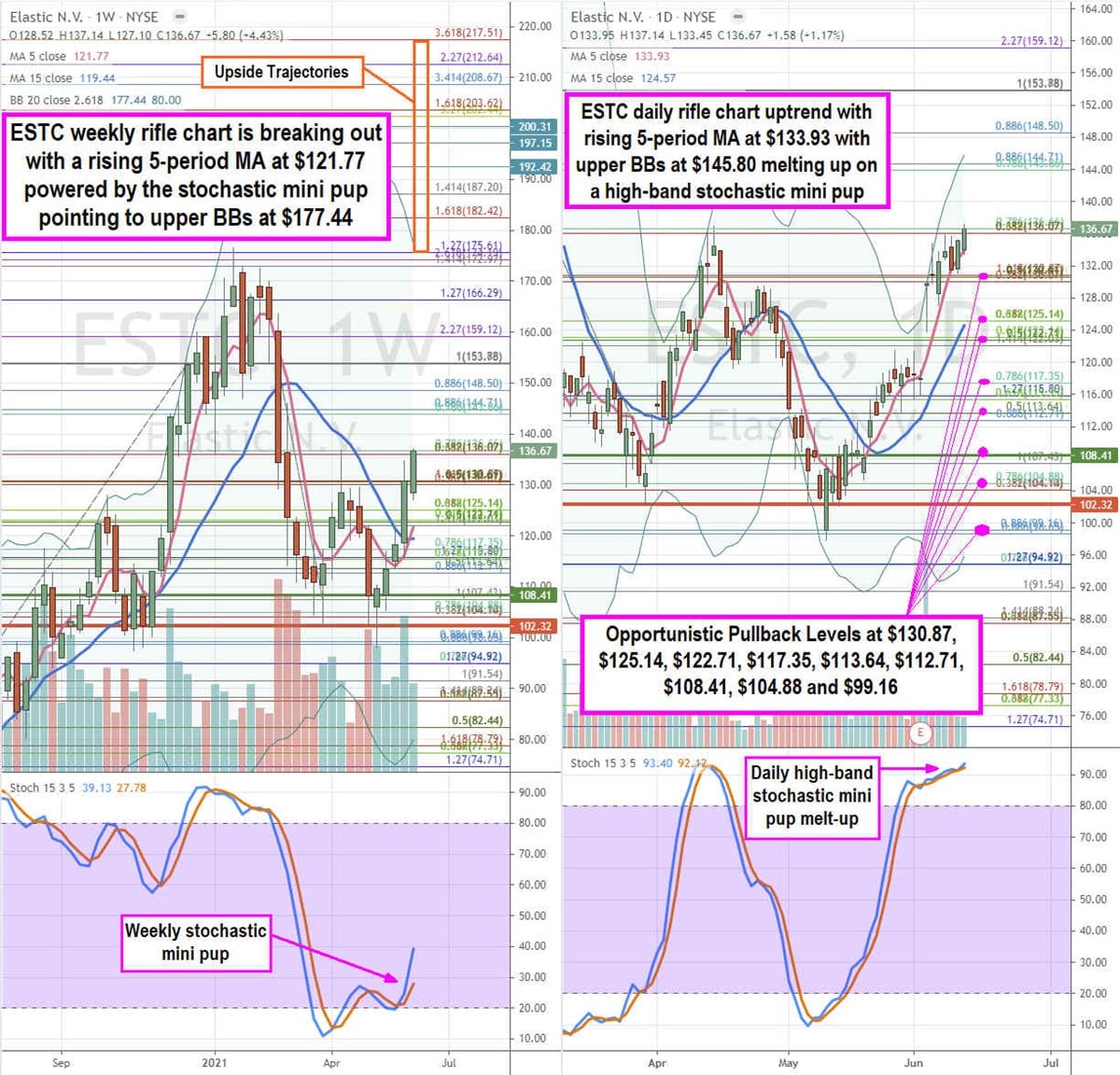

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for ESTC stock. The weekly rifle chart stochastic completed a full oscillation down and formed a divergence bottom with a stochastic mini pup setting up a powerful breakout. The weekly 5-period moving average (MA) support is rising at the $121.77 Fibonacci (fib) level. The weekly upper Bollinger Bands (BBs) sit at 177.44. The daily rifle chart triggered a market structure low (MSL) buy signal on the breakout through $108.41. The daily stochastic is still rising at very high bands above 90-band with a slow melt-up mini pup pointing at upper BBs at $145.80. The full daily stochastic oscillation started from below $100 so prudent investors have to be patient and await opportunistic pullback levels at the $130.87 fib, $125.14 fib, $122.71 fib cluster, $117.35 fib, $113.64 fib, $112.71fib, $108.41 weekly MSL trigger, $104.88 fib cluster and the $99.16 fib. Upside trajectories range from the $175.61 fib level up to the $217.51 fib level.

Featured Article: How Does the Quiet Period Work?