Fastenal Stock is Ready to Sprint Higher

Industrial and construction supplies wholesaler Fastenal (NASDAQ: FAST) stock has recently sold off on strong fiscal Q1 2022 earnings.

This story originally appeared on MarketBeat

Industrial and construction supplies wholesaler Fastenal (NASDAQ: FAST) stock has recently sold off on strong fiscal Q1 2022 earnings. The Company has experienced double-digit daily growth in each of its three divisions: Fasteners, Safety Products, and Other products which are composed of eight smaller product segments. The housing and construction boom has been a powerful tailwind as evidenced by the unit growth in sales for fiscal Q1 2022. Improved weather conditions from a year ago also helped to boost daily sales by 18.4%. The Company raised prices to mitigate the effects of inflation on its products, fasteners, and transportation services. Spike in fuel prices accelerated its impact. The Company says that while supply chains remain tight, the conditions have stabilized. In addition to international growth hitting a $100 million milestone, e-commerce also hit a milestone generating north of $100 million in the month of March 2022, up 53%. Growth continues to ramp up despite shares falling. Prudent investors can look for opportunistic pullbacks in shares of Fastenal.

Q1 Fiscal 2022 Earnings Release

On April 13, 2022, Fastenal released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.47 excluding non-recurring items beating consensus analyst estimates of $0.45, by $0.02. Revenues grew by 20.3% year-over-year (YOY) to $1.7 billion beating analyst estimates for $1.69 billion. This was driven by higher unit sales by manufacturing and construction customers and an additional selling day for the quarter. The improved weather from the prior year also helped to improve daily sales by 18.4% in the quarter. Fastener daily sales rose 24.6% making up $34.3% of its net sales. Safety product daily sales rose 15.3% representing 21% of net sales. Other products accounted for 44.7% of net sales in fiscal Q1 2022.

Conference Call Takeaways

CEO Dan Florness presented insights into the Company’s performance in a conversational manner. He noted how nice it is to recover from the 2008 to 2009 real estate meltdown and 2011-2012 final meltdown periods. The pandemic has caused them to implement strategies to improve efficiency which paid off as the context has made it challenging to add labor and energy into the organization. However, it hasn’t dented sales since the branch consolidation process was started 6 to 8 years ago. He says that supply chains have stabilized. The Company is seeing upticks in applications as supply chains improve and labor returns to the workforce. Fastenal exceeded $100 million in international sales for the first time and the Company expects to return to normalcy with the restart of its in-person customer expo selling event and in-person annual meeting after two years. FMI Technology has improved from signing 74-a-day a year ago to 83-a-day in this quarter. FMI technology accounts for 35.5% of total sales, up from 28.7% the prior year. E-commerce grew 55.6% hitting a milestone of cracking $100 million for the first time ever in March 2022. He concluded, Finally if you roll up our FMI Technology in our e-commerce, we talk about our digital footprint. We hit 47% of sales in the quarter, 39.1% a year ago, 34.9% two years ago. Our goal is to hit 55% of sales at some point later in the year. And we still believe that long term, that has the potential to be 85% of sales, and we’re gearing our supply chain and have been gearing our supply chains to support that kind of business in the future.”

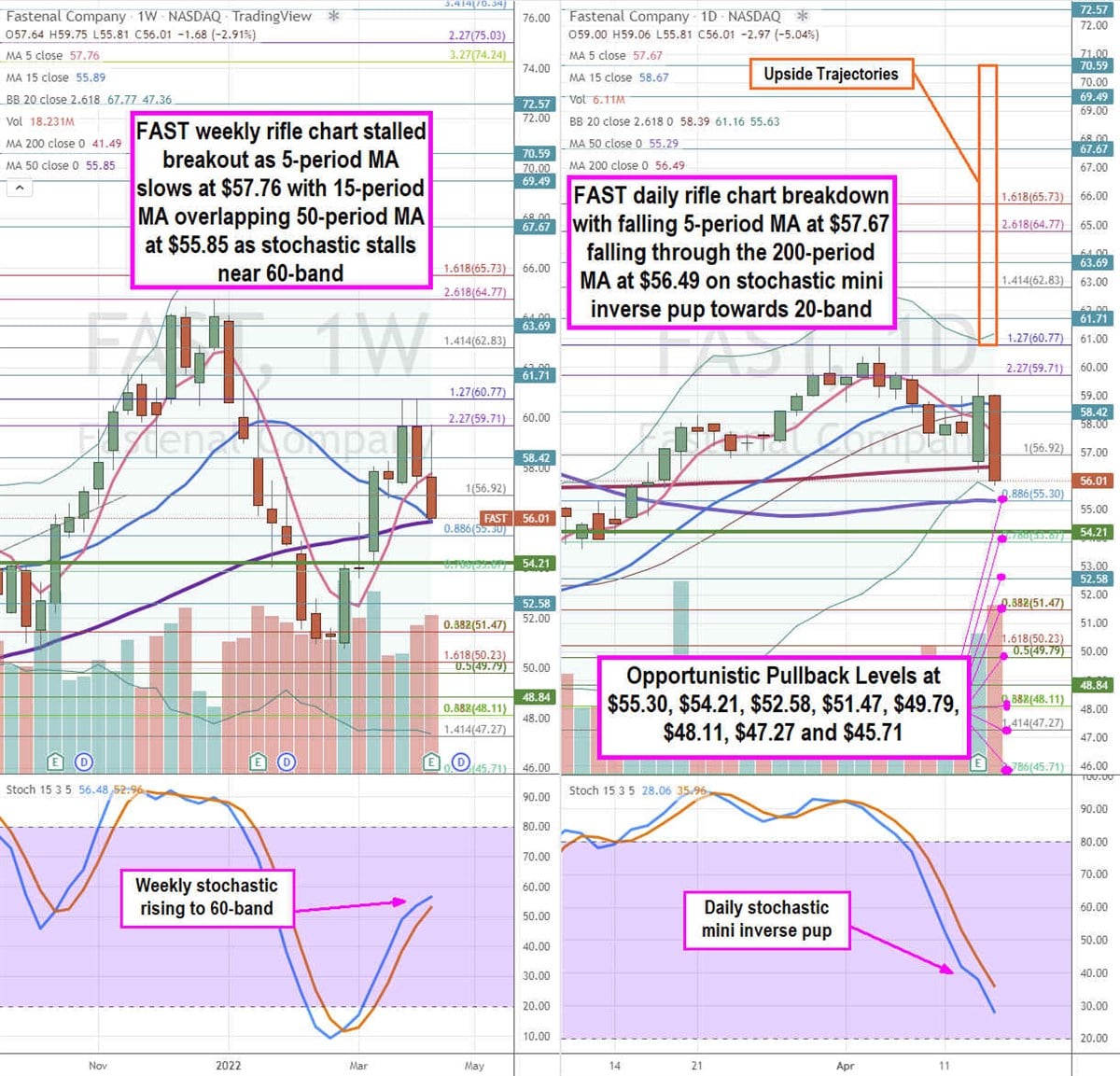

FAST Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for FAST stock. The weekly rifle chart peaked near the $60.77 Fibonacci (fib) level. Shares sold off back towards the overlapping weekly 15-period moving average (MA) and weekly 200-period MA at $55.85. The weekly uptrend stalled as the 5-period MA slowed at $57.76. The weekly upper Bollinger Bands (BBs) $67.77 and lower BBs at $47.36. The weekly market structure low (MSL) buy triggered the breakout through $54.21. The daily rifle chart breakdown has a falling 5-period MA at $57.67 and 15-period MA starting to fall at $58.67 as shares fall under the daily 200-period MA at $56.49 towards the daily lower BBs at $55.63 and daily 50-period MA at $55.29. The daily stochastic is falling on the stochastic mini inverse pup through the 30-band. Prudent investors can look for opportunistic pullback levels at the $56.30 fib/daily 50-period MA, $54.21 weekly MSL trigger, $52.58, $51.47 fib, $49.79 fib, $48.11 fib, $47.27 fib, and the $45.71 fib level.

Industrial and construction supplies wholesaler Fastenal (NASDAQ: FAST) stock has recently sold off on strong fiscal Q1 2022 earnings. The Company has experienced double-digit daily growth in each of its three divisions: Fasteners, Safety Products, and Other products which are composed of eight smaller product segments. The housing and construction boom has been a powerful tailwind as evidenced by the unit growth in sales for fiscal Q1 2022. Improved weather conditions from a year ago also helped to boost daily sales by 18.4%. The Company raised prices to mitigate the effects of inflation on its products, fasteners, and transportation services. Spike in fuel prices accelerated its impact. The Company says that while supply chains remain tight, the conditions have stabilized. In addition to international growth hitting a $100 million milestone, e-commerce also hit a milestone generating north of $100 million in the month of March 2022, up 53%. Growth continues to ramp up despite shares falling. Prudent investors can look for opportunistic pullbacks in shares of Fastenal.

Q1 Fiscal 2022 Earnings Release

On April 13, 2022, Fastenal released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.47 excluding non-recurring items beating consensus analyst estimates of $0.45, by $0.02. Revenues grew by 20.3% year-over-year (YOY) to $1.7 billion beating analyst estimates for $1.69 billion. This was driven by higher unit sales by manufacturing and construction customers and an additional selling day for the quarter. The improved weather from the prior year also helped to improve daily sales by 18.4% in the quarter. Fastener daily sales rose 24.6% making up $34.3% of its net sales. Safety product daily sales rose 15.3% representing 21% of net sales. Other products accounted for 44.7% of net sales in fiscal Q1 2022.

Conference Call Takeaways

CEO Dan Florness presented insights into the Company’s performance in a conversational manner. He noted how nice it is to recover from the 2008 to 2009 real estate meltdown and 2011-2012 final meltdown periods. The pandemic has caused them to implement strategies to improve efficiency which paid off as the context has made it challenging to add labor and energy into the organization. However, it hasn’t dented sales since the branch consolidation process was started 6 to 8 years ago. He says that supply chains have stabilized. The Company is seeing upticks in applications as supply chains improve and labor returns to the workforce. Fastenal exceeded $100 million in international sales for the first time and the Company expects to return to normalcy with the restart of its in-person customer expo selling event and in-person annual meeting after two years. FMI Technology has improved from signing 74-a-day a year ago to 83-a-day in this quarter. FMI technology accounts for 35.5% of total sales, up from 28.7% the prior year. E-commerce grew 55.6% hitting a milestone of cracking $100 million for the first time ever in March 2022. He concluded, Finally if you roll up our FMI Technology in our e-commerce, we talk about our digital footprint. We hit 47% of sales in the quarter, 39.1% a year ago, 34.9% two years ago. Our goal is to hit 55% of sales at some point later in the year. And we still believe that long term, that has the potential to be 85% of sales, and we’re gearing our supply chain and have been gearing our supply chains to support that kind of business in the future.”