How Will Recent Inflation Highs Impact the Stock Market? The recent news that inflation hit highs not seen since the first Bush administration has undoubtedly unnerved more than a few investors. While the recent CPI figure is worse than...

By David Cohne

This story originally appeared on StockNews

The recent news that inflation hit highs not seen since the first Bush administration has undoubtedly unnerved more than a few investors. While the recent CPI figure is worse than expected, that doesn't mean there will be a return to the 1970s. While inflation may run hotter and more broadly through the end of the year, I still believe things will cool down next year as the economy completely recovers from the pandemic. I will talk about the effect I think this will have on the S&P 500 (SPY) and more in this week's commentary. Read on below….

(Please enjoy this updated version of my weekly commentary published November 10, 2021 from the POWR Value newsletter).

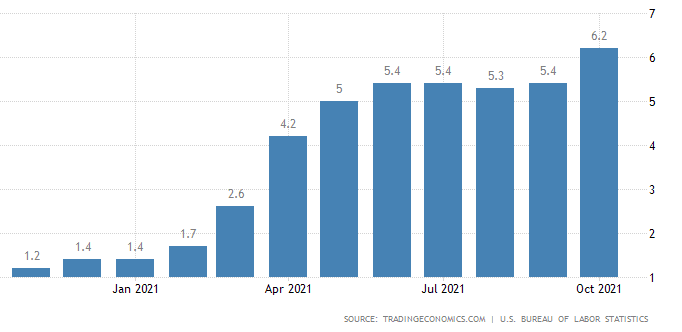

Unless you haven't checked the news today, you must know the big topic is inflation. Inflation in the U.S hit a three-decade high last month, rising at a 6.2% annual rate. The consumer price index rose at its fastest annual pace since 1990 and topped 5% for the fifth consecutive month. Sequentially, the CPI jumped 0.9% in October from September.

This was a much higher jump from September's 0.4% increase. Inflation was driven by supply shortages and strength in consumer demand, which has pushed prices higher. Even core inflation, which excludes food and energy, rose 4.6% from the prior year.

This was higher than September's 4% increase and the most significant increase since 1991.

Another thing to note is that inflation looks to be broader now. Previously, prices were being pushed up due to higher vehicle prices and an increase in consumer demand. Now we are seeing all types of price increases, including energy, food, rents, and more. So, while I believe inflation is still transitory, it may get worse before it gets better.

In fact, supply chain concerns may get worse as we head into the holiday season. This could lead to a period of higher inflation as we head into next year. The shortage of workers is also putting pressure on wages, which results in companies raising prices to help offset the higher labor costs.

However, with the exception of rent and medical expenses, I do expect inflation to recede by the middle of next year.

The key to remember is that the current inflation situation can't be compared to previous inflationary periods. Currently, inflation is reflective of a pandemic-driven supply and demand imbalance. So, while inflation is expected to remain, it should improve as the economy fully recovers from the pandemic.

But we do need to consider its short-term effects on the market. The market is down again today due to investor reaction to the recent CPI figure. This followed Tuesday's session where stocks took a breather after an eight-day winning streak where the S&P 500 closed above 4,700 for the first time.

Much of those gains were driven by very strong growth in third-quarter earnings reports that showed companies were largely able to navigate higher costs and help preserve their margins. In fact, many companies were able to blow past earnings projections.

We are also still seeing positive news regarding COVID as infections fall, and Pfizer (PFE) reported positive data for its new COVID-19 antiviral pill that cut hospitalization risk by 89 percent. Plus, children are now eligible for vaccines. In addition, hiring is starting to pick up as more offices reopen. The U.S. added 531,000 jobs in October.

Prior months were also revised upward, and unemployment fell to 4.6 percent in October from 4.8 percent in September. The ISM Manufacturing data for October was also strong. It was the 17th consecutive month of expansion. Services, especially, were strong, jumping 7.5 percentages points to 69.7.

As I've mentioned before, the transition from a goods economy to a services economy bodes well. First of all, as more consumers spend on services, it can help ease pressure on supply chains. Secondly, our economy is a services economy, so it means we're heading on the right track.

So overall, while the recent inflation figure looks alarming, I believe higher prices will lessen over the long run. We just need to prepare for higher inflation over the next three to six months. Aside from inflation, though, the economy, corporate profit margins, and the market look strong. We just need to stay the course.

What To Do Next?

The POWR Value portfolio was launched in early May and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Value Stocks strategy which has stellar +38.63% annual returns.

If you would like to see the current portfolio of value stocks, then consider starting a 30 day trial by clicking the link below.

About POWR Value newsletter & 30 Day Trial

All the Best!

![]()

David Cohne

Chief Value Strategist, StockNews

Editor, POWR Value Newsletter

SPY shares rose $1.64 (+0.35%) in premarket trading Thursday. Year-to-date, SPY has gained 25.22%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: David Cohne

David Cohne has 20 years of experience as an investment analyst and writer. He is the Chief Value Strategist for StockNews.com and the editor of POWR Value newsletter. Prior to StockNews, David spent eleven years as a consultant providing outsourced investment research and content to financial services companies, hedge funds, and online publications. David enjoys researching and writing about stocks and the markets. He takes a fundamental quantitative approach in evaluating stocks for readers.

The post How Will Recent Inflation Highs Impact the Stock Market? appeared first on StockNews.com