Is Bank of America Stock a Buy Under $40?

With its shares currently trading at less than $40, Bank of America (BAC) reported better than expected earnings in its last reported quarter. In addition, it provided a positive outlook…

This story originally appeared on StockNews

With its shares currently trading at less than $40, Bank of America (BAC) reported better than expected earnings in its last reported quarter. In addition, it provided a positive outlook for the coming quarters, citing strong net interest income growth. But is it worth adding the stock to one’s portfolio now given the prevailing economic uncertainties? Read on to learn our view.

Bank of America (BAC) is a financial organization that caters to a wide range of consumers, including individuals, small- and mid-sized enterprises, institutional investors, the government, and corporations. It offers a wide range of financial and risk management products and services, including banking, investing, asset management, and other financial and risk management services. BAC is headquartered in Charlotte, N.C.

In its most recent earnings report, the bank reported a 10% year-over-year rise in loans and leases, totaling $974 billion, excluding Paycheck Protection Program loans. Global markets saw the most significant increase in loan balances, up more than 40%, followed by wealth and investment management, up 12%.

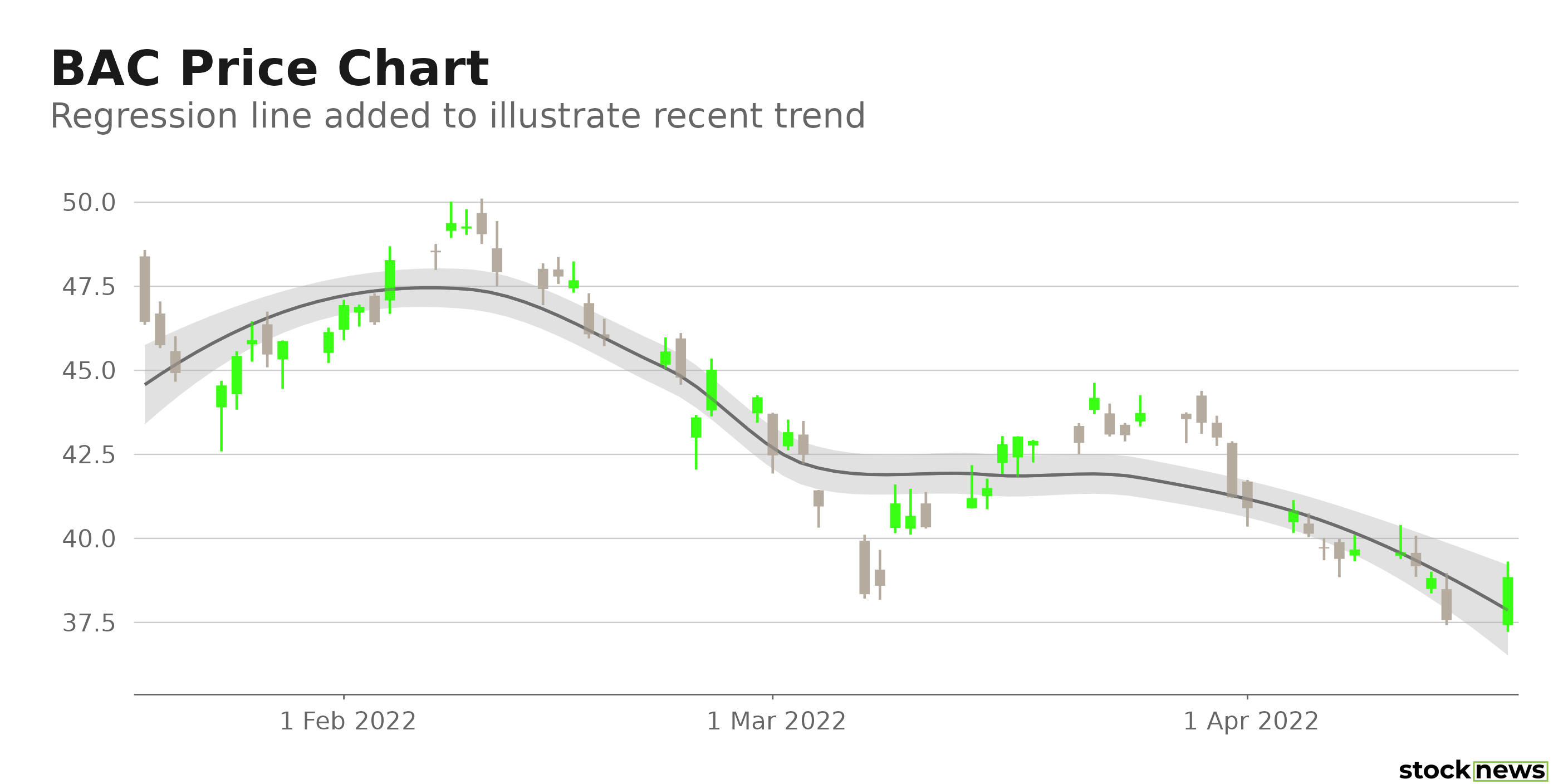

However, the stock is down 12.7% in price year-to-date and 9.4% over the past month to close yesterday’s trading session at $38.85. In addition, the stock is currently trading 22.5% below its 52-week high of $50.11, which it hit on February 02, 2022.

Here is what could shape BAC’s performance in the near term:

Soaring Interest Rates

According to first-quarter reports and industry experts, the future for banks’ home lending portfolios is bleak, with rising interest rates scaring away would-be mortgage consumers. According to Mortgage Bankers Association (MBA) data, the average interest rate on a 30-year fixed-rate mortgage, the most popular home loan, climbed to 5.13% in the week ending April 8, its highest level since November 2018. That rate has risen by more than 1.5 percentage points since the beginning of the year, as the Federal Reserve has moved to tighten financial conditions to curb rising inflation. According to MBA data and bank executives, while rate hikes are beneficial for bank earnings, the spike in borrowing costs is hurting demand for mortgage originations.

Mixed Financials

BAC’s total revenue increased 1.8% year-over-year to $23.2 billion for the first quarter ended March 31, 2021. Its noninterest expense declined 1.3% from the year-ago value to $15.3 billion. However, its net income fell 12.3% from the prior-year quarter to $7.1 billion. In addition, its EPS decreased 7% year-over-year to $0.80.

Poor Profitability

BAC’s trailing-12-months ROA and ROE are 28.5% and 5.5% lower than their respective industry averages. In addition, its cash from operations stood at a negative $7.19 billion compared to the $151 million industry average.

POWR Ratings Reflect Uncertainty

BAC has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. BAC has a C grade for Growth and Quality. The company’s mixed financial and poor profitability is consistent with these grades.

Among the 10 stocks in the D-rated Money Center Banks industry, BAC is ranked #4.

Beyond what I have stated above, one can view BAC ratings for Momentum, Stability, Value, and Sentiment here.

Bottom Line

While BAC is optimistic regarding its prospects and delivered a strong outlook for the coming quarters, rising economic uncertainties related to inflation, a potential recession, and ongoing geopolitical tension could weigh on investor sentiment. Furthermore, the stock is currently trading below its 50-day and 200-day moving average of $43.05 and $43.42, respectively, indicating a bearish sentiment. Therefore, we believe investors should wait for a better entry point in the stock.

BAC shares rose $0.07 (+0.18%) in premarket trading Tuesday. Year-to-date, BAC has declined -12.25%, versus a -7.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing.In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Is Bank of America Stock a Buy Under $40? appeared first on StockNews.com

With its shares currently trading at less than $40, Bank of America (BAC) reported better than expected earnings in its last reported quarter. In addition, it provided a positive outlook for the coming quarters, citing strong net interest income growth. But is it worth adding the stock to one’s portfolio now given the prevailing economic uncertainties? Read on to learn our view.

Bank of America (BAC) is a financial organization that caters to a wide range of consumers, including individuals, small- and mid-sized enterprises, institutional investors, the government, and corporations. It offers a wide range of financial and risk management products and services, including banking, investing, asset management, and other financial and risk management services. BAC is headquartered in Charlotte, N.C.

In its most recent earnings report, the bank reported a 10% year-over-year rise in loans and leases, totaling $974 billion, excluding Paycheck Protection Program loans. Global markets saw the most significant increase in loan balances, up more than 40%, followed by wealth and investment management, up 12%.