Is Crypto Coming to an End? This $100 Million Settlement Will Impact Crypto Forever Back on February 14, 2022, crypto exchange extraordinaire BlockFi was slapped with an unprecedented SEC fine. How large are we talking here? A massive $100 million fine. If you didn't...

This story originally appeared on Due

Back on February 14, 2022, crypto exchange extraordinaire BlockFi was slapped with an unprecedented SEC fine. How large are we talking here? A massive $100 million fine. If you didn't know, this is the largest penalty ever recorded against crypto firms.

If you're a BlockFi customer, like I am, I'm sure you have a lot of questions and concerns about how this settlement will impact you. What if you aren't a BlockFi customer? You may be wondering how this is going to affect the crypto space going forward.

So, to help address these concerns, let me quickly explain what BlockFi did, as well as their response. I also want to go over how this is going to affect BlockFi customers and how you should proceed with BlockFi and crypto in general.

BlockFi Overview

Now, before I can any further, let me give you all a little background here on BlockFi if you aren't familiar with them.

Currently headquartered in Jersey City, NJ, BlockFi was founded in 2017. A major goal of BlockFi was to expand the reach of traditional banking services into communities that had not previously had access. And, it appeared to work as the company quickly gained a global presence.

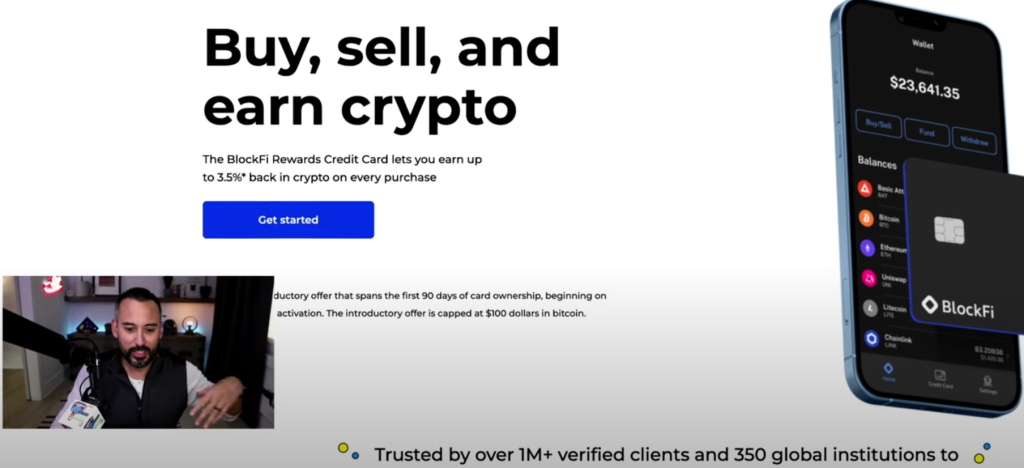

BlockFi's variety of products was what drew users to the platform. In addition to offering an exchange, BlockFi also offers loans at low-interest rates, a cryptocurrency rewards credit card, and an interest-bearing account where you can earn up to 9.25% APY.

Of course, BlockFi isn't the only company that offers high-yield crypto accounts. This is where customers deposit cryptocurrency for the promise of high APY while the company lends out that cryptocurrency for fees. Similar features are available from Celsius, Nexo, and Eco.

BlockFi, however, provides its users with a centralized mobile app, a unique credit card, and an array of other financial services. Moreover, a handy help center provides unique cryptocurrency use cases and teaches BlockFi's users how to utilize the platform.

Another distinction? BlockFi is the first company to reach an agreement with the SEC that mandates it register its products as securities.

What Did BlockFi Do?

Alright, so let's get into it. What exactly did BlockFi do to receive such a hefty penalty from the SEC?

Basically, BlockFi was charged with failing to register its crypto lending product for retail sale. And, as a result, this violated the Investment Company Act of 1940 registration requirements.

In particular, BlockFi marketed its interest accounts as a way to accumulate "up to 9.25 percent" interest on crypto deposited into the accounts. But in reality, the percentage varied from month to month. And, it was also determined by how much you had deposited in your account.

If you're lost, here's a breakdown of the process.

Customers deposited crypto assets into BIAs (BlockFi Interest Accounts) offered by BlockFi — usually Bitcoin and Ethereum. Customers, in turn, receive substantial interest in the form of crypto deposited back into their accounts every month.

Essentially, this system acted as a traditional savings account. But, you know, with crypto assets instead of dollars.

What made BlockFi's returns seem so much higher than an average savings account? Well, it would lend crypto both to institutional traders and other collateralized borrowers. But, thanks to demand and limited access, BlockFi could charge higher rates of interest.

From the SEC's point of view, this is a security. That means it needs either to be registered as a security or exempt from registration.

The SEC's Response

"This is the first case of its kind with respect to crypto lending platforms," SEC Chair Gary Gensler said. "Today's settlement makes clear that crypto markets must comply with time-tested securities laws, such as the Securities Act of 1933 and the Investment Company Act of 1940. It further demonstrates the Commission's willingness to work with crypto platforms to determine how they can come into compliance with those laws. I'd like to thank and commend our remarkable SEC staff and state regulators for their efforts and collaboration on this settlement."

"Crypto lending platforms offering securities like BlockFi's BIAs should take immediate notice of today's resolution and come into compliance with the federal securities laws," said Gurbir S. Grewal, Director of the SEC's Division of Enforcement. "Adherence to our registration and disclosure requirements is critical to providing investors with the information and transparency they need to make well-informed investment decisions in the crypto asset space."

Although the government says its settlement with BlockFi is "the first case of its kind with respect to crypto lending platforms," this isn't its first run-in with a crypto company.

Coinbase pulled the plug on its Lend program in 2021, which is called a "high-yield alternative to traditional savings accounts." Because it was a security, the SEC allegedly threatened legal action. Coinbase said at the time it was seeking "regulatory clarity for the crypto industry." Since then, it released a product that lets non-US customers earn interest on their crypto.

Nevertheless, BlockFi will have to dish out $100 million charges. Payments will be made to the SEC, with $50 million being paid directly, and the remainder going to 32 states. And, BlockFi also agrees to stop selling BlockFI Interest Accounts (BIAs) to new customers.

How is BlockFi Responding?

You'd think that a company that was just imposed the biggest penalty ever would have a grim demeanor. That hasn't exactly happened so far.

"From the day we started BlockFi, we have always known that strong engagement with regulators would be critical for the adoption of financial services powered by cryptocurrencies," said Zac Prince, CEO, and Founder of BlockFi. "Today's milestone is yet another example of our pioneering efforts in securing regulatory clarity for the broader industry and our clients, just as we did for our first product – the crypto-backed loan."

"We intend for BlockFi Yield to be a new, SEC-registered crypto interest-bearing security, which will allow clients to earn interest on their crypto assets."

Now, this is unprecedented. Why? The SEC does not regulate interest products at this time. Because, you know, it's all decentralized lending. This is one of the reasons why they are able to offer such insane interest rates.

We almost expected that BlockFi would release a registered securities product, the BlockFi Yield. It appears, then, that Block Fi has to take the lead and I have to assume that other crypto exchanges will follow.

Now, here's where I have a problem with this. The company said that they "intend" to file. Why's that an issue? Well, for months BlockFi customers have been receiving emails about this new product. So, they knew something was up. And, in my opinion, they should have something else to offer right now.

But, there's a little more to that.

The Real Impact of the BlockFi Settlement

For starters, BlockFi says that customers based outside of the United States will not be affected by the SEC settlement. U.S users, like me, will still earn interest on cryptos they already have in their interest accounts. But, they won't be able to make additional deposits. And, those accounts will also be turned into BlockFi Yield accounts once the SEC approves this

What I found interesting is that when you now go to BlockFi's website, there's no boasting about how much money you can make on your Stablecoin. Now, the site is focusing on a crypto rewards card.

So, when I login into my BlockFi, everything appears to be on the up-and-up. But, I'm really curious. Has BlockFi done something illegal?

"BlockFi has not been very transparent. I think that is part of the reason why [the] SEC went after them," said PitchBook fintech analyst Robert Le. "These are new products, so no one really knows what the real risks of these products look like." Users don't yet know whether or not they can lose their bitcoin and Ethereum if they lend them out or if the product is 100% risk-free.

Additionally, regulators are reportedly investigating Celsius, Gemini, and Voyager Digital's digital lending practices.

"Other providers could either register their products with the SEC, or they can try to fight it out in court," Le said. His prediction is that Celsius, which is mainly about crypto lending, will try to prove these aren't securities so they don't have to be registered with the SEC.

And, considering that the company made false and misleading statements regarding the level of risk in the loan portfolio and lending, investors have every right to be concerned with the risk-level is working with BlockFi.

Is Crypto Coming to an End?

I hate to break the news to all the crypto haters out there. But, as long as there is demand, this is not the end of crypto. And, if you want to know, the demand is high.

At the same time, there will be ripple effects.

Well, it puts pressure on its peers to follow suit by playing nice with the SEC (due to its responsibilities). BlockFi would have a huge edge over its competitors if it got the SEC to approve its high-yield crypto loan plan. As far as BlockFi is concerned, this settlement is just a minor setback. The situation is kind of like DraftKings and FanDuel's settlement with the New York Attorney General last year, which helped them become industry leaders.

But, there could be more serious consequences too.

In an interview with TechCrunch, Max Dilendorf said that the SEC's action against BlockFi essentially "wiped out" the crypto lending business model.

What if a crypto company wanted to keep selling interest-bearing products? It must complete an S-1 registration statement. And, that would be just like a publicly-traded company would. In order to buy into interest-bearing products, investors must be accredited. That is, unlessm they qualify for specific exemptions (and win), he said.

Smaller players in the space could get crushed by the new rules, regulations, and associated costs.

"BlockFi can probably afford to go forward with [offering registered securities] even though the outcome is not certain, because it's a $3 billion company," Dilendorf said. "What about a smaller DeFi protocol? They are going to get wiped out if they become targets of similar enforcement action."

The worst-case scenario.

There remains a possibility that the SEC won't approve the products BlockFi, Celsius, Nexo, and Eco want to offer. It's what SEC Commissioner Hester Peirce wants to happen.

According to a statement on the SEC website, she wasn't on board with the settlement and thinks BlockFi's S-1 process will take "longer than it would for more traditional filings." In addition, BlockFi will have to "leap through another regulatory hoop," the Investment Company Act. Additionally, she considers 60 days-or 90 days if BlockFi receives an extension-to be "extremely ambitious."

The bottom line?

I don't think you need to panic and withdrawal everything from your BlockFi account if you have one. But, I wouldn't add any more to it. And, I would probably explore alternatives like Celsius or diversify my crypto accounts. This way it will be easy to transfer just in case.

The post Is Crypto Coming to an End? This $100 Million Settlement Will Impact Crypto Forever appeared first on Due.