Is Snapchat Stock is Setting Up Its Next Leg Up?

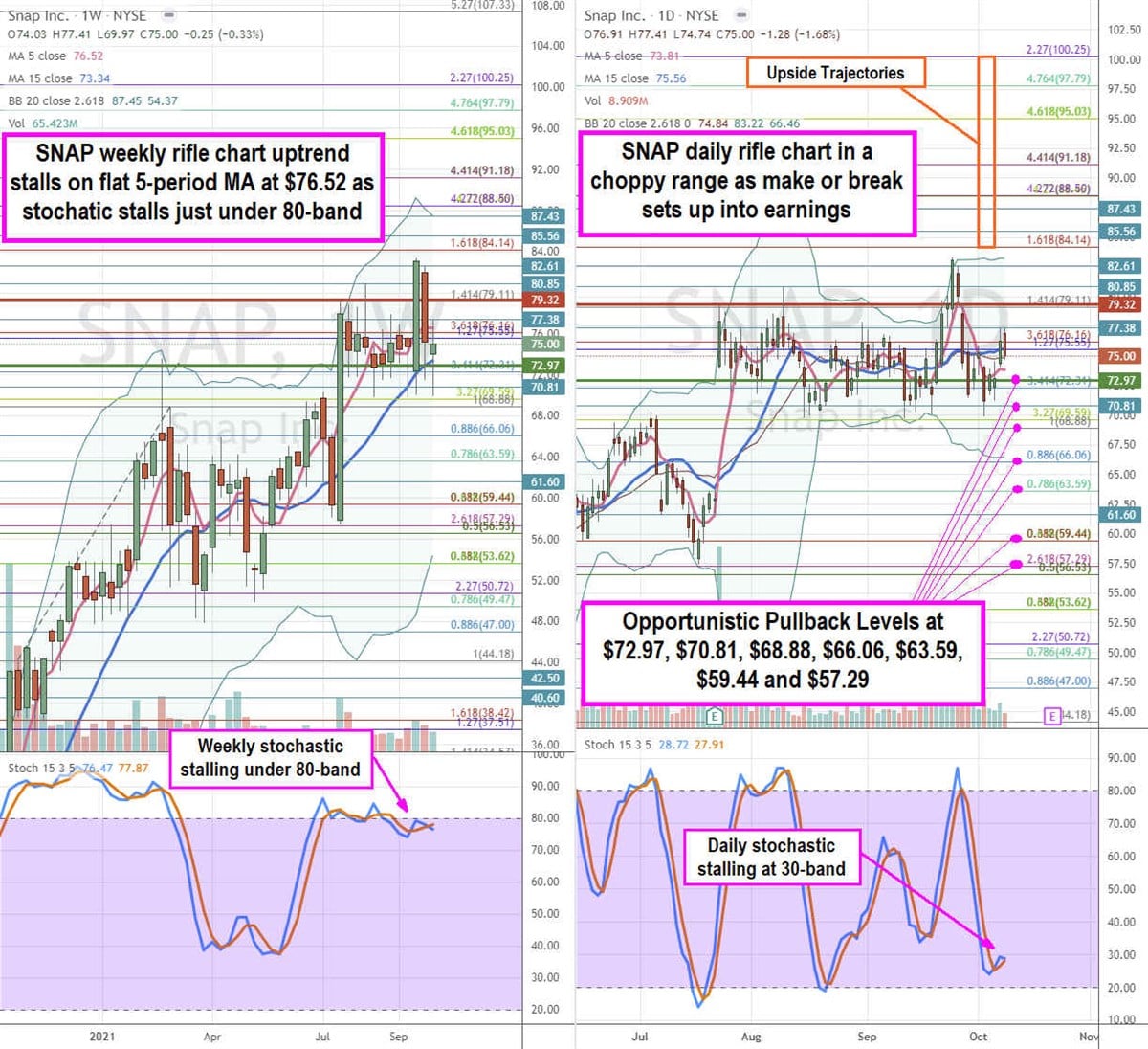

Using the rifle charts on the weekly and daily time frames provides a precision playing field view of the landscape for SNAP stock.

This story originally appeared on MarketBeat

Social media platform Snap Inc. (NYSE: SNAP) stock has surprised investors to the upside as it continues to expand its products and user growth. Daily active users (DAU) rose 23% in Q2 2021 to 293 million. The platform has gotten much deeper during the pandemic as the Company launched it Spotlight product. Spotlight DAU grew 49% with average daily content submissions more than tripling and daily time spent by U.S. users rose 60% sequentially. The Company is operating on all cylinders constantly expanding its partnerships and products. The level of sophisticated synergies is impressive and its DAU continues to grow, unlike its peer Pinterest (NASDAQ: PINS) which is showing a decline as users leave home with the acceleration of COVID vaccinations. Fears of a DAU reversion for Snapchat usage upon the return to work and the reopening trend has so far been put to rest, but still lingers in investors’ minds. Prudent investors seeking exposure in this growing social media platform can watch for opportunistic pullbacks in shares.

Q2 FY 2021 Earnings Release

On July 22, 2021, Snap released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.10 excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.01), beating estimates by $0.11. Revenues surged by 116.2% year-over-year (YOY) to $982.11 million beating analyst estimates for $846.57 million. Adjusted EBITDA grew 223% to $117 million. Snapchat CEO Even Spiegel commented, “Our second-quarter results reflect the broad-based strength of our business, as we grew both revenue and daily active users at the highest rates. We have achieved this in the past four years. We are pleased by the progress our team is making with the development of our augmented reality platform, and we are energized by the many opportunities to grow our community and business around the world.”

Q3 2021 Guidance Raised

Snap raised its Q3 2021 forecast for revenues between $1.07 billion to $1.085 billion versus $1.01 billion consensus analyst estimates. The Company expects Adjusted EBITDA between $100 million to $120 million versus $56 million in Q3 2020.

Conference Call Takeaways

CEO Evan Spiegel set the tone, “At our annual Partner Summit in May, we introduced new product innovations for our community and partners, including the next generation of Spectacles augmented reality glasses that overlay computing on the world, and we are excited by the tremendous opportunity for our business in 2021 and beyond. We made significant progress with our augmented reality platform this quarter. More than 200 million Snapchatters engage with AR every day on average, and over 200,000 creators use Lens Studio to build AR Lenses for our community.

We are focused on learning from our large and engaged community of Snapchatters and creators, which allows us to continually improve our AR Lenses and the tools we provide to create them in Lens Studio. This quarter, our Cartoon 3D Style Lens, which uses machine learning to turn people into a 3D-animated cartoon in real-time, highlighted the power of Lenses to go viral both inside and outside of Snapchat. In the first week of release, it generated 2.8 billion impressions on Snapchat alone. We rolled out Lens Studio 4.0 at our Partner Summit, with new features like visual classification, multi-person 3D body mesh, advanced cloth simulation, TrueSize technology for eyewear try-on, and a new visual effects editor, which enables creators to build sophisticated Lenses without writing any code.”

Partnerships

CEO Spiegel commented on the benefits for its partners, “We also announced a number of new products and partnerships at our Partner Summit for Maps, Minis, and Games. We are adding Layers to the Snap Map, so that Snapchatters can find personalized local experiences from our partners overlaid directly on the Map. For example, users will be able to see restaurant recommendations from The Infatuation or their own saved Snaps from Memories on the Map. We are also expanding our Minis platform, including a new Mini featuring daily shopping events hosted by Poshmark.” He continued, “Ticketmaster is partnering with us across a few of these products, with a Mini where you and your friends can discover different artists and shows and buy tickets, which also integrates directly with the Ticketmaster Layer on our Map that overlays different concerts and events directly on the Snap Map. We are adding new titles and genres to Snap Games, with Voodoo launching five new games to Snapchat this year. We have learned that players who use their Bitmoji in a game spend twice as much time playing, which is one reason Unity is bringing 3D Bitmoji into their mobile, PC, and console games with our new Unity plugin. We have observed a number of changes in content engagement as we evolve our content products and manage through the mixed impacts of the pandemic.”

SNAP Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision playing field view of the landscape for SNAP stock. The weekly rifle chart is stalling out on the uptrend with a flat 5-period moving average (MA) near the $76.16Fibonacci (fib) level. The weekly 15-period MA sits at the $73.34 level as the weekly stochastic stalls just under the 80-band. The daily rifle chart has been chopping in a flat range as Bollinger Bands (BBs) attempt to expand heading into earnings. The daily rifle chart has a make or break as the downtrend stalls as the stochastic attempts to coil. The daily 5-period MA sits at $73.81 and daily stochastic stalls near the 80-band. The trading range is stuck between the daily market structure high (MSH) sell trigger at $79.32 and the daily market structure low (MSL) buy trigger at $72.97. Prudent investors can watch for opportunistic pullbacks at the $72.97 daily MSL trigger, $70.81 dib, $68.88 fib, $66.06 fib, $63.59 fib, $59.44 fib, and the $57.29 fib. The upside trajectories range from $84.14 fib upwards to the $100.25 fib level.

Social media platform Snap Inc. (NYSE: SNAP) stock has surprised investors to the upside as it continues to expand its products and user growth. Daily active users (DAU) rose 23% in Q2 2021 to 293 million. The platform has gotten much deeper during the pandemic as the Company launched it Spotlight product. Spotlight DAU grew 49% with average daily content submissions more than tripling and daily time spent by U.S. users rose 60% sequentially. The Company is operating on all cylinders constantly expanding its partnerships and products. The level of sophisticated synergies is impressive and its DAU continues to grow, unlike its peer Pinterest (NASDAQ: PINS) which is showing a decline as users leave home with the acceleration of COVID vaccinations. Fears of a DAU reversion for Snapchat usage upon the return to work and the reopening trend has so far been put to rest, but still lingers in investors’ minds. Prudent investors seeking exposure in this growing social media platform can watch for opportunistic pullbacks in shares.

Q2 FY 2021 Earnings Release

On July 22, 2021, Snap released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.10 excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.01), beating estimates by $0.11. Revenues surged by 116.2% year-over-year (YOY) to $982.11 million beating analyst estimates for $846.57 million. Adjusted EBITDA grew 223% to $117 million. Snapchat CEO Even Spiegel commented, “Our second-quarter results reflect the broad-based strength of our business, as we grew both revenue and daily active users at the highest rates. We have achieved this in the past four years. We are pleased by the progress our team is making with the development of our augmented reality platform, and we are energized by the many opportunities to grow our community and business around the world.”