Landstar Systems Stock Can Bottom Down Here Transportation management solutions provider Landstar Systems (NASDAQL LSTR) stock has been resilient throughout the selling in the benchmark indices.

By Jea Yu

This story originally appeared on MarketBeat

Transportation management solutions provider Landstar Systems (NASDAQ LSTR) stock has been resilient throughout the selling in the benchmark indices. While fuel prices have risen, the transportation logistics and insurance provider has largely benefitted from the global supply chain disruption and rising freight costs. E-commerce is still a tailwind as small package van volume rose 15% from the year ago same period despite disruption with two of its largest independent sales agents in Ukraine. The Company is firing on all cylinders as evidenced by its fiscal Q1 2022 being the best quarterly performance in its history hitting all-time highs in revenues and earnings in addition to an optimistic outlook. The stock buyback programs have whittled down the outstanding shares to a tiny 37.3 million. Shares are trading at 15.5X forward earnings with a 6% short interest. Prudent investors seeking an efficient supply chain and logistics operator can watch for opportunistic pullbacks in shares of Landstar.

Q1 Fiscal 2022 Earnings Release

On April 20, 2022, Landstar released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit $3.34, beating consensus analyst estimates for $3.19, a $0.15 beat. Revenues rose 53.1% year-over-year (YoY) to $1.97 billion versus $1.9 billion consensus analyst estimates. Landstar CEO Jim Gattoni commented, "I am very pleased overall with Landstar's 2022 first quarter performance, as the Company continued to perform at record levels. The 2022 first quarter once again set a new standard for the best quarterly financial performance in Landstar history. Revenue, gross profit, variable contribution, net income, and diluted earnings per share were each all-time quarterly records. The increase in truck revenue per load and the number of loads hauled via truck over the 2021 first quarter represent very strong, balanced growth. Remarkably, for the first time in Landstar history, February truck revenue per load was higher than in the preceding December."

Upside Guidance

The Company provided upside guidance for fiscal Q1 2022 for EPS between $3.22 to $3.32 versus $2.77 consensus analyst estimates. The Company expects revenues between $2.0 billion to $2.5 billion versus $1.82 billion consensus analyst estimates.

Conference Call Takeaways

CEO Gattoni pointed out that the Company had posted its best-ever quarterly performance ever, despite being a seasonally slow period. Revenues, gross profits, variable contribution, operating income, and EPS hit all-time records. Landstar capitalized on rising ocean freight rates in addition to spiking truckload rates and volume, which are typically at the lowest in the first quarter. Truck rates rose 27% during the first eight weeks of the year. Overall truckload volumes rose 17%, 30%, and 14% during January, February, and March, respectively. The strong consumer demand for small packages via e-commerce drove Q1 2022 volumes higher by 15% YoY. While the level of debt hasn't changed, the balance sheet remains strong with 2.25X the long-term debt outstanding. The Company has $251 million in cash and short-term securities and should have no problems sustaining the $112 million dividend payment. The Company spent $72.47 million to buyback 813,909 shares of stock in the year at an average price of $89.03 per share ending the year with 37.295 million shares. He concluded, "We continue to attract qualified agent candidates to the model. Revenue from new agents was $25 million in the 2022 first quarter, the second highest revenue from new agents over the past 17 quarters. The agent pipeline remains full. We ended the quarter with record 11,935 trucks provided by business capacity owners, 71 trucks above our year-end 2021 count. Overall, the net increase in the number of BCO trucks in the 2022 first quarter speaks to Landstar's ability to attract quality capacity in a tight truck capacity market."

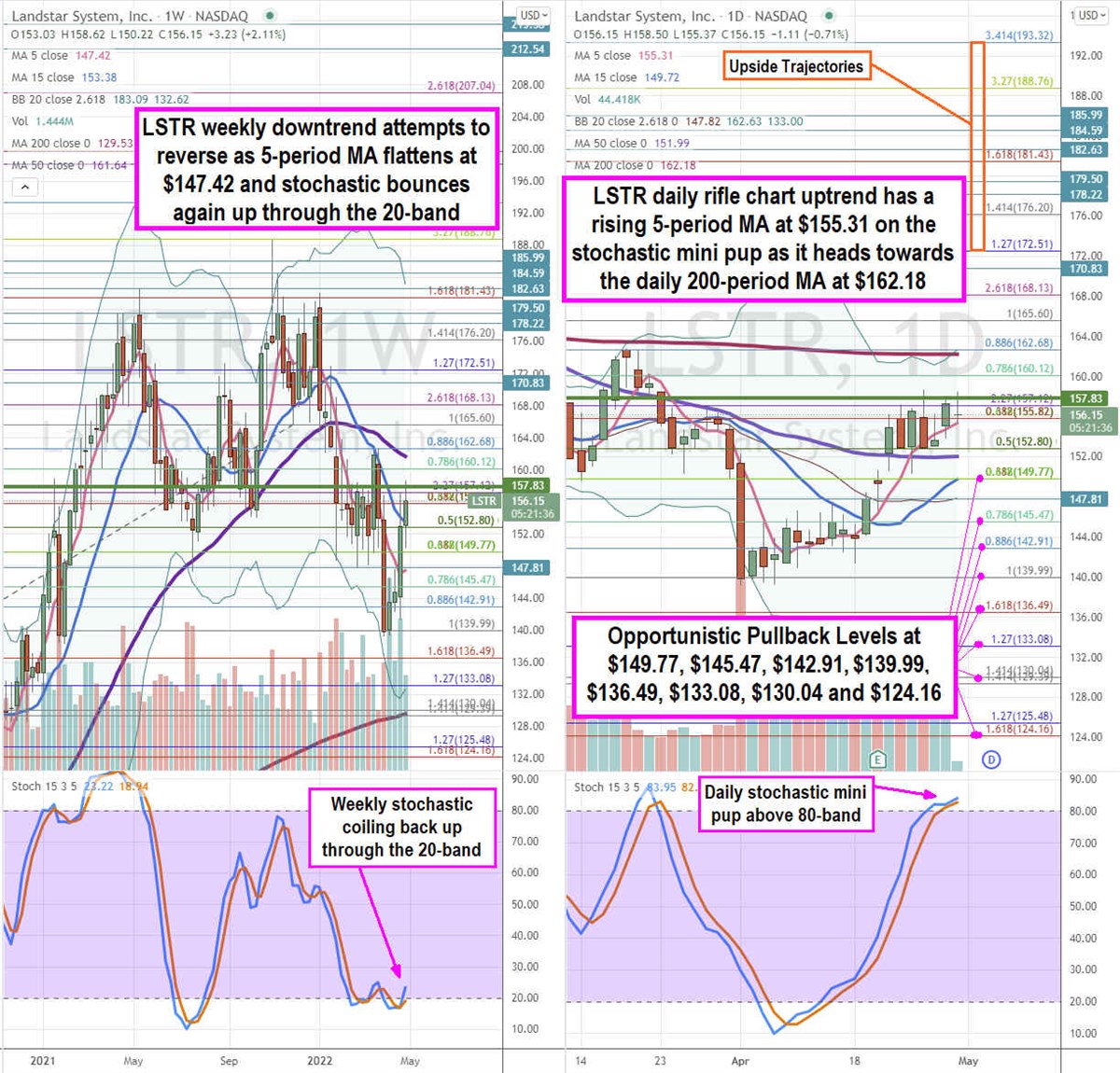

LSTR Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field for LSTR stock. The weekly rifle chart peak sharply near the $162.68 Fibonacci (fib) level. Shares proceeded to fall sharply as it formed a weekly inverse pup breakdown to the $134.99 level before staging a rally. The weekly 5-period moving average (MA) is flat at $147.42 while the 15-period MA stalls at $153.38. The weekly 50-period MA sits at $161.64. The weekly stochastic has coiled again back up through the 20-band. The weekly market structure low (MSL) buy triggers on the breakout through $157.83. The daily rifle chart has an uptrend with a rising 5-period MA at $155.31 and 15-period MA following at $149.72. The daily upper Bollinger Bands (BBs) nearly overlap the daily 200-period MA. The daily 50-period MA is flat at $151.99 and daily lower BBs sit at $133. The daily stochastic formed a high band mini pup above the 80-band. Prudent investors can watch for opportunistic pullback levels at the $149.77 fib, $145.47 fib, $142.91 fib, $139.99 fib, $136.49 fib, $133.08 fib, $130.04 fib, and the $124.16 fib level.