Old Dominion Rolls To Record Quarter, Beating Wall Street Views Trucking company Old Dominion Freight Line (NASDAQ: ODFL) gapped down Wednesday following its second-quarter earnings report. However, mid-session, th...

By Kate Stalter

This story originally appeared on MarketBeat

Trucking company Old Dominion Freight Line (NASDAQ: ODFL) gapped down Wednesday following its second-quarter earnings report. However, in mid-session, the stock reversed much of the early loss and was near the high of its daily trading range.

The company reported earnings of $2.21 per share, up 85% from the year-ago quarter. Revenue was $1.319 billion, a gain of 47%.

That earnings number topped analyst estimates by $0.10. Revenue beat by $40 million.

Old Dominion beat Wall Street estimates in each of the past four quarters. The last time it missed was the quarter that ended in March 2020, which reflected the early weeks of pandemic closures. Even then, the company only missed by a penny.

The company's board also OK'd a new share repurchase program. Old Dominion is now authorized to buy back as much as $2 billion of outstanding shares. This repurchase program is set to begin upon the completion of Old Dominion's current $700 million repurchase program, which had $206.3 million remaining available and uncommitted as of June 30.

The new share repurchase program has no expiration date.

Old Dominion's revenue growth accelerated in each of the past three quarters, from 1% to the current 47%. Earnings growth also accelerated during that time, from 25% to 85%.

According to the earnings release, "While the Company intends to return excess capital to its shareholders through its share repurchase and dividend programs, the priority for capital spending will continue to be strategic investments in capital expenditures to support the long-term profitable growth of its business."

Of course, the trucking industry is a beneficiary of the economic boost from online buying during the pandemic. It's also not immune to current economic conditions, such as rising fuel prices and labor shortages.

In the earnings release, CEO Greg Gantt said the company achieved its record results in the quarter "by continuing to execute on the fundamental aspects of our long-term strategic plan, which is centered on our ability to provide superior service at a fair price."

He also addressed higher costs, saying, "Our consistent, long-term pricing strategy generally focuses on offsetting our cost inflation while also supporting further investments in capacity and technology."

Old Dominion specializes in what's called "less than truckload," or LTL shipping. As the name suggests, LTL services are geared toward smaller loads. Many businesses require that type of shipping, which is where a company like Old Dominion comes in.

The company's service offerings include expedited transportation and are offered through a network of service centers in the continental U.S. Old Dominion also maintains alliances with other carriers and offers additional services, such as logistics consulting.

Old Dominion joined the S&P 500 index in December 2019. It comprises only 0.79% of the index, meaning it won't have any impact on the S&P's movements, but it may follow the moves wither up or down.

Old Dominion returned 33.04% year-to-date and 40.30% over the past 12 months.

Even with those strong gains, smaller trucking companies, such as TFI International (NYSE: TFI), Patriot Transportation (NASDAQ: PATI), P.A.M. Transportation Services (NASDAQ: PTSI) and USA Truck (NASDAQ: USAK) have notched better price performance over the past year.

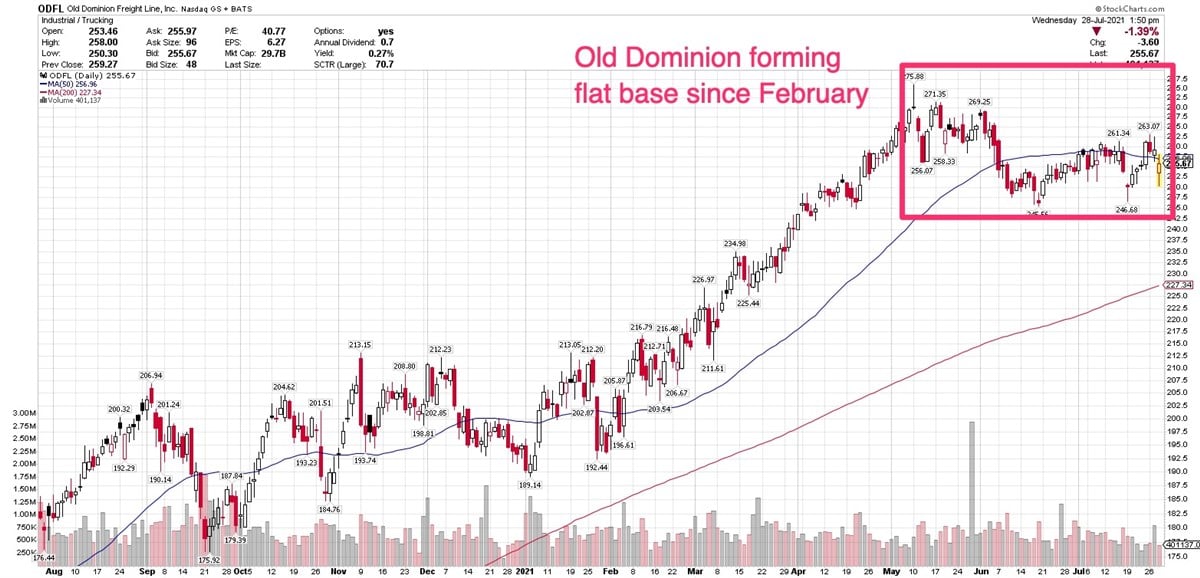

Old Dominion's gains have been muted recently, with a three-month return of just 0.43%. The stock has been consolidating below its June 10 high of $276.09.

Between early February and early June, Old Dominion shares trended higher along their 10-week moving average. Even with the pullback below that price line, the stock continues trading well above its 200-day line, an indication that institutional owners are essentially holding at this time, rather than rolling a convoy for the exits.

Its current consolidation can be characterized as a flat base, as the peak-to-trough correction is just 11%. That could change if the stock pulls into a steeper correction, but at this juncture, the next buy point would be above the prior high of $276.09. As it clears that point, you'd ideally like to see heavy trading volume to confirm the rally.