onsemi Is A Deep-Value In The Chip Sector The correction in tech stocks may not be over, the headwinds within the economy may still be present, but onsemi's (NASDAQ: ON) Q1 results prove that business is still strong...

This story originally appeared on MarketBeat

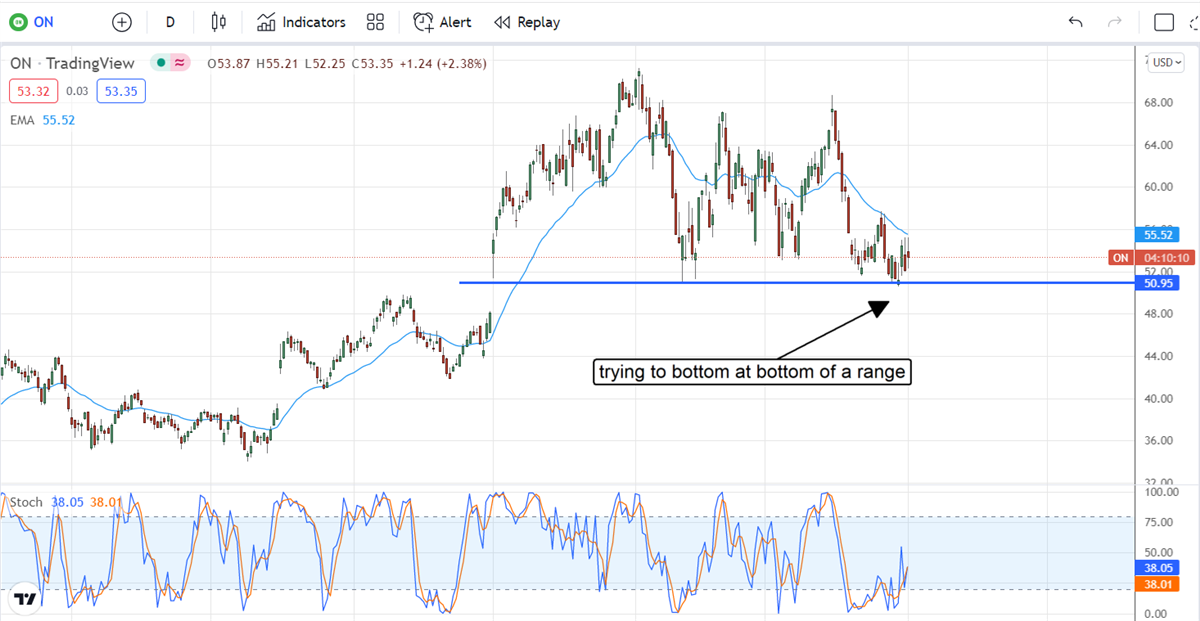

onsemi Tries To Bottom After Strong Q1 Results

The correction in tech stocks may not be over, the headwinds within the economy may still be present, but onsemi's (NASDAQ: ON) Q1 results prove that business is still strong in the chip sector. Specifically, onsemi's results prove the company's refocusing efforts are paying off and that is seen in the segment data. The company calls out the auto and industrial markets as drivers of the growth but all three operating segments are up double-digits and underpinning the company's success.

"Our focused strategy has delivered sustainable results in onsemi's margin and growth profile with the automotive and industrial end-markets now representing 65% of our revenue. Our record quarterly results with year-over-year growth of 31% in our first-quarter revenue, and gross margin expansion of 1,420 bps to a record of 49.4% highlight the strength of our business and the value of our products as we continue our transformation. With a highly differentiated portfolio of intelligent power and sensing products, strong visibility driven by long-term supply agreements, and exposure to secular megatrends of vehicle electrification, ADAS, energy infrastructure, and factory automation, we are well-positioned to sustain our momentum," said Hassane El-Khoury, president and CEO of onsemi.

onsemi Beats On Top And Bottom Line

onsemi had a great quarter with revenue up more than 30% in all three operating segments. The auto and industrial markets accounted for 65% of the net and drove the top line to $1.95 billion. This is up 31.8% over last year and beat the consensus by $0.04 billion albeit this is a slim 2% margin. Moving down to the margin, the news is even better with both the gross and operating margin expanding by more than 1000 basis points. The GAAP and adjusted gross margin are both up 1420 basis points while the GAAP operating margin is up 2480 basis points. The adjusted operating margin is up 2060 basis points and all margin comparisons are up in the sequential comparison as well. On the bottom line, the GAAP $1.18 is up from last year's $0.20 while the adjusted $1.22 beat the Marketbeat.com consensus by $0.17 and is up from last year's $0.35.

Turning to the guidance, the company is expecting sequential improvement at all levels for the coming quarter as well. The best news is the guidance is not only better than the consensus estimates but could easily be beaten as well. The company is expecting $1.965 to $2.065 billion in revenue versus the $1.92 consensus and for EPS of $1.20 at the low end of the range compared to only $1.05 expected by the analysts. The analysts, they rate the stock a solid Buy with a price target more than 25% above the recent price action. There haven't been any commentaries since the earnings were released but the most recent included price target reductions. Even those, however, have the stock trading near the consensus so we see considerable upside potential for this stock.

The Technical Outlook: onsemi Is Trying To Bottom

Price action in onsemi jumped in the wake of the earnings report but has hit resistance in the time since. Resistance is at the short-term moving average and may keep price action from advancing but we see a bottom beginning to form. Assuming the stock is able to maintain support above $51, we would expect to see sideways trading at this level until the market balance shifts back in favor of the bulls, or new news comes out. Until then, onsemi is a value in the semiconductor space and trades at only 12.5X its earnings.