SelectQuote Stock Bestows a Bargain Opportunity Direct-to-consumer (DTC) insurance platform SelectQuote (NYSE: SLQT) stock has collapsed from a high of $33.13 to a low of $7.72 In six months to prov...

By Jea Yu

Our biggest sale — Get unlimited access to Entrepreneur.com at an unbeatable price. Use code SAVE50 at checkout.*

Claim Offer*Offer only available to new subscribers

This story originally appeared on MarketBeat

Direct-to-consumer (DTC) insurance platform SelectQuote (NYSE: SLQT) stock has collapsed from a high of $33.13 to a low of $7.72 In six months to provide a potential bargain opportunity. The insurance platform sells a number of insurance policies from various insurers acting as a middleman, not an insurer. There are three segments Seniors, Life and Auto & Home. It also sells senior Medicare advantage and supplemental policies. The pandemic has caused consumers to consider getting health coverage especially with expanded open season extensions. SelectQuote enables consumers to compare policy coverage and pricing across a number of carriers to as the platform helps them shop for the best value. The Company also deems itself the nation's number one term insurance company and has over two million users. The Company is not a new fintech or fly-by-night rather it has been in business for over 35 years. Recent analyst downgrades have plunged shares on weak guidance, but the reopening trends should provide a tailwind. Prudent investors can watch for opportunistic pullback levels for exposure in the DTC insurance market.

Q4 Fiscal 2021 Earnings Release

On Aug. 25, 2021, SelectQuote released its fiscal fourth-quarter 2021 results for the quarter ending June 2021. The Company reported GAAP earnings-per-share (EPS) loss of (-$0.02) missing consensus analyst estimates for a loss of (-$0.01) by $0.01. Revenues rose 33.2% year-over-year (YoY) to $188.45 million, beating consensus analyst estimates for $186.58 million. Adjusted EBITDA few (-47%) YoY to $21.3 million. The Senior segment grew $42% YoY to 124.4 million. The Life segment revenues grew 41% YoY to $59.9 million. The Auto and Home segment fell (-41%) YoY to $7.2 million. The fiscal full-year 2021 growth rate is 76% YoY to $937.8 million.

CEO and CFO Comments

SelectQuote CEO Tim Danker stated, "2021 was a landmark year for SelectQuote both in terms of our growth but also in the significant opportunity established through the initiation of our Population Health (PHIC) strategy. For the full year we grew Adjusted EBITDA by $74.0 million or nearly 50% following growth of 46% in 2020. We continue to have high conviction in our differentiated model and our ability to scale quality growth in 2022 and beyond. We believe that SelectQuote's strong connection with our end customers creates differentiated value and we expect Population Health to strengthen that bond in the years to come." SelectQuote CFO Raffaele Sadun commented, "Our Senior full-year revenues grew 101% year-over-year, which follows full-year growth of 88% in fiscal 2020. New MA approved policies also grew in excess of 100% at attractive unit economics with a Revenue to CAC of 3.0x. Our MA LTV was down 2% for the year, which includes a full-year true-up in our 4th Quarter results for additional provision due to higher than expected intra-year lapse rates. Despite some persistency pressure compared to original expectations, we expect cohort-level IRRs to remain very attractive."

Conference Call Takeaways

CEO Danker talked about risks moving forward, "The larger tail adjustment taken in 2021 was primarily driven by lower than expected persistency tied to the introduction of OEP. As you can see, our original IRR expectation for the 2019 cohort was 45%. And as a result of our adjustments to date, the expected IRR is now trending to 39%. Additionally, we would note that the current realized IRR in the cohort is already 13%. Now if we turn to 2020. We are seeing the same types of pressure impact this cohort but to date we have had enough constraint to offset this pressure. That said, we have utilized a significant portion of our constraint due to lower than model persistency." He underscored, "As a result, our fiscal 2022 guidance contemplates the risk of potential cohort tail adjustments which would impact the cohort as depicted by the grey line on this chart. Regarding the 2020 cohort, lower persistency was driven primarily by the introduction of OEP. Again, for context, our adjusted trend for 2020 assuming tail adjustment next year would still generate an IRR of 24% compared to our original 28% expectation."

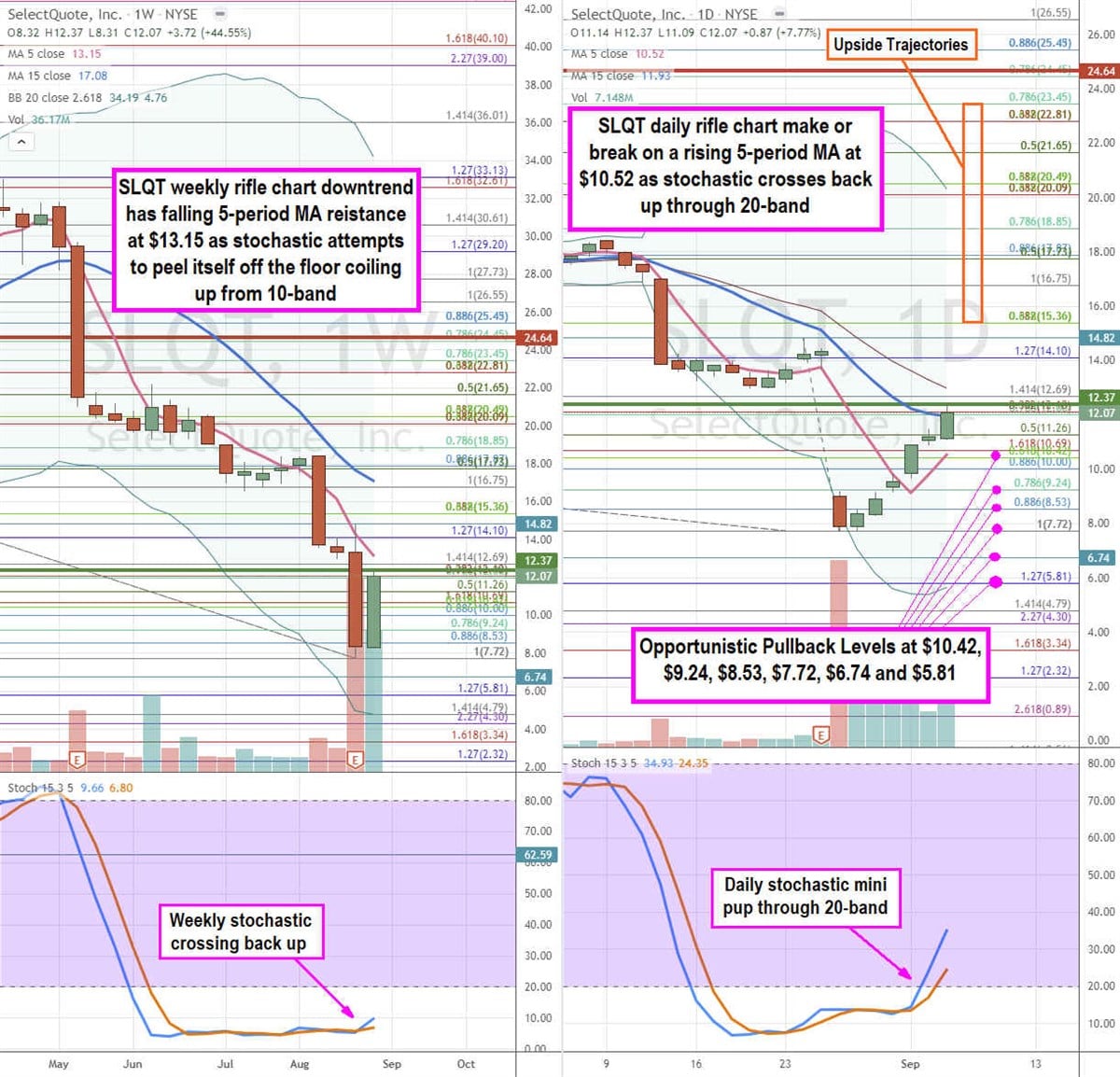

SLQT Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a near-term precision view of the price action playing field for SLQT shares. The weekly rifle chart peaked at the $33.13 Fibonacci (fib) level before triggering the weekly market structure sell on the breakdown below $24.64 plunging all the way down to the $7.72 fib. The weekly 5-period moving average (MA) resistance is falling at $13.15 and 15-period MA falling at $17.08. The weekly stochastic has just started to finally cross back up as shares staged a rally to form a weekly market structure low (MSL) buy trigger about $12.37. The daily rifle chart completed the channel tightening with the rising 5-period MA at $10.52 and 15-period MA at $11.93. The daily stochastic has formed a mini pup through the 20-band. Prudent investors can watch for opportunistic pullbacks at the $10.42 fib, $9.24 fib, $8.53 fib, $7.72 fib, $6.74 fib, and the $5.81 fib. The upside trajectories range from the $15.38 fib towards the $23.45 fib level.