Skechers Stock is a Turnaround Story Consumer footwear and athleisure brand Skechers U.S.A. (NYSE: SKX) stock has based off its recent highs and is setting up another leg highs on the hee...

By Jea Yu

This story originally appeared on MarketBeat

Consumer footwear and athleisure brand Skechers U.S.A. (NYSE: SKX) stock has based off its recent highs and is setting up another leg highs on the heels of a strong turnaround in the context of the reopening trend. While the Company was a winner during the pandemic as consumers immersed themselves in athleisure and comfort wear working, engaging, and entertaining from home during the lockdowns, Skechers was able to expand market share and emerge a stronger Company. It's ready to expand as a post-pandemic play as the return to a new normal takes shape with the acceleration of COVID vaccinations in the U.S. and internationally. China is a great recovery template as its seen both revenue growth and market share expansion as consumers head back outdoors. The Company knocked it out of the ballpark in its Q1 2021 earnings release and raised estimates for Q2 2021 and full-year 2021. Shares initially peaked at $53.14 and proceeded to sell-off. Prices have been basing and setting up for the next leg up on a multiple expansion. Prudent investors can watch for opportunistic pullback levels to gain exposure on this post-pandemic recovery theme play on the reopening.

Q1 2021 Earnings Release

On April 22, 2021, Skechers released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.68 excluding non-recurring items versus consensus analyst estimates for a profit of $0.46, beating estimates by $0.22. Revenues grew 15% year-over-year (YOY) to $1.43 billion, beating analyst estimates for $1.33 billion. International wholesales sales rose 23.8% YoY and direct-to-consumer (DTC) sales rose 18.1% YoY. The cash and cash equivalents at the end of the Q was $1.51 billion. Skechers CEO Robert Greenburg stated, "Skechers new sales record for fiscal first quarter is a remarkable achievement, especially given the lockdown measures in many key countries, including across Europe. This significant growth is a result of consumer demand for Skechers products as consumer desire comfort and quality in their footwear and walking remains a top COVID-19 pandemic activity. With warmer weather and increased vaccination rates around the world, traffic is improving in many of our retail stores, and our digital business continues to be a very strong growth driver."

Raised Estimates

Skechers issued upside guidance for Q2 with EPS coming in between $0.40 to $0.50 versus $0.30 consensus analyst estimates. Revenues for Q2 are expected to come in between $1.45 billion to $1.55 billion versus $1.22 billion analyst estimates. The Company also raised its full-year 2021 EPS to come in between $1.80 to $2.00 versus $1.92 analyst estimates and full-year revenues between $5.8 billion to $5.9 billion versus $5.54 billon consensus analyst estimates.

Conference Call Takeaways

Skechers U.S.A. COO, David Weinberg, set the tone, "While many countries' restrictions are easing, our thoughts are with those regions facing another coronavirus wave. As is the case with most businesses, the pandemic continues to impact Skechers, but the high demand for our comfort technology product resulted in a strong beginning to 2021 and it feels reminiscent of 2019." The double-digit growth in international sales made up 57.8% of total sales in Q1. He noted, "Consumers are returning to a new normalcy, one that involves more walking, more comfort on the job, and a casual lifestyle mindset. We are the natural choice for any demographic worldwide with comfort technology at our core." The record 23.8% international wholesale growth in sales are the "testament" that supports this statement. The big recovery continues to be in China with quarterly sales up 174% YoY as COVID restrictions have been eased. However, sales in the domestic wholesale business fell (-1%) in Q1 but improved 8.1% over Q1 2019. The decrease is associated with supply chain issues that negatively impacted product shipments and presented logistical challenges. The average selling prices per pair of shoes increased 2.7%, which reflects the "strength and appeal of new comfort products and technologies." Domestic DTC grew 28.4% in the quarter thanks to 143% growth in domestic e-commerce and 13.6% growth in brick and mortar stores. DTC average selling price rose 10.9% per unit. International company-owned stores lost 37% of available selling days in the quarter due to COVID-19 restrictions internationally. This leaves more room for recovery as restrictions get lifted in the global reopening.

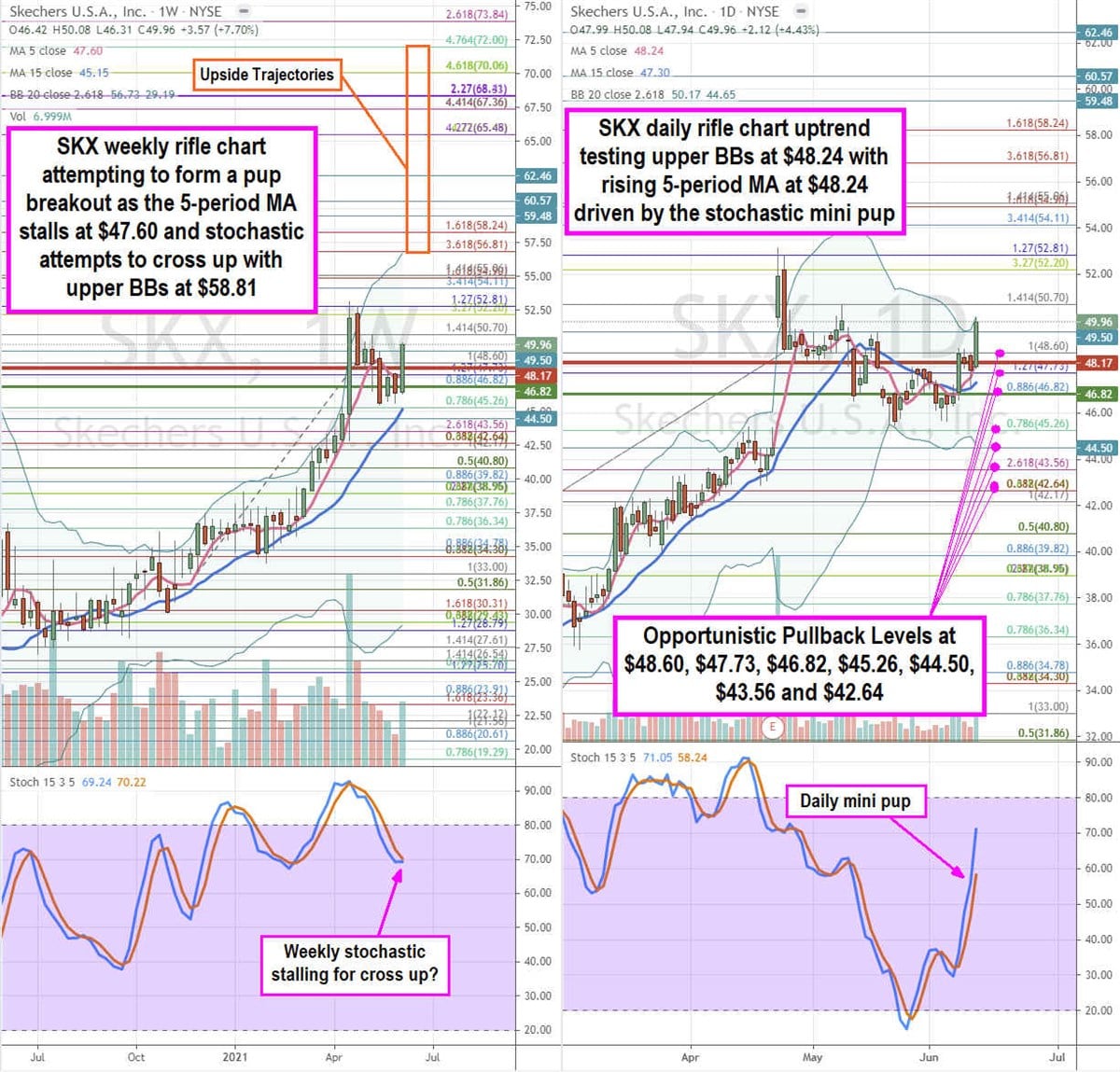

SKX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for SKX stock. The weekly rifle chart has been basing around the $46.82 Fibonacci (fib) level as it becomes a very significant price level. The weekly 5-period moving average (MA) support sits at the $46.82 fib and it is also the weekly market structure low (MSL) buy trigger that is forming a pup breakout. The confirmation will form when the weekly stochastic crosses up. The weekly upper Bollinger Bands (BBs) are near the $56.81 fib. The daily rifle chart formed a breakout with a rising 5-period MA support at $48.24 as it nears the daily upper BBs at $50.10. The daily 15-period MA support is rising at $47.36. The daily BBs are starting to expand after a few weeks of contraction. Prudent investors can watch for opportunistic pullback levels at the $48.60 fib, $47.73 fib, $46.82 fib and weekly MSL trigger, $45.26 fib, $44.50 stinky 5s, $43.54 fib, and the $42.64 fib. Upside trajectories range from the $56.81 fib up to the $72 fib level.

Featured Article: What are Bollinger Bands?