Taxes on Small Businesses Across the Globe, Mapped: See Where Rates Are High, Low — and Nonexistent

A study from OnDeck charts the massive corporate-tax discrepancies among nations; find out how yours compares.

As our world becomes more interconnected and doing business across borders increasingly common, corporate tax rates have emerged as a hot topic — the make-or-break factor when it comes to foreign investment. Some of the biggest companies on Earth, including tech behemoths like Apple, Amazon and Google, have turned to countries with lower rates to save big on taxation, rewarding those that bring them the greatest profits.

The minimal international coordination regarding corporate taxation prompted leaders of the world’s 20 largest economies (G-20) to endorse a global minimum tax rate of 15% last October. “We call on the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting to swiftly develop the model rules and multilateral instruments as agreed in the Detailed Implementation Plan, with a view to ensure that the new rules will come into effect at global level in 2023,” the draft conclusions, as seen by Reuters, stated.

Related: The Pandora Papers Reveals Where the Richest People in the World Are Hiding Their Money

The deal was signed by 136 countries, which account for 90% of the global economy, per the World Economic Forum. The new rate applies to overseas profits of multinational firms with $868 million in sales globally and allows local governments to instate a tax rate of their choosing — though a company’s home government could bump its taxes to meet the 15% minimum threshold and prevent the profit loophole.

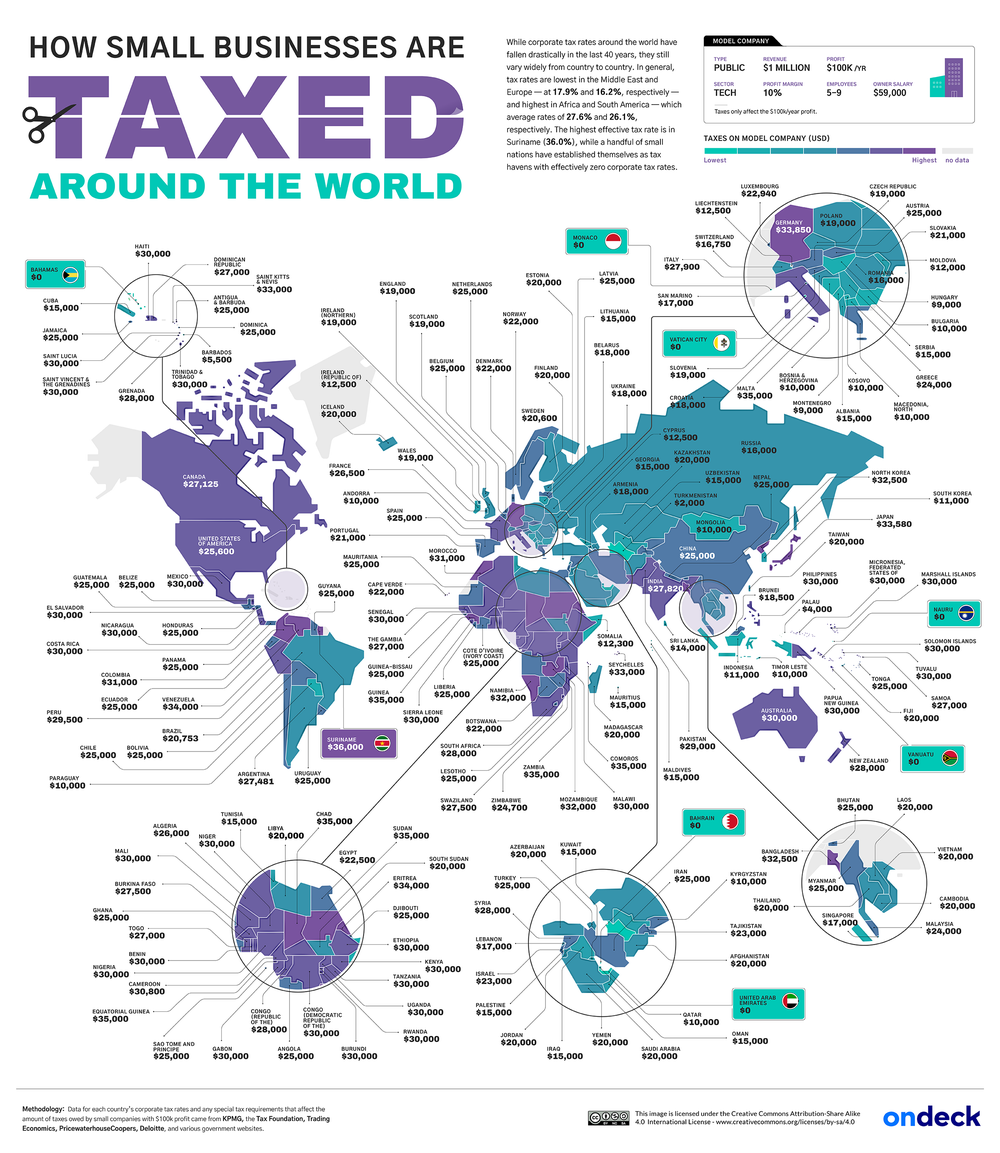

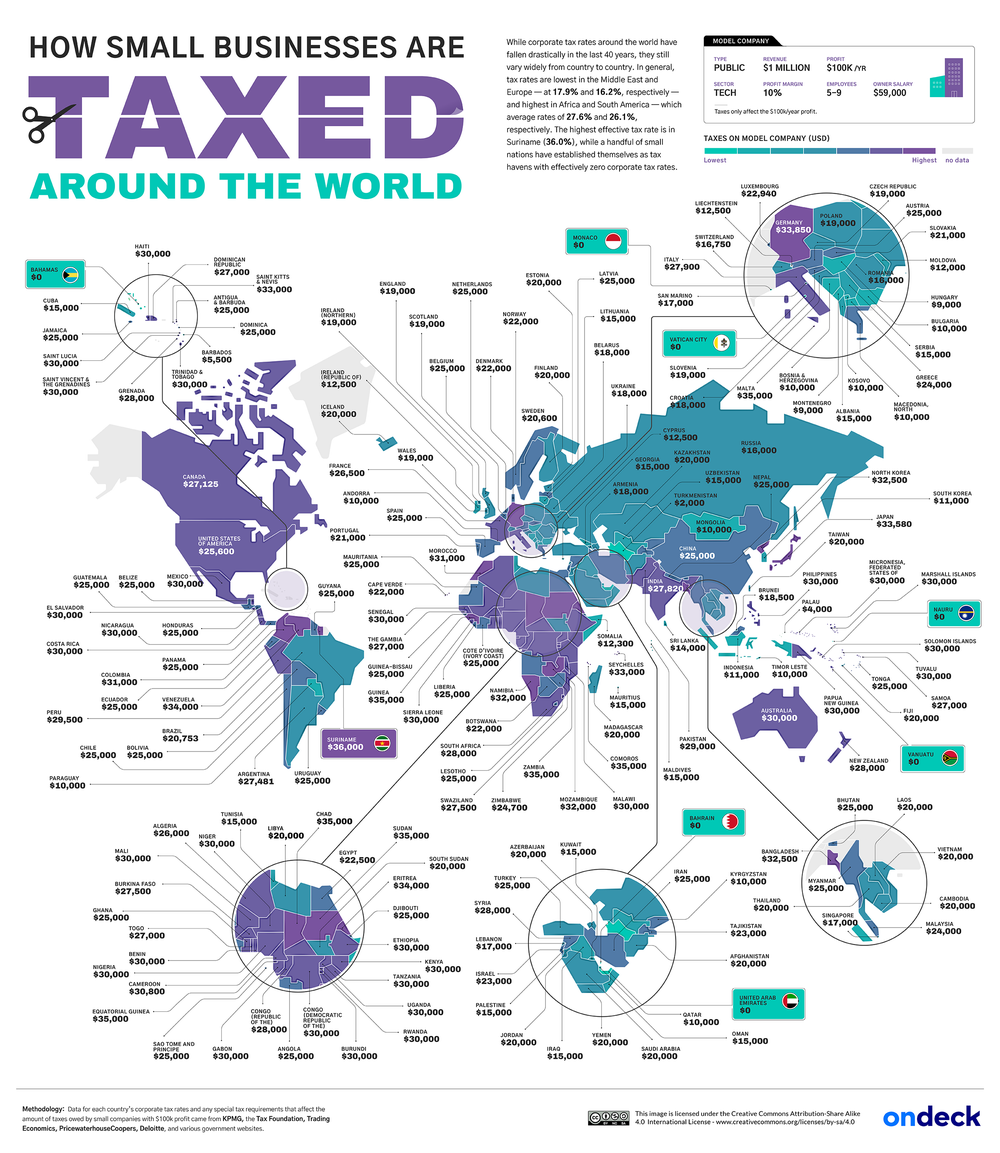

To get a sense of just how widely corporate tax rates vary from country to country, small business lending company OnDeck mapped it out. OnDeck pulled corporate-tax-rate data from KPMG, the Tax Foundation, Trading Economics, PricewaterhouseCoopers, Deloitte and various government websites, applying each country’s tax laws to “a model company with revenue of $1 million, profit of $100,000 a year, five to nine employees, is owned by a resident of the country in question, and earns a majority of its revenue from business operations within the country in question.”

Related: Here’s How The UAE’s New 9% Corporate Tax Could Impact the Country’s Entrepreneurial Ecosystem

OnDeck’s study didn’t include companies in the oil, gas and mining sectors, or publicly traded companies.

Here’s what the study found.

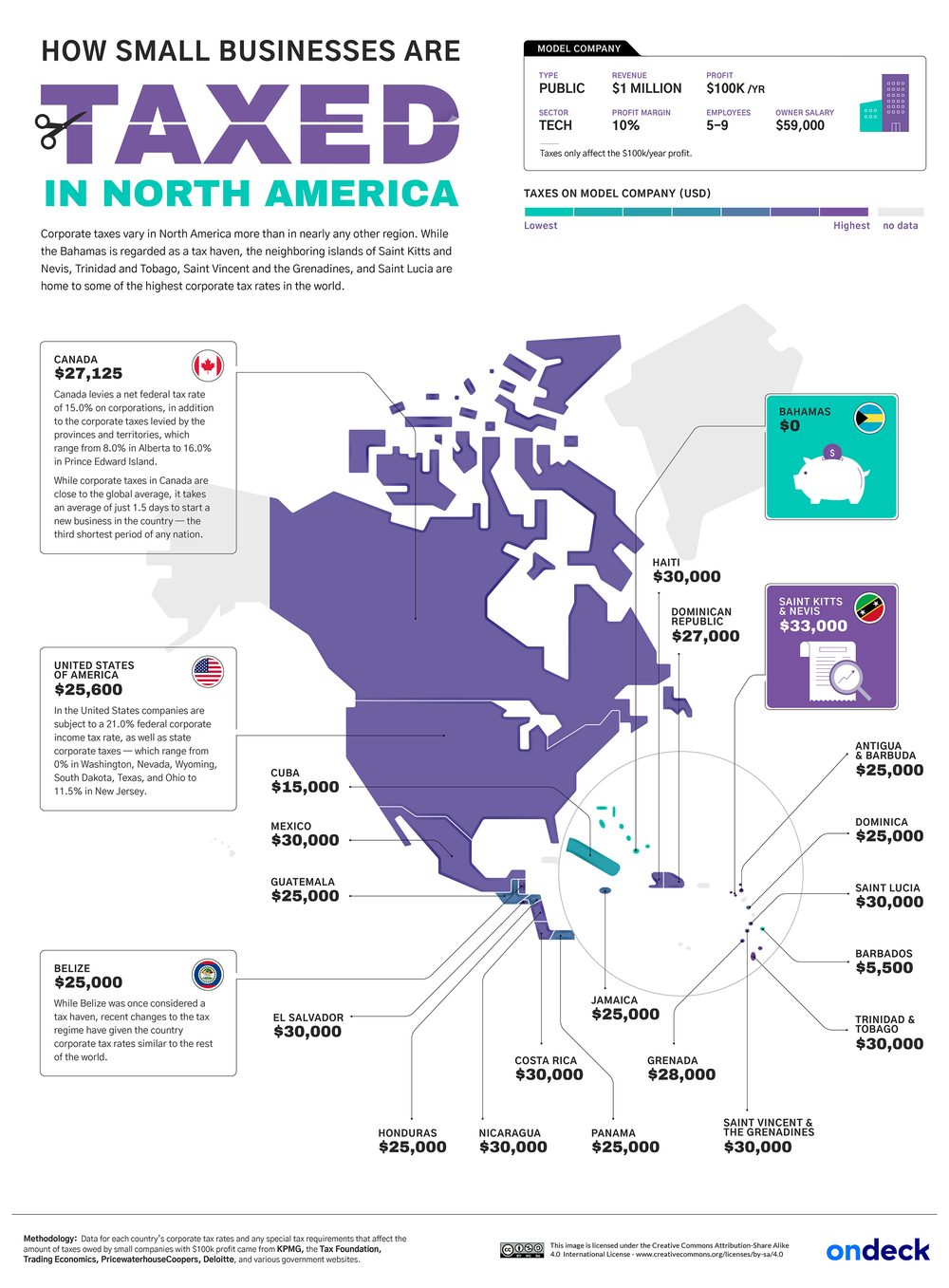

North America’s tax rates for business owners are comparable to the global average

The average corporate tax rate for North American countries is 21.5% — about in line with the worldwide average. In the U.S., companies are subject to a 21% federal tax rate in addition to state corporate taxes, which range from 0% in South Dakota and Wyoming to upwards of 9% in Alaska, Illinois, Iowa, Minnesota and Pennsylvania — and a high of 11.5% in New Jersey, per the Tax Foundation. Canada comes in close behind the U.S., imposing a $27,125 tax per $100,000 in annual profit.

But tax rates in nearby island nations vary more significantly, with a taxation of $33,000 per $100,000 in annual profit in Saint Kitts and Nevis; $30,000 in Saint Lucia and several others; $15,000 in Cuba; and $0 in the Bahamas — the only remaining tax haven associated with the continent.

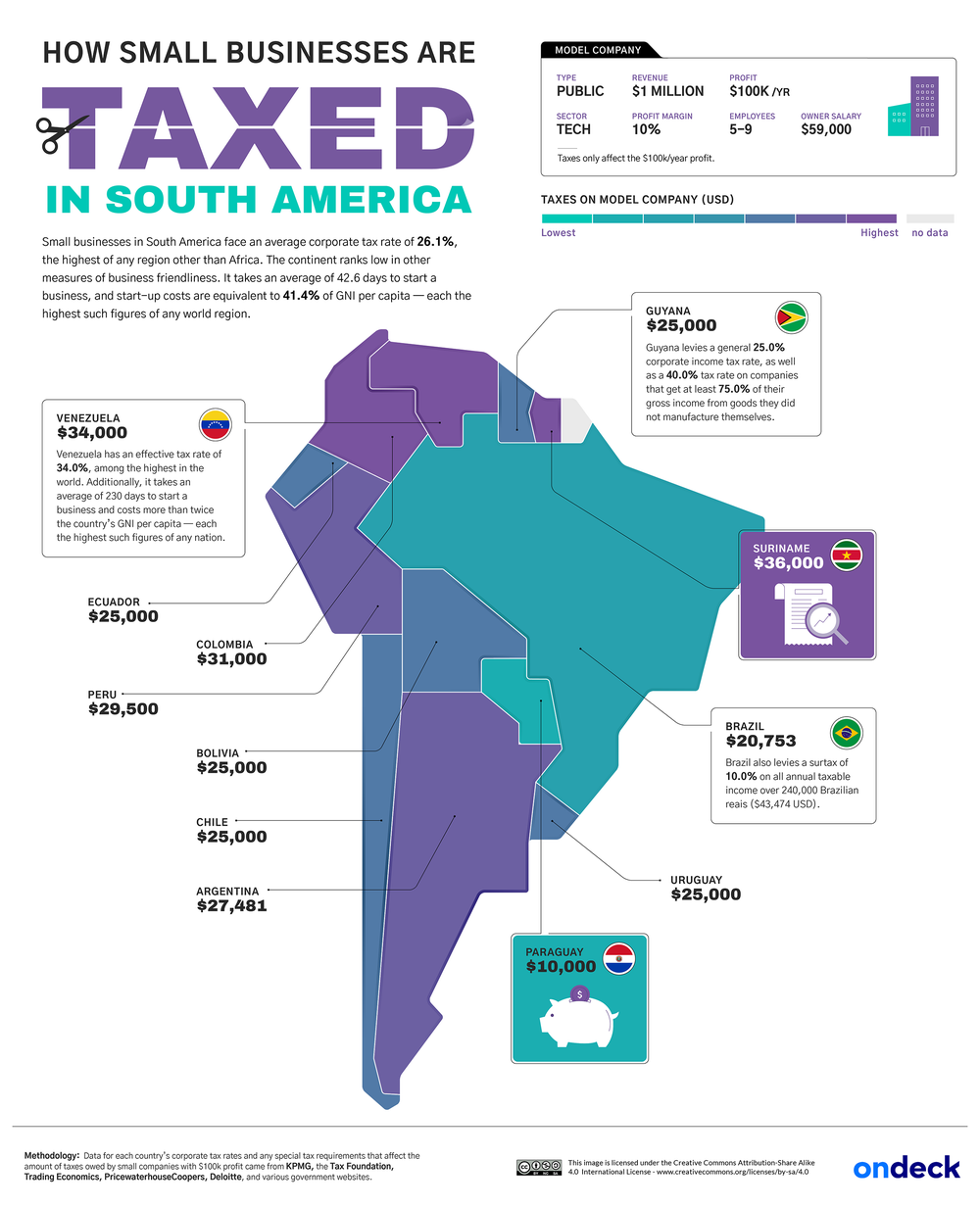

South America has the second highest average tax rate, plus barriers for business owners

Small businesses in South America are subject to a 26.1% tax rate on average — the second highest among all continents. Still, there’s quite a bit of variation, with a taxation of $36,000 per $100,000 in annual profit in Suriname (the highest corporate tax rate anywhere in the world); $25,000 in Ecuador, Chile and several other countries; and just $10,000 in Paraguay. Additionally, it takes an average of 42.1 days to start a business in South America — considerably longer than Canada’s one-and-a-half days, Georgia’s one day or New Zealand’s half a day.

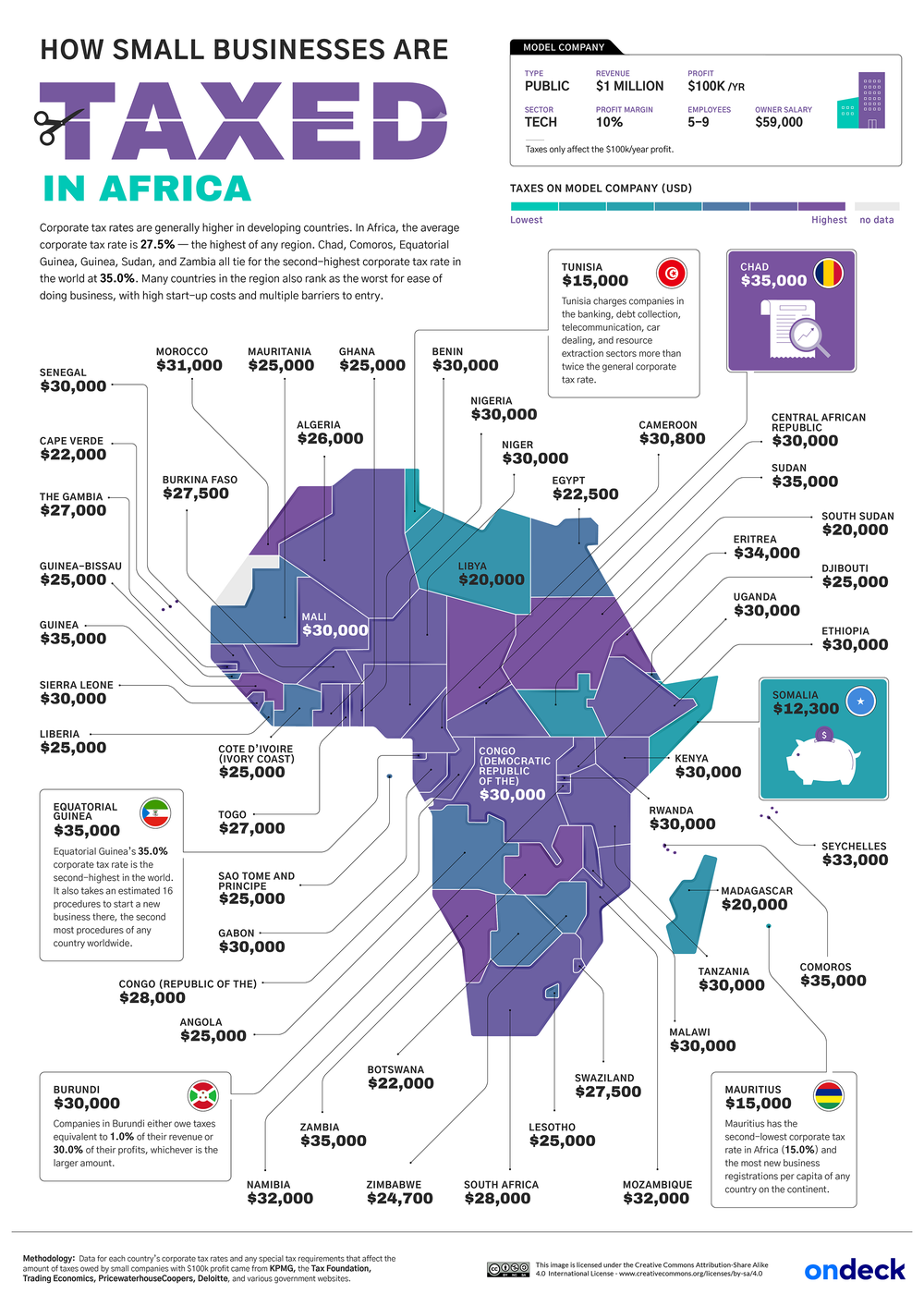

Africa has the highest corporate tax rate, on average

Africa has the highest average tax rate of any region, at 27.5%. According to the Organisation for Economic Co-operation and Development (OECD), developing countries rely more heavily on corporate income tax; in Malaysia, for example, corporate taxation makes up 66% of the country’s total tax revenue versus just 9% in France and the United Kingdom. Chad, Comoros, Equatorial Guinea, Guinea, Sudan and Zambia have a taxation rate of 35% — tied for the second highest in the world. The process of starting a business is also expensive and difficult; in Equatorial Guinea, for instance, it requires approximately 16 procedures to get a new venture off the ground.

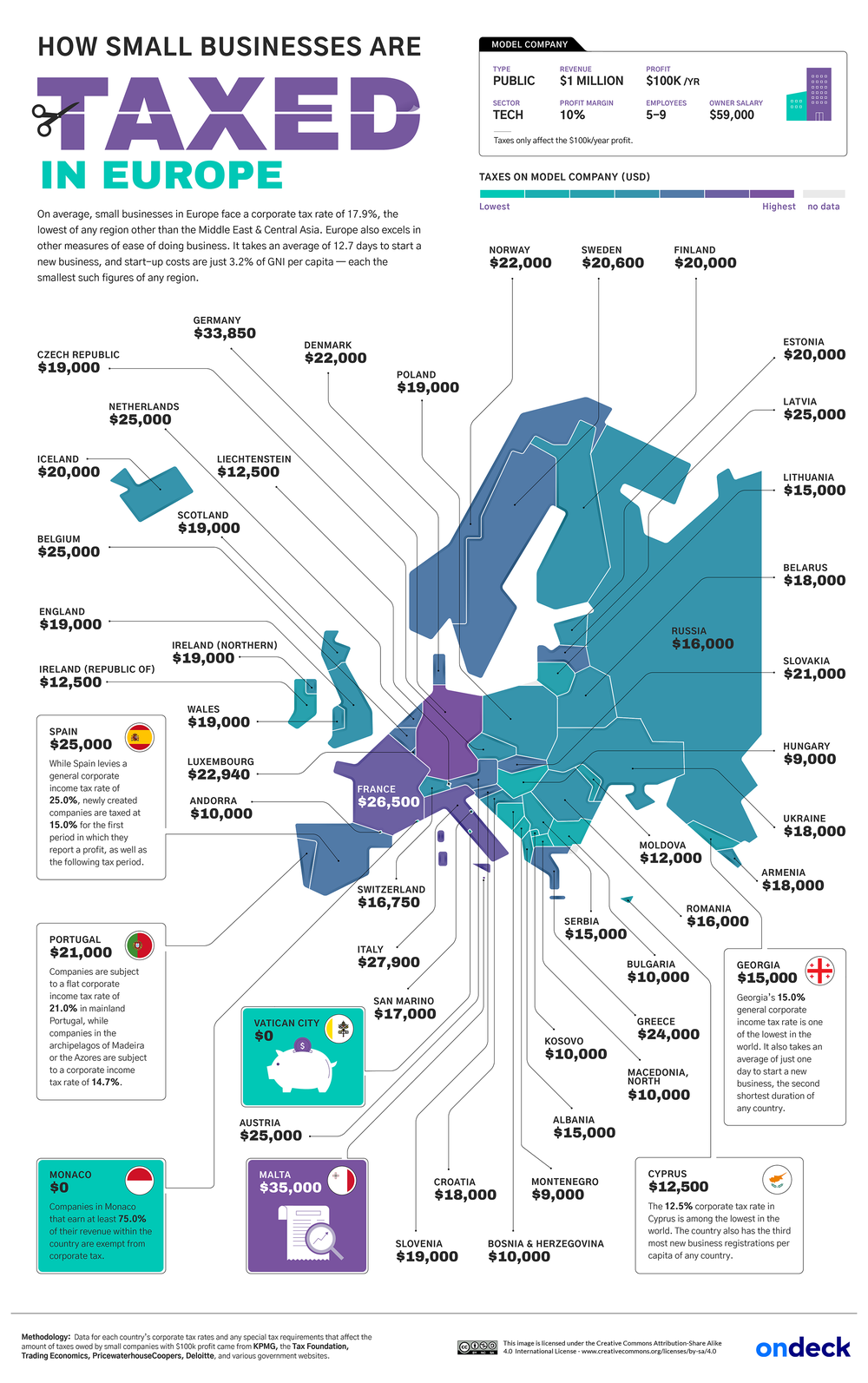

Eastern Europe has some of the lowest corporate tax rates

The average corporate tax rate for European countries is 17.9%, remarkably lower than those in Africa, South America or North America. Malta levies the highest taxation at $35,000 per $100,000 in annual profit, but the range is wide across the continent, dipping to just $15,000 in Georgia, $12,500 in Cyprus and even as low as $0 in Monaco (dependent on earning a minimum of 75% of revenue within the country) and Vatican City. Starting a business is also relatively expedient, taking only 12.7 days on average.

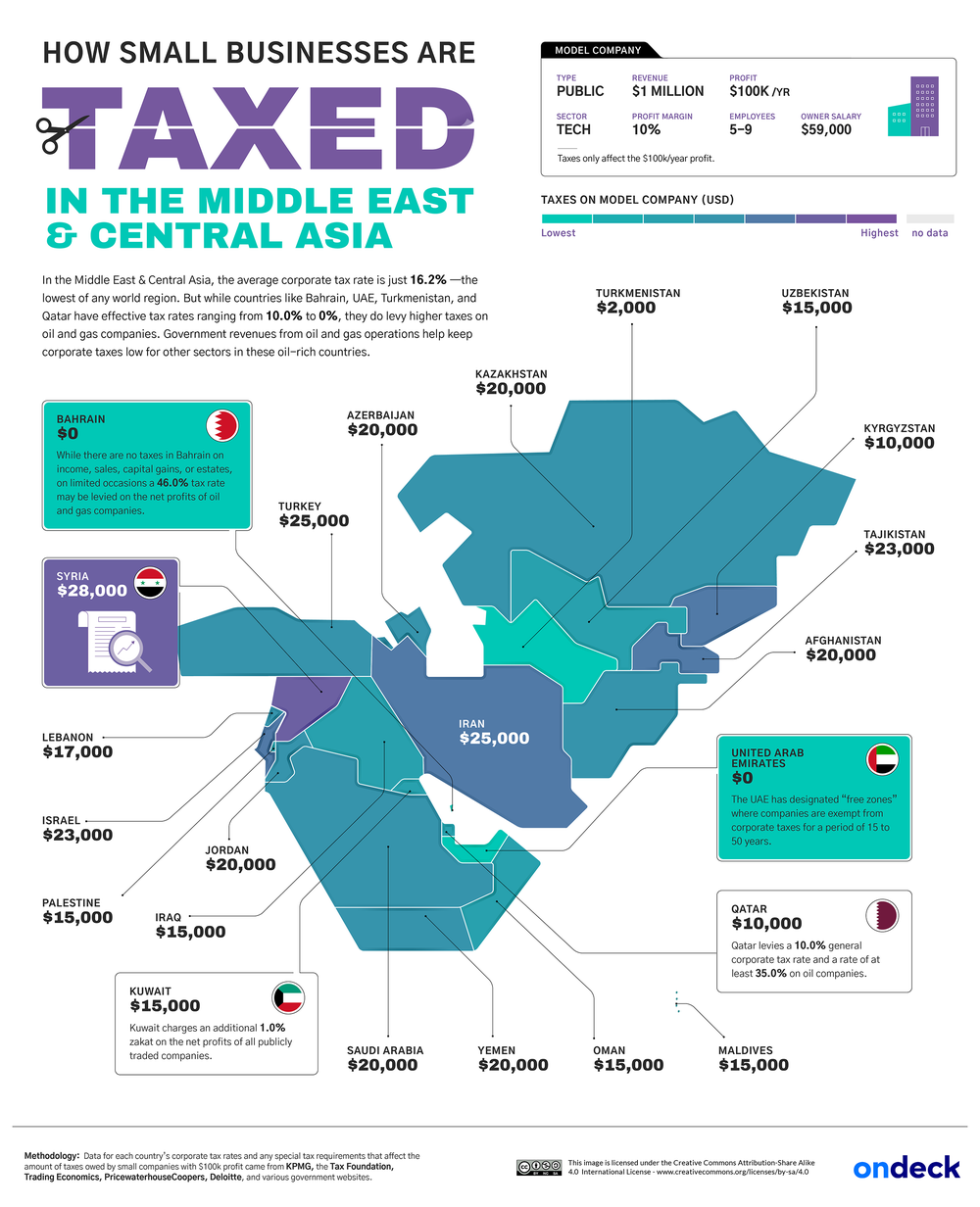

The Middle East and Central Asia have the lowest average tax rate

Small businesses in the Middle East and Central Asia are taxed at the lowest average rate, just 16.7%. Many governments in the region receive the majority of their revenue from national oil and gas companies (which were not included in this study), driving down taxation rates for small businesses outside of those sectors. Case in point: Qatar imposes a $10,000 general corporate tax rate per $100,000 in annual profit and more than triples that figure to $35,000 (or even more) for oil companies. Similarly, Bahrain serves as a tax haven for most businesses, charging $0, but it can levy a 46% tax rate on oil and gas companies’ net profits.

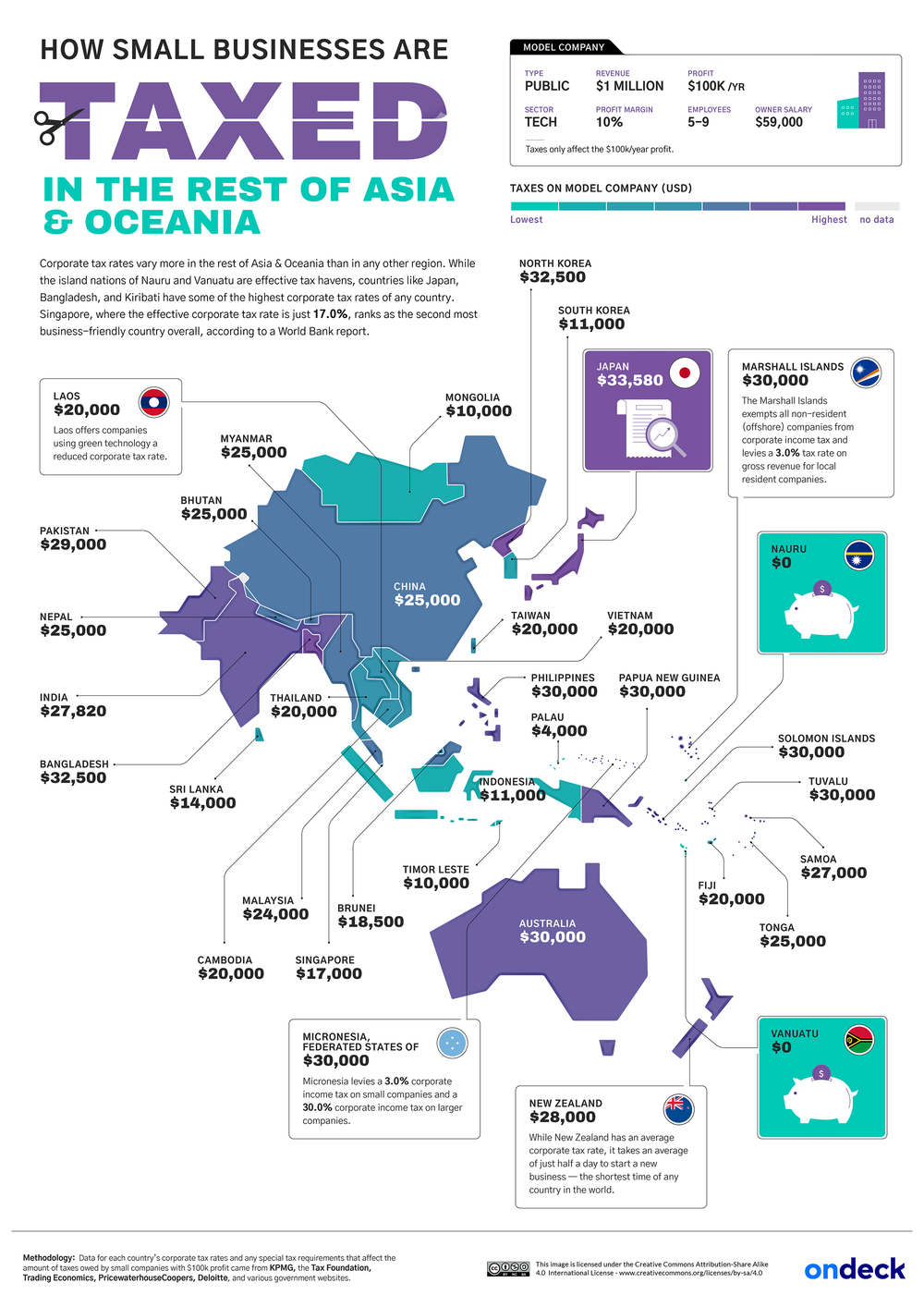

Corporate tax rates vary significantly across the rest of Asia and Oceania

As we’ve already seen across several continents, taxation rates can differ substantially from country to country. For example, Japan has the highest rate in the region — $33,580 per $100,000 in annual profit — while South Korea has one of the lowest in the region at just $11,000. Bangladesh, with a tax rate of $32,500 per $100,000 in annual profit, is another high-tax standout in the region, while island nations Nauru and Vanuatu round out the tax havens across the globe.

Related: Will Biden’s Proposed Tax Hikes Prevent Companies From Hiring?

As our world becomes more interconnected and doing business across borders increasingly common, corporate tax rates have emerged as a hot topic — the make-or-break factor when it comes to foreign investment. Some of the biggest companies on Earth, including tech behemoths like Apple, Amazon and Google, have turned to countries with lower rates to save big on taxation, rewarding those that bring them the greatest profits.

The minimal international coordination regarding corporate taxation prompted leaders of the world’s 20 largest economies (G-20) to endorse a global minimum tax rate of 15% last October. “We call on the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting to swiftly develop the model rules and multilateral instruments as agreed in the Detailed Implementation Plan, with a view to ensure that the new rules will come into effect at global level in 2023,” the draft conclusions, as seen by Reuters, stated.