The Time to Buy Roku Stock is Now, and History Confirms it InvestorPlace - Stock Market News, Stock Advice & Trading TipsAfter a dismal fourth-quarter report, Roku stock tanked yesterday. We've seen this all before, though. And Roku will soar again...

By Luke Lango

This story originally appeared on InvestorPlace

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

In early 2019, I made a really bold call that seemed totally counterintuitive at the time. I told investors to buy the dip in Roku (NASDAQ:ROKU) after the streaming player's stock had crashed in December 2018.

Amid the collapse, most investors were running away from Roku. But I was running toward it.

Specifically, I wrote:

"Roku is a true growth stock with a powerful underlying secular growth narrative. In late 2018, while ROKU dropped more than 50%, the market forgot that. But it won't forget that forever. As such, while the broader market suffers from short-term memory loss, this is an opportunity for investors to pick up a growth stock at a value stock price."

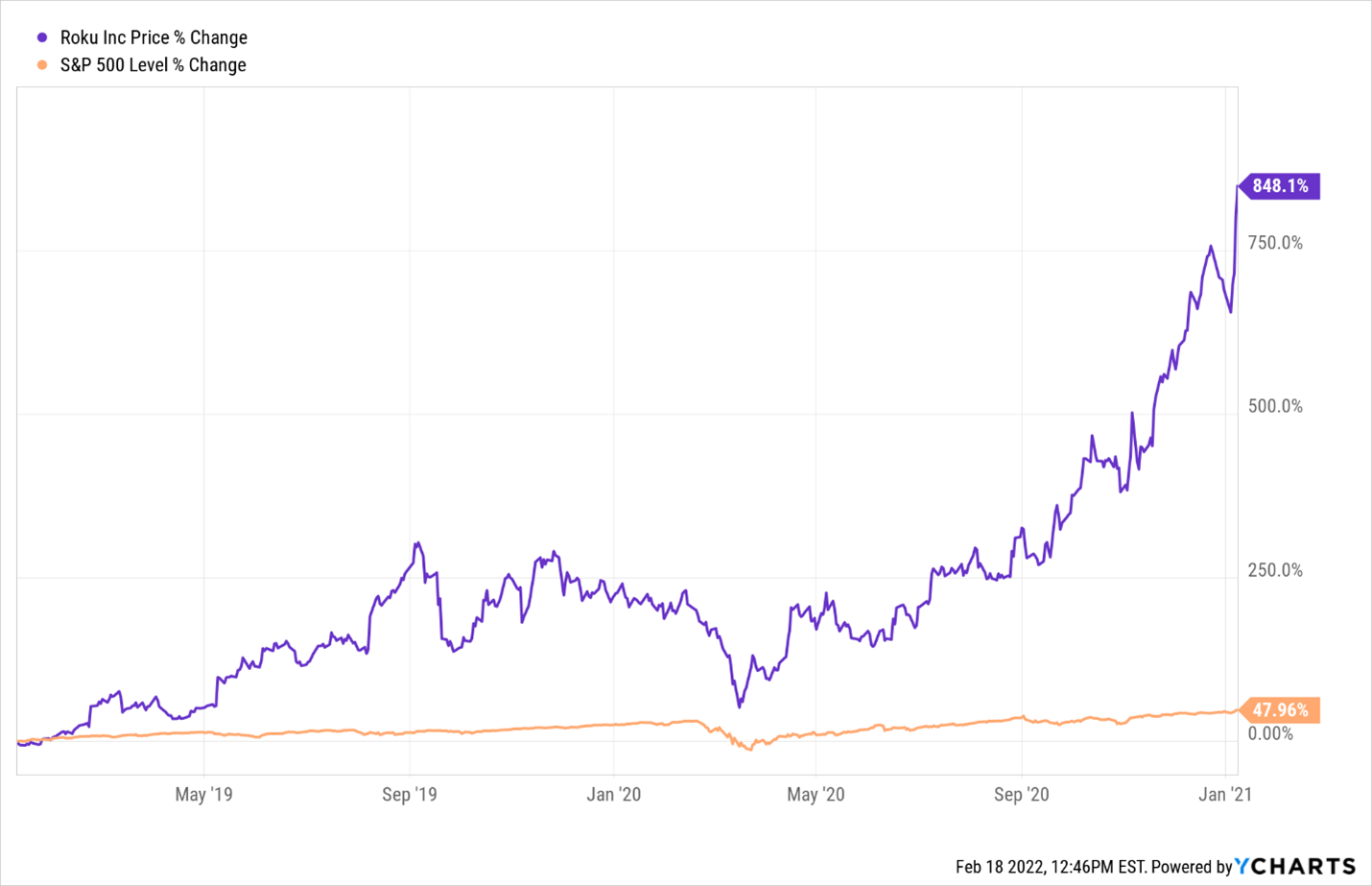

Take a look at what happened to Roku stock over the next two years.

It soared 850% — next to a measly 50% gain for the S&P 500. Investors who followed my call back then had the chance to 10X their money in two years.

Well, folks, history is repeating itself.

Today I am seeing another dip-buying opportunity in Roku stock that is just as compelling — if not more so — than the one I identified in early 2019.

On Friday, Roku stock crashed more than 20% after the company reported ostensibly dismal fourth-quarter earnings. Account growth and engagement growth are slowing. Unit revenue growth and total revenue growth are stalling. Gross margins are compressing. Profits are declining.

Every key performance metric of the business is going in the wrong direction. Investors panicked, and the stock crashed.

It makes sense.

Supply Chain Reality Check

However, with Roku stock now 80% off its recent highs — its biggest drawdown ever — I'm feeling a golden buying opportunity.

The reality is that all of Roku's KPIs are trending in the wrong direction for one very simple reason — the supply chain crisis.

It's limiting the production of TV-makers across the globe, leading to lower TV sales everywhere. This is hurting Roku's account growth. At the same time, the product Roku can acquire and sell is coming with significantly higher input prices. And Roku is refusing to pass those prices onto consumers, so margins are falling. Meanwhile, its advertisers are spending with less velocity because they, too, don't have enough supply to satisfy demand. Therefore, they're not spending as many ad dollars to chase incremental demand.

It's all supply chain driven.

So if the crisis improves throughout 2022, all of Roku's KPIs should recover.

And that's exactly what will happen.

The current supply chain crisis is mostly Covid-related. Governments instituted strict quarantining and social-distancing policies in response to the pandemic. And these greatly limited the production capacity of manufacturers. However, those policies are now changing, as the governments are amending their responses from "we have to eliminate Covid" to "we have to learn to live with Covid." As governments more broadly embrace this "live with Covid" ethos in 2022, quarantining and social-distancing policies will disappear. Manufacturing output will improve, and supply chain pressures will ease.

Roku Stock Takeoff

And so, with respect to Roku, that means that TV-makers are going to dramatically increase their output this year. Input prices on TVs and streaming sticks will fall, and advertisers will re-up spending as their own supply rebuilds.

As all that happens, Roku's account growth, revenue growth and profit margins will all shift higher.

This propulsion will converge on a super-cheap valuation in Roku stock. Simply consider: Roku is worth less today than it was worth before the pandemic. Yet, relative to its pre-pandemic levels, Roku has 60% more users, 145% more revenues and 13X the EBITDA.

It makes no sense.

And because it makes no sense, the 2022 rebound rally in Roku stock will be especially large. Before the year is out, we will see prices on Roku stock of $200 or even $300.

The time to buy is now.

That's why, in our flagship investment research advisory Innovation Investor, we told subscribers to buy the dip in Roku stock yesterday.

In that research advisory, we ignore near-term stock price fluctuations, and stay focused on investing in the world's most innovative companies — with the biggest long-term growth potential.

Roku stock falls under that umbrella. So do a few dozen other hypergrowth tech stocks with enormous upside potential at current levels — and all of those stocks are in our Innovation Investor portfolio.

Gain access to that portfolio — and learn about the best tech stocks to buy today!

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post The Time to Buy Roku Stock is Now, and History Confirms it appeared first on InvestorPlace.