Tractor Supply Stock Should Plow Ahead Rural lifestyle provider Tractor Supply Company (NASDAQ: TSCO) stock has been performing relatively stronger than the benchmark indices.

By Jea Yu

This story originally appeared on MarketBeat

Rural lifestyle provider Tractor Supply Company (NASDAQ: TSCO) stock has been performing relatively stronger than the benchmark indices. Shares hit a new all-time high of $241.54 as recently as March 31, 2022. However, the macro market sell-off in April managed to collapse shares by nearly (-15%). The farming products retailer has seen remarkable growth in its e-commerce channel with its 39th consecutive quarter of double-digit percentage growth, which now accounts for 7% of total sales with a target of 15%. With 2,003 Tractor Supply and 178 Petsense locations, it has grown to be the largest of its kind in the nation with a 7% market share of its total addressable market (TAM). The Company plans to open 75 to 80 new stores per year despite the volatile and inflationary conditions. Higher commodity input costs and higher labor and freight costs impacted its vendor partners. Its shares fell upon the release due to reaffirmed as opposed to raised guidance, which is considered a let-down in the current financial market market climate. The ESG purpose-driven company seeks to reduce its water footprint by 25 million gallons by 2025. Prudent investors seeking exposure in the rural lifestyle retail market segment can watch for opportunistic pullbacks in shares of Tractor Supply.

Q1 Fiscal 2022 Earnings Release

On April 21, 2022, Tractor Supply released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit $1.65, beating consensus analyst estimates for $1.42, a $0.23 beat. Revenues rose 8.3% year-over-year (YoY) to $3.02 billion versus $2.92 billion consensus analyst estimates. Comparable store sales rose 5.2% driven by comparable average ticket growth of 6.7% while average transaction count fell (-1.4%). E-commerce experienced its 39th consecutive double-digit growth quarter. Tractor Supply CEO Hal Lawton commented, "While we anticipate that we will continue to operate in a highly inflationary and volatile environment, we believe Tractor Supply is uniquely positioned for growth with a resilient, domestic business model that has stood the test of time. The strength of our business and the needs-based, demand-driven nature of our product categories complemented by our Life Out Here strategy give us confidence in our outlook and in our ability to successfully navigate the continuing challenges of the dynamic environment."

Reaffirmed Guidance

Tractor Supply reaffirmed fiscal full-year 2022 EPS between $9.20 to $9.40 versus $9.41 consensus analyst estimates. Total fiscal full-year 2022 revenues are expected to come in between $13.6 to $13.8 billion versus $13.79 analyst estimates.

Conference Call Takeaways

CEO Lawton says the Company experienced more pressure to the upside on inflation and continues to see rising costs in commodity inputs, higher wages, and transport costs have impacted its vendors. The Company expects these costs to continue rising. However, this was offset by impressive demand in its consumable, usable, and edible (CUE) categories, which are need-based and demand-driven products pulling consumers into its stores. The CUE sales are triple overall sales growth indicating unprecedented strength trends. Its Tractor Supply app surpassed 3 million downloads and accounting for 15% of its digital sales. It's successful Neighbor's Club loyalty program grew to 24.8 million members in the quarter, up 24% YoY. He reiterated guidance and noted they are working with the FTC towards a positive resolution in regards to the Orscheln acquisition.

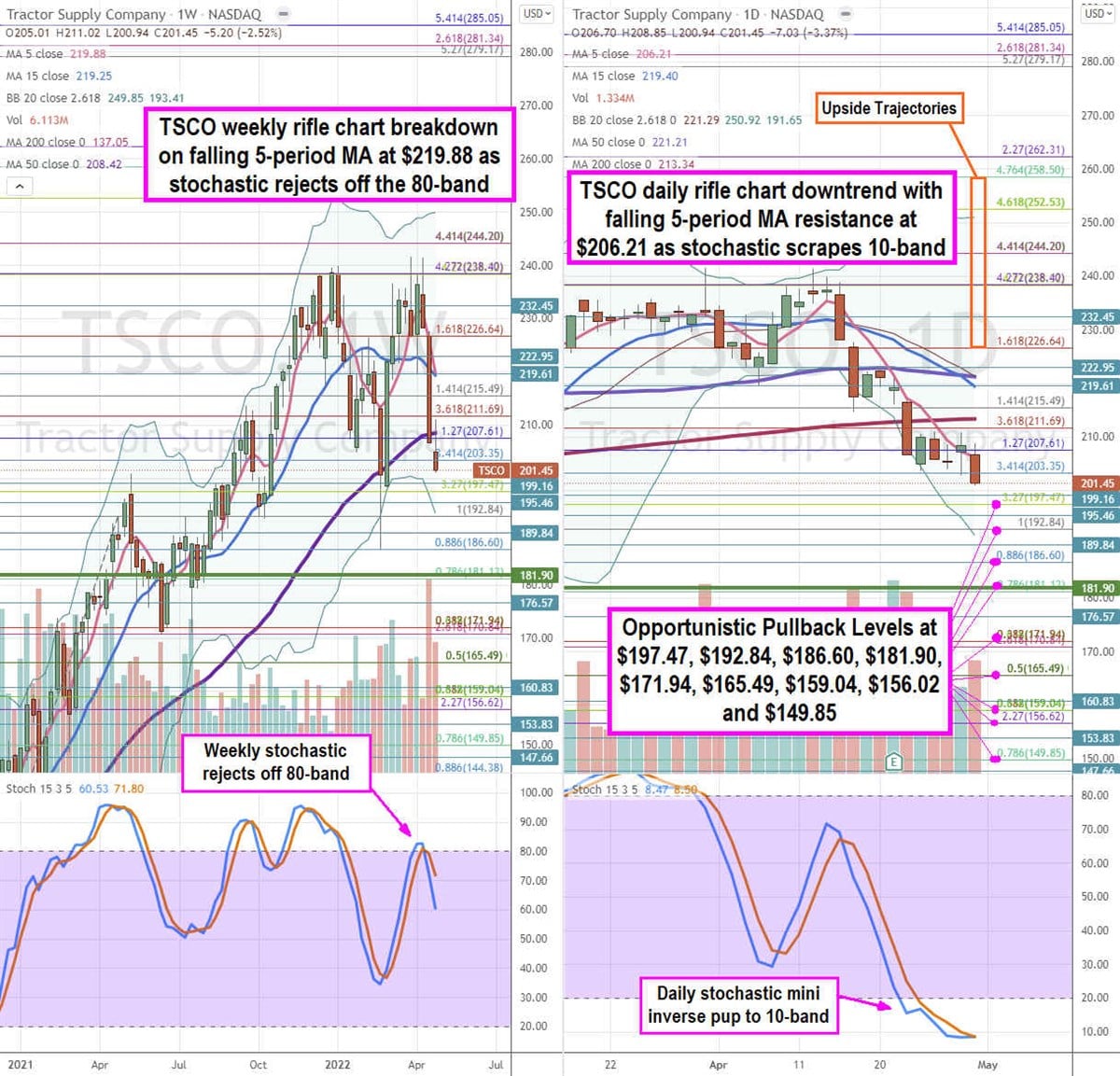

TSCO Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field for TSCO stock. The weekly rifle chart hit a 2022 bottom near the $186.60 Fibonacci (fib) level. Shares were able to rally to new all-time highs of $241.54 before selling off sharply. The weekly 5-period moving average (MA) is falling at $219.88 towards a crossover through 15-period MA at $219.25 to attempt a breakdown. Shares fell hard through the weekly 50-period MA at $208.42 with weekly lower Bollinger Bands (BBs) at $193.41. The weekly stochastic rejected off the 80-band to oscillate through to the 60-band. The weekly market structure low (MSL) buy triggered on the breakout through $181.90, which is a key support level for bulls. The daily rifle chart has been in a downtrend with a falling 5-period MA resistance at $206.21 followed by the 15-period MA at $219.40. The daily 50-period MA resistance sits at $221.21 and 200-period MA resistance at $213.34. The daily lower BBs sit at $191.65 as the daily stochastic triggered below 20-band mini inverse pup than may attempt to coil if it doesn't slip again. Prudent investors can watch for opportunistic pullback levels at the $197.47 fib, $192.84 fib, $186.60 fib, $181.90 fib, $171.84 fib, $165.49 fib, $159.04 fib, $156.02 fib, and the $149.05 fib. Upside trajectories range from the $226.64 fib level up towards the $258.50 fib level.