Uber Looking Like A Top 2022 Pick With a 30% run since this time last month, shares of ride hailing app Uber (NYSE: UBER) are carrying some decent momentum with them into the new year.

By Sam Quirke

Our biggest sale — Get unlimited access to Entrepreneur.com at an unbeatable price. Use code SAVE50 at checkout.*

Claim Offer*Offer only available to new subscribers

This story originally appeared on MarketBeat

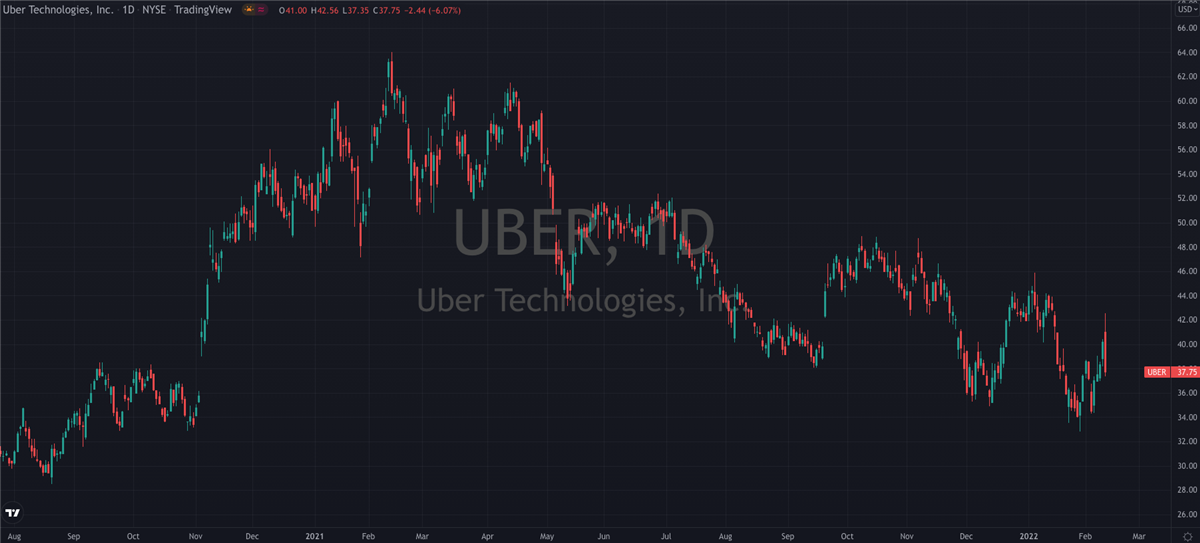

With a 30% run since this time last month, shares of ride-hailing app Uber (NYSE: UBER) are carrying some decent momentum with them into the new year. While they bounced off their lows of the year as part of this rally, they look set to break the downtrend that's had them under pressure since February's all-time high. There's definitely a bit of risk to be had by buying into their growth potential, but looking at their recent numbers and headlines it's fair to say that investors could do a whole lot worse.

For starters, their Q3 numbers released in November showed revenue growth of 72% year on year which was well ahead of what analysts had been expecting. Their bottom line EPS registered a deeper loss than expected but on the whole, this wasn't as bad as it looked. The company gross booking jumped 57% on the year as that shot to an all-time high of $23 billion, while trips during the quarter grew by 39% year on year. Investors and Wall Street were quick to write off the EPS number as being largely due to an "an unrealized loss of $3.2 billion (pre-tax) related to the revaluation of Uber's Didi equity investment". The fact that adjusted EBITDA registered its first profitable quarter was seen to be much more important.

Bullish Comments

Since this release in early November, it's been only good news for the San Francisco headquartered company. In the first week of December, the team over at UBS was out with bullish comments that helped kickstart the rally that's currently underway. They figured the stock could easily double from current levels, with analyst Lloyd Walmsley saying that "at current levels, Uber Technologies shares don't appreciate the company's mobility and delivery businesses, adding that there is evidence it is taking market share in mobility away from competitors, such as Lyft (NASDAQ: LYFT)."

They initiated coverage of Uber's stock with a Buy rating and slapped a price target of $80 onto shares. Considering they closed at $44 last night, that's suggesting there's an upside of close to 100% to be had which isn't to be sniffed at. UBS also believes that Uber's market share of the food delivery business has "stabilized" and the company is executing at a better rate than bears appreciate. Walmsley added that "we see improving bookings and profitability from Mobility, and ramping Delivery profitability as driving improving investor confidence in long-term profitability, which should lead to shares re-rating".

Less than a fortnight later, CEO Dara Khosrowshahi told investors the ride-hailing company had had its "best week ever in terms of overall gross bookings." According to Khosrowshahi, Uber is on track to reach the high end of its adjusted EBITDA forecast. He also told investors that "our overall mobility business continues to get closer to pre-pandemic levels. We're starting to inch up to call it like the 90% mark, we're not quite there. Last week was our best week, you know, post-pandemic." At the same time, he made sure to point out that their Uber Ads business is performing "well ahead" of expectations and is profitable.

Looking Ahead

If all that wasn't enough of a Christmas present for investors to take into the holidays, the team at Evercore helped them close out the year on an even more positive note. Just last week, they named Uber as one of their top tech stocks for 2022. Analyst Mark Mahaney has given them an $82 price target, suggesting there's a similar upside to UBS, and believes it is "the best recovery/reopening play in our sector." This is all the more relevant as the global economy continues to reopen amid the fallout from the COVID-19 pandemic. The fact that Amazon (NASDAQ: AMZN) and Meta Platforms (NASDAQ: FB) made the same list underlines the quality that analysts see in Uber, which has yet to be reflected in its share price.

Uber shares need to kick on past the $50 to firmly break the downtrend but if they can manage that there's no reason they won't be testing the previous all-time high of $63 shortly after. Considering they have two fresh price targets of $80+ behind them, you'd be backing them to do it before too long.