Uber (NYSE: UBER) or Lyft (NASDAQ: LYFT): Which Should You Pick? There can be no doubt that the likes of Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT) have changed the ride hailing and taxi industry forever.

By Sam Quirke

This story originally appeared on MarketBeat

There can be no doubt that the likes of Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT) have changed the ride-hailing and taxi industry forever. Their technology has disrupted one of the world's oldest and most constant industries and it looks like it's only going to continue doing so. For investors keen to get some exposure to that kind of technology, Uber and Lyft offer similar but still fundamentally different opportunities. Let's take a look at the pros and cons of each.

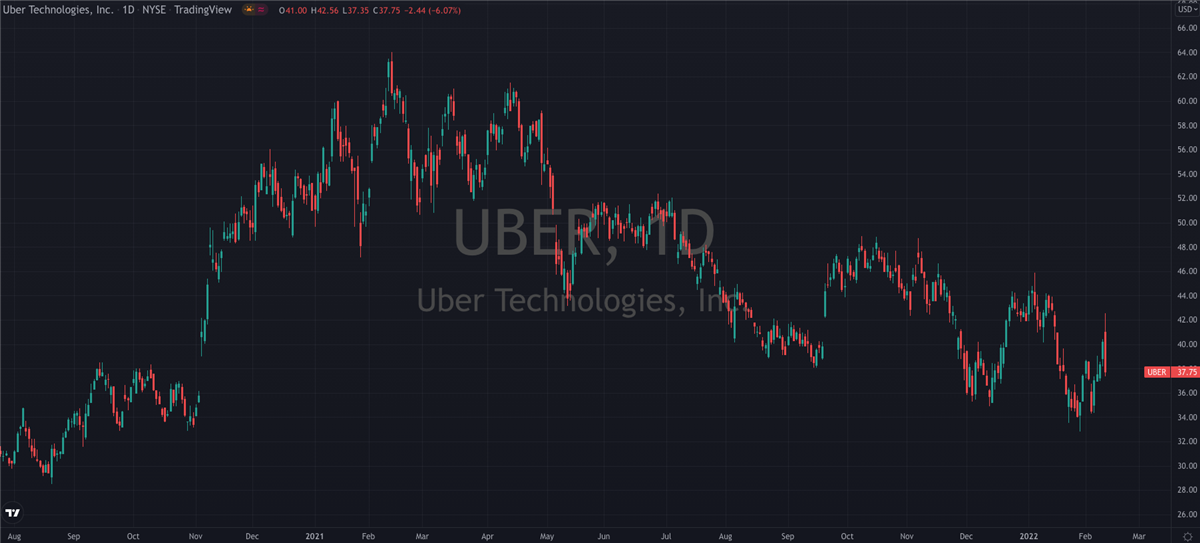

On the one hand, we have Uber, who have cemented their position as the first mover and market leader to the extent that they reached the holy grail of brand marketing - their company name became a verb in and of itself. Despite seeing their shares take the guts of a 70% tumble last year as COVID kept most of the world's population at home, investors who held or even bought in at the lows have had quite the journey since.

Post-Pandemic Landscape

Uber managed to ride the tech recovery wave all through last summer and found new fuel from the reopening play that came online towards the end of last year. Their shares hit an all time high this past February to cap off a staggering 350% run from the lows of 2020. They've since given some of that back but have been consolidating in recent weeks and look keen to get going again.

Wells Fargo added them to their Signature Picks list last month while Melvin Capital recently initiated a fresh position in Uber. The company's Q1 numbers had revenue down only 10% on the year with EPS only $0.06 away from a positive print. The company's long term potential has been leaned on by many in the bull camp, who see Uber coming out of the pandemic with more strings to its bow than when it went into it. Evercore ISI went so far as to reiterate their Outperform rating on the stock two weeks ago, while also calling them "the clear leader".

Up and Comer

If Uber is the clear leader, then Lyft is definitely coming in at a close second. In fact, on a short term view they're actually pulling ahead by some margin. Since last November, Lyft's shares have tacked on 145% while Uber's are only up 40%. One of the big drivers behind this outperformance has been the company's numbers, which show that Lyft is very much in growth mode while Uber could be said to be in consolidation mode.

Lyft's management offered some informal upside guidance with their Q1 report which came as a nice surprise. They're expecting revenue of $680-700 million versus a consensus of $683 million, while their contribution margin for Q2 is also expected to be an all time high at around 57%. This means the company is on track to come very close to hitting profitability.

Evercore has an Outperform rating on Lyft as well, and their $77 price target suggests there's upside of more than 20% to be had from Friday's closing price. Technically, both stocks have an RSI that's in an attractive uptrend which suggests there's decent momentum on the bid right now, which means investors weighing up the options have plenty to chew on.

Getting Involved

On the one hand, Uber is by far and away the heavyweight of the two, boasting almost 5x Lyft's market cap. But their shares are undoubtedly moving more sluggishly, perhaps as a direct result. Lyft can claim to be carrying the most momentum right now, but it has a few gaps in its portfolio, for example, food delivery, that might hold it back over the long run.

They'll both have to contend with DiDi (NYSE: DIDI), China's biggest ride-hailing app which started trading in New York last week via ADRs. However, tough it has an impressive $75 billion market cap, it's already coming under regulatory scrutiny from the top dogs in China which makes it probably a little too much of a risk for any non-meme stock investors right now. It's still very much a two-horse race on these shores, with not a whole lot to dislike between them.

Featured Article: What is the price-to-earnings growth (PEG) ratio?