U.S. Concrete Stock is a Top U.S. Infrastructure Play Concrete and aggregate products maker U.S. Concrete (NASDAQ: USCR) stock has been on a tear thanks to the housing boom and tailwinds created by the Biden infrastructure bill.

By Jea Yu

This story originally appeared on MarketBeat

Concrete and aggregate products maker U.S. Concrete (NASDAQ: USCR) stock has been on a tear thanks to the housing boom and tailwinds created by the Biden infrastructure bill. The stock has benefited as both a pandemic benefactor from housing and re-opening play with infrastructure spending. Construction and raw materials prices including lumber, steel and concrete have surged double-to-triple digits in the last year. While Congress is still negotiating the multi-trillion dollar infrastructure bill, the sentiment for a deal is very optimistic especially when domestic companies providing U.S. jobs can benefit. With the strategic recent acquisition of a California-based concrete plant, the Company has bolstered its capacity in anticipation of U.S. highway, road, and bridge renovation contracts. California is the jackpot demographic in need of the most renovation work in the country. Prudent investors seeking a top tier benefactor from infrastructure spending can monitor shares for opportunistic pullback levels to consider exposure.

Q4 2020 Earnings Release

On Feb. 24, 2021, U.S. Concrete released Q4 2020 results for the quarter ending in December 2020. The Company reported earnings per share (EPS) of $0.55 excluding non-recurring items, beating consensus analyst estimates of $0.28, by $0.55. Revenues fell (-9.4%) year-over-year (YoY) to $334.4 million, falling short of analyst estimates for $355.52. The Company generated a record $158.6 million of adjusted free cash flow to end 2020 with $420 million in total liquidity comprised of cash, cash equivalents and two credit revolvers. The Company expects full-year 2021 total adjusted EBITDA to rise 2% to 5% YoY around $200 million.

Conference Call Takeaways

U.S. Concrete CEO, Ronnie Pruitt, set the tone, " We are anticipating that the second half of the year will be stronger than the first half led by robust residential activity across all of our markets, complemented by heavy industrial commercial projects, including warehouses, data centers, and other commercial work that support the development of new neighborhoods. The Company anticipated favorable pricing trends as it focuses on improving operating margins. The Horizon 2025 goal of $300 million of EBITDA will be achieved by organizational efficiencies, organic growth, automation of the WHERE'S MY CONCRETE platform and expansion of the Aggregates platform. The Company is acquiring a cementitious distribution terminal in the Bay area to bolster rail and bulk cement storage. Black Bear enables the Company to expand its presence to the Orca quarry to supply additional coarse Aggregates to the west cost markets which are currently in limited supply to California. Black Bear is targeted to be fully operational in late 2023 with revenues generated in early 2024. CEO Pruitt summed it up, "Our key markets all expect strong and resilient activity for infrastructure, including freeways, roads, and streets, either with or without the federal infrastructure bill."

Carbon Reduction

U.S. Concrete continues to meet the rising demand for low carbon concrete notably in the San Francisco Bay area through the LinkedIn Middlefield campus in Mountain View. The project utilized carbon cure and recycled supplementary cementitious materials (SEMS) and implementing recycled Aggregates to meet the "aggressive carbon goal". The Company was an early adopter of integrating compressed natural gas (CNG) resulting in upgrading 47 trucks or 15% of its New York fleet. The Company meets ESG investing objectives and the carbon reduction theme powered by the potential for major federal infrastructure spending. The Company plays down the upside from the infrastructure package, which sets the bar low moving forward. Additionally, shares have been pricing in the disruption in Texas from the outlier freeze and shutdown of the grid in February through March 2021. Prudent investors monitor opportunistic pullback levels to consider exposure.

USCR Opportunistic Pullback Levels

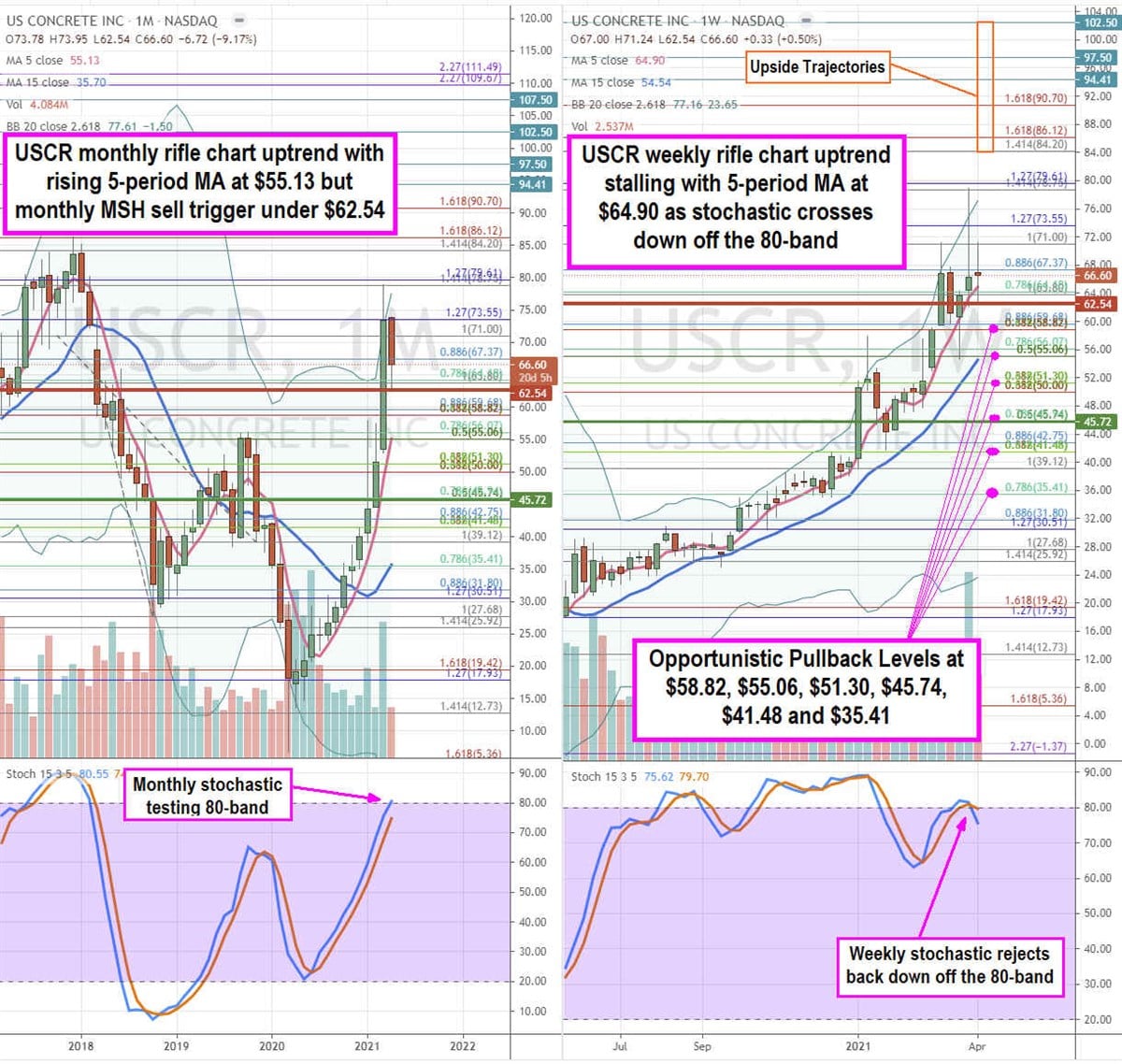

Using the rifle charts on monthly and weekly time frames provides a broader view of the landscape for USCR stock. The monthly rifle chart has a been in a parabolic uptrend with a rising 5-period MA support at $55.13 peaking at the $78.75 Fibonacci (fib) level. The monthly stochastic is rising to the 80-band as the monthly upper Bollinger Bands (BBs) sit at $77.61.The monthly market structure high (MSH) sell triggers under $62.54 and the daily market structure low (MSL) buy triggered above $45.72. The weekly uptrending is stalling with a 5-period moving average (MA) at $64.90 as the weekly stochastic crosses back down under the 80-band. This indicates a potential channel tightening on a break of the weekly 5-period MA accelerated if the monthly MSH triggers. Prudent investors can watch for opportunistic pullback levels at the $58.82 fib, $55.06 fib, $51.30 fib, $45.74 fib, $41.48 fib, and the $35.41 fib. Upside trajectories range from the $84.20 fib upwards to the $102.50 sticky 2.50s range.

Featured Article: What is a good rate of return for a mutual fund?