Why Facebook (NASDAQ: FB) Is Looking Better Than Ever Since consolidating their 2020 gains in the first quarter of this year, shares of Facebook (NASDAQ: FB) have gone on to launch a fresh rally that's st...

By Sam Quirke

This story originally appeared on MarketBeat

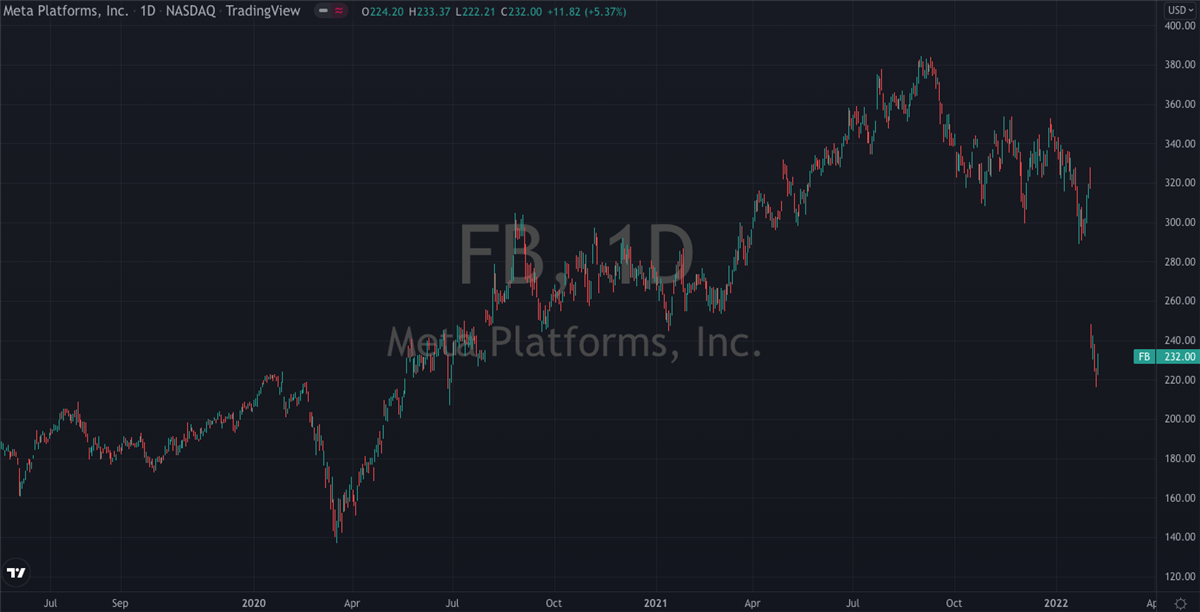

Since consolidating their 2020 gains in the first quarter of this year, shares of Facebook (NASDAQ: FB) have gone on to launch a fresh rally that's still building up to full steam. The $1 trillion social media giant has seen its stock tack on a solid 40% since early March, and it's only a few green weeks away from crossing $400 for the first time.

Investors new to Facebook might be forgiven for being a little wary of a $1 trillion stock that's soaring to highs while the tech market, in general, is struggling to continue the same level of outperformance it boasted of last year. But a quick look under the hood tells us all we need to know. The company reported revenues of more than $26 billion last quarter, which were up a staggering 47% on the same quarter in 2020. For context, this kind of turnover puts them ahead of several well-developed countries' GDP.

Attractive Valuation

And even with a well-earned rally in shares underway, there's no hint that the stock is getting to be a little frothy. Facebook's price-to-earnings (PE) ratio is at a healthy 30, a far cry from some of the triple-digit prints that their Silicon Valley peers have. Tesla (NASDAQ: TSLA) for example has a price-to-earnings ratio of almost 650, and that's after a 30% haircut to its stock. Facebook's PE ratio has been below 35 for several years now, which suggests the stock is reaching a point of maturity that should make it all the more attractive to long-term investors and big money funds.

In addition to growing into a more attractive PE range, the company has done remarkably well out of the COVID pandemic. Facebook's ad business was perfectly positioned to capture huge market share from the pandemic-driven surge in e-commerce activity, and these gains are expected to be pretty sticky and so long-lasting. Zuckerberg and co aren't slowing down when it comes to expansion and innovation either. They've been nimble enough in the past to snap up WhatsApp and Instagram, and their virtual reality subsidiary Oculus, acquired in 2014, is on track to start delivering $1 billion in annual revenue alone in the near future.

Compared To Peers

When compared to its peers in the fabled FAANG group, Facebook is second only to Google (NASDAQ: GOOGL) in stock performance over the past twelve months, and is the standout winner from the past quarter. As we've seen above, there's more than enough momentum in play to keep them in the driver's seat at the front of the pack through the rest of the year.

Those in the bear camp might not agree totally with this however and instead might point towards lingering anti-trust and privacy policy concerns. But these regulatory risks have been present for so long you'd expect them to already be accounted for in the share price. If anything, the possible dissipation of these risks could provide near-term upside and a longer-term tailwind to the stock, as Wall Street would be forced to start thinking about its higher best-case scenarios being exceeded.

On the whole, we're talking here about a company whose product is used by upwards of 2 billion people every single day. There's arguably never been a company with greater reach and market depth before, and as we've seen with the most recent earnings report, Facebook clearly knows how to make use of it.

Their shares have been hitting fresh all-time highs for some weeks now and aren't even starting to look overvalued. The stock's relative strength index is at a fairly neutral 60, suggesting there's a ton of room for shares to continue running from here. Next week's earnings report is expected to deliver a solid beat on analyst expectations and assuming it does, we could soon be seeing Facebook shares trade in the $300s for the last time.

Facebook is a part of the Entrepreneur Index, which tracks some of the largest publicly traded companies founded and run by entrepreneurs.