Why This Could Be the Long Awaited Bear Rally Over the last couple of weeks, we've increased our allocation of stocks. Last week and earlier this week, I was uncertain whether this was the correct move. But, the last...

This story originally appeared on StockNews

Over the last couple of weeks, we've increased our allocation of stocks. Last week and earlier this week, I was uncertain whether this was the correct move. But, the last 2 days of market action are validating those moves as the S&P 500 (SPY) finally seems to be commencing its long, awaited bear market rally. The last genuine thrust higher was in March when the stock market rallied more than 10% in less than 3 weeks. In today's commentary, I want to talk about why we could see a similar explosive rally, then I want to share my thoughts on the recession debate which is currently roiling the markets. Read on below to find out more….

(Please enjoy this updated version of my weekly commentary published May 26th, 2022 from the POWR Stocks Under $10 newsletter).

First, let's review the past week…

Over the past week, the S&P 500 is up by 4%. Even more impressive is that we are up 6.5% from Friday's lows.

It's looking more and more like Friday's low is our "tradeable bottom' and that 3,810 level is an important one to keep in mind.

There was little that was unusual about the Russell 2000 or the Nasdaq worth pointing out except that the small-caps made a higher low, while the large-cap dominant S&P and Naz did make lower lows.

An Explosive Rally?

Last week, I discussed some of the improvements "under the surface' which was contributing to my bullish stance. And, these were also why I was willing to hold on through the volatility.

Some of the major reasons discussed include strength in bonds, stability in growth stocks, outperformance in risky assets, and a low-risk, high-reward trade setup.

Of course, these factors remain intact and are why I continue to see more upside ahead. Over the last couple of months, we've had several 3 to 4-day bounces that inevitably roll over.

The only real "bear market rally' that we've had was in March when we saw a more than 10% gain. I don't believe it's absurd to expect a similar outcome given how oversold the market is and the extremes we've reached in terms of sentiment and positioning.

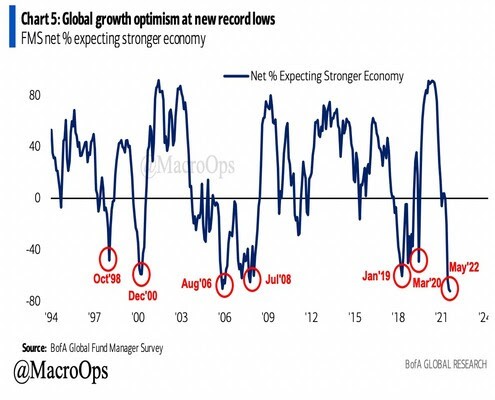

Here are 2 charts from Bank of America (and @Macroops) showing this:

This is from a survey of global fund managers which is showing that expectations for economic growth are at rock-bottom levels, similar to previous inflection/turning points.

It's also interesting that fund managers are more pessimistic than in March 2020. And, here's a chart showing how these fund managers are feeling about tech:

This is a potentially great setup for the market. Market sentiment going from bearish to neutral could trigger a big rally in stocks.

As of now, my inclination would also be to lighten up and reduce exposure as we move higher.

Let's Talk About the R-Word

This is an excerpt from my POWR Growth commentary but wanted to include it, because it covers my stance on the recession debate. After the excerpt, I will talk about how it specifically applies to stocks under $10.

If we zoom back and take a bigger-picture perspective, it becomes easier to understand the market action. In January, we had an inflation scare which led to a 10%+ drop in the major averages despite strong earnings.

This is because higher inflation leads to multiple compression as the Fed is forced to wring liquidity out of the system.

The market bottomed in late January and was quite choppy for a couple of months with several failed breakout and breakdown attempts. In mid-April, the inflation scare receded and we got a growth scare which is leading to weakness in cyclical stocks and expectations of a decline in earnings.

Many are speculating that a recession is imminent. In fact, I would argue that many stocks in the market are priced as if a recession is a certainty rather than a possibility.

My Take

This is a controversial take. First of all, recessions are fantastic buying opportunities for stocks. So, when people start openly talking about recessions, you should start getting excited.

I'm going to make another claim.

When there is no systemic risk, it's better to buy early as there is a greater chance of a V-shaped bounce. If there is systemic risk, then it's better to be patient as there is a greater chance of a market crash or more liquidations.

Currently, we don't have systemic risk. Not like what we had in 2008 with banks leveraged at 30:1. Yes, there are pockets of froth and overvaluation, but these markets could be liquidated and would hurt holders of these assets, but there would be limited damage to the broader economy.

To be specific, here's what I think is happening. Two parts of the economy are in a recession – tech and discretionary spending. Depending on your bias, some, most, or all of it is due to incredible growth in 2020 and 2021 due to one-offs like the pandemic and stimulus payments.

On a 2-year basis, both segments have strong double-digit growth. But, it's slowing sharply and going negative in many instances. These are both massive parts of the economy, so a contraction would be meaningful enough to put the economy in a recession or a near recession.

However, I believe other parts of the economy will remain in growth mode like the industrial sector, housing, energy, steel, materials, autos, etc.

In fact, we had a very similar circumstance during 2015-2016 when we had a recession scare. Except during this time, steel/energy/materials were in a major bear market. Oil was around $30, and copper was at $2.

Supply was strong due to large investments in production that were made from 2007 to 2011, and aggregate global demand had never meaningfully recovered after the Great Recession.

Real GDP growth dipped from 3% to below 1.4% but never went negative. The major reason is that other parts of the economy saw a slowdown but didn't go negative. Examples are housing, tech, and consumer spending. Another source of support was that interest rates were falling.

So, this is similar except larger components of the economy are vulnerable, and there won't be as much support from interest rates. Therefore, I anticipate more volatility and think a *technical* recession is likely.

However, just like the last recession scare which kind of crested between February 2016 and June 2016, this will turn out to be a fantastic buying opportunity.

In next week's article, I want to include some historical analogs that are similar to the current economic and market environment to give greater context.

(end of POWR Growth commentary)

For our purposes, I believe certain parts of the market continue to have significant upside while those parts that are more "recessionary' like tech and consumer spending are better suited for short-term traders rather than investments to work.

What To Do Next?

If you'd like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead.

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares . Year-to-date, SPY has declined -14.40%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini's background, along with links to his most recent articles.

The post Why This Could Be the Long Awaited Bear Rally appeared first on StockNews.com