2023 Stock Market Lessons Learned

If we don’t honestly review the lessons of the past, then we are likely doomed to repeat those same mistakes in the future. Not only is that foolish…but highly unprofitable….

This story originally appeared on StockNews

If we don’t honestly review the lessons of the past, then we are likely doomed to repeat those same mistakes in the future. Not only is that foolish…but highly unprofitable. And that is the importance of doing this annual review of 2023 Stock Market Lessons Learned to improve our odds of topping the S&P 500 (SPY) in the year ahead. Read on below for the full story including a preview of Steve Reitmeister’s top 13 trades.

Our 2023 Stock Market Lessons Learned starts with appreciating that the most dangerous expression in all of investing is…

“This time is different”

That is rarely ever true because history typically repeats itself and that is the safest best for investors That is why almost everyone and their mother predicted a recession forming with deeper bear market to follow once inflation spiked and the Fed embarked on one of the most aggressive rate hiking regimes in history.

When you consider that 12 of the last 15 times the Fed has raised rate, we have entered a recession. On top of that the Fed typically has a positive bias in their outlook calling for a soft landing and yet still 75% of the time a recession unfolded.

Amazingly, this time around the Fed actually predicted a mild recession before their hawkish policies concluded. Add that with the historical track record and it only makes sense to bet on recession and bear market. Yet amazingly…this time is different.

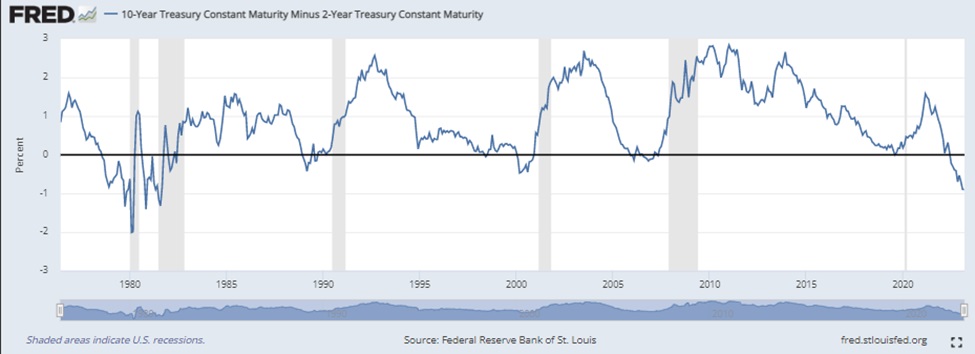

Let’s not forget that the yield curve inverted. That’s when short term rates become higher than long term rates (typically comparing the 2 year vs. 10 year Treasury). Here is the picture from March 2023.

As you can see the track record of this inversion predicting a future recession (gray bars) is legendary. And yet here again…this time is different as no recession emerged.

Of course, the key question now is…WHY was this time different?

As it turns out the onset of Covid pushed 2 to 4 million American workers to choose early retirement instead of going back to work. This made the jobs market amazingly resilient as virtually any skilled person could find employment.

Thus, no matter how hard the Fed stepped on the brakes of the economy with their rate hikes…they could not hurt the resilient employment market. And without job loss…there is no income loss…and thus no drop in spending.

That is how the economy broke with tradition and remained in growth mode. Gladly inflation was tamed in the process creating the pathway to a soft landing and resumption of the bull market.

Those of us with a fundamental bias (like yours truly both blessed and cursed with an Economics degree) found it harder to appreciate this change that broke from historical norms. Gladly there is a counterbalance to fundamentals that I have come to appreciate more and more in my investment process.

Of course, I am talking about price action. In particular, the benefit of monitoring the 200 day moving average for the S&P 500 (SPY) which is the best indicator of the long term trend.

When you boil it down, it is wise to be bullish above the 200 day for the S&P 500. And to be bearish under that mark.

I wrote a lengthier piece on the virtues of minding the 200 day moving average back in July 2023 (read it here).

Here are the key excerpts:

“Price action is a much more reliable means of market timing than fundamentals. In particular, a focus on the 200 day moving average (AKA the long term trend line).

The merits of this technical signal is hard to admit for someone like myself with an economics background. But then I remembered some behavioral finance studies from that Mohamed El-Erian discussed a few years back.

The original theory was that investors predicted events 4-6 months in advance. That is why stocks typically dumped before bad economic events happened and seemed to rise during the darkest hour before the data improved.

Interestingly, some of the more recent research shows that it may not be that investors are so clairvoyant. Rather the positive or negative vibes from the stock price trends had a resounding effect on the economy.

At first this notion sounds crazy. But let’s remember that the vast majority of wealth in this country is in the hands of the top 10% who own 90% of the assets. No doubt a lot of that money is in the stock market.

Now consider that these same folks are the captains of industry. So, when their portfolios take a hit…they see their net worth go down…which leads to more cautious personal and business spending…which slows the economy. Here we can clearly see how price action actually precedes economic activity.

On the flip side we have a soaring stock market in the midst of a weak economic outlook. The net worth of these same wealthy people are on the rise…which lifts their mood. As they become less cautious and more optimistic, they start to spend more…thus improving economic conditions…thus showing the wisdom of the rising stock prices.

Long story short, price action is another valuable leading economic indicator. This only increases the value of using the 200 day moving average as a key lever in when to be cautious (under 200 day) or more aggressive with stocks (over 200 day).”

Heeding the merits of the improved price action this year allowed my Reitmeister Total Return portfolio to become bullish sooner than many of my fundamentally inclined peers.

Yes, in hindsight it would have been great to heed these signals even sooner. But as they say no one rings a bell at the bottom.

All in all, appreciating the lessons learned from the past, the inclusion of price action as a failsafe overriding the fundamental outlook improved my results this year. The main takeaway going forward is to react even sooner to those signals the next time around.

Now let’s switch from these valuable Lessons Learned to finding the best stocks and ETFs for today’s unique market environment.

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model.

This includes 4 small caps recently added with tremendous upside potential.

Plus I have added 2 special ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $474.32 per share on Tuesday afternoon, up $2.35 (+0.50%). Year-to-date, SPY has gained 25.40%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post 2023 Stock Market Lessons Learned appeared first on StockNews.com

If we don’t honestly review the lessons of the past, then we are likely doomed to repeat those same mistakes in the future. Not only is that foolish…but highly unprofitable. And that is the importance of doing this annual review of 2023 Stock Market Lessons Learned to improve our odds of topping the S&P 500 (SPY) in the year ahead. Read on below for the full story including a preview of Steve Reitmeister’s top 13 trades.

Our 2023 Stock Market Lessons Learned starts with appreciating that the most dangerous expression in all of investing is…

“This time is different”