50% Bullish vs. 50% Bearish 40 year investment pro Steve Reitmeister has a more balanced view of whether the future is bullish or bearish. This doesn't mean to sit on your hands waiting for an...

This story originally appeared on StockNews

40 year investment pro Steve Reitmeister has a more balanced view of whether the future is bullish or bearish. This doesn't mean to sit on your hands waiting for an outcome as there are indeed ways to actively invest at this time to top the S&P 500 (SPY). Get Steve's most recent market outlook, trading plan and top picks in the commentary below.

The S&P 500 (SPY) is near dead even week over week. And yet there is an interesting theme playing out as we look back the past month.

On one hand it is quite bullish. And on the other hand actually bearish.

Meaning that altogether it is quite confusing. So we will do our best to make sense of it all in the fresh market commentary that follows...

Market Commentary

OK...what is so bullish about action the past month?

Easy to say it's because the S&P 500 is up +3.3% in that span. Plus, we are flirting with the recent highs found in early February just under 4,200.

Cool...so what is bearish about that?

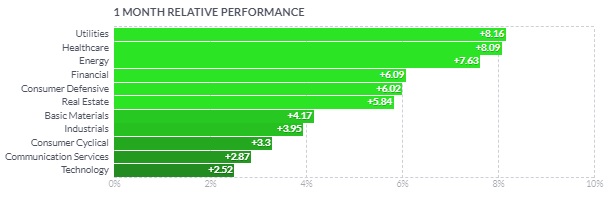

The Risk Off nature of the groups that are leading the way. The next 2 performance charts for the past month points out the issue in spades:

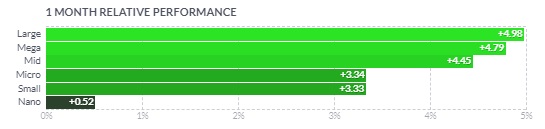

Bullish times are generally marked by investors taking on a bit more risk to enjoy more upside. So that is when smaller stocks outperform. Plus investors will bid up the more growth oriented industries like Consumer Cyclical and Technology.

CLEARLY NOT THE CASE NOW

As you can see the larger the stocks the higher the returns. And Risk Off sectors like Utilities, Healthcare and Consumer Defensive are leading the charge.

Again...kind of bullish when you see green arrows across the board. But kinda bearish with investors in Flight to Safety mode.

Meredith Margrave of our POWR Stocks Under $10 service had some other interesting ideas on this front:

"That brings me back to my earlier point that "the stock market" is doing well, and not "stocks." You see, "stocks" aren't really doing that great.

A number of analysts are concerned that this rally is much more vulnerable than it appears to be. Part of that is because market breadth has been weak. As of last Friday, less than half (45%) of Russell 3000 stocks were trading above their 200-day moving averages. That matches up with news that this rally has largely been carried by a handful of mega-cap stocks like Microsoft and Apple.

We're also seeing low volatility – VIX is at its lowest since the beginning of the year – which could mean investors are possibly too complacent and stocks could be heading for a selloff."

Until there is something blatantly bearish happening stocks will likely continue to float higher up to resistance at the February high of 4,200. Helping matters in the short run is that earnings season is better than low expectations...but not super impressive either.

What clearly showed up early in the results was that the big banks benefited from the banking crisis as deposits rushed out of smaller regional and community banks to the "too big to fail" institutions.

All in all, earnings season is just like everything else...not bearish, but not really bullish either. This keeps limbo in place until a new catalyst comes along to have people recalibrate the odds of recession making them either more bearish or more bullish.

Looking at the economic calendar there are not many catalysts that matter until ISM Manufacturing on 5/1 and the next would be the ISM Services and Fed rate hike decision on 5/3 and then winding up the week with Government Employment on 5/5.

The catalysts to become bearish will be obvious. That being clear cut proof of a recession unfolding with stocks tumbling to the October low of 3,491 and likely lower.

The funny thing is that the catalysts to the upside may be quite subtle. Simply the ABSENCE of bad news = good news = stocks move higher.

This is what Goldman Sachs was kind of saying in their write up that this stock market seems "bullet proof". And the main reason why is the robustness of the employment market which refuses to buckle. With that being the case then income is in place which begets spending and economic growth. This is why we keep avoiding recession.

This has me shifting down odds for a future recession and extension of the bear market once again. I would say its about 50/50 at this time. As such I have been increasing my exposure to the stock market with emphasis on the best stocks thanks to the advantage in our POWR Ratings model.

I know some would prefer that I had greater certainty...like there is something wrong with me.

No friends. I have an Economics background and can say with full confidence it is an inexact science. That is why the average recession forms when less than 50% of economists predicting that outcome.

I say 50/50 NOT because I am flakey or afraid to make a call. It is because at one time I was 80% sure of recession and with it not happening again and again...I have to appreciate that odds are lower. BUT those recessionary odds still very much exist.

Thus, I will continue to sleep with 1 eye open for its potential return. Until that truly comes on the scene, then I will continue to increase my allocation to attractive stocks.

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has beaten the S&P 500 by a wide margin so far in April.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused...volatile...uncertain.

Yet, even in this unattractive setting we can still chart a course to outperformance. Just click the link below to start getting on the right side of the action:

Steve Reitmeister's Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.17 (-0.04%) in after-hours trading Friday. Year-to-date, SPY has gained 8.20%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post 50% Bullish vs. 50% Bearish appeared first on StockNews.com