9 Ways to Invest in Real Estate for Retirement Investing in real estate is one of the oldest forms of investing and many people consider it to be a safe investment compared to other more volatile investments like stocks....

By Melissa Won

This story originally appeared on Due

Investing in real estate is one of the oldest forms of investing and many people consider it to be a safe investment compared to other more volatile investments like stocks. This is because traditional real estate investing, or buying rental properties, provides more stability than the stock market does.

When you buy a house or apartment building as a rental property, you don't have to worry about the value going up and down every day.

Instead, you can expect that your money will grow steadily over time as long as you keep investing in properties that provide cash flow and appreciate in value. Although there are many ways to invest in real estate, this article will focus on how you can get started by purchasing single family homes or commercial buildings for yourself.

Invest in property that you already own

It's hard to beat the security of your own home, especially if you're planning on staying put for the long haul. Nearly 80% of senior citizens owned homes going into 2022.

"When you own a home, it's possible to pay down your mortgage debt and build equity at the same time—both of which are attractive retirement investment strategies," says Cliff Auerswald, President of All Reverse Mortgage. You can also rent out rooms or even move into a smaller rental property and rent out the rest of your house!

- Buy a multi-family home or commercial building

If living in one place isn't an option for you right now, consider investing in a multi-family home or commercial building where other people will be paying rent while making your mortgage payments for you every month (and potentially even paying off some of its principal).

While this type of real estate may require slightly more upfront capital than single family homes do, there are often tax benefits associated with owning multiple properties as well as increased potential for growth over time if done correctly!

Invest in a REIT

Another way to invest in real estate is through a REIT– It owns approximately $3.5 trillion in gross real estate assets, with more than $2.5 trillion of that total from public listed and non-listed REITs and the remainder from privately held REITs. or real estate investment trusts. REITs are companies that own income-producing real estate and then sell shares of themselves to investors.

You can think of investing in a REIT as a way to invest in real estate without actually owning any property yourself. These entities are traded on stock exchanges like any other publicly traded company, which means you get some liquidity—and hopefully, better returns—compared with buying and selling individual properties.

Invest for cash flow

Cash flow is the amount of money you receive from rent and other income. It's a key indicator of whether or not a property is a good investment, because it shows how well a property is generating income. If the cash flow isn't there, you might not be able to afford mortgage payments and maintenance costs.

While many investors focus on home-price appreciation—how much their house has increased in value since they bought it—you should consider cash flow as your primary concern when deciding whether or not to buy real estate for retirement.

Your goal is to have enough money left over after paying all your bills that you can live comfortably without having to work again!

Flip properties for profit

Flipping properties is a risky proposition that can be a good strategy when the market is hot. The flip involves buying a property, fixing it up and then selling it at a profit. "If you're willing and able to take on some risk, this strategy can pay off big," says Kevin Bazazzadeh, Founder of Brilliant Day Homes.

There are risks involved with flipping properties because you have no guarantee that you'll make money after all your expenses (including renovations) have been paid for.

Even if the real estate market has bottomed out and is about to turn around, there are no guarantees that your property will sell for more than what you bought it for—or even cover what you've spent on repairs.

Purchase a vacation rental property

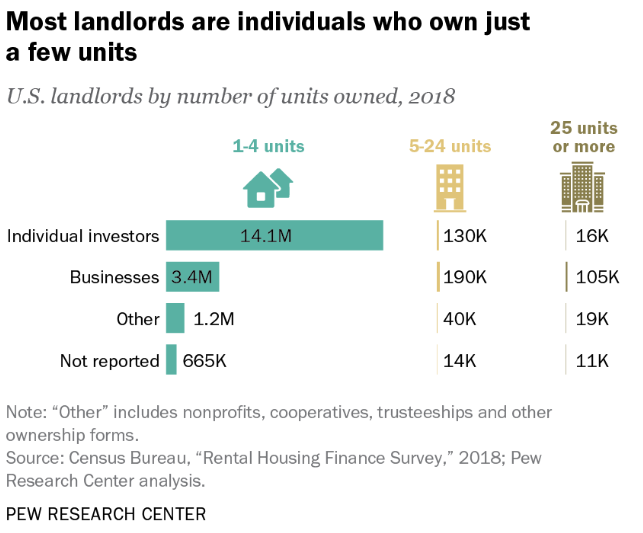

When it comes to investing, the best kinds of properties are those that can generate passive income. This means you can buy and rent out the property without having to manage it full-time. Individual real estate investors account for 72.5% of rental properties in the United States.

Vacation rental properties fit this criteria perfectly. You'll be able to use your investment as a secondary income stream, offsetting the costs of ownership with rental payments. And if you're not comfortable managing tenants or dealing with maintenance issues, there's always Airbnb!

According to Alan Harder, a Vancouver mortgage broker, "the key here is to make sure you choose a vacation rental property that has an established market and demand for rentals in order for it to be profitable for both you and any potential tenants – that way, no one loses out."

Invest in a long-term rental property

- Find a property. Whether you're looking for an apartment building or a house, you want to find a location that is growing and has good potential for rental income.

- Calculate the ROI (Return on Investment). There are many variables that go into calculating the ROI of your property—the number of bedrooms, price per square foot, etc., but one thing remains constant:

- Your monthly rent should cover all expenses and then some more each month in order for it to be an investment worth pursuing.

- Find a tenant who will pay on time every month without fail! This can be difficult if you don't have prior experience doing this sort of thing yourself (or if you're just starting out),

- so it might be wise to hire a property management company that can help with this step while also solving any other problems that may arise after moving tenants in or out of the house/apartment building itself over time as well as managing repairs

Buy and convert office space to residential units

Converting office space to residential units is a good investment for retirees. One of the main reasons for this is that underutilized offices are often located in great areas, and they're cheaper than residential properties.

Additionally, converting office space to residential units means that you can get more use out of the property by providing it with additional value.

This is especially true if you live near an area where there aren't many places for people to rent or buy homes but need them anyway because they work in a nearby city center or business district during weekdays but don't like staying at hotels on weekends.

Purchase a multi-family dwelling and live in one unit while renting the others out.

If you're looking to buy a multi-family dwelling, there are a few things to consider.

- You can live in one unit and rent out the others. "This is a great way to earn passive income as you'll be collecting rent payments from tenants while you live in your own home," notes Rinal Patel, a Licensed Realtor and Co-Founder of We Buy Philly Home.

- You could also decide to buy a multi-family home and rent all of the units, leaving yours empty until it becomes available. In this case, you'd need access to another source of income that will pay for your mortgage while waiting for renters who want to move into their new homes—and potentially give back some of that money when they leave!

Partner with another investor on a deal (or two or three)

If you're not an expert, it can be hard to know how much to pay for a property and how to find good deals. One way to mitigate the risk is by partnering with other investors on a deal (or two or three).

With more people involved in the purchase, there are more eyes on each stage of the process and more people who can help make decisions about which properties are worth pursuing.

If you're looking for someone to partner with, your best bets include online platforms like RealtyShares and Fundrise that allow investors from across the world access each others' listings.

If that doesn't work out, try asking friends or family members if they'd be interested in getting involved in real estate together — chances are they'll be happy for your help! There are also local meetups specifically designed for finding investor partners; just search online for "real estate investing meetup" near you.

There are many ways to invest in real estate, which include buying homes and commercial buildings, putting money into other people's investments and borrowing to invest in rental properties.

- Buy a home

- Invest in a REIT (real estate investment trust)

- Invest for cash flow

- Flip properties for profit

Conclusion

If you're looking for a way to generate income or profits during retirement, then real estate may be the right choice for you. There are many different types of investments that can help you meet your goals. The best way to decide which one will work best is by doing research on each type before making any decisions.

I hope this article has given some insight into the ways in which retirees may invest in real estate.

The post 9 Ways to Invest in Real Estate for Retirement appeared first on Due.