A Bearish Investor Ponders the Bull Case for Stocks Steve Reitmeister is by no means a permabear...but its hard for him to give up his economics background and turn away from the bearish evidence in hand. However, with the...

This story originally appeared on StockNews

Steve Reitmeister is by no means a permabear...but its hard for him to give up his economics background and turn away from the bearish evidence in hand. However, with the S&P 500 (SPY) up more than 20% from the October lows its time for some honest reflection of the current bull vs. bear case. That is what you will find below along with a trading plan for the weeks and months ahead.

The S&P 500 (SPY) has been consolidating around 4,400 early in July after a big rally to end June.

On the surface that doesn't sound so impressive. Gladly below the surface money is rotating out of overblown mega caps into small and mid caps. That improving market breadth is a very bullish sign.

Yet not everything is bullish. There are still a lot of indicators that point decidedly bearish. Which altogether makes things VERY CONFUSING.

I will do my best to give a fair and balanced review of what is happening now so we can chart our course forward.

Market Commentary

Let's review what is bullish at this time.

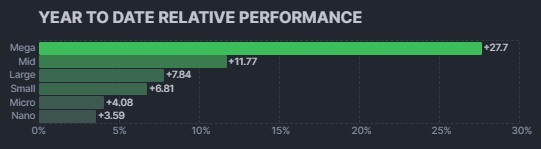

Price Action: At first many investors shrugged off the news that this was a new bull market given a greater than 20% rise from the October bottom of 3,577. That's because almost all the gains were accruing to the Magnificent 7 mega caps while most smaller stocks were just treading water.

Over the past month that picture has greatly improved leading to more gains across more stock groups:

No Recession at This Time: Investors keep hearing about the possibility of recession yet with the vast majority of relevant Q2 economic data in hand, the US economy continues to muddle along.

This includes a +2.3% prediction from the famed GDPNow Model from the Atlanta Fed. The Bluechip Economists panel sees things a bit more subdued at +1.3%...but that prediction is up from only +0.8% a month ago. So, there may be more upside in that number before it is announced in late August.

Jobs-A-Plenty: Plain and simple, without job loss there is no recession. And as of the most recent monthly employment reports we are seeing ample job adds that keep the unemployment rate near historic lows.

Now let's juxtapose that versus an interesting slate of indicators that still point decidedly bearish.

Inverted Yield Curve: You know this is one of the most consistent indicators that points to future recessions as you will see in the chart below:

Note that EVERY TIME the yield curve inverts that a recession follows. And now appreciate that the yield curve is the most inverted it has been since the early 1980's when the market was riddled with recessions and bear markets. Hard to see that an not give it serious credence.

Don't Fight the Fed: This is everyone's favorite chant when the economy goes in the dumpster and the Fed lowers rates to improve the economy. This is also a magical tonic for stock prices.

Yet now we have the exact opposite where the Fed is proactively stepping on the brakes of the economy to stamp out the flames of high inflation. Even now 16 months into their rate hike cycle the work is not done with likely 2 more increases to come starting with the July 26th meeting.

Fed officials have been incredibly clear that they would rather have a recession than allow inflation to become entrenched. Taken another way...they will keep raising rates until they get inflation under control. This also adds up when you appreciate that 12 of the last 15 rate hike cycles ended in recession.

Now appreciate that the most persistent form of inflation, is wage inflation given an impressively strong employment market. So for the Fed to win the final battle over inflation they likely will have to keep raising rates til there is job loss. That is a Pandoras Box that once opened usually leads to much greater job loss > recession > bear market.

Meaning that the current positive of a strong labor market is what will actually keep the Fed working overtime to reverse course in order to bury high inflation once and for all. This fits in with Steve Liesman's statement on CNBC that the Fed is "going to keep raising rates til they break something."

Who is Right and Who is Wrong?

The fundamental bearish case is compelling...but the positive price action is hard to ignore. And truly every day that there is not negative news the pull of FOMO rally has more people bidding up stocks at this time.

Thus, a lot depends on the next set of market moving events such as:

7/12 CPI Report: Not just the headline year over year comparison matters. Investors need to look into the current pace of inflation that is better seen in month over month data. As well as the composition of Sticky vs. Flexible inflation components. This report will tell give investors more clues about how much harder the Fed will have to fight to end high inflation.

7/26 Fed Rate Hike Meetings: It is a forgone conclusion that the Fed will be hiking rates another 25 basis points at the meeting. So what really matters is the statements and hawkish tone of Powell at the press conference that follows. If he still thinks this rate hike cycle ends with a recession then investors should probably listen up.

Q2 Earnings Season: Earnings expectations are very low with Wall Street predicting a 12% year over year decline in corporate earnings. Yet going forward investors are currently expecting an earnings rebound that many think is a bit too optimistic.

So the real key to this earnings season is not the % of companies that beat or miss expectations in Q2. Rather, it is earnings estimate revisions to future quarters that will have the greatest impact on stock prices.

On that front, let me share with you the recent comments of noted earnings expert, Nick Raich from EarningsScout.com:

- Inflation and Fed monetary policy remain the key drivers for future corporate earnings and ultimately stock prices.

- With hopes for interest rate cuts fading as the harsh reality the Fed will keep interest rates higher for longer, we are measuring weakening EPS estimate revisions among the early 2Q 2023 reporters.

- In total, 15 out of the first 18 S&P 500 companies reporting 2Q 2023 had their next quarter EPS estimates fall afterwards.

- With no interest rate cuts on the horizon and a rate hike expected later this month, it is doubtful that S&P 500 EPS expectations will see any improvement this earnings season.

- Our advice? Stay underweight stocks

And My Trading Plan Is...

With my economics background, and the lessons of history, there is no way for me to not see the current environment as fundamentally bearish.

On the other hand, I can not deny some aspects of the bullish story. Plus how often the positive price action of stocks is a leading indicator of a turn in economic data because it improves sentiment and purchasing decisions that spur the economy.

This keeps me in a balanced portfolio posture that is approximately 50% invested in the stock market. However, the stocks that I am focused on are small caps that are finally starting to take the baton from mega caps to lead the pack. Meaning buying the Magnificent 7 and outpacing the market game plan of the first half of 2023 is played out...time for worthy others to lead.

As more facts emerge it will become more apparent if the market is truly bullish or bearish. With that will come appropriate changes to my investment strategy. My hope is that the bull story wins out and more than happy to get back to gung ho bullish investing.

However, if the bear is indeed going to come out of hibernation, then we need to adjust in that direction. That includes selling our recent winners to lock in profits before they quickly get wiped off the boards.

What To Do Next?

Discover my full market outlook and trading plan for the rest of 2023. It's all available in my latest presentation:

2nd Half of 2023 Stock Market Outlook >

Just in case you are curious, let me pull back the curtain a little wider on the main contents:

- Review of...How Did We Get Here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case more likely)

- Trading Plan with Specific Trades Like...

- Top 10 Small Cap Stocks

- 4 Inverse ETFs

- And Much More!

If these ideas appeal to you, then please click below to access this vital presentation now:

2nd Half of 2023 Stock Market Outlook >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.03 (+0.01%) in after-hours trading Tuesday. Year-to-date, SPY has gained 16.57%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post A Bearish Investor Ponders the Bull Case for Stocks appeared first on StockNews.com