AMD’s Recent Correction: A Buying Opportunity For Investors?

Shares of AMD have made a healthy retracement, and if buyers continue to step in to support the stock, a re-test of the highs could be a near-term target.

This story originally appeared on MarketBeat

Advanced Micro Devices (NASDAQ: AMD) has been one of the standout performing semiconductor and NASDAQ companies of 2023. YTD shares of the semiconductor company are up about 70%, last trading near $109. This comes after the stock has recently pulled back almost 18% from the year’s high, $132.83, set mid-June. On a higher timeframe, shares of AMD have made a healthy retracement, and if buyers step in to support the stock, then a re-test of the highs could be a near-term target.

Semiconductor Stocks Lower on Fresh News

The Wall Street Journal reported that the Biden administration is weighing stricter restrictions on exports of computer chips that process AI software. Specifically, the restrictions would curb exports of AI technology to China.

The market isn’t too worried over the news as shares of AMD are close to flat on the week amidst the catalyst. With global demand increasing for chips that process AI software, other territories will likely make up for lost business from China if the restrictions come into effect.

Cathie Wood’s ARK Investment Loads Up On AMD

On Monday, Cathie Wood’s ARK Investment purchased 18,583 shares of AMD. Based on the closing price on Monday, $107.51, the value of the purchase was about $2 million. AMD wasn’t the only semiconductor name that ARK purchased. During the most recent sector-wide correction, the Cathie Wood-led ARK Investment also purchased over 18,000 shares of Taiwan Semiconductor Manufacturing Company (NYSE: TSM).

AMD has certainly been popular among institutional investors in recent years. Since Q1 2022, the stock has experienced net institutional inflows of $10.18 billion. The current institutional ownership stands at 68.9%. As of May 2023, the largest institutional shareholder of AMD is State Street Corp, with a 4.039% ownership stake.

Analysts See Upside In AMD

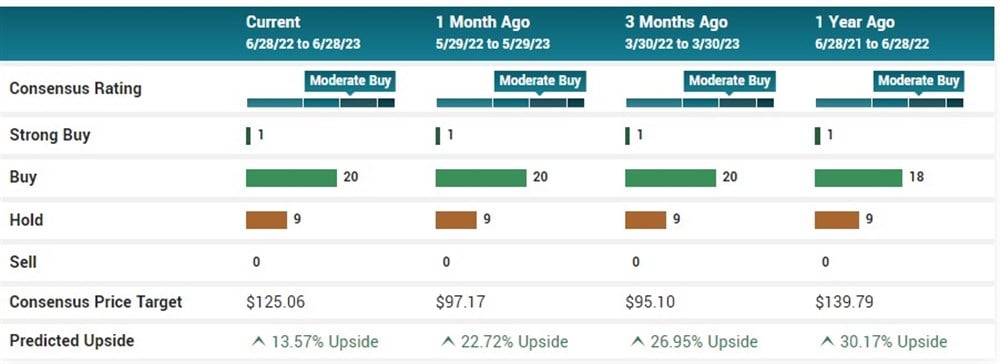

Based on 30 analyst ratings, AMD has a consensus analyst rating of Moderate Buy and a price target of $125.06, predicting a 13.57% upside in the stock. Morgan Stanley recently boosted their rating and price target to Overweight and $138 from $97. Of the 30 analyst ratings, 20 are Buy, 9 Hold, and 1 Strong Buy.

Technical Analysis

Shares of AMD have surged higher this year, up 70% so far YTD. While the most recent pullback has been steep, on a higher timeframe, shares have retraced into the uptrends support and 50d SMA. The uptrend remains intact, with AMD making a higher low near the uptrend support.

The move in AMD off the 200d SMA in May to the highs in June was impressive but unstable. Investors and traders are most likely welcoming this pullback in AMD as it allows participants the opportunity to purchase near support versus 52W highs. It also allows the stock to digest its most recent surge higher and discover newfound support at higher prices.

If the stock discovers support in a critical area between $105 and $110, a move over $110 will confirm the higher low on the higher timeframe, and $120 will become a realistic short-term target.

Advanced Micro Devices (NASDAQ: AMD) has been one of the standout performing semiconductor and NASDAQ companies of 2023. YTD shares of the semiconductor company are up about 70%, last trading near $109. This comes after the stock has recently pulled back almost 18% from the year’s high, $132.83, set mid-June. On a higher timeframe, shares of AMD have made a healthy retracement, and if buyers step in to support the stock, then a re-test of the highs could be a near-term target.

Semiconductor Stocks Lower on Fresh News

The Wall Street Journal reported that the Biden administration is weighing stricter restrictions on exports of computer chips that process AI software. Specifically, the restrictions would curb exports of AI technology to China.

The market isn’t too worried over the news as shares of AMD are close to flat on the week amidst the catalyst. With global demand increasing for chips that process AI software, other territories will likely make up for lost business from China if the restrictions come into effect.