Are Hidden Gems Lurking Among Chemical & Fertilizer Stocks?

Don’t limit your stock selection to glamour industries: Agricultural chemical makers like Sociedad Quimica y Minera and CF Industries are outperforming.

This story originally appeared on MarketBeat

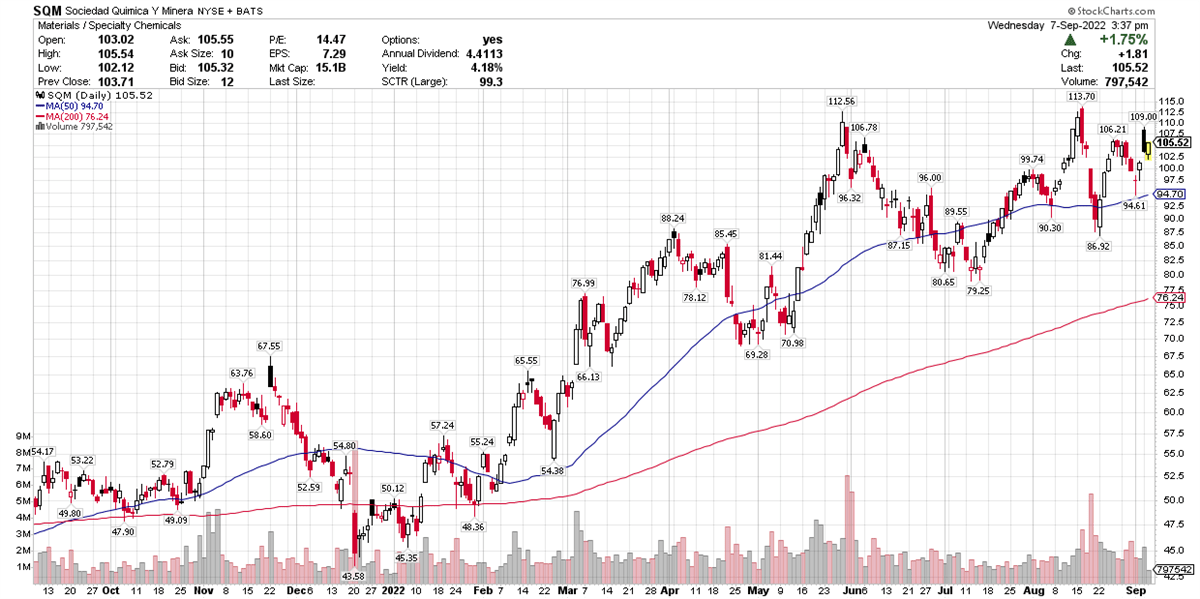

Agricultural chemical makers, such as Chilean firm Sociedad Quimica y Minera (NYSE: SQM) are among stocks outperforming other industries.

SQM is active in several business lines, including iodine, specialty chemicals and fertilizers, and potassium.

The company reported second-quarter results in mid-August, it said lithium demand was surging, a trend it sees continuing.

As the electric vehicle industry continues ramping up, companies supplying parts, such as lithium for batteries, are benefiting. With supply constricted at a time of escalating demand, you’re bound to see prices rise, and that’s exactly what’s happening.

The company earned $3.01 per share, up a whopping 871% from the year-earlier quarter. Revenue came in at $2.598 billion, a gain of 342%. Earnings and sales have grown at double- or triple-digit rates in each of the past six quarters.

In the August earnings statement, CEO Ricardo Ramos said, “These results were related to favorable market conditions related to fertilizers, iodine and lithium…”

He added that the company was close to reaching 180,000 metric tons of lithium carbonate capacity, and is aiming to complete a lithium carbonate capacity of 210,000 metric tons … This new capacity will let us produce high-value-added lithium products to power more than 5 million electric vehicles.”

The company expects worldwide demand for lithium demand to increase by 35% through the remainder of this year.

SQM said its potassium and specialty plant nutrition units are also performing well, due to high demand. Fertilizer prices surged due to inflation and the usual supply-chain issues, which were exacerbated as a result of the Russia-Ukraine war.

The stock is up 109.37% year-to-date, and up 11.77% in the past month. It’s among the price-performance leaders within the chemical producers’ industry.

Growing Demand For Fertilizers

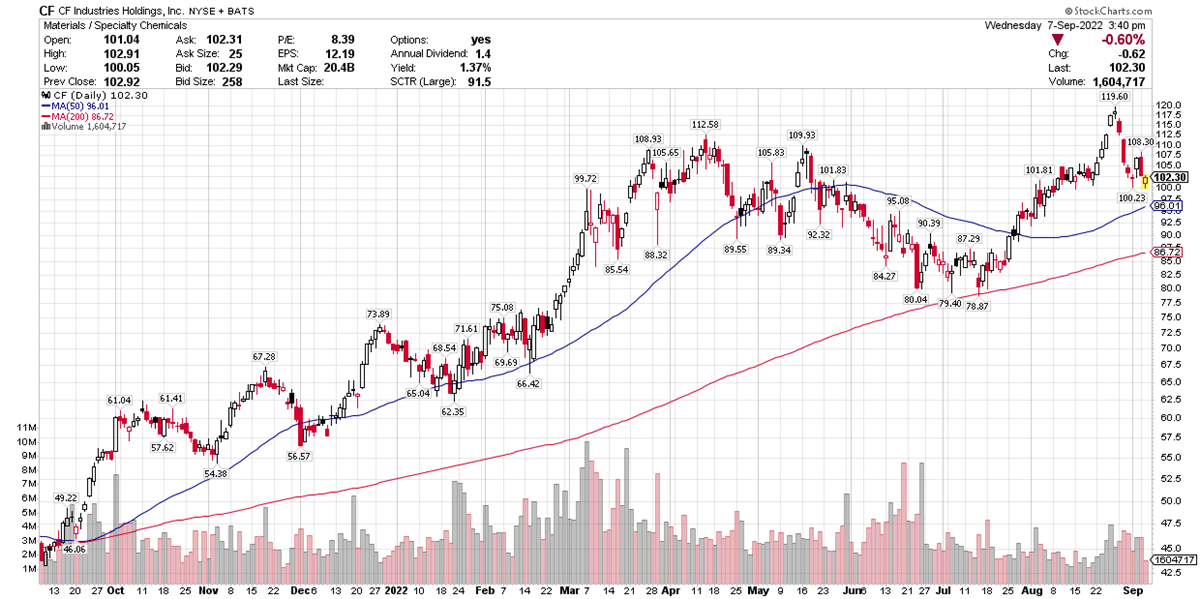

Another top performer is CF Industries (NYSE: CF), which rallied after reporting earnings on August 1, but has since pulled back along with the broader market.

The Deerfield, Illinois producer of fertilizers rallied to a new high of $119.60 on August 26, but retreated as market dynamics weakened.

The company earned $6.21 per share in the most recent quarter, a gain of 440%. Revenue was $3.389 billion, up 113% from a year ago.

In the earnings release, which also addressed the first half of the year, CF said, “Average selling prices for 1H 2022 were higher than 1H 2021 across all segments due to strong global demand and decreased global supply availability”

Those gains came despite lower sales volume, which the company attributed to “unfavorable weather delaying spring application and reducing planted acres” and “impact of operations at the Company’s Ince Complex remaining halted.”

The latter point refers to plant operations that were closed in September 2021, due to high natural gas prices.

Given the lower sales volume, do analysts believe the company can maintain its growth trajectory?

The answer is: Sort of.

For the full year, Wall Street expects CF to earn $18.63 per share, up 184% over 2021. However, that’s seen declining to $14.34 per share next year, which would represent a 23% drop.

Analysts have a “hold” rating on the stock, according to data compiled by MarketBeat. The consensus price target is $101.73, less than $1 above where it was trading on Wednesday.

The Right Chemistry?

Given industry sales growth, does it make sense to add a chemical producer to your portfolio? You don’t have to choose between SQM and CF; others showing strength include Mosaic (NYSE: MOS) and Nutrien (NYSE: NTR).

In fact, you can approach your stock portfolio in a manner similar to that of active fund managers: When looking to fill a slot, it’s a good idea to evaluate stocks from similar businesses to determine which fits the bill.

Assuming the industry is poised for growth, you can look at growth rates, forecasts and specific lines of business. Which are likely to grow versus those likely to slow?

Also determine whether a more stable large cap stock is a good fit for you, or if you can handle the increased volatility of a small- or mid-cap stock.

Whatever you decide, chemical stocks, though definitely non-glamorous, are among those in growth mode right now.

Agricultural chemical makers, such as Chilean firm Sociedad Quimica y Minera (NYSE: SQM) are among stocks outperforming other industries.

SQM is active in several business lines, including iodine, specialty chemicals and fertilizers, and potassium.

The company reported second-quarter results in mid-August, it said lithium demand was surging, a trend it sees continuing.