Bear Market Warning from the Bond Market?

The S&P 500 (SPY) is flirting with a break below the 200 day moving average. Part of the story you already know…that about the recent rapid rise in bond rates….

This story originally appeared on StockNews

The S&P 500 (SPY) is flirting with a break below the 200 day moving average. Part of the story you already know…that about the recent rapid rise in bond rates. Unfortunately there is an even more ominous part of this story that needs to be told today. That is why 43 year investment veteran tries to simplify the dynamics behind the potentially looming Debt Supercycle. Read on below for the full story.

Sometimes the investing landscape is incredibly simple. Like 85% of your lifetime the economy has been expanding and the stock market is bullish. And then from that period of excess a recession comes along creating a bear market the other 15% of the time.

Each is easy to see when you are in the middle of that phase. Unfortunately, it is rather more difficult to know which it is for sure at the cusp of where the two periods meet. And that is where we find ourselves today.

On top of that we have an economic boogeyman that has been swept under the rug time after time that has reared its ugly head once again. At some point we will have to pay the piper for this with a long term period of below trend growth and weak stock prices.

Has that dreadful time arrived?

That and more will be at the heart of this week’s Reitmeister Total Return commentary.

Market Commentary

Let’s start our conversation today with the precariousness of the technical picture for the stock market.

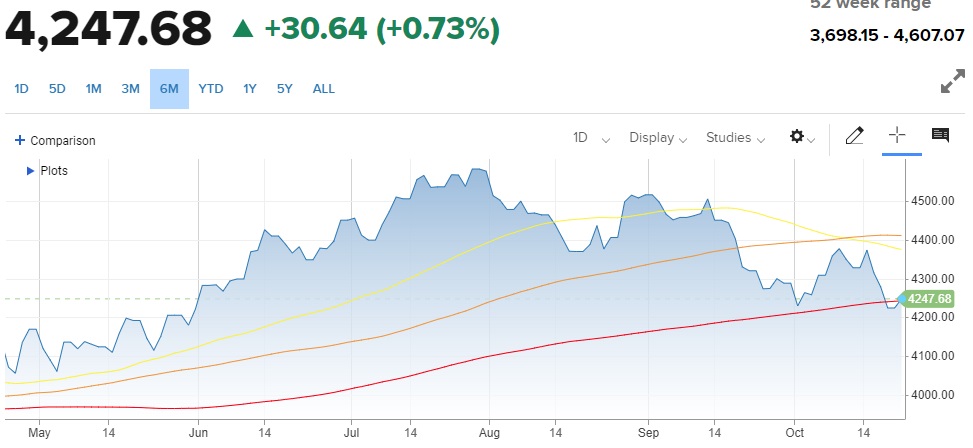

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

The 200 day moving average for the S&P 500 (SPY) is the most vital of the long term trend lines. It general pays to be more aggressive above that level…and conversely, to be more defensive under that mark. That is why this week’s tangle with this important technical level at 4,237 deserves all of our attention.

Monday we closed below for the first time in several months. And then Tuesday we climbed back above. This is the second such test of this key level and as most of you know bad things often come in groups of 3. Meaning I doubt this is our last conversation about potentially breaking below.

Because of the above struggle and increased odds we spend some time below this key level, I have moved the Reitmeister Total Return portfolio down to 74.5% invested. Hard to call that bearish by any stretch.

Rather it is an appropriate dose of caution because of the fundamental dynamics taking place. Some of it has already discussed in previous commentaries about how bond rates are “normalizing” back to historically average levels from artificially suppressed levels.

If that is the only things at play, then likely we are pretty close to the peaks in those bond levels and bull market should resume from here. (Read more about this dynamic in my recent commentary here)

BUT WHAT IF THIS TIME IS DIFFERENT?

That is the most dangerous expression in all of investing…but always one worth contemplating. Especially as we digest this next topic.

Perhaps this is not about rate normalization, but rather the oncoming of the Debt Supercycle.

John Mauldin goes in depth on this topic once again in his very provocative weekend commentary. Truly a must read you will find here.

I will try my best to simplify the discussion with the following.

Far too many of the world’s governments are overextended with debt. Take a look at this country by country list with the United States coming in with the 9th worst Debt to GDP ratio.

We all know its unsustainable. At some point it will need to be paid back Yet amazingly year after year…and decade after decade we sweep it under the rug. At some point the piper will need to be paid.

Only 2 ways to pay it down. And both are terrible for stock investors.

Deficit Reduction: First, this will never happen. Truly sad but both political parties in the US are so beholden to special interests with their hands out, that neither has proven any fiscal discipline in DECADES. And just because you balance the budget for a year or two…doesn’t really do anything to cut down the $33.63 trillion in debt already accumulated. And the cost of serving that debt is only going higher by the minute (especially in this higher rate environment).

But pushing back the laughter, lets imagine some alternative universe where we elect politicians disciplined enough to pull this off. WELL that is a recipe for recession as the Government currently represents 25% of GDP. So even a modest 5% reduction in government spending would tilt the economy into recession. And by the way…5% ain’t gonna cut it to make the needed dent in our mountain of debt.

When you add up the above you appreciate that this preferred path to debt reduction is still a recipe for disaster. So, let’s move on to the even worse outcome…

Debt Crisis: Imagine the Greece situation from a decade ago…and now make it about 50X worse. Because if the US or Japan start coming under pressure it likely will have a domino effect to wipe out the rest of the weaklings….which is most everyone. That is why some call this the Debt Tsunami.

The 16 year period of ultralow rates we are emerging from was very beneficial to these governments to keep piling on the debt because its pretty easy to pay back at long term rates of 0 to 2%. That party is unravelling right now as noted above.

The main question is whether rates are just “normalizing” back to more realistic historical levels…or is this a more painful process of world debtors saying its “time to pay up”.

Yes, we have been very fortunate that we keep avoiding that day of reckoning. But again…this time could be different. In that regard, let me share with you the key section from Mauldin’s article on the topic of confidence:

“Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence—especially in cases in which large short-term debts need to be rolled over continuously—is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang! — confidence collapses, lenders disappear, and a crisis hits.”

Reity, this is a scary thought…are you saying this is what is happening now?

Probably not…but it’s not out of the question. Which is why it’s appropriate to take a more conservative approach with our investing right now. Also wise to get rid of our positions most tied to higher rates (which we did this morning).

This is a hard topic for me personally. I absolutely HATE owing people money. Always did.

Thus, I would avoid borrowing unless absolutely necessary. And then would absolutely pay back before anyone asked for the money.

Now you know why I’m not a politician 😉

The point being that I am very sensitive on this subject. However, it doesn’t really take a fiscally responsible person like myself…or a rocket scientist, to appreciate that this situation is untenable in the long run.

The difficult part is saying if that crisis of confidence is starting now. Or we get to kick that can down the road once again. But because of the big question mark lingering out there, it seems only appropriate to be more conservative/defensive in our approach.

Do consider this…the US is still one of the better bets for borrowers and likely the first cracks would occur elsewhere…with other highly indebted countries.

(See chart below…2nd column is % of debt to national GDP)

My sense is that a smaller, highly indebted player like Singapore or Italy would show cracks first in their debt. If that happened, then like the Greece situation it would be wise for all of us to honker down in much more defensive portfolios postures in case the dominos keep falling to other countries like the US.

Yes, it would create a recession. And yes stocks would tumble into a nasty recession. And it would stay dark for quite a while to work its way out.

Gladly we know the way to make profits in that environment:

Sell all stocks > buy inverse ETFs to rise in value as the market declines.

But again…maybe that is not happening. And we are just dealing with the more benign rate normalization issues. In that case, we should feel good that rates have peeled back a notch this week as 2 of the biggest bond traders, Bill Ackman and Bill Gross, are both now betting on rates going down from here.

Just to add one more wrinkle to the story. It is also possible that rates have normalized and that the reduction in rates from here is from increased concern that a recession is coming.

Meaning the reason that the Fed is now expected to sit on their hands for the next two meetings is because the rising of rates outside of their efforts is no doubt going to slow the economy from the 4% pace that likely gets announced on Thursday.

Gladly slowing from 4% gives a lot of cushion to not tip over into recession. Just moderating to 1-2% growth would still likely be ample backdrop to stay bullish. Unfortunately history shows many recessions forming right after a robust economic reading.

A slowing economy is not necessarily like a car that is pumping its breaks to slowly ease into a red light. Often it is like slamming the brakes with everyone flying through the windshield into the next recession.

Yes, I am quite the ray of sunshine today 😉

However, I thought it was vital to get all the realistic possibilities on the table. And that we are in wait and see mode for what comes next.

If just another in a long line of false alarms with rates leveling out and economy rolling forward, then we will get back to 100% bullish soon enough.

On the other hand, if odds of recession, or even worse, whiffs of a debt crisis pick up, then we will at first become more defensive and ultimately bearish with inverse ETFs.

The point is that we need to see what happens and then react in kind. Gladly we know what to do and will react quickly to make the best of the situation.

What To Do Next?

Discover my current portfolio of 6 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 3 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 9 hand selected trades, and all the market commentary and trades to come….then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.63 (-0.15%) in after-hours trading Tuesday. Year-to-date, SPY has gained 12.00%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Bear Market Warning from the Bond Market? appeared first on StockNews.com

The S&P 500 (SPY) is flirting with a break below the 200 day moving average. Part of the story you already know…that about the recent rapid rise in bond rates. Unfortunately there is an even more ominous part of this story that needs to be told today. That is why 43 year investment veteran tries to simplify the dynamics behind the potentially looming Debt Supercycle. Read on below for the full story.

Sometimes the investing landscape is incredibly simple. Like 85% of your lifetime the economy has been expanding and the stock market is bullish. And then from that period of excess a recession comes along creating a bear market the other 15% of the time.

Each is easy to see when you are in the middle of that phase. Unfortunately, it is rather more difficult to know which it is for sure at the cusp of where the two periods meet. And that is where we find ourselves today.