Best Financial Books for Beginners

Want to manage your money better and wiser? Well, you can start by reading financial books for beginners that are designed to help you improve the financial outlook in your…

This story originally appeared on Due

Want to manage your money better and wiser? Well, you can start by reading financial books for beginners that are designed to help you improve the financial outlook in your life.

Personal finance books can provide valuable information on topics ranging from:

- What you need to do to become financially independent.

- How to trade stocks.

- Tips for managing mortgages.

- Having difficult money conversations with family members.

- Why and how to create a nest egg.

- Retirement savings tips.

Although it might not be the lightest reading, you’ll thank your wallet and future self in the long run.

How we evaluate and test financial books

All of our best financial books roundups are written by humans (including myself) who’ve spent a lot of time reading, listing, testing, and examining financial books. We spend dozens of hours researching and testing the financial advice in each one of the books. We’re never paid for placement in our articles from any book or for links to our site—we value the trust readers put in us to offer authentic book evaluations of the financial advice behind them. Especially for beginners in this financial world.

From expert ways to increase your credit to more simple ways to save money on a daily basis, Dues best financial books for beginners will help you out outshine the rest. Compare the best finance books to help you save a lot more money in the next year.

To help you improve your financial literacy and make the best decisions with your money, we’ve selected the ten best-selling, highest-rated, and beginner-friendly finance books.

Best Financial Books for Beginners

1.“I Will Teach You to Be Rich” by Ramit Sethi

Rating: 4.5 Stars – 3,019 Reviews

Ramit Sethi, dubbed the “wealth wizard” by Forbes, outlines a 6-week program for increasing your income and saving for retirement in his landmark New York Times and Wall Street Journal bestseller “I Will Teach You to Be Rich.”

Despite being aimed at millennials and beginners in finance, this book is a must-read for anyone new to the FIRE (financial independence, retire early) movement.

By ruthlessly weeding out the things that don’t make you happy, the book teaches you how to spend money on the things that make you satisfied. It also explains how to set up a “conscious spending plan.”

You’ll find practical advice, helpful money lessons, and simple steps to improve your relationship with money in this book. As part of the book’s many lessons, it provides practical advice on:

- Maintaining your daily latte habit while saving mone.

- Dealing with recurring expenses such as phone and insurance bills.

- Negotiating a raise at work.

- Reducing the amount of student loan debt you owe.

- Making your finances automated so your money goes where you want it to go.

- The best way to cover major purchases, such as a car, house, or wedding.

Quote: “Conscious spending isn’t about cutting your spending on everything. That approach wouldn’t last two days. It is, quite simply, about choosing the things you love enough to spend extravagantly on—and then cutting costs mercilessly on the things you don’t love.”

Format: Paperback, Audiobook, Kindle

2. “Total Money Makeover” by Dave Ramsey

Rating: 4.7 Stars – 5207 Reviews

Dave Ramsey’s “Total Money Makeover” is one of the most popular finance books available for beginners. Some even circles consider it to be the best personal finance book ever written.

As a financial expert, author, and radio host, Ramsey offers sage advice about taking charge of your finances in his book. Through an outlined 7-step plan for financial fitness, he emphasizes his points.

As a result of his stern, no-nonsense advice, readers are encouraged to take responsibility for their money choices, while being motivated to achieve success. That’s why it’s a great resource for beginners.

Furthermore, Ramsey provides clear steps to success, describes common pitfalls to avoid, and encourages readers to take charge of their finances. For people struggling with debt and student loans, his straight talk on debt, as well as his plan to get rid of it, is highly relevant.

However, many people appreciate the fact that Ramsey shares his personal story in his finance book for beginners. As he relates his own money failures, readers are able to accept their own mistakes and follow his example.

Quote: “Savings without a mission is garbage. Your money needs to work for you, not lie around you.”

Format: Paperback, Audiobook, Kindle

3. “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” by Vicki Robin

Rating: 4.5 Stars – 4204 Reviews

Vicki Robin and Joe Dominguez originally published this book in 1992. For the FIRE movement, this book is considered a seminal work. “As you can imagine, this was pretty radical stuff in the early 1990s,” notes Kara Perez in a previous Due article.

To start using money as a tool to free yourself from the labor force, the book’s first edition spent a significant amount of time discussing lifestyle and mindset shifts.

There is more to this book than those who dream of becoming financially independent. There is more information on investing and money management in the updated in 2008 version. It is also important to focus on mindset shifts for people looking to retire early.

“As far as finance books go, this is a great place to start if you want to get in touch with the WHY behind your spending,” adds Kara. By doing this, you will be able to start thinking of money as a tool. After all, a lot of us do not realize how our spending impacts our financial goals over the long term. With this book, you’ll learn how to establish a new relationship with money.

Quote: “Money is something we choose to trade our life energy for.”

Format: Paperback, Audiobook, Kindle, CD

4. “The One-Page Financial Plan” by Carl Richards

Rating: 4.3 Stars – 588 Reviews

Are you looking for a better way to manage your money, but lack the motivation? If that describes you, a good place to begin is with Carl Richards’ “The One-Page Financial Plan.”

Ultimately, this is a refreshing and fun look at personal finance that explains how you can plan your entire financial future on a single page, taking away the burden of financial planning for the less disciplined.

Richards spent over 20 years as a financial advisor. In “The One-Page Financial Plan,” he incorporates all of the conversations he’s had over the years into a personal finance process that works for you.

The following three lessons can help you take control of your finances:

- Plan your goals, but stay flexible and fine-tune them along the way.

- Make saving fun by making budgeting a game.

- Invest in your future by paying off your debt.

Quote: “The most important thing to remember about money is that it’s not about the money. Money is a means to an end. It’s a tool to help you live the life you want to live.

Format: Paperback, Audiobook, Kindle

5. “Rich Dad Poor Dad” by Robert Kiyosaki

Rating: 4.7 Stars – 82,101 Reviews

Robert Kiyosaki’s “Rich Dad Poor Dad” is probably familiar to many, but there’s a reason it’s remained a personal finance fixture.

As a child, Kiyosaki learned all about personal finance from his father and from the father of one of his friends, who is referred to in the title as “rich dad”. You will learn how to get rich without spending a lot of money, about assets and liabilities, and why schools don’t teach your children about personal finance.

Updates on money, economics, and investing are included in this twentieth-anniversary edition.

Quote: “Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.”

Format: Paperback, Audiobook, Kindle, Workbook

6. “What To Do With Your Money When Crisis Hits: A Survival Guide” by Michelle Singletary

Rating: 4.6 Stars – 105 Reviews

Originally released as “7 Money Mantras for a Richer Life,” Michele Singletary learned these lessons from her grandmother, Big Mama. And, they are;

- If it’s on your ass, it’s not an asset!

- Is this a need or is it a want?

- Sweat the small stuff.

- Cash is better than credit.

- Keep it simple.

- Priorities lead to prosperity.

- Enough is enough.

Those mantras provide the basis for this straightforward and practical book about financial advice.

Quote: “We are minimizing our financial potential by making minimum credit-card payments.”

Format: Paperback, Audiobook, Kindle

7. “Broke Millennial” by Erin Lowry

Rating: 4.6 Stars – 1,585 Reviews

Erin Lowry offers tips for 20 to 30-somethings on getting control of their finances. The result? “Broke Millennial” is the ultimate guide for every financially uninformed millennial on how to spend responsibly.

In addition to providing helpful tips for beginners, the book teaches you how to navigate the market based on your values and beliefs. Throughout this book, young people will learn how to manage credit card debt, student loans, budgeting, and investing.

Also included are tips on:

- Getting your partner to talk about money.

- Budgeting styles such as Cash Diet, Track Every Penny, Envelope Budgeting, and Percentage Budgeting.

- Choosing the best financial products, like savings accounts.

- Using your credit score to your advantage.

Quote: “Investments are the sexiest part of personal finance, but it’s just one piece.”

Format: Paperback, Audiobook, Kindle

[Related: 3 Books Every Millennial Should Read]

8. “Why Didn’t They Teach Me This in School?” By Cary Siegel

Rating: 4.5 Stars – 1,753 Reviews

A father of five, Cary Siegel, wrote “Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By” specifically for young people just graduating from high school or college.

The 99 principles – which include lessons on life, credit cards, and housing – are presented in bite-sized chunks. Siegel’s wisdom is not mind-blowing. Mostly, it’s just good, sound money advice that focuses on the fundamentals.

Overall, readers won’t feel frustrated or overwhelmed after reading it, which makes it a great book for beginners. Rather, he offers nuggets of information about finances that should help young people avoid getting into financial trouble before it’s too late. Therefore, for anyone starting from scratch – or guiding someone who is standing at the starting line “Why Didn’t They Teach Me This in School?” is one of the best finance books to read.

Quote: “Net worth is what dollar value you are worth. To come up with this number, you add up all that you own and subtract everything you owe.”

Format: Paperback, Audiobook, Kindle

9. “The Millionaire Next Door: The Surprising Secrets Of America’s Wealthy” by Dr. Thomas J. Stanley & William D. Danko

Rating: 4.6 Stars – 11,696 Reviews

This 1996 book still holds up well in the current digital age despite being originally published in 1996. Millionaires are actually quite modest and discreet, unlike what social media may imply. It’s not necessary for millionaires to own costly cars, jet-set around the world, or lounge around their mansions swimming pools despite what you see on Keeping Up With The Kardashians.

This book reveals that millionaires have not only created wealth but also maintained it. Thomas J. Stanley, Ph.D., and William D. Danko, Ph.D. explain how millionaires accomplish this.

Quote: “Most people have it all wrong about wealth in America. Wealth is not the same as income. If you make a good income each year and spend it all, you are not getting wealthier. You are just living high. Wealth is what you accumulate, not what you spend.”

Format: Paperback, Audiobook, Kindle, CD

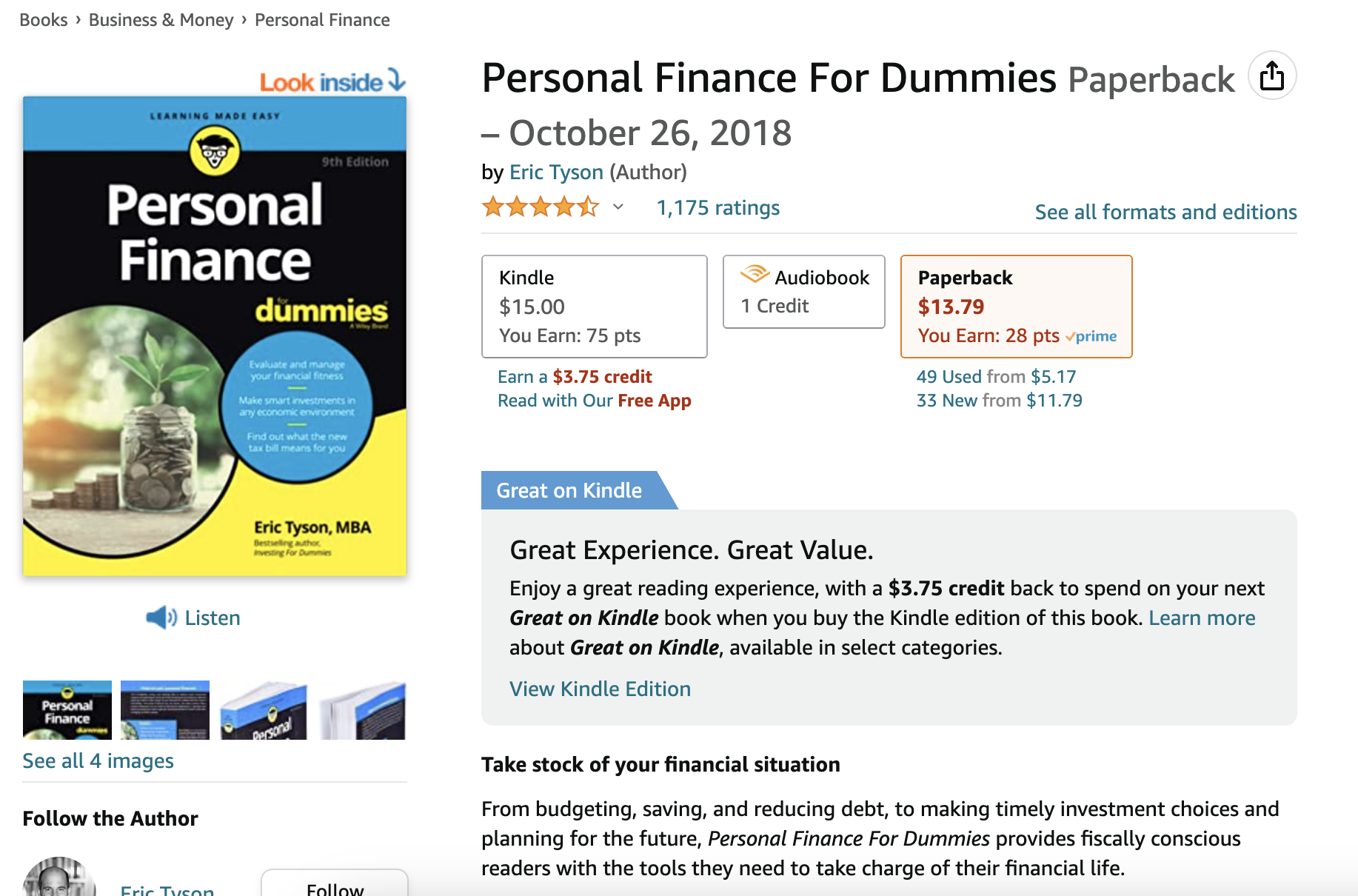

10. “Personal Finance for Dummies” by Eric Tyson

Rating: 4.7 Stars – 1175 Reviews

A great primer on living a financially savvy life, Eric Tyson’s “Personal Finance for Dummies” has already reached its 9th edition. Why? Because all aspects of personal finance are covered in the book.

It has everything you need for budgeting, debt management, saving for retirement, and planning for big purchases. In this sense, “Personal Finance” is truly the go-to guide for anyone who wants to learn all the basics of money management and improve their financial situation immediately.

Quote: “To achieve typical longer-term financial goals, such as retiring, the money that you save and invest generally needs to grow at a rate much faster than the rate of inflation.”

Format: Paperback, Audiobook, Kindle

FAQs

What are financial literacy books?

A financial literacy book explains the fundamentals of personal finance and money matters in a clear and simple way. The basic principles of personal financial management, budgeting, and investing are covered in introductory finance books.

Finance books should not only discuss principles and ideas, but also demonstrate the importance of becoming financially literate. Moreover, beginners’ finance books should motivate and encourage them to handle their money effectively.

What are the benefits of reading a book about finance?

You’ll be more confident and successful with your finances later in life if you learn the basics of money early on. Although there is no time like the present to learn about money, it pays to tip your toes in as soon as possible, and education is the essential first step.

Investing, budgeting, and saving your money is among the topics you can find guidance on in quality books.

How do I choose the right book?

To begin with, you must set your goals and understand your level of knowledge. Second, identify your most pressing needs. For example, do you want to get rid of debt, get into the stock market, or learn how to spend more wisely? Lastly, choose the book that fits these criteria best.

For beginners, where can I find finance books?

There are multiple formats available for the best books on finance for beginners. You can buy my recommended finance books as paperbacks, eBooks, and audiobooks. Free personal finance books can however be found at your local library. Especially if you are trying to save money or learn how to be frugal, you should use the library!

All of the money management books I recommend for beginners are available at my local library, so you might be able to find them there as well. While you wait for a specific book, check if another book on finance for beginners is available.

There are also plenty of places to purchase personal finance books, both online and offline. Second-hand bookstores sell a variety of financial education books at better prices, including some of the best books for beginners.

If you’re looking for affordable money finance books, Amazon is a good place to start. A subscription to Amazon Audible allows you to get audiobooks for free or at a discount

Should I avoid certain finance books?

Make sure you steer clear of books that oversimplify to the point of distortion, or that boast a get-rich-quick scheme. There is no point in oversimplifying jargon when true experts know that most financial truths are nuanced and complex.

It is precisely for this reason that financial education is essential, to understand the subtle nuances hidden behind all the half-truths about investing.

The post Best Financial Books for Beginners appeared first on Due.

Want to manage your money better and wiser? Well, you can start by reading financial books for beginners that are designed to help you improve the financial outlook in your life.

Personal finance books can provide valuable information on topics ranging from:

- What you need to do to become financially independent.

- How to trade stocks.

- Tips for managing mortgages.

- Having difficult money conversations with family members.

- Why and how to create a nest egg.

- Retirement savings tips.

Although it might not be the lightest reading, you’ll thank your wallet and future self in the long run.