Composer Serves Up Hedge Fund Performance for the Average Investor This platform offers strategies and automatic purchasing to create the portfolio you want.

By StackCommerce Edited by Jason Fell

Disclosure: Our goal is to feature products and services that we think you'll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

There's never been a magic-bullet secret for guaranteed investing success. If there were, well, we'd all be doing it. Especially in volatile financial times like these, we look for every edge, every tip, and every crucial mistake to avoid to help keep our heads above water or even — dare to dream — help us triumph.

For most people, navigating the stock market requires even more homework than they've done in the past, evaluating investing options, charting performance, and making quicker decisions than ever before. Composer is not only offering a new way to get involved in the stock market, but they're doing it with a platform that even those who don't devour CNBC every day can understand.

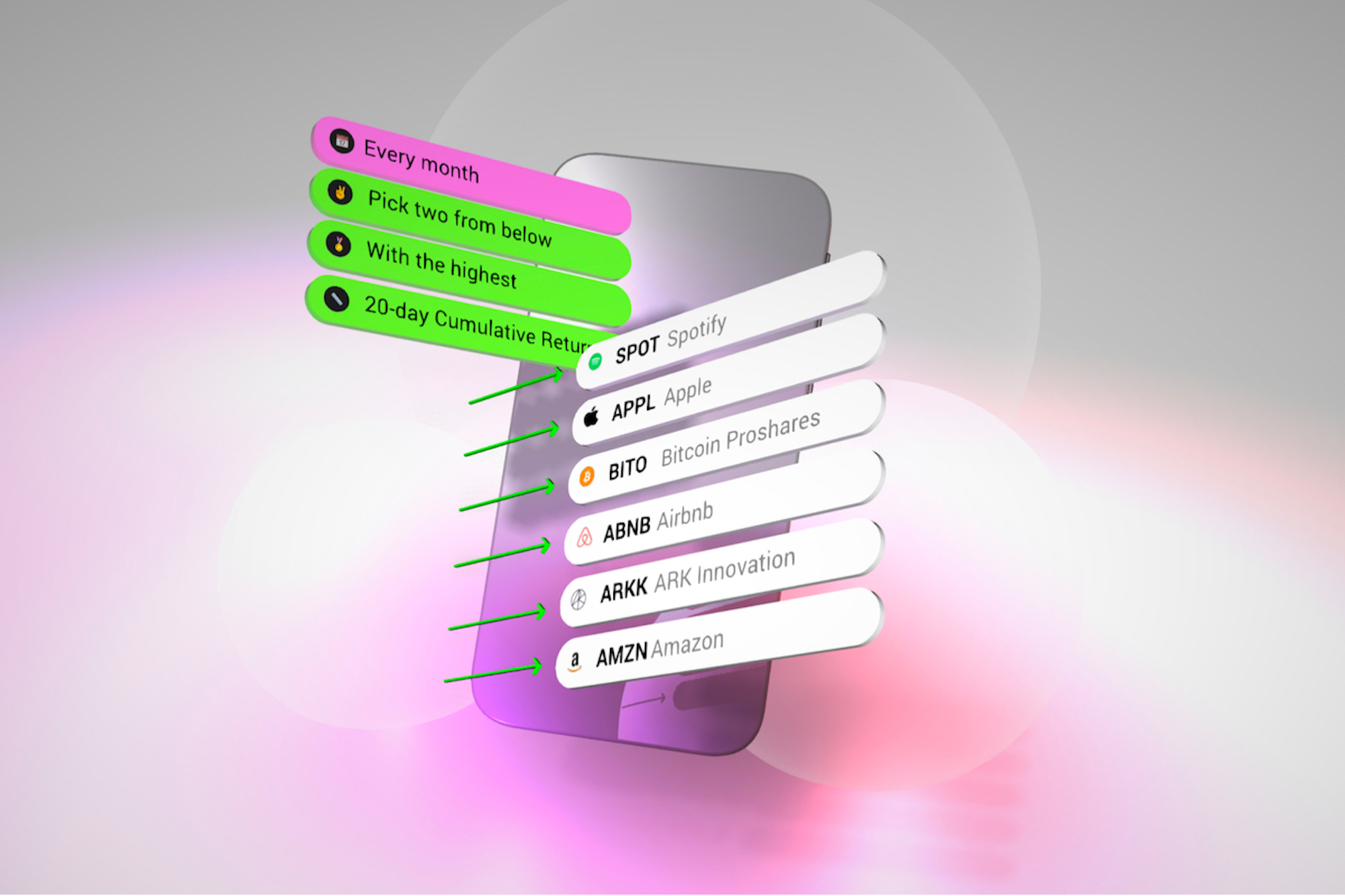

Launched late last year, Composer is how individual investors can stay as active in the market as hedge fund managers without sinking hours and hours of their time into it. The platform enlists a smart, intuitive, easy-to-use interface to help users find and build automated trading strategies, which Composer calls symphonies. Comprised of different securities traded on the major U.S. exchanges, each symphony features a different theme.

Strategies like Big Tech Momentum may center around investing in the two best-performing tech stocks each month, while others like the Inflation Spiral Hedge can be an amalgam of consumer staples, gold, energy, and agricultural commodities favored by an industry favorite. Users can dig into each symphony, evaluate their past performance, assess each asset, and decide if it's the right addition to their current portfolio.

Of course, if a symphony isn't an exact fit for an investor, all they have to do is open it up in the Composer Editor and make some adjustments. With the Editor, users can dissect a symphony, replace certain stocks with others, or even pick out bits and pieces of multiple strategies to create one uniquely their own. Composer even goes back to show you exactly how that new symphony would have performed over the few years.

Once you have purchased your funds, Composer also makes it easy to set your own specific buy and sell instructions that will be carried out automatically. If a stock dips to a certain point and you'd like to sell or buy more, Composer can make the move on your behalf when that threshold is reached. It's like having your own hedge fund manager continuously overseeing your assets.

Head to the Composer website now, sign up for an account, then get up to speed on creating a responsive new investing strategy in as little as 90 seconds.

Prices are subject to change.

*See important disclaimer