Delta Airlines Is Ready To Fly Higher

Delta Airlines is on a flight path to higher price points and near-term headwinds are opening an opportunity for investors.

This story originally appeared on MarketBeat

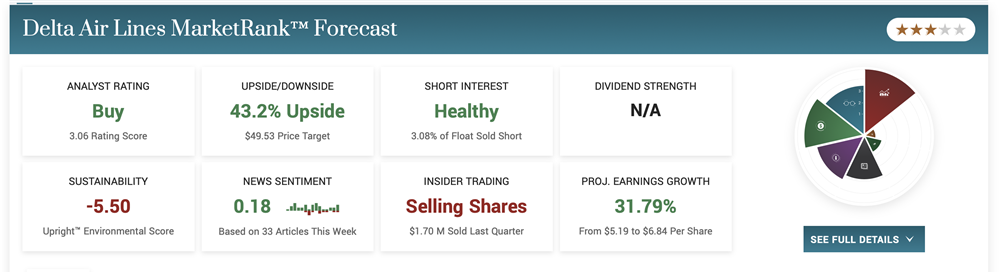

Delta Airlines (NYSE: DAL) shares are down following the Q1 results, but this is an opportunity for investors. While earnings fell short in the quarter, revenue growth was robust, free cash flow hit record levels, debt was reduced, and the guidance calls for more of the same. There are certainly risks with this stock, but the upside potential outweighs them. The analysts have yet to come out with new commentary, but we can expect it soon.

The trend leading into the report was favorable, and more of that is also expected. The latest shout-out came from Raymond James a week before the report was released. That firm has the stock pegged at Strong Buy with a price target over 50% above the current action.

The analysts are in support of this stock. Their activity increased the rating to firm Buy from Moderate Hold over the last year, and the price target is trending higher. The pre-release consensus is near $45 and about 45% above the price action, while the most recent is $55. Raymond James called Delta one of its top pair trades.

It is a Buy compared to American Airlines Hold due to its stronger balance sheet and discounted valuation. The Q1 results support that position.

Delta Has Mixed Quarter, Guides For Strength

Delta had a mixed quarter, which is only relative to the analyst consensus. While revenue outpaced consensus and earnings fell short, both are consistent with the company’s guidance and resulted in record free cash flow. The $12.8 billion in revenue is up 37% compared to last year on strength in business and consumer travel aided by loyalty and premium services. The revenue beat the consensus by $0.55 billion or 440 basis points, and record revenue is expected in the current quarter.

The company’s operating margin was negative, as expected and slightly below the consensus, leaving the adjusted EPS at $0.25. However, the takeaway is that earnings are enough to keep the FY guidance intact and operating leverage is expected in Q2.

The company says it has already received record bookings for the June-ended quarter. The bookings are up 20% compared to 2019 and are expected to drive bottom-line strength. The company expects $2.00 to $2.25 in adjusted EPS compared to the $1.64 consensus and plans to use the capital to reduce debt.

The Q1 FCF of $1.9 billion allowed the company to pay down $1.2 billion in debt and accelerate its debt-reduction plans. This has it on track to meet its FY debt reduction target in the 1st half of the year and bring leverage down to 3 to 3.5X by year-end.

“With record advance bookings for the summer, we expect June quarter revenue to be 15 to 17 percent higher on capacity growth of 17 percent year over year,” said Glen Hauenstein, Delta’s president.

Institutional Support Builds For Delta Airlines

The institutions have been buying Delta for the last 8 consecutive quarters, and that trend is not likely to change with the Q1 report. More likely, the institutions will continue to nibble on this stock and build the support base. The stock shows support in the low $30 range; if this is confirmed again, the market should begin to drift higher; if not, this stock may retest lower levels before the next earnings release.

Delta Airlines (NYSE: DAL) shares are down following the Q1 results, but this is an opportunity for investors. While earnings fell short in the quarter, revenue growth was robust, free cash flow hit record levels, debt was reduced, and the guidance calls for more of the same. There are certainly risks with this stock, but the upside potential outweighs them. The analysts have yet to come out with new commentary, but we can expect it soon.

The trend leading into the report was favorable, and more of that is also expected. The latest shout-out came from Raymond James a week before the report was released. That firm has the stock pegged at Strong Buy with a price target over 50% above the current action.